(All amounts have been expressed in US Dollars except where

otherwise indicated)

Dundee Precious Metals Inc. (TSX: DPM)(TSX: DPM.WT)(TSX:

DPM.WT.A) ("DPM" or "the Company") is pleased to report the results

of the update to the existing definitive feasibility study (the

"DFS") of the Chelopech mine expansion and metals plant project

(the "Project") in Bulgaria undertaken in cooperation with GRD

Minproc Ltd. ("Minproc") and Coffey Mining Pty Ltd. ("Coffey").

"We are extremely pleased with the results of the update to the

2005 feasibility study on our Chelopech expansion project which

confirms the commercial viability of the project and indicates an

internal rate of return of over 27%", stated Jonathan Goodman,

President and CEO. The company is now working on completion of

permitting, project financing and the implementation plan for the

project taking into account the flexibility that we have gained

from our smelter agreement announced in late December. This will

enable us to focus our spending on maximizing cash flows from the

mine and allow an orderly construction of the metals plant, in a

manner that best enhances shareholder value."

---------------------------------------------------------------------------

Project Highlights 2012 - 2018(1)

---------------------------------------------------------------------------

Average annual mine production 2 million tonnes

Average annual concentrate production 150,000 tonnes

Average annual gold production 139,568 oz

Average annual copper production 47.9 million lbs

Total cash cost/tonne ore processed(2) $52.40

Total cash cost per oz gold (copper co-product basis)(2) $430

Total cash cost per oz gold (net of copper credit)(2) $152

Total cash cost per lb copper (copper co-product basis)(2) $0.94

Capital costs from January 2009(2),(3) $216 million

Sustaining capital(2) $63 million

Average annual EBITDA(4) $90 million

---------------------------------------------------------------------------

---------------------------------------------------------------------------

Item Life of Mine

---------------------------------------------------------------------------

Total gold production (oz) 1,506,179

Total copper production (M lbs) 517.7

NPV at a discount rate of 7.5%, after tax $238 million

Internal Rate of Return, after tax (IRR) (5) 27.7%

Payback Period, after tax (from 2011 startup) 2.8 years

Mine Life 12 years

---------------------------------------------------------------------------

(1) Representative period. Based on current Mineral Reserves, the Project

has a mine life of 12 years assuming an annual operating rate of 2

million tonnes ore.

(2) Accuracy of +/- 10%, assumes US$1.35 equals 1 Euro.

(3) Excludes sunk capital of $101.5 million.

(4) Assuming gold, copper and silver prices of $800/oz, $1.75/lb and

$11.00/oz, respectively.

(5) IRR sensitivity to: (i) +/- $100/oz change in average gold price

is +/- 6.4%; (ii) +/- $0.15/lb change in copper price is +/- 3.3%;

and (iii) +/- 10% change in Euro exchange rate is +/-6%.

Mineral Reserves and Resources

The updated Chelopech mineral resource envelope prepared by

Coffey was optimized using Datamine's Mineable Resource Optimizer

software. This software program is designed to produce an optimum

ore boundary based on specified mining constraints. The stope

optimization process, combined with the selection of a lower

cut-off grade of 3.2 g/t gold equivalent (versus 4.0 g/t gold

equivalent), has increased the Mineral Reserves of the Project from

approximately 22 million tonnes, as reported in December 2005, to

over 24 million tonnes, taking mining depletion into account.

Contained metal has increased from 2.5 million ounces of gold and

661.4 million pounds of copper, as reported in December 2005, to

2.9 million ounces of gold and 687.9 million pounds of copper. Over

the three year period since December 2005, replacement of the

reserve tonnage has exceeded depletion by 12% and contained gold

and copper metal in reserves have increased by approximately 17%

and 4%, respectively.

---------------------------------------------------------------------------

Chelopech - Mineral Reserves as at December 2008

3.2g/t AuEq Cut-Off Grade

---------------------------------------------------------------------------

Gold Copper

Tonnes ---------------------------------------------------

Category (M) Grade (g/t) Ounces (M) Grade(%) Pounds (M)

---------------------------------------------------------------------------

Proven 11.68 3.89 1.46 1.42 366.03

---------------------------------------------------------------------------

Probable 12.69 3.53 1.44 1.15 321.86

---------------------------------------------------------------------------

Total 24.37 3.70 2.90 1.28 687.89

---------------------------------------------------------------------------

(1) Cut-off Grade Equivalent Gold is based on the following formula:

Au (g/t) + 2.5 x Cu (%).

(2) Stated Mineral Reserves are completely included within the quoted

Mineral Resources.

The Measured and Indicated Resources reported below were used as the basis

of the Mineral Reserve determination.

---------------------------------------------------------------------------

Chelopech - Mineral Resources as at December 2008

3.2g/t AuEq Cut-Off Grade

---------------------------------------------------------------------------

Gold (Au) Copper (Cu) Silver (Ag)

----------------------------------------------------

Tonnes Ounces Pounds Ounces

Category (M) (g/t) (M) (%) (M) (g/t) (M)

---------------------------------------------------------------------------

Measured 15.70 4.1 2.07 1.47 508.9 10.8 5.45

---------------------------------------------------------------------------

Indicated 19.08 3.52 2.16 1.10 462.6 7.42 4.55

---------------------------------------------------------------------------

---------------------------------------------------------------------------

M&I 34.78 3.78 4.23 1.27 971.5 8.94 10.00

---------------------------------------------------------------------------

Inferred 9.79 2.72 0.86 0.87 187.8 11.44 3.60

---------------------------------------------------------------------------

Project Background

DPM has operated the copper/gold mine and ore concentrating

facility located at Chelopech, Bulgaria, since late 2003. The

concentrate produced contains a high concentration of arsenic which

limits the opportunities for sales to third party smelters and

reduces the realizable return on the value of the metals contained

in the concentrate. To overcome these constraints, and maximize the

potential economic value of the complex, DPM proposes to increase

mine production and construct a facility to produce copper and gold

metals for direct sale to end users. This process will also convert

the arsenic present in the concentrate into an environmentally

stable form suitable for safe disposal into a tailings management

facility ("TMF") located on site.

This proposal was originally presented in 2005, in the form of a

definitive feasibility study (the "2005 DFS"), also prepared by

Minproc, which covered the proposed Project. This Project has

continuously advanced since then. Detailed engineering is now

complete and permitting has progressed since the approval of the

environmental impact assessment ("EIA") by the Bulgarian Government

in July 2008.

The updated DFS includes the upgrade of the existing mine and

concentrator, the new metals production facility ("MPF"), upgrade

of existing infrastructure and associated facilities proposed to be

added or upgraded as part of the Project.

The Project

The Project is anticipated to produce, on average, 47.9 million

pounds of copper metal and 139,568 ounces of gold dore per annum,

from 2012 to 2018, at the designed mining rate of two million

tonnes of ore per annum. Processing will be carried out by

grinding, flotation, pressure oxidation ("POX"), solvent extraction

and electrowinning ("SX/EW") for copper, and carbon in leach

("CIL") cyanidation of the residue for gold recovery. Following

CIL, the solid tailings containing the stabilized arsenic minerals

will be subjected to "cyanide destruction" to ensure compliance

with the maximum levels allowed by European Union and Bulgarian

legislation, prior to deposition in a fully lined tailings

depository.

The Project comprises:

- Expansion of mine production capacity to 2.0 million tonnes

per year (Mt/a);

- Modernization and upgrade of the existing concentrator to

treat the mined tonnage and produce up to 150,000 tonnes of

concentrate per year;

- Installation of an MPF that incorporates POX, CIL and SX/EW to

treat the copper gold concentrate and produce copper cathode and

gold dore; and

- Upgrade of the existing TMF and construction of a new facility

for storage of POX-CIL tailings.

The engineering for the mine, process plant and infrastructure

has been developed to support a capital cost estimate, as well as

an operating cost estimate, to an accuracy of +/-10%. The capital

and operating costs consider the mining, processing, general

administration costs and environmental implications and are in

fourth quarter 2008 ("Q4 2008") United States Dollars (US$).

-----------------------------------------------------------

Life of Mine Production Assumptions

-----------------------------------------------------------

Item Through 2020

-----------------------------------------------------------

Total Quantity Ore Mined/Milled 21.9 million tonnes

Average Grades

Gold 3.84 g/t

Copper 1.31%

-----------------------------------------------------------

Concentrate Recoveries

-----------------------------------------------------------

Gold 58.2%

Copper 85.3%

-----------------------------------------------------------

MPF Recoveries

-----------------------------------------------------------

Gold 95.0%

Copper 95.0%

-----------------------------------------------------------

Metal Processing Facility

Several comprehensive testwork programs have been completed on

samples representing various Chelopech ore types. The testing

included batch and continuous pilot scale programs for the mineral

processing and hydrometallurgical aspects of the concentrator

upgrade and MPF.

These results were used as the basis for development of the MPF

process flow sheet, process design criteria, mass balance model and

equipment sizing.

Minproc commenced and managed a comprehensive testwork program

as part of the 2005 DFS. This program followed on from a limited

batch testing program conducted during 2003 as part of the earlier

pre-feasibility level due diligence study and continued until

November 2005.

The key results of the testwork program were:

- Confirmation that the high copper and gold extraction results

obtained in earlier due diligence phase batch testing

(approximately 95% Cu, and 90-95% Au) are achievable on a range of

Chelopech concentrates, including future samples derived from bulk

flotation of representative composites of drill core from the three

major ore zones of the deposit (Blocks 19, 150 and 151);

- Identification of process conditions and an overall process

flow sheet which can deliver these extractions at optimal reagent

consumptions and, preferably, in a single train POX plant; and

- Confirmation of the process performance and design criteria of

the key circuits.

Included in this program was characterization and flotation of

run-of-mine ore and a number of stope and drill core ore samples

from the Chelopech resource, characterization of two limestone

samples from potential Bulgarian suppliers near the Chelopech site

and environmental testing of barren liquors and residues following

the recovery of copper and gold. Commissioned by DPM, the bulk of

this testwork was conducted in three laboratories: SGS

Lakefield-Oretest and Ammtec in Perth, Australia and Dynatec at

Fort Saskatchewan in Canada.

Tailings Management

Two TMFs will be operated for the Project. The existing TMF

("Flotation TMF") will be upgraded to meet modern environmental

standards and will continue to be used for storage of the flotation

tailings together with a gypsum waste stream from the new facility.

This facility has sufficient storage to provide over 20 years life

at the proposed production rate.

A new TMF ("New TMF"), in two separate cells, will be built

upstream of the Flotation TMF to provide storage for the tailings

from the cyanide circuit. This will be a fully lined facility.

The Project engineering and planning have been certified by The

International Cyanide Management Institute as being compliant with

the International Cyanide Management Code. The New TMF and water

balance for the Project were included in this certification. An

operating audit is scheduled to be carried out once the Project is

in operation to provide for an operational certification. The New

TMF is also engineered to be compliant with the European directives

on safety and the management of waste from the extractive

industry.

Community Consultation

The Chelopech mine is located in an area with a large mining

industry and currently employs over 900 people. DPM has made a

great effort to improve community consultation and involvement

since taking over ownership of the mine.

Land Purchase

The implementation of the Project requires acquisition of land

for the New TMF, site access, expansion of the new MPF and some

buffer zones adjacent to the TMFs and site access areas.

Approximately 75% of all required 160 hectares of land in the

Municipalities of Chelopech and Chavdar has been purchased from

private owners and both municipalities. The acquisition of the

remaining 25% of land, 26 hectares of which is municipal, is in

progress and is expected to be complete mid-2009. Re-designation of

land from agricultural into industrial is the next step and is a

prerequisite for issuance of the construction permit for project

implementation. It is estimated that the land re-designation

process will be complete at the beginning of 2010.

Permitting

The permitting process for project implementation in Bulgaria is

complex, involving various ministries and government agencies. The

environmental permits, such as the EIA, The Integration Pollution

and Prevention Control ("IPPC") and Working with Hazardous

Substances ("Seveso"), are prerequisites for issuance of the

construction permit. The EIA, completed by the Balkan Science and

Education Centre of Ecology and Environment in November 2005, and

registered in February 2006, was approved by the Bulgarian Ministry

of Environment and Waters ("MoEW") in July 2008. The IPPC

application has been filed with the MoEW and the Seveso application

is in progress. Both the IPPC and Seveso permits are expected to be

issued by or in the third quarter of 2009. The Company is currently

preparing a detailed development and implementation plan for the

Project and site areas, which is also a prerequisite for issuance

of a construction permit. The Project is fully compliant with all

European safety and environmental directives and industry Best

Available Techniques requirements, as determined by IPPC, and the

engineering has passed through rigorous audit and been certified by

The International Cyanide Management Institute as being compliant

with the International Cyanide Management Code.

Bulgarian Public Private Partnership

As announced in July 2008, the Company signed an MOU with the

Bulgarian authorities outlining the terms of modified royalty

provisions, a Project reclamation bond and the formation of a new

joint stock Bulgarian company to be owned 75% by DPM and 25% by the

Republic of Bulgaria for the purpose of financing, constructing and

operating the MPF.

The Company will pay a higher royalty in accordance with the

Bulgarian Ordinance on Royalty Computation for all the metals that

can be mined economically from the Chelopech deposit. The royalty

will be calculated on a sliding scale of 2% to 8% at a

profitability ratio of 10% to 60%. The new royalty, which came into

effect on July 31, 2008, replaced the 1.5% fixed rate entered into

in 2004. The royalty in excess of 1.5% will be accrued but is

payable only after the start of construction of the MPF.

DPM has also agreed to provide a financial guarantee for

environmental closure and rehabilitation costs for the Chelopech

mine. The Company will prepare and submit for approval to both the

Ministry of Economy and Energy and the MoEW a closure and

rehabilitation plan within 18 months of July 10, 2008, the date of

the amended concession agreement. The Company is moving forward

with the development of this agreement.

Capital Cost

As of December 31, 2008, the Company had invested $102 million

in the Project for engineering, procurement and construction

management on the MPF, mine upgrades, the construction of the

decline for access from surface to underground, acquisition and

refurbishment of an oxygen plant and the first phase of the mine

backfill plant. The increase in estimated capital cost to complete

the Project reflects the price escalations for equipment, services

and materials experienced globally by the mining industry since the

original DFS was prepared in 2005.

The updated DFS and the related financial analysis include only

incremental costs and exclude sunk costs. The table below is a

summary of the estimated additional capital costs required to

complete the Project, excluding closure costs:

-----------------------------------------------------------

CAPITAL COST ESTIMATE SUMMARY

-----------------------------------------------------------

Item Total ($M)

-----------------------------------------------------------

Capital Expenditure (to end 2010)

Mine 54.33

Concentrator 15.70

Metal Production Facility 70.54

Environmental (including TMFs) 9.68

Infrastructure and Services 35.10

Owners Costs 30.90

-----------------------------------------------------------

Total Capital 216.25

-----------------------------------------------------------

Sustaining Capital 62.75

-----------------------------------------------------------

TOTAL CAPITAL - Life of Mine 279.00

-----------------------------------------------------------

The capital cost estimate has a level of accuracy of +/-10% and

is expressed in Q4 2008 US dollars. Approximately 50-60% of the

capital cost is expected to be incurred in Euro. For the purpose of

this study an exchange rate of US$1.35 equals 1 Euro was used.

Operating Costs

Operating costs are based on the mining and treatment of 2.0

million tonnes ore per year, producing an average of 47.9 million

pounds of copper and 139,578 oz gold per year, for the period

indicated. Costs for the new facilities are based on Q4 2008

quotations for all materials and consumables, while the current

site costs for labour and consumables have been used, as

applicable.

-----------------------------------------------------------

SUMMARY OF ESTIMATED OPERATING COSTS

-----------------------------------------------------------

2012 - 2018

Item Average

-----------------------------------------------------------

Operating Costs ($/t ore processed)

Mine 21.52

Concentrator 6.55

Services 3.18

General & Administration 4.16

Metal Production 12.20

Royalty 4.78

-----------------------------------------------------------

Total 52.39

-----------------------------------------------------------

Technical Information

The independent technical report in support of this DFS, which

has been prepared by Brett Gossage and Peter Wade of Coffey, Gary

Jobson of Minproc, Brett Stevenson of Knight Piesold Pty Ltd. and

J. Fergus Anckorn of AMEC Earth & Environmental UK Ltd., all of

whom are Qualified Persons under National Instrument 43-101 ("NI

43-101"), will be filed on Sedar at www.sedar.com by the end of

March 2009. Investors should review the detailed information

contained in the technical report for the key assumptions,

parameters and additional information relevant to the matters

discussed in this press release. The Summary of the DFS will be

posted on the Company's website at www.dundeeprecious.com.

Dr. Simon Meik, Operations Manager, Processing of Chelopech

Mining EAD, who is a Qualified Person under NI 43-101, has

supervised the preparation of the technical data included in this

news release.

FORWARD LOOKING STATEMENTS

This news release contains certain "forward-looking information"

under applicable Canadian securities legislation. Except for

statements of historical fact relating to the Company, information

contained herein constitutes forward-looking statements, including

any information as to the Company's strategy, plans or future

financial or operating performance. Forward-looking statements are

characterized by words such as "plan", "expect", "budget",

"target", "project", "intend", "believe", "anticipate", "estimate"

and other similar words, or statements that certain events or

conditions "may" or "will" occur.

Forward-looking statements are based on the opinions,

assumptions and estimates of management considered reasonable (some

of which are outlined herein and in the technical report to be

filed in connection with this press release) at the date the

statements are made, and are inherently subject to a variety of

risks and uncertainties and other known and unknown factors that

could cause actual events or results to differ materially from

those projected in the forward-looking statements. These factors

include, but are not limited to, the advantages determined based on

findings of the current feasibility study conducted on the Project

proving to be accurate, the Company's expectations in connection

with the Project discussed herein being met, the impact of general

business and economic conditions, global liquidity and credit

availability on the timing of cash flows and the values of assets

and liabilities based on projected future conditions, possible

variations in ore grade or recovery rates, fluctuating metal prices

(such as gold and copper), currency exchange rates, changes in the

Company's accounting policies, changes in the Company's corporate

resources, changes in Project parameters as plans continue to be

refined, changes in Project development and production time frames,

risk related to the possibility of Project cost overruns or

unanticipated costs and expenses, higher prices for fuel, steel,

power, labour and other consumables contributing to higher costs

and general risks of the mining industry, failure of plant,

equipment or processes to operate as anticipated, unexpected

changes in mine life, final pricing for concentrate sales,

unanticipated results of future studies, seasonality, costs and

timing of the development of new deposits, success of exploration

activities, permitting time lines, government regulation of mining

operations, environmental risks, unanticipated reclamation

expenses, title disputes or claims, limitations on insurance

coverage and timing and possible outcome of pending litigation and

labour disputes, as well as those risks and uncertainties discussed

or referred to in the Company's annual Management's Discussion and

Analysis and Annual Information Form filed with the securities

regulatory authorities in Canada and available at

www.sedar.com.

Although the Company has attempted to identify important factors

that could cause actual actions, events or results to differ

materially from those described in forward-looking statements,

there may be other factors that cause actions, events or results

not to be anticipated, estimated or intended. There can be no

assurance that forward-looking statements will prove to be

accurate, as actual results and future events could differ

materially from those anticipated in such statements. The Company

undertakes no obligation to update forward-looking statements if

circumstances or management's estimates, assumptions or opinions

should change, except as required by applicable law. The reader is

cautioned not to place undue reliance on forward-looking

statements. The forward-looking information contained herein is

presented for the purpose of assisting investors in understanding

the Company's expected operational performance and the Company's

plans and objectives related to the projects discussed herein and

may not be appropriate for other purposes.

NON-GAAP MEASURES

This press release refers to estimated EBITDA, cash cost per

tonne of ore processed, cash cost per pound of copper, cash cost

per ounce of gold because certain investors may use this

information to assess the Company's ability to generate cash flow

for investing activities. In addition, management utilizes these

metrics as an important management tool to project and monitor

performance of the Company's operations. These measurements have no

standardized meaning under Canadian GAAP and are therefore unlikely

to be comparable to similar measures presented by other companies.

These measurements are intended to provide additional information

and should not be considered in isolation or as a substitute for

measures of performance prepared in accordance with Canadian

GAAP.

Dundee Precious Metals Inc. is a Canadian based, international

mining company engaged in the acquisition, exploration, development

and mining of precious metals. DPM owns the Chelopech Mine, a

producing gold/copper mine, and the Krumovgrad Gold Project, a

mining development project, both located in Bulgaria, and is

engaged in mineral exploration activities in Serbia. In addition,

Dundee Precious owns the Back River gold exploration project in

Nunavut, Canada and a 95% interest in the Kapan Mine in

Armenia.

Contacts: DUNDEE PRECIOUS METALS INC. Jonathan Goodman President

& Chief Executive Officer (416) 365-2408 Email:

jgoodman@dundeeprecious.com DUNDEE PRECIOUS METALS INC. Lori Beak

Vice President, Investor Relations and Corporate Secretary (416)

365-5165 Email: lbeak@dundeeprecious.com

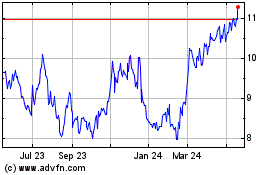

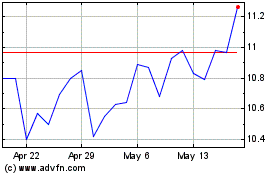

Dundee Precious Metals (TSX:DPM)

Historical Stock Chart

From Jul 2024 to Jul 2024

Dundee Precious Metals (TSX:DPM)

Historical Stock Chart

From Jul 2023 to Jul 2024