(All amounts have been expressed in US Dollars except where otherwise indicated)

Dundee Precious Metals Inc. (TSX:DPM)(TSX:DPM.WT)(TSX:DPM.WT.A) ("DPM" or "the

Company") is pleased to report the results of the update to the existing

definitive feasibility study (the "DFS") of the Chelopech mine expansion and

metals plant project (the "Project") in Bulgaria undertaken in cooperation with

GRD Minproc Ltd. ("Minproc") and Coffey Mining Pty Ltd. ("Coffey").

"We are extremely pleased with the results of the update to the 2005 feasibility

study on our Chelopech expansion project which confirms the commercial viability

of the project and indicates an internal rate of return of over 27%", stated

Jonathan Goodman, President and CEO. The company is now working on completion of

permitting, project financing and the implementation plan for the project taking

into account the flexibility that we have gained from our smelter agreement

announced in late December. This will enable us to focus our spending on

maximizing cash flows from the mine and allow an orderly construction of the

metals plant, in a manner that best enhances shareholder value."

---------------------------------------------------------------------------

Project Highlights 2012 - 2018(1)

---------------------------------------------------------------------------

Average annual mine production 2 million tonnes

Average annual concentrate production 150,000 tonnes

Average annual gold production 139,568 oz

Average annual copper production 47.9 million lbs

Total cash cost/tonne ore processed(2) $52.40

Total cash cost per oz gold (copper co-product basis)(2) $430

Total cash cost per oz gold (net of copper credit)(2) $152

Total cash cost per lb copper (copper co-product basis)(2) $0.94

Capital costs from January 2009(2),(3) $216 million

Sustaining capital(2) $63 million

Average annual EBITDA(4) $90 million

---------------------------------------------------------------------------

---------------------------------------------------------------------------

Item Life of Mine

---------------------------------------------------------------------------

Total gold production (oz) 1,506,179

Total copper production (M lbs) 517.7

NPV at a discount rate of 7.5%, after tax $238 million

Internal Rate of Return, after tax (IRR) (5) 27.7%

Payback Period, after tax (from 2011 startup) 2.8 years

Mine Life 12 years

---------------------------------------------------------------------------

(1) Representative period. Based on current Mineral Reserves, the Project

has a mine life of 12 years assuming an annual operating rate of 2

million tonnes ore.

(2) Accuracy of +/- 10%, assumes US$1.35 equals 1 Euro.

(3) Excludes sunk capital of $101.5 million.

(4) Assuming gold, copper and silver prices of $800/oz, $1.75/lb and

$11.00/oz, respectively.

(5) IRR sensitivity to: (i) +/- $100/oz change in average gold price

is +/- 6.4%; (ii) +/- $0.15/lb change in copper price is +/- 3.3%;

and (iii) +/- 10% change in Euro exchange rate is +/-6%.

Mineral Reserves and Resources

The updated Chelopech mineral resource envelope prepared by Coffey was optimized

using Datamine's Mineable Resource Optimizer software. This software program is

designed to produce an optimum ore boundary based on specified mining

constraints. The stope optimization process, combined with the selection of a

lower cut-off grade of 3.2 g/t gold equivalent (versus 4.0 g/t gold equivalent),

has increased the Mineral Reserves of the Project from approximately 22 million

tonnes, as reported in December 2005, to over 24 million tonnes, taking mining

depletion into account. Contained metal has increased from 2.5 million ounces of

gold and 661.4 million pounds of copper, as reported in December 2005, to 2.9

million ounces of gold and 687.9 million pounds of copper. Over the three year

period since December 2005, replacement of the reserve tonnage has exceeded

depletion by 12% and contained gold and copper metal in reserves have increased

by approximately 17% and 4%, respectively.

---------------------------------------------------------------------------

Chelopech - Mineral Reserves as at December 2008

3.2g/t AuEq Cut-Off Grade

---------------------------------------------------------------------------

Gold Copper

Tonnes ---------------------------------------------------

Category (M) Grade (g/t) Ounces (M) Grade(%) Pounds (M)

---------------------------------------------------------------------------

Proven 11.68 3.89 1.46 1.42 366.03

---------------------------------------------------------------------------

Probable 12.69 3.53 1.44 1.15 321.86

---------------------------------------------------------------------------

Total 24.37 3.70 2.90 1.28 687.89

---------------------------------------------------------------------------

(1) Cut-off Grade Equivalent Gold is based on the following formula:

Au (g/t) + 2.5 x Cu (%).

(2) Stated Mineral Reserves are completely included within the quoted

Mineral Resources.

The Measured and Indicated Resources reported below were used as the basis

of the Mineral Reserve determination.

---------------------------------------------------------------------------

Chelopech - Mineral Resources as at December 2008

3.2g/t AuEq Cut-Off Grade

---------------------------------------------------------------------------

Gold (Au) Copper (Cu) Silver (Ag)

----------------------------------------------------

Tonnes Ounces Pounds Ounces

Category (M) (g/t) (M) (%) (M) (g/t) (M)

---------------------------------------------------------------------------

Measured 15.70 4.1 2.07 1.47 508.9 10.8 5.45

---------------------------------------------------------------------------

Indicated 19.08 3.52 2.16 1.10 462.6 7.42 4.55

---------------------------------------------------------------------------

---------------------------------------------------------------------------

M&I 34.78 3.78 4.23 1.27 971.5 8.94 10.00

---------------------------------------------------------------------------

Inferred 9.79 2.72 0.86 0.87 187.8 11.44 3.60

---------------------------------------------------------------------------

Project Background

DPM has operated the copper/gold mine and ore concentrating facility located at

Chelopech, Bulgaria, since late 2003. The concentrate produced contains a high

concentration of arsenic which limits the opportunities for sales to third party

smelters and reduces the realizable return on the value of the metals contained

in the concentrate. To overcome these constraints, and maximize the potential

economic value of the complex, DPM proposes to increase mine production and

construct a facility to produce copper and gold metals for direct sale to end

users. This process will also convert the arsenic present in the concentrate

into an environmentally stable form suitable for safe disposal into a tailings

management facility ("TMF") located on site.

This proposal was originally presented in 2005, in the form of a definitive

feasibility study (the "2005 DFS"), also prepared by Minproc, which covered the

proposed Project. This Project has continuously advanced since then. Detailed

engineering is now complete and permitting has progressed since the approval of

the environmental impact assessment ("EIA") by the Bulgarian Government in July

2008.

The updated DFS includes the upgrade of the existing mine and concentrator, the

new metals production facility ("MPF"), upgrade of existing infrastructure and

associated facilities proposed to be added or upgraded as part of the Project.

The Project

The Project is anticipated to produce, on average, 47.9 million pounds of copper

metal and 139,568 ounces of gold dore per annum, from 2012 to 2018, at the

designed mining rate of two million tonnes of ore per annum. Processing will be

carried out by grinding, flotation, pressure oxidation ("POX"), solvent

extraction and electrowinning ("SX/EW") for copper, and carbon in leach ("CIL")

cyanidation of the residue for gold recovery. Following CIL, the solid tailings

containing the stabilized arsenic minerals will be subjected to "cyanide

destruction" to ensure compliance with the maximum levels allowed by European

Union and Bulgarian legislation, prior to deposition in a fully lined tailings

depository.

The Project comprises:

- Expansion of mine production capacity to 2.0 million tonnes per year (Mt/a);

- Modernization and upgrade of the existing concentrator to treat the mined

tonnage and produce up to 150,000 tonnes of concentrate per year;

- Installation of an MPF that incorporates POX, CIL and SX/EW to treat the

copper gold concentrate and produce copper cathode and gold dore; and

- Upgrade of the existing TMF and construction of a new facility for storage of

POX-CIL tailings.

The engineering for the mine, process plant and infrastructure has been

developed to support a capital cost estimate, as well as an operating cost

estimate, to an accuracy of +/-10%. The capital and operating costs consider the

mining, processing, general administration costs and environmental implications

and are in fourth quarter 2008 ("Q4 2008") United States Dollars (US$).

-----------------------------------------------------------

Life of Mine Production Assumptions

-----------------------------------------------------------

Item Through 2020

-----------------------------------------------------------

Total Quantity Ore Mined/Milled 21.9 million tonnes

Average Grades

Gold 3.84 g/t

Copper 1.31%

-----------------------------------------------------------

Concentrate Recoveries

-----------------------------------------------------------

Gold 58.2%

Copper 85.3%

-----------------------------------------------------------

MPF Recoveries

-----------------------------------------------------------

Gold 95.0%

Copper 95.0%

-----------------------------------------------------------

Metal Processing Facility

Several comprehensive testwork programs have been completed on samples

representing various Chelopech ore types. The testing included batch and

continuous pilot scale programs for the mineral processing and

hydrometallurgical aspects of the concentrator upgrade and MPF.

These results were used as the basis for development of the MPF process flow

sheet, process design criteria, mass balance model and equipment sizing.

Minproc commenced and managed a comprehensive testwork program as part of the

2005 DFS. This program followed on from a limited batch testing program

conducted during 2003 as part of the earlier pre-feasibility level due diligence

study and continued until November 2005.

The key results of the testwork program were:

- Confirmation that the high copper and gold extraction results obtained in

earlier due diligence phase batch testing (approximately 95% Cu, and 90-95% Au)

are achievable on a range of Chelopech concentrates, including future samples

derived from bulk flotation of representative composites of drill core from the

three major ore zones of the deposit (Blocks 19, 150 and 151);

- Identification of process conditions and an overall process flow sheet which

can deliver these extractions at optimal reagent consumptions and, preferably,

in a single train POX plant; and

- Confirmation of the process performance and design criteria of the key circuits.

Included in this program was characterization and flotation of run-of-mine ore

and a number of stope and drill core ore samples from the Chelopech resource,

characterization of two limestone samples from potential Bulgarian suppliers

near the Chelopech site and environmental testing of barren liquors and residues

following the recovery of copper and gold. Commissioned by DPM, the bulk of this

testwork was conducted in three laboratories: SGS Lakefield-Oretest and Ammtec

in Perth, Australia and Dynatec at Fort Saskatchewan in Canada.

Tailings Management

Two TMFs will be operated for the Project. The existing TMF ("Flotation TMF")

will be upgraded to meet modern environmental standards and will continue to be

used for storage of the flotation tailings together with a gypsum waste stream

from the new facility. This facility has sufficient storage to provide over 20

years life at the proposed production rate.

A new TMF ("New TMF"), in two separate cells, will be built upstream of the

Flotation TMF to provide storage for the tailings from the cyanide circuit. This

will be a fully lined facility.

The Project engineering and planning have been certified by The International

Cyanide Management Institute as being compliant with the International Cyanide

Management Code. The New TMF and water balance for the Project were included in

this certification. An operating audit is scheduled to be carried out once the

Project is in operation to provide for an operational certification. The New TMF

is also engineered to be compliant with the European directives on safety and

the management of waste from the extractive industry.

Community Consultation

The Chelopech mine is located in an area with a large mining industry and

currently employs over 900 people. DPM has made a great effort to improve

community consultation and involvement since taking over ownership of the mine.

Land Purchase

The implementation of the Project requires acquisition of land for the New TMF,

site access, expansion of the new MPF and some buffer zones adjacent to the TMFs

and site access areas. Approximately 75% of all required 160 hectares of land in

the Municipalities of Chelopech and Chavdar has been purchased from private

owners and both municipalities. The acquisition of the remaining 25% of land, 26

hectares of which is municipal, is in progress and is expected to be complete

mid-2009. Re-designation of land from agricultural into industrial is the next

step and is a prerequisite for issuance of the construction permit for project

implementation. It is estimated that the land re-designation process will be

complete at the beginning of 2010.

Permitting

The permitting process for project implementation in Bulgaria is complex,

involving various ministries and government agencies. The environmental permits,

such as the EIA, The Integration Pollution and Prevention Control ("IPPC") and

Working with Hazardous Substances ("Seveso"), are prerequisites for issuance of

the construction permit. The EIA, completed by the Balkan Science and Education

Centre of Ecology and Environment in November 2005, and registered in February

2006, was approved by the Bulgarian Ministry of Environment and Waters ("MoEW")

in July 2008. The IPPC application has been filed with the MoEW and the Seveso

application is in progress. Both the IPPC and Seveso permits are expected to be

issued by or in the third quarter of 2009. The Company is currently preparing a

detailed development and implementation plan for the Project and site areas,

which is also a prerequisite for issuance of a construction permit. The Project

is fully compliant with all European safety and environmental directives and

industry Best Available Techniques requirements, as determined by IPPC, and the

engineering has passed through rigorous audit and been certified by The

International Cyanide Management Institute as being compliant with the

International Cyanide Management Code.

Bulgarian Public Private Partnership

As announced in July 2008, the Company signed an MOU with the Bulgarian

authorities outlining the terms of modified royalty provisions, a Project

reclamation bond and the formation of a new joint stock Bulgarian company to be

owned 75% by DPM and 25% by the Republic of Bulgaria for the purpose of

financing, constructing and operating the MPF.

The Company will pay a higher royalty in accordance with the Bulgarian Ordinance

on Royalty Computation for all the metals that can be mined economically from

the Chelopech deposit. The royalty will be calculated on a sliding scale of 2%

to 8% at a profitability ratio of 10% to 60%. The new royalty, which came into

effect on July 31, 2008, replaced the 1.5% fixed rate entered into in 2004. The

royalty in excess of 1.5% will be accrued but is payable only after the start of

construction of the MPF.

DPM has also agreed to provide a financial guarantee for environmental closure

and rehabilitation costs for the Chelopech mine. The Company will prepare and

submit for approval to both the Ministry of Economy and Energy and the MoEW a

closure and rehabilitation plan within 18 months of July 10, 2008, the date of

the amended concession agreement. The Company is moving forward with the

development of this agreement.

Capital Cost

As of December 31, 2008, the Company had invested $102 million in the Project

for engineering, procurement and construction management on the MPF, mine

upgrades, the construction of the decline for access from surface to

underground, acquisition and refurbishment of an oxygen plant and the first

phase of the mine backfill plant. The increase in estimated capital cost to

complete the Project reflects the price escalations for equipment, services and

materials experienced globally by the mining industry since the original DFS was

prepared in 2005.

The updated DFS and the related financial analysis include only incremental

costs and exclude sunk costs. The table below is a summary of the estimated

additional capital costs required to complete the Project, excluding closure

costs:

-----------------------------------------------------------

CAPITAL COST ESTIMATE SUMMARY

-----------------------------------------------------------

Item Total ($M)

-----------------------------------------------------------

Capital Expenditure (to end 2010)

Mine 54.33

Concentrator 15.70

Metal Production Facility 70.54

Environmental (including TMFs) 9.68

Infrastructure and Services 35.10

Owners Costs 30.90

-----------------------------------------------------------

Total Capital 216.25

-----------------------------------------------------------

Sustaining Capital 62.75

-----------------------------------------------------------

TOTAL CAPITAL - Life of Mine 279.00

-----------------------------------------------------------

The capital cost estimate has a level of accuracy of +/-10% and is expressed in

Q4 2008 US dollars. Approximately 50-60% of the capital cost is expected to be

incurred in Euro. For the purpose of this study an exchange rate of US$1.35

equals 1 Euro was used.

Operating Costs

Operating costs are based on the mining and treatment of 2.0 million tonnes ore

per year, producing an average of 47.9 million pounds of copper and 139,578 oz

gold per year, for the period indicated. Costs for the new facilities are based

on Q4 2008 quotations for all materials and consumables, while the current site

costs for labour and consumables have been used, as applicable.

-----------------------------------------------------------

SUMMARY OF ESTIMATED OPERATING COSTS

-----------------------------------------------------------

2012 - 2018

Item Average

-----------------------------------------------------------

Operating Costs ($/t ore processed)

Mine 21.52

Concentrator 6.55

Services 3.18

General & Administration 4.16

Metal Production 12.20

Royalty 4.78

-----------------------------------------------------------

Total 52.39

-----------------------------------------------------------

Technical Information

The independent technical report in support of this DFS, which has been prepared

by Brett Gossage and Peter Wade of Coffey, Gary Jobson of Minproc, Brett

Stevenson of Knight Piesold Pty Ltd. and J. Fergus Anckorn of AMEC Earth &

Environmental UK Ltd., all of whom are Qualified Persons under National

Instrument 43-101 ("NI 43-101"), will be filed on Sedar at www.sedar.com by the

end of March 2009. Investors should review the detailed information contained in

the technical report for the key assumptions, parameters and additional

information relevant to the matters discussed in this press release. The Summary

of the DFS will be posted on the Company's website at www.dundeeprecious.com.

Dr. Simon Meik, Operations Manager, Processing of Chelopech Mining EAD, who is a

Qualified Person under NI 43-101, has supervised the preparation of the

technical data included in this news release.

FORWARD LOOKING STATEMENTS

This news release contains certain "forward-looking information" under

applicable Canadian securities legislation. Except for statements of historical

fact relating to the Company, information contained herein constitutes

forward-looking statements, including any information as to the Company's

strategy, plans or future financial or operating performance. Forward-looking

statements are characterized by words such as "plan", "expect", "budget",

"target", "project", "intend", "believe", "anticipate", "estimate" and other

similar words, or statements that certain events or conditions "may" or "will"

occur.

Forward-looking statements are based on the opinions, assumptions and estimates

of management considered reasonable (some of which are outlined herein and in

the technical report to be filed in connection with this press release) at the

date the statements are made, and are inherently subject to a variety of risks

and uncertainties and other known and unknown factors that could cause actual

events or results to differ materially from those projected in the

forward-looking statements. These factors include, but are not limited to, the

advantages determined based on findings of the current feasibility study

conducted on the Project proving to be accurate, the Company's expectations in

connection with the Project discussed herein being met, the impact of general

business and economic conditions, global liquidity and credit availability on

the timing of cash flows and the values of assets and liabilities based on

projected future conditions, possible variations in ore grade or recovery rates,

fluctuating metal prices (such as gold and copper), currency exchange rates,

changes in the Company's accounting policies, changes in the Company's corporate

resources, changes in Project parameters as plans continue to be refined,

changes in Project development and production time frames, risk related to the

possibility of Project cost overruns or unanticipated costs and expenses, higher

prices for fuel, steel, power, labour and other consumables contributing to

higher costs and general risks of the mining industry, failure of plant,

equipment or processes to operate as anticipated, unexpected changes in mine

life, final pricing for concentrate sales, unanticipated results of future

studies, seasonality, costs and timing of the development of new deposits,

success of exploration activities, permitting time lines, government regulation

of mining operations, environmental risks, unanticipated reclamation expenses,

title disputes or claims, limitations on insurance coverage and timing and

possible outcome of pending litigation and labour disputes, as well as those

risks and uncertainties discussed or referred to in the Company's annual

Management's Discussion and Analysis and Annual Information Form filed with the

securities regulatory authorities in Canada and available at www.sedar.com.

Although the Company has attempted to identify important factors that could

cause actual actions, events or results to differ materially from those

described in forward-looking statements, there may be other factors that cause

actions, events or results not to be anticipated, estimated or intended. There

can be no assurance that forward-looking statements will prove to be accurate,

as actual results and future events could differ materially from those

anticipated in such statements. The Company undertakes no obligation to update

forward-looking statements if circumstances or management's estimates,

assumptions or opinions should change, except as required by applicable law. The

reader is cautioned not to place undue reliance on forward-looking statements.

The forward-looking information contained herein is presented for the purpose of

assisting investors in understanding the Company's expected operational

performance and the Company's plans and objectives related to the projects

discussed herein and may not be appropriate for other purposes.

NON-GAAP MEASURES

This press release refers to estimated EBITDA, cash cost per tonne of ore

processed, cash cost per pound of copper, cash cost per ounce of gold because

certain investors may use this information to assess the Company's ability to

generate cash flow for investing activities. In addition, management utilizes

these metrics as an important management tool to project and monitor performance

of the Company's operations. These measurements have no standardized meaning

under Canadian GAAP and are therefore unlikely to be comparable to similar

measures presented by other companies. These measurements are intended to

provide additional information and should not be considered in isolation or as a

substitute for measures of performance prepared in accordance with Canadian

GAAP.

Dundee Precious Metals Inc. is a Canadian based, international mining company

engaged in the acquisition, exploration, development and mining of precious

metals. DPM owns the Chelopech Mine, a producing gold/copper mine, and the

Krumovgrad Gold Project, a mining development project, both located in Bulgaria,

and is engaged in mineral exploration activities in Serbia. In addition, Dundee

Precious owns the Back River gold exploration project in Nunavut, Canada and a

95% interest in the Kapan Mine in Armenia.

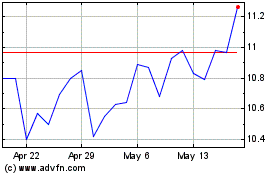

Dundee Precious Metals (TSX:DPM)

Historical Stock Chart

From Jul 2024 to Jul 2024

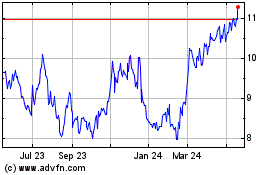

Dundee Precious Metals (TSX:DPM)

Historical Stock Chart

From Jul 2023 to Jul 2024