FIRST QUARTER 2024 HIGHLIGHTS

- Revenues of $129.3 million were up +69.9%, or +$76.1 million

vs. Q1 2023

- Gross profit of $37.3 million increased +57.9% or $13.7

million

- Gross profit as a percentage of revenues of 28.9%, a sequential

improvement that shows our progress towards our goal of returning

our gross margin to the +30% range

- SG&A expenses were $25.4 million or 19.6% of revenues in Q1

2024, compared to 18.1% of revenues in Q1 2023. Higher relative

SG&A expenses in the quarter primarily related to a one-time

consulting project

- Adjusted EBITDA1 was $18.7 million, an increase of +46.2% vs.

the prior year

- Adjusted EBITDA represented 14.4% of revenues, compared to

16.8% for 2023, consistent with our planned objectives to improve

Adjusted EBITDA margins to more than 14%

- Net income was $1.5 million compared to a net loss of $2.4

million last year; Adjusted net income was $4.9 million compared to

$5.9 million last year

- Net debt at the end of Q1 2024 was $78.3 million, down -$66.9

million or -46.1% since the closing of the MCC acquisition. The

Company ended the quarter with a net debt to trailing 12 months

Adjusted EBITDA (net of lease payments) ratio of 1.8x. Our

commitment to paying down debt remains a key priority

DATA Communications Management Corp. (TSX: DCM; OTCQX: DCMDF)

(“DCM” or the "Company"), a leading provider of marketing and

business communication solutions to companies across North America,

today reported its first quarter 2024 financial results.

MANAGEMENT COMMENTARY

“I am pleased to report on the continued progress of our

business in the first quarter of 2024, following a transformative

year in 2023 when we completed our acquisition of Moore Canada

Corporation (“MCC”) and made substantial progress in our

post-acquisition integration,” said Richard Kellam, President &

CEO of DCM.

“Our focus in the first quarter and for the balance of the year

is on delivering our post-acquisition integration commitments.

These priorities include consolidating our plant network,

integrating legacy MCC systems, completing our restructuring plans,

focusing on profitable growth, and realizing total annualized

post-acquisition synergies of between $30 and $35 million within

the next year.”

“We are optimistic about our full year outlook based on order

trends we are seeing, new logo wins, and progress on our

initiatives to drive improved operating performance, including

strategic revenue management opportunities, improving product mix,

and leveraging our expanded suite of product and service

offerings.”

FIRST QUARTER 2024 EARNINGS CALL

The Company will host a conference call and webcast on Tuesday,

May 14,2024, at 9:00 a.m. Eastern time. Mr. Kellam, and James

Lorimer, CFO, will present the first quarter of 2024 results

followed by a live Q&A period.

Instructions on how to access both the webcast and call are

available below.

DCM will be using Microsoft Teams to broadcast our earnings

call, which will be accessible via the options below:

Click here to join the meeting

Meeting ID: 284 159 172 699 Passcode: rVeV5u Download Teams | Join on the

web

Or call in (audio only)

+1 647-749-9154,,174293459# Canada, Toronto Phone Conference ID:

174 293 459#

The Company’s full results will be posted on its Investor

Relations page and on www.sedarplus.ca. A video message from Mr.

Kellam will also be posted on the Company’s website.

TABLE 1 The following table sets out selected historical

consolidated financial information for the periods noted.

For the periods ended March 31, 2024

and 2023

January 1 to March 31,

2024

January 1 to March 31, 2023

(in thousands of Canadian dollars, except

share and per share amounts, unaudited)

Revenues

$

129,254

$

76,077

Gross profit

37,311

23,635

Gross profit, as a percentage of

revenues

28.9

%

31.1

%

Selling, general and administrative

expenses

25,382

13,736

As a percentage of revenues

19.6

%

18.1

%

Adjusted EBITDA

18,665

12,766

As a percentage of revenues

14.4

%

16.8

%

Net income (loss) for the

period

1,475

(2,431

)

Adjusted net income

4,903

5,890

As a percentage of revenues

3.8

%

7.7

%

Basic (loss) earnings per share

$

0.03

$

(0.06

)

Diluted (loss) earnings per

share

$

0.02

$

(0.06

)

Weighted average number of common

shares outstanding, basic

55,022,883

44,062,831

Weighted average number of common

shares outstanding, diluted

59,051,883

44,062,831

TABLE 2 The following table provides reconciliations of

net (loss) income to EBITDA and of net (loss) income to Adjusted

EBITDA for the periods noted.

EBITDA and Adjusted EBITDA reconciliation

For the periods ended March 31, 2024

and 2023

January 1 to March 31,

2024

January 1 to March 31, 2023

(in thousands of Canadian dollars,

unaudited)

Net income (loss) for the period

$

1,475

$

(2,431)

Interest expense, net

5,553

1,083

Amortization of transaction costs and debt

extinguishment gain, net

140

72

Current income tax expense

1,342

1,647

Deferred income tax (recovery) expense

(1,163)

(1,608)

Depreciation of property, plant and

equipment

1,523

691

Amortization of intangible assets

728

463

Depreciation of the ROU Asset

4,485

1,713

EBITDA

$

14,083

$

1,630

Acquisition and integration costs

283

6,118

Restructuring expenses

1,085

—

Net fair value (gains) losses on financial

liabilities at fair value through profit or loss

3,214

5,018

Adjusted EBITDA

$

18,665

$

12,766

TABLE 3 The following table provides reconciliations of

net (loss) income to Adjusted net income and a presentation of

Adjusted net income per share for the periods noted.

Adjusted net income reconciliation

For the periods ended March 31, 2024

and 2023

January 1 to March 31,

2024

January 1 to March 31, 2023

(in thousands of Canadian dollars, except

share and per share amounts, unaudited)

Net income (loss) for the period

$

1,475

$

(2,431)

Acquisition and integration costs

283

6,118

Restructuring expenses

1,085

—

Net fair value (gains) losses on financial

liabilities at fair value through profit or loss

3,214

5,018

Tax effect of the above adjustments

(1,154)

(2,815)

Adjusted net income

$

4,903

$

5,890

Adjusted net income per share,

basic

$

0.09

$

0.13

Adjusted net income per share,

diluted

$

0.08

$

0.12

Weighted average number of common

shares outstanding, basic

55,022,883

44,062,831

Weighted average number of common

shares outstanding, diluted

59,051,883

47,650,204

About DATA Communications Management Corp.

DCM is a marketing and business communications partner that

helps companies simplify the complex ways they communicate and

operate, so they can accomplish more with fewer steps and less

effort. For 65 years, DCM has been serving major brands in vertical

markets including financial services, retail, healthcare, energy,

other regulated industries, and the public sector. We integrate

seamlessly into our clients’ businesses thanks to our deep

understanding of their needs, our technology-enabled solutions, and

our end-to-end service offering. Whether we are running technology

platforms, sending marketing messages, or managing print workflows,

our goal is to make everything surprisingly simple.

Additional information relating to DATA Communications

Management Corp. is available on www.datacm.com, and in the

disclosure documents filed by DATA Communications Management Corp.

on SEDAR+ at www.sedarplus.ca.

FORWARD-LOOKING STATEMENTS

Certain statements in this press release constitute

“forward-looking” statements that involve known and unknown risks,

uncertainties and other factors which may cause the actual results,

performance, objectives or achievements of DCM, or industry

results, to be materially different from any future results,

performance, objectives or achievements expressed or implied by

such forward-looking statements. When used in this press release,

words such as “may”, “would”, “could”, “will”, “expect”,

“anticipate”, “estimate”, “believe”, “intend”, “plan”, and other

similar expressions are intended to identify forward-looking

statements. These statements reflect DCM’s current views regarding

future events and operating performance, are based on information

currently available to DCM, and speak only as of the date of this

press release.

These forward-looking statements involve a number of risks,

uncertainties, and assumptions. They should not be read as

guarantees of future performance or results and will not

necessarily be accurate indications of whether or not such

performance or results will be achieved. Many factors could cause

the actual results, performance, objectives or achievements of DCM

to be materially different from any future results, performance,

objectives or achievements that may be expressed or implied by such

forward-looking statements. We caution readers of this press

release not to place undue reliance on our forward-looking

statements since a number of factors could cause actual future

results, conditions, actions, or events to differ materially from

the targets, expectations, estimates or intentions expressed in

these forward-looking statements.

The principal factors, assumptions and risks that DCM made or

took into account in the preparation of these forward-looking

statements and which could cause our actual results and financial

condition to differ materially from those indicated in the

forward-looking statements are described in further detail in our

Management Discussion and Analysis for the three months ended March

31, 2024, and include but are not limited to the following:

- Our ability to successfully integrate the DCM and MCC

businesses and realize anticipated synergies from the combination

of those businesses, including revenue and profitability growth

from an enhanced offering of products and services, larger customer

base and cost reductions;

- The expected annualized synergies that the Company expects to

derive from the MCC acquisition have been estimated by the Company

based on its experience integrating previously acquired businesses,

other facilities and completing previous restructuring initiatives,

and includes estimated benefits expected to be derived from the

acquisition, including those related to facility sales and

consolidations, operational improvements, eliminating redundant

positions, and purchasing synergies;

- Our expected total annualized synergies estimates are

principally based upon the following material factors and

assumptions: (a) given the significant overlap in the nature of the

two businesses, DCM will be able to eliminate duplication of

overhead expenses across the combined DCM and MCC businesses in its

SG&A functions; (b) given significant overlap in the nature of

DCM’s and MCC’s production processes and available combined excess

capacity, DCM will be able to consolidate manufacturing plants; (c)

further operational and SG&A costs savings will be achievable

once the above-noted initiatives are completed; (d) the combined

business will achieve more favourable purchasing terms by virtue of

the fact it is approximately twice the size of each of DCM and MCC

pre-acquisition, and therefore able to command lower pricing from

vendors based on larger volumes, and its expected ability to better

harmonize purchasing strategies to leverage more favourable

purchasing terms than each company had individually for similar

goods or services; and (e) the combined business will be able to

generate certain revenue synergies from cross-selling each other’s

broader, combined, suite of capabilities; and

- Such expected annualized cost savings have not been prepared in

accordance with IFRS Accounting Standards, nor has a reconciliation

to IFRS Accounting Standards been provided, and the Company

evaluates its financial performance on the basis of these non-IFRS

Accounting Standards measures. Therefore, the Company does not

consider their most comparable IFRS Accounting Standards measures

when evaluating prospective acquisitions.

Additional factors are discussed elsewhere in this press release

and under the headings "Liquidity and capital resources" and “Risks

and Uncertainties” in DCM’s Management Discussion and Analysis and

in DCM’s other publicly available disclosure documents, as filed by

DCM on SEDAR+ (www.sedarplus.ca). Should one or more of these risks

or uncertainties materialize, or should assumptions underlying the

forward-looking statements prove incorrect, actual results may vary

materially from those described in this press release as intended,

planned, anticipated, believed, estimated or expected. Unless

required by applicable securities law, DCM does not intend and does

not assume any obligation to update these forward-looking

statements.

NON-IFRS ACCOUNTING STANDARDS MEASURES

NON-IFRS ACCOUNTING STANDARDS AND OTHER FINANCIAL MEASURES

This press release includes certain non-IFRS Accounting

Standards measures, ratios and other financial measures as

supplementary information. This supplementary information does not

represent earnings measures recognized by IFRS Accounting Standards

and does not have any standardized meanings prescribed by IFRS

Accounting Standards. Therefore, these non-IFRS Accounting

Standards measures, ratios and other financial measures are

unlikely to be comparable to similar measures presented by other

issuers. Investors are cautioned that this supplementary

information should not be construed as alternatives to net income

(loss) determined in accordance with IFRS Accounting Standards as

an indicator of DCM’s performance. Definitions of such

supplementary information, together with a reconciliation of net

income (loss) to such supplementary financial measures, can be

found in Table 4 and Table 5 of our Management Discussion and

Analysis for the three months ended March 31, 2024 and filed on

SEDAR+ at www.sedarplus.ca.

Condensed interim consolidated

statements of financial position

(in thousands of Canadian dollars,

unaudited)

March 31, 2024

December 31, 2023

$

$

Assets

Current assets

Cash and cash equivalents

$

19,842

$

17,652

Trade receivables

107,154

117,956

Inventories

32,286

28,840

Prepaid expenses and other current

assets

5,827

5,313

Income taxes receivable

1,248

2,640

Assets held for sale

—

8,650

166,357

181,051

Non-current assets

Other non-current assets

7,096

2,900

Deferred income tax assets

9,122

9,801

Property, plant and equipment

31,088

30,358

Right-of-use assets

157,556

159,801

Pension assets

2,724

1,962

Intangible assets

9,888

10,616

Goodwill

22,265

22,265

$

406,096

$

418,754

Liabilities

Current liabilities

Bank overdraft

199

1,564

Trade payables and accrued liabilities

$

69,963

$

75,766

Current portion of credit facilities

8,119

6,333

Current portion of lease liabilities

11,820

10,322

Provisions

13,395

16,325

Deferred revenue

6,032

6,221

109,528

116,531

Non-current liabilities

Provisions

914

1,004

Credit facilities

88,379

93,918

Lease liabilities

144,049

144,993

Pension obligations

20,288

26,386

Other post-employment benefit plans

3,704

3,606

Asset retirement obligation

3,583

3,552

$

370,445

$

389,990

Equity

Shareholders’ equity

Shares

$

283,738

$

283,738

Warrants

219

219

Contributed surplus

3,346

3,135

Translation Reserve

207

177

Deficit

(251,859)

(258,505)

$

35,651

$

28,764

$

406,096

$

418,754

Condensed interim consolidated

statements of operations

(in thousands of Canadian dollars, except

per share amounts, unaudited)

For the three months ended

March 31, 2024

For the three months ended March

31, 2024

$

$

Revenues

129,254

76,077

Cost of revenues

91,943

52,442

Gross profit

37,311

23,635

Expenses

Selling, commissions and expenses

10,864

8,322

General and administration expenses

14,518

5,414

Restructuring expenses

1,085

—

Acquisition and integration costs

283

6,118

Net fair value (gains) losses on financial

liabilities at fair value through profit or loss

3,214

5,018

29,964

24,872

Income before finance and other costs,

and income taxes

7,347

(1,237)

Finance costs

Interest expense on long term debt and

pensions, net

2,498

543

Interest expense on lease liabilities

3,055

540

Amortization of transaction costs net of

debt extinguishment gain

140

72

5,693

1,155

Income (loss) before income

taxes

1,654

(2,392)

Income tax expense

Current

1,342

1,647

Deferred

(1,163)

(1,608)

179

39

Net Income (loss) for the

period

1,475

(2,431)

Condensed interim consolidated

statements of cash flows

(in thousands of Canadian dollars,

unaudited)

For the three months ended

March 31, 2024

For the three months ended March

31, 2023

$

$

Cash provided by (used in)

Operating activities

Net income (loss) for the period

$

1,475

$

(2,431)

Items not affecting cash

Depreciation of property, plant and

equipment

1,523

691

Amortization of intangible assets

728

463

Depreciation of right-of-use-assets

4,485

1,713

Interest expense on lease liabilities

3,055

540

Share-based compensation expense

211

85

Net fair value losses on financial

liabilities at fair value through

profit or loss

3,214

5,018

Pension expense

472

119

(Gain) loss on sale and leaseback

(11)

—

(Gain) loss on disposal of property, plant

and equipment

(22)

—

Provisions

1,085

—

Amortization of transaction costs,

accretion of debt premium/discount, net of debt extinguishment

gain

140

(6)

Accretion of non-current liabilities

31

—

Other post-employment benefit plans

expense

149

68

Income tax expense

179

39

Changes in working capital

(6,560)

3,220

Contributions made to pension plans

(319)

(215)

Contributions made to other

post-employment benefit plans

(51)

(43)

Provisions paid

(4,105)

(1,316)

Income taxes received (paid)

50

(1,612)

5,729

6,333

Investing activities

Proceeds on sale and leaseback

transaction

8,661

—

Purchase of property, plant and

equipment

(2,766)

(558)

Purchase of intangible assets

—

(14)

Proceeds on disposal of property, plant

and equipment

535

—

6,430

(572)

Financing activities

Exercise of warrants

—

96

Proceeds from credit facilities

21,000

—

Repayment of credit facilities

(24,893)

(4,749)

Decrease in bank overdrafts

(1,365)

—

Lease payments

(4,730)

(2,324)

(9,988)

(7,073)

Change in cash and cash equivalents

during the period

2,171

(1,216)

Cash and cash equivalents – beginning

of period

$

17,652

$

4,208

Effects of foreign exchange on cash

balances

19

2

Cash and cash equivalents – end of

period

$

19,842

$

2,994

____________________________

1 Adjusted EBITDA, Adjusted EBITDA as a

percentage of revenues, Adjusted net income (loss) and Adjusted net

income (loss) as a percentage of revenues are non-IFRS Accounting

Standards measures. For a description of the composition of these

and other non-IFRS Accounting Standards measures used in this press

release, and a reconciliation to their most comparable IFRS

Accounting Standards measure, where applicable, see the information

under the heading “Non-IFRS Accounting Standards Measures”, the

information set forth on Table 2 and Table 3 herein, and our most

recent Management Discussion & Analysis filed on

www.sedarplus.ca.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240513715319/en/

Mr. Richard Kellam President and Chief Executive Officer DATA

Communications Management Corp. Tel: (905) 791-3151

Mr. James E. Lorimer Chief Financial Officer DATA Communications

Management Corp. Tel: (905) 791-3151 ir@datacm.com

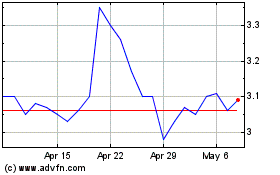

Data Communications Mana... (TSX:DCM)

Historical Stock Chart

From Oct 2024 to Nov 2024

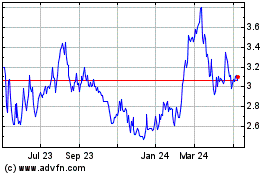

Data Communications Mana... (TSX:DCM)

Historical Stock Chart

From Nov 2023 to Nov 2024