Canadian Tire Corporation, Limited (TSX: CTC) (TSX: CTC.A) and Scotiabank (TSX:

BNS) (NYSE: BNS) today announced a far-reaching strategic partnership that

creates unprecedented opportunities for joint marketing to drive new business

growth. The agreement will see Scotiabank acquire a 20% equity interest in

Canadian Tire's financial services business for $500 million in cash. Scotiabank

will also provide a funding commitment to Canadian Tire's financial services

business with credit card receivable financing of up to $2.25 billion.

"The real strength of our partnership with Scotiabank lies in the opportunity it

creates to benefit our retail customers and grow our business," said Stephen

Wetmore, Chief Executive Officer, Canadian Tire Corporation. "By working

together and innovating, we will better serve our customers, earn new business,

and strengthen our community initiatives."

Canadian Tire's financial services division is the eighth largest credit card

issuer in Canada with $4.4 billion in receivables, 1.8 million active customer

accounts and $12 billion in annual spend volume. The agreement also provides an

option for Canadian Tire to sell up to an additional 29% of its financial

services business to Scotiabank within the next 10 years at the then fair market

value.

"We are excited about the possibilities that come with this partnership.

Canadian Tire is an iconic company with an incredibly strong brand and great

customer focus," said Brian Porter, President and Chief Executive Officer,

Scotiabank. "This is a strategic investment in a high performing business and a

partnership with the Canadian Tire family of companies will provide

opportunities for us to grow our customer base and provide unique and relevant

solutions to our customers."

The investment in the financial services business will be funded from

Scotiabank's cash resources and is expected to be modestly accretive to

Scotiabank's earnings. The deal is subject to customary closing conditions and

regulatory approvals and the transaction is expected to close by September 30,

2014.

Marketing Agreement

Scotiabank will become the exclusive partner for new financial products to the

Canadian Tire portfolio of customers. The agreement allows for joint marketing

efforts to introduce the companies' respective customers to each other's brands

with exclusive offers. Available only to customers of the Canadian Tire family

of companies and Scotiabank, the offers are expected to attract new customers

and provide more value to loyal consumers.

Today, the companies announced two inaugural offers available from May 9 to

August 31, 2014 to celebrate the new partnership:

-- New customers who join the Scotiabank Start Right Program, which

provides new Canadians with a bank account, credit card and other

financial services, will receive $50 at Canadian Tire and $50 at Mark's

to help them buy every day essentials for life in Canada.

-- Through Canadian Tire, Scotiabank will offer $500 in Canadian Tire Money

to any Canadian Tire Options MasterCard holders who switch or take a new

five-year mortgage from Scotiabank.

Canadian Tire and Scotiabank share a strong understanding of customer needs and

what drives consumer decisions. With a rapidly changing consumer and digital

landscape, there are significant benefits to working together to develop new

online and mobile payment technologies that will benefit both retail and banking

customers.

Both brands are committed to giving back to communities, investing in grassroots

hockey and helping families in need. The companies share the belief that local

investments help build strong communities and will work together on

opportunities to celebrate sport and maximize sponsorship activity from

coast-to-coast.

CANADIAN TIRE CORPORATION FORWARD-LOOKING STATEMENTS

This document contains forward-looking information that reflects management's

current expectations related to the business partnership with Scotiabank.

Forward-looking statements are provided for the purposes of providing

information about management's current expectations and plans and allowing

investors and others to get a better understanding of the Company's anticipated

financial position, results of operations and operating environment. Readers are

cautioned that such information may not be appropriate for other purposes.

All statements other than statements of historical facts included in this

document may constitute forward-looking information, including but not limited

to, statements regarding the expected benefits of the partnership between the

Company and Scotiabank, such as the growth of the retail and financial services

businesses, significant benefits to customers, the enhancement of brand affinity

among customers, the integration of marketing, sponsorships, and community

contributions, the collaboration on technological solutions and other statements

concerning management's expectations relating to possible or assumed future

prospects and results, our strategic goals and priorities, our actions and the

results of those actions and the economic and business outlook for us. Often but

not always, forward-looking information can be identified by the use of

forward-looking terminology such as "may", "will", "expect", "believe",

"estimate", "plan", "could", "should", "would", "outlook", "forecast",

"anticipate", "foresee", "continue" or the negative of these terms or variations

of them or similar terminology. Forward-looking information is based on the

reasonable assumptions, estimates, analyses, beliefs and opinions of management

made in light of its experience and perception of trends, current conditions and

expected developments, as well as other factors that management believes to be

relevant and reasonable at the date that such information is provided.

By its very nature, forward-looking information requires us to make assumptions

and is subject to inherent risks and uncertainties, which give rise to the

possibility that the Company's assumptions, estimates, analyses, beliefs and

opinions may not be correct and that the Company's expectations and plans will

not be achieved. Although the Company believes that the forward-looking

information in this document is based on information, assumptions and beliefs

which are current, reasonable and complete, this information is necessarily

subject to a number of factors that could cause actual results to differ

materially from management's expectations and plans as set forth in such

forward-looking information for a variety of reasons. Some of the factors --

many of which are beyond our control and the effects of which can be difficult

to predict -- include, but are not limited to, changes in economic and market

conditions, the possibility that the anticipated benefits and synergies from the

partnership cannot be realized or may take longer to realize than expected and

other risks and uncertainties discussed in the Company's materials filed with

the Canadian securities regulatory authorities from time to time, including the

"Risk Factors" section of our Annual Information Form for fiscal 2013 and our

2013 Management's Discussion and Analysis, as well as the Company's other public

filings, available at www.sedar.com and at www.corp.canadiantire.ca.

Investors and other readers are urged to consider the foregoing risks,

uncertainties, factors and assumptions carefully in evaluating the

forward-looking information and are cautioned not to place undue reliance on

such forward-looking information. The forward-looking statements and information

contained herein are based on certain factors and assumptions as of the date

hereof. The Company does not undertake to update any forward-looking

information, whether written or oral, that may be made from time to time by it

or on its behalf, to reflect new information, future events or otherwise, unless

required by applicable securities laws.

SCOTIABANK FORWARD-LOOKING STATEMENTS

Our public communications often include oral or written forward-looking

statements. Statements of this type are included in this document, and may be

included in other filings with Canadian securities regulators or the United

States Securities and Exchange Commission, or in other communications. All such

statements are made pursuant to the "safe harbour" provisions of the United

States Private Securities Litigation Reform Act of 1995 and any applicable

Canadian securities legislation. Forward-looking statements include, but are not

limited to, statements made in this document, the Management's Discussion and

Analysis in the Bank's 2013 Annual Report under the headings "Overview -

Outlook", for Group Financial Performance "Outlook", for each business segment

"Outlook" and in other statements regarding the Bank's objectives, strategies to

achieve those objectives, expected financial results (including those in the

area of risk management), and the outlook for the Bank's businesses and for the

Canadian, United States and global economies. Such statements are typically

identified by words or phrases such as "believe", "expect", "anticipate",

"intent", "estimate", "plan", "may increase", "may fluctuate", and similar

expressions of future or conditional verbs, such as "will", "should", "would"

and "could".

By their very nature, forward-looking statements involve numerous assumptions,

inherent risks and uncertainties, both general and specific, and the risk that

predictions and other forward-looking statements will not prove to be accurate.

Do not unduly rely on forward-looking statements, as a number of important

factors, many of which are beyond our control, could cause actual results to

differ materially from the estimates and intentions expressed in such

forward-looking statements. These factors include, but are not limited to: the

economic and financial conditions in Canada and globally; fluctuations in

interest rates and currency values; liquidity; significant market volatility and

interruptions; the failure of third parties to comply with their obligations to

us and our affiliates; the effect of changes in monetary policy; legislative and

regulatory developments in Canada and elsewhere, including changes in tax laws;

the effect of changes to our credit ratings; amendments to, and interpretations

of, risk-based capital guidelines and reporting instructions and liquidity

regulatory guidance; operational and reputational risks; the risk that the

Bank's risk management models may not take into account all relevant factors;

the accuracy and completeness of information the Bank receives on customers and

counterparties; the timely development and introduction of new products and

services in receptive markets; the Bank's ability to expand existing

distribution channels and to develop and realize revenues from new distribution

channels; the Bank's ability to complete and integrate acquisitions and its

other growth strategies; changes in accounting policies and methods the Bank

uses to report its financial condition and financial performance, including

uncertainties associated with critical accounting assumptions and estimates (see

"Controls and Accounting Policies - Critical accounting estimates" in the Bank's

2013 Annual Report, as updated in this document); the effect of applying future

accounting changes (see "Controls and Accounting Policies - Future accounting

developments" in the Bank's 2013 Annual Report, as updated in this document);

global capital markets activity; the Bank's ability to attract and retain key

executives; reliance on third parties to provide components of the Bank's

business infrastructure; unexpected changes in consumer spending and saving

habits; technological developments; fraud by internal or external parties,

including the use of new technologies in unprecedented ways to defraud the Bank

or its customers; consolidation in the Canadian financial services sector;

competition, both from new entrants and established competitors; judicial and

regulatory proceedings; acts of God, such as earthquakes and hurricanes; the

possible impact of international conflicts and other developments, including

terrorist acts and war on terrorism; the effects of disease or illness on local,

national or international economies; disruptions to public infrastructure,

including transportation, communication, power and water; and the Bank's

anticipation of and success in managing the risks implied by the foregoing. A

substantial amount of the Bank's business involves making loans or otherwise

committing resources to specific companies, industries or countries. Unforeseen

events affecting such borrowers, industries or countries could have a material

adverse effect on the Bank's financial results, businesses, financial condition

or liquidity. These and other factors may cause the Bank's actual performance to

differ materially from that contemplated by forward-looking statements. For more

information, see the "Risk Management" section starting on page 60 of the Bank's

2013 Annual Report.

Material economic assumptions underlying the forward-looking statements

contained in this document are set out in the 2013 Annual Report under the

headings "Overview - Outlook", as updated in this document; and for each

business segment "Outlook". These "Outlook" sections are based on the Bank's

views and the actual outcome is uncertain. Readers should consider the

above-noted factors when reviewing these sections.

The preceding list of important factors is not exhaustive. When relying on

forward-looking statements to make decisions with respect to the Bank and its

securities, investors and others should carefully consider the preceding

factors, other uncertainties and potential events. The Bank does not undertake

to update any forward-looking statements, whether written or oral, that may be

made from time to time by or on its behalf.

Additional information relating to the Bank, including the Bank's Annual

Information Form, can be located on the SEDAR website at www.sedar.com and on

the EDGAR section of the SEC's website at www.sec.gov.

ABOUT CANADIAN TIRE

Canadian Tire Corporation, Limited, (TSX: CTC.A) (TSX: CTC) or "CTC," is a

family of businesses that includes a retail segment, a financial services

division, CT REIT and Canadian Tire Jumpstart, a nationally registered charity

dedicated to removing financial barriers so kids across Canada can participate

in sports and physical activities. Our retail business is led by Canadian Tire,

which was founded in 1922 and provides Canadians with products for life in

Canada across its Living, Playing, Fixing, Automotive and Seasonal categories.

PartSource and Gas+ are key parts of the Canadian Tire network. The retail

segment also includes Mark's, a leading source for casual and industrial wear,

and FGL Sports (Sport Chek, Hockey Experts, Sports Experts, National Sports,

Intersport, Pro Hockey Life and Atmosphere), which offers the best active wear

brands. The nearly 1,700 retail and gasoline outlets are supported and

strengthened by our Financial Services division and the tens of thousands of

people employed across the Company. For more information, visit

Corp.CanadianTire.ca.

ABOUT SCOTIABANK

Scotiabank is a leading financial services provider in over 55 countries and

Canada's most international bank. Through our team of more than 83,000

employees, Scotiabank and its affiliates offer a broad range of products and

services, including personal and commercial banking, wealth management,

corporate and investment banking to over 21 million customers. With assets of

$783 billion (as at January 31, 2014), Scotiabank trades on the Toronto (TSX:

BNS) and New York Exchanges (NYSE: BNS). Scotiabank distributes the Bank's media

releases using Marketwired. For more information please visit

www.scotiabank.com.

FOR FURTHER INFORMATION PLEASE CONTACT:

FOR MORE INFORMATION

Media:

Amy Cole

Canadian Tire

416-544-7655

amy.cole@cantire.com

Media:

Diane Flanagan

Scotiabank

416-933-2176

diane.flanagan@scotiabank.com

Investors:

Lisa Greatrix

416-480-8725

lisa.greatrix@cantire.com

Investors:

Peter Slan

416 933-1273

peter.slan@scotiabank.com

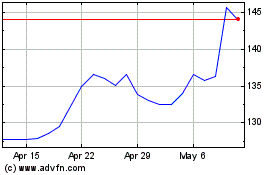

Canadian Tire (TSX:CTC.A)

Historical Stock Chart

From May 2024 to Jun 2024

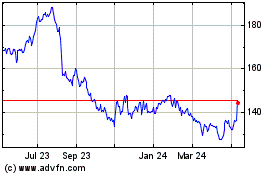

Canadian Tire (TSX:CTC.A)

Historical Stock Chart

From Jun 2023 to Jun 2024