CanBanc Income Corp. Closes Initial Public Offering

August 18 2010 - 8:32AM

Marketwired Canada

CanBanc Income Corp. (the "Company") (TSX:CIC) is pleased to announce the

closing of its initial public offering. Pursuant to the offering, the Company

issued an aggregate of 23 million shares at $10 per share, for gross proceeds of

$230 million. The shares are listed on the Toronto Stock Exchange under the

symbol CIC.

The Company will invest in a portfolio (the "Portfolio") of common shares of the

six largest Canadian banks: Bank of Montreal; Canadian Imperial Bank of

Commerce; National Bank of Canada; Royal Bank of Canada; The Bank of Nova

Scotia; and The Toronto-Dominion Bank (each, a "Bank", and collectively, the

"Banks"). First Asset Investment Management Inc. (the "Manager" or "First

Asset") will employ a covered call option writing program on approximately, and

not more than, 25% of the common shares of each Bank held in the Portfolio, in

order to seek to earn tax effective income from dividends and call option

premiums, lower the overall volatility of returns associated with owning a

portfolio of common shares of the Banks, and to generate capital appreciation

for holders of Shares of the Company (the "Shareholders").

The objectives of the Company are to provide Shareholders with:

(a) quarterly distributions;

(b) the opportunity for capital appreciation; and

(c) lower overall volatility of Portfolio returns than would be experienced

by owning a portfolio of common shares of the Banks directly.

The Company will not have a fixed distribution, but intends to set periodic

distribution targets. Based on the Manager's current estimates, the initial

distribution target for the Company is expected to be $0.175 per quarter ($0.70

per annum to yield 7.0% on the subscription price of $10 per Share). The

Company's initial cash distribution will be in respect of the quarter-ending

December 31, 2010, but will include a pro rated amount for the period from the

Closing.

The Company has granted the agents for the offering an over-allotment option to

acquire additional shares exercisable at any time during the next thirty days.

The syndicate of agents for this offering was led by CIBC World Markets Inc.,

National Bank Financial Inc. and RBC Capital Markets, and included BMO Capital

Markets, Scotia Capital Inc., TD Securities Inc., Canaccord Genuity Corp., HSBC

Securities (Canada) Inc., Raymond James Ltd., Wellington West Capital Markets

Inc., Dundee Securities Corporation, GMP Securities L.P., Macquarie Private

Wealth Inc. and Mackie Research Capital Corporation.

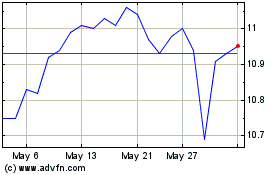

CI Canadian Banks Coverd... (TSX:CIC)

Historical Stock Chart

From Jun 2024 to Jul 2024

CI Canadian Banks Coverd... (TSX:CIC)

Historical Stock Chart

From Jul 2023 to Jul 2024