New Proprietary Online Content and New

Market Entry to Drive Near- and Long-Term Growth

Raises Full Year 2021 Revenue Guidance to

EUR €49.0 million (USD $57.8 Million2) and

Adjusted EBITDA of EUR €5.4 million (USD $6.4 million) and

Initiates Full Year 2022 Revenue Guidance

Bragg Gaming Group (TSX:BRAG, OTC: BRGGF) ("Bragg" or the

"Company"), a global B2B gaming technology and content provider,

today reported its financial results for the second quarter ended

June 30, 2021 and provided an update on its strategic growth

initiatives.

Summary of Q2-21 Financial and Operational

Highlights

Euros (Thousands)

Q2-21

Q2-20

% Change

Revenue

€15,491

€12,145

27.6%

Adjusted EBITDA

€1,900

€1,751

8.5%

Adjusted EBITDA margin

12.3%

14.4%

-2.1%

Operational

Q2-21

Q2-20

% Change

Wagering revenue (Euros)

€3.8B

€3.3B

15.9%

Unique players3

2.3M

1.9M

21.0%

Revenue / top 10 customers

57%

64%

-11.3%

Select Recent Strategic Development Progress

- Bragg completed the acquisition of Wild Streak LLC (“Wild

Streak”) on June 2, 2021. Wild Streak, a leading U.S. and

European-focused proprietary casino content studio, provides Bragg

with a library of nearly 40 casino content titles as well as

expertise in game design, slot mathematics, and advanced game

mechanics and features. As of June 30, 2021 Wild Streak had seven

online casino games live in key iGaming markets including in New

Jersey, the UK and other regulated jurisdictions in Europe which

have helped grow Wild Streak’s revenues and Adjusted EBITDA by 149%

and 940%, respectively, in the first half of 2021 compared to the

same period in 2020. Bragg launched its first Wild Streak online

game in Michigan last month, to a strong player response.

The acquisition of Wild Streak will

significantly help transform the Company’s business going forward

as it continues to shift from primarily providing third-party

online gaming content to be predominantly focused on providing

in-house developed proprietary online gaming content that carry

higher gross profit margins. Wild Streak’s product roadmap

currently contemplates the release of six new games through the end

of 2021 and 12 new games next year.

- Bragg continues to make progress with the U.S. and Canadian

licensing process in connection with its previously announced,

pending acquisition of Spin Games LLC (“Spin Games”) and expects to

complete the acquisition in the fourth quarter, pending regulatory

approval from various U.S. states’ gaming commissions. The

technical integration between Spin Games and the Company’s Oryx Hub

distribution platform is complete and the combined offering will

deliver the benefits of Oryx’s advanced player engagement, data

tools and platform technology alongside Spin Games’ U.S. market

content and operator relationships, providing a differentiated and

widely distributed iGaming product offering.

Following completion of the transaction,

Bragg will gain access to key strategic operator relationships in

the U.S. where Spin Games has over 30 customers including leading

iGaming operators. The Company plans to leverage these

relationships to initially cross-sell its existing European casino

content followed by the new, proprietary online casino content

currently being developed to address the U.S. and Canadian markets.

Spin Games’ remote games server and casino content are fully

licensed and distributed in the U.S. states of New Jersey,

Pennsylvania and Michigan, and is licensed and pending go-live in

British Columbia, Canada. Spin Games has a proprietary content

portfolio of more than 30 in-house developed games, including

content in emerging and trending categories such as slots, video

poker, action bingo and keno. Spin Games will also augment Bragg’s

existing content portfolio with numerous popular third-party titles

from well-known, land-based slot manufacturers.

- Bragg’s Oryx Gaming is live in various European online gaming

markets, the largest of which by revenue contribution is Germany.

Following the new iGaming regulatory regime in Germany which became

effective on July 1, 2021, revenue contributions from Germany are

expected to decline in the second half of 2021 and into 2022

compared to historical levels. These changes are fully anticipated

in Bragg’s growth forecasts and are expected to be offset by strong

growth in both new and existing markets as well as from new

clients, from increased profit margins as a result of the Company’s

focus on developing more proprietary content, and from

acquisitions. Bragg continues to make progress with diversifying

its European market penetration including recent activations in

Spain, Denmark and Greece, as well as being fully prepared to enter

the Netherlands when the newly regulated market opens, anticipated

on October 1, 2021.

- The Company is expanding into new global online gaming markets

including Europe’s two largest iGaming markets, the U.K. and Italy,

and the Company expects to obtain appropriate licenses and

certification for both of these countries in Q4 2021. In the U.S.,

the Company is in the process of applying for licenses in New

Jersey, Pennsylvania and Michigan. Overall, the Company expects to

move from supplying its products in markets with a combined total

addressable market (“TAM”) for online casino of US$2.8 billion in

2021, to markets with a combined online casino TAM of US$18.4

billion in 2022, presenting significant revenue uplift

opportunities.

- During the quarter The Company launched eleven new exclusive

games via its Oryx remote games server in partnership with

third-party studios, and two new proprietary games from its

in-house Oryx Gaming studio. In addition, Wild Streak launched two

new games during the quarter.

- The Company expects to increase its output of games produced

from its in-house studios, which capture a greater share of the

value chain compared to the distribution of third-party games.

Illustrating this progress, in 2020 the Company released zero games

developed by in-house studios and this year it expects to release

five games in Europe from its proprietary Oryx Gaming studio,

representing 11% of all exclusive games released via the Oryx

remote games server (“RGS”) this year. In 2022, the Company’s Oryx

Gaming studio expects to release 19 proprietary games in Europe,

representing 33% of exclusive games released via the Oryx RGS in

the region that year. In addition, in 2022 the Oryx Gaming studio

expects to release four proprietary games in the U.S., and the

Company’s Wild Streak studio expects to release ten proprietary

games in the U.S. for a total of 14 fully-owned online slot game

titles expected to go live in the region, and representing 37% of

all exclusive games expected to be launched by the Company in the

U.S. in 2022. The increased proportion of in-house games released

is expected to benefit the Company’s gross profit margin

profile.

- As previously disclosed, Bragg has submitted an application to

list its common shares on the Nasdaq Stock Market.

“Bragg had strong 2021 second quarter financial performance

while also continuing to advance our in-house content development

strategy and new market entry plans, including entry into the North

American market, while also making progress on our Germany

mitigation strategies. Overall, our comprehensive growth

initiatives are expected to contribute to revenue and Adjusted

EBITDA growth over the balance of this year and more meaningfully

in 2022,” said Richard Carter, CEO of Bragg Gaming Group. “Second

quarter revenue rose 27.6% to EUR €15.5 million (USD $18.3

million), generating Adjusted EBITDA of EUR €1.9 million (USD $2.2

million) representing year-over-year Adjusted EBITDA growth of

8.5%. Our effectiveness in helping online casino operators connect

with players is clearly reflected in the 21% year-over-year

increase in the number of unique players using Bragg content, and

in the 41 new customers using our games and services we’ve added

over the last twelve months.

“Throughout the second quarter, we made meaningful progress with

our strategic growth initiatives including expanding existing

customer relationships, building out a pipeline of premium in-house

iGaming content, and providing our content and offerings to new

markets throughout North America and Europe. These and other

strategies are transforming Bragg into a leading content focused,

B2B iGaming provider and will help drive growth as we leverage our

scalable technology stack, which features industry unique player

engagement tools, and proprietary intellectual property to address

the burgeoning global online casino markets. We believe our growth

initiatives will not only help to rapidly mitigate the near-term

impact from the new Germany regulatory structure, but more

importantly will help drive our execution on future revenue growth

opportunities and lead to significant expansion of our EBITDA

margins over the medium term."

“Our recent acquisition of Wild Streak brings to Bragg a

fast-growing leading game development studio with a strong online

content pipeline and expands on the in-house development

capabilities of our Oryx Gaming studio. Wild Streak currently has

seven online games live in New Jersey and other non-U.S. markets

including Dragon Power, which has been a top performing title in

New Jersey since its release in May 2020. In the six-month period

ending June 30, 2021, Wild Streak’s online gaming revenue has risen

rapidly, and we expect ongoing growth as their pace of new game

introductions increases going forward."

“Further, our pending acquisition of Spin Games LLC (“Spin

Games”) will accelerate our entry into North American iGaming

markets, help us port high-performing European online content into

North America, and bring a wealth of U.S. market and compliance

expertise to Bragg. We expect our pipeline of internally developed

premium content will increase to 33 new online games in 2022 up

from five games produced by our Oryx Gaming studio in 2021. Our

ability to develop and commercialize our own game content and marry

it with our leading player engagement tools such as tournaments and

jackpots is one of our highest priorities as this combination

offers significant economic advantages, boosting wagers and

generating greater gross profit margins when compared to the

distribution of third-party content."

“As we continue to transition to the distribution of internally

developed content, we remain focused on growing the number of

markets we serve. We are moving forward with further expansion in

the U.S. and preparing for the introduction of our games in Ontario

when that market opens, which is expected before year-end. While we

will continue to serve the German market, we are diversifying away

from our historic revenue concentration in that market based on our

entrance into new North American and international iGaming markets

such as the U.K. and Italy, which are the two largest European

markets. Our market expansion and revenue diversification

initiatives will help offset the anticipated revenue decline in

Germany related to the new regulatory regime, as reflected in our

expectation that full year 2021 revenues will rise 5.6%

year-over-year. We expect our entry into new markets will be a

significant driver of growth throughout 2022 as we expect to

increase the TAM we can address more than 500% to over US$18

billion.”

Mr. Carter concluded, “Bragg possesses many competitive

advantages including proprietary, modern technology and development

resources that enable us to innovate rapidly and develop content

quickly. With our technology platform, growing proprietary premium

content portfolio, value-added player engagement tools, and global

distribution capabilities, we believe Bragg is well positioned to

capture a growing share of the large global iGaming market. These

factors, combined with our low capitalized expenditure requirements

and predominantly fixed cost operating model, will enable Bragg to

grow revenue and Adjusted EBITDA margins that results in near and

long-term Adjusted EBITDA growth and creates value for our

shareholders.”

Second Quarter 2021 Financial Results and other Key Metrics

Highlights

- Revenue increased by 27.6% to EUR €15.5 million (USD $18.3

million) in Q2 2021 compared to EUR €12.1 million (USD $14.3

million) in Q2 2020, inclusive of 28 days of contributions from

Wild Streak.

- Wagering revenue generated by customers increased 15.9% to EUR

€3.8 billion (USD $4.5 billion) compared to EUR €3.3 billion (USD

$3.9 billion) in Q2 2020.

- The number of unique players[4] using Bragg games via its Oryx

Hub distribution platform and content increased by 21.0% to 2.3

million, from 1.9 million in Q2 2020.

- Gross profit increased by 37.5% to EUR €7.0 million (USD $8.3

million) from EUR €5.1 million (USD $6.0 million) in Q2 2020,

reflecting higher revenue and a 3.3% margin improvement to 45.4%.

The margin expansion is primarily the result of the continued

revenue mix shift towards a higher proportion of revenues from

iGaming and turnkey services, which have lower associated cost of

sales when compared to games and content.

- Net loss for the period was EUR €2.3 million (USD $2.8

million), an increase of EUR €1.9 million (USD $2.3 million) from

Q2 2020, primarily due to incremental increase in employee costs,

exceptional professional fees as a result of the Nasdaq listing

efforts, offset by increased gross profit and a reduction in costs

in relation to deferred consideration payable.

- Adjusted EBITDA was EUR €1.9 million (USD $2.2 million), up

8.5% compared to EUR €1.8 million (USD $2.1 million) in Q2 2020,

and the Adjusted EBITDA margin decreased by 2.1% to 12.3%,

reflecting increased salary and subcontractors’ costs as part of

the Company’s investment in the expansion of its software

development, product and management functions.

- Cash and cash equivalents as of June 30, 2021 was EUR €21.0

million (USD $24.7 million)

Raises Full Year 2021 Guidance and Initiates Full Year 2022

Revenue Guidance

Bragg today provided full year revenue and Adjusted EBITDA

guidance, inclusive of contributions from Wild Streak. The Company

expects revenue of EUR €49 million (USD $57.8 million) and Adjusted

EBITDA of EUR €5.4 million (USD $6.4 million), compared to its

prior, pre-acquisition guidance of revenue of EUR €47 million (USD

$55.5 million) and Adjusted EBITDA of EUR €4 million (USD $4.7

million). This also compares to 2020 full year revenue and Adjusted

EBITDA of EUR €46.4 million (USD $54.8 million) and EUR €5.5

million (USD $6.5 million), respectively. In addition, Bragg

initiated full year revenue guidance for 2022 of EUR €54 million to

EUR €56 million (USD $63.7 million to USD $66.1 million).

Investor Conference Call

The Company will host a conference call today, August 11, 2021,

at 8:30 a.m. Eastern Time, to discuss the second quarter 2021

results. During the call, management will review a presentation

that will be made available at http://www.bragg.games/investors a

few minutes before the start of the call.

To join the call, please use the below dial-in information:

US/Canada: (844) 965-3274 UK: 0203 547 8613 / 0800 051 7107

International: (639) 491-2382 Passcode: 7796169

A replay of the call will be available for seven days following

the conclusion of the live call. In order to access the replay,

dial (416) 621-4642 or (800) 585-8367 (toll-free) and use the

passcode 7796169.

Cautionary Statement Regarding Forward-Looking

Information

This news release may contain forward-looking statements or

"forward-looking information" within the meaning of applicable

Canadian securities laws ("forward-looking statements"), including,

without limitation, statements with respect to the following: the

Company's strategic growth initiatives and corporate vision and

strategy; financial guidance for 2021 and 2022, expected

performance of the Company's business; expansion into new markets;

the impact of the new German regulatory regime, expected future

growth and expansion opportunities; expected benefits of

transactions, including the acquisition of Wild Streak and Spin;

expected future actions and decisions of regulators and the timing

and impact thereof. Forward-looking statements are provided for the

purpose of presenting information about management’s current

expectations and plans relating to the future and allowing readers

to get a better understanding of the Company's anticipated

financial position, results of operations, and operating

environment. Often, but not always, forward-looking statements can

be identified by the use of words such as "plans", "expects" or

"does not expect", "is expected", "budget", "scheduled",

"estimates", "forecasts", "intends", "anticipates" or "does not

anticipate", or "believes", or describes a "goal", or variation of

such words and phrases or state that certain actions, events or

results "may", "could", "would", "might" or "will" be taken, occur

or be achieved.

All forward-looking statements reflect the Company's beliefs and

assumptions based on information available at the time the

statements were made. Actual results or events may differ from

those predicted in these forward-looking statements. All of the

Company's forward-looking statements are qualified by the

assumptions that are stated or inherent in such forward-looking

statements, including the assumptions listed below. Although the

Company believes that these assumptions are reasonable, this list

is not exhaustive of factors that may affect any of the

forward-looking statements. The key assumptions that have been made

in connection with the forward-looking statements include the

following: the impact of COVID-19 on the business of the Company;

the closing of the acquisition of Spin; the integration of Wild

Streak; the regulatory regime governing the business of the

Company; the operations of the Company; the products and services

of the Company; the Company's customers; the growth of Company's

business, the meeting minimum listing requirements of Nasdaq; which

may not be achieved or realized within the time frames stated or at

all; the integration of technology; and the anticipated size and/or

revenue associated with the gaming market globally.

Forward-looking statements involve known and unknown risks,

future events, conditions, uncertainties and other factors that may

cause actual results, performance or achievements to be materially

different from any future results, prediction, projection,

forecast, performance or achievements expressed or implied by the

forward-looking statements. Such factors include, among others, the

following: risks related to the Company’s business and financial

position; that the Company may not be able to accurately predict

its rate of growth and profitability; the risks associated with the

completion of the acquisition of Spin and ability to satisfy

closing conditions; risks associated with the integration of Wild

Streak; risks associated with general economic conditions; adverse

industry events; future legislative and regulatory developments;

the inability to access sufficient capital from internal and

external sources; the inability to access sufficient capital on

favorable terms; realization of growth estimates, income tax and

regulatory matters; the increased costs associated with meeting the

minimum listing requirements on Nasdaq; the ability of the Company

to implement its business strategies; competition; economic and

financial conditions, including volatility in interest and exchange

rates, commodity and equity prices; changes in customer demand;

disruptions to our technology network including computer systems

and software; natural events such as severe weather, fires, floods

and earthquakes; and risks related to health pandemics and the

outbreak of communicable diseases, such as the current outbreak of

COVID-19. Although the Company has attempted to identify important

factors that could cause actual actions, events or results to

differ materially from those described in forward-looking

statements, there may be other factors that cause actions, events

or results not to be as anticipated, estimated or intended. There

can be no assurance that forward-looking statements will prove to

be accurate, as actual results and future events could differ

materially from those anticipated in such statements. Accordingly,

readers should not place undue reliance on forward-looking

statements.

The Company disclaims any intention or obligation to update or

revise any forward-looking statements whether as a result of new

information, future events, or otherwise, except in accordance with

applicable securities laws.

Non-IFRS Financial Measures

Statements in this news release make reference to "Adjusted

EBITDA", which is a non-IFRS (as defined herein) financial measure

that the Company believes is appropriate to provide meaningful

comparison with, and to enhance an overall understanding of, the

Company's past financial performance and prospects for the future.

The Company believes that "Adjusted EBITDA" provides useful

information to both management and investors by excluding specific

expenses and items that management believe are not indicative of

the Company's core operating results. "Adjusted EBITDA" is a

financial measure that does not have a standardized meaning under

International Financial Reporting Standards ("IFRS"). As there is

no standardized method of calculating "Adjusted EBITDA", it may not

be directly comparable with similarly titled measures used by other

companies. The Company considers "Adjusted EBITDA" to be a relevant

indicator for measuring trends in performance and its ability to

generate funds to service its debt and to meet its future working

capital and capital expenditure requirements. "Adjusted EBITDA" is

not a generally accepted earnings measure and should not be

considered in isolation or as an alternative to net income (loss),

cash flows or other measures of performance prepared in accordance

with IFRS. Adjusted EBITA is more fully defined and discussed, and

reconciliation to IFRS financial measures is provided, in Company's

Management's Discussion and Analysis ("MD&A") for the second

quarter ended June 30, 2021.

About Bragg Gaming Group

Bragg Gaming Group (TSX:BRAG, OTC: BRGGF) ("Bragg") is a growing

global gaming technology and content group and owner of leading B2B

companies in the iGaming industry. Since its inception in 2018,

Bragg has grown to include operations across Europe, North America

and Latin America and is expanding into an international force

within the global online gaming market.

Bragg’s ORYX Gaming delivers proprietary, exclusive and

aggregated casino content via its in-house remote games server

(RGS) and ORYX Hub distribution platform. ORYX offers a full

turnkey iGaming solution, including its Player Account Management

(PAM) platform, as well as managed operational and marketing

services.

Nevada-based Wild Streak Gaming is Bragg's wholly owned premium

U.S. gaming content studio. Wild Streak has a popular portfolio of

casino games that are offered across land-based, online and social

casino operators in global markets including the U.S. and UK.

In May 2021, Bragg announced its planned acquisition of

Nevada-based Spin Games, B2B gaming technology and content provider

currently servicing the U.S. market. Spin holds licenses in key

iGaming-regulated U.S. states and supplies Tier 1 operators in the

region. Find out more.

__________________________________

1 Adjusted EBITDA is a non-IFRS measure. For important

information on the Company’s non-IFRS measures, see “Non-IFRS

Financial Measures” below. 2 Bragg Gaming’s reporting currency is

Euros. The exchange rate provided for U.S. dollars is 1.18. Due to

fluctuating currency exchange, this rate is provided for

convenience only. 3 “Unique players" are defined as individuals who

made a real money wager at least once during the period.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210811005337/en/

Yaniv Spielberg Chief Strategy Officer Bragg Gaming Group

info@bragg.games

Joseph Jaffoni, Richard Land, James Leahy JCIR 212-835-8500 or

bragg@jcir.com

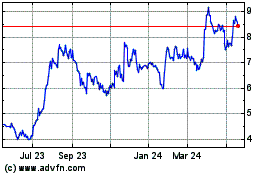

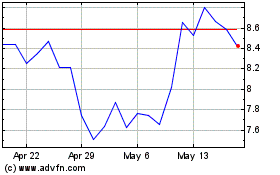

Bragg Gaming (TSX:BRAG)

Historical Stock Chart

From Oct 2024 to Nov 2024

Bragg Gaming (TSX:BRAG)

Historical Stock Chart

From Nov 2023 to Nov 2024