Artis Real Estate Investment Trust Announces Quarterly Cash Distributions

March 17 2014 - 5:00PM

Marketwired

Artis Real Estate Investment Trust Announces Quarterly Cash

Distributions

WINNIPEG, MANITOBA--(Marketwired - Mar 17, 2014) - Artis Real

Estate Investment Trust

(TSX:AX.UN)(TSX:AX.PR.A)(TSX:AX.PR.U)(TSX:AX.PR.E) ("Artis" or "the

REIT") announced that its trustees have declared the following

quarterly cash distributions:

- $0.328125 per Series A preferred unit ("Series A Unit") of

Artis for the quarter ending March 31, 2014. The cash distributions

will be made on March 31, 2014 to Series A Unitholders of record on

March 31, 2014. As at the date hereof, there are an aggregate of

3,450,000 Series A Units issued and outstanding.

- US$0.328125 per Series C preferred unit ("Series C Unit") of

Artis for the quarter ending March 31, 2014. The cash distributions

will be made on March 31, 2014 to Series C Unitholders of record on

March 31, 2014. As at the date hereof, there are an aggregate of

3,000,000 Series C Units issued and outstanding.

- $0.296875 per Series E preferred unit ("Series E Unit") of

Artis for the quarter ending March 31, 2014. The cash distributions

will be made on March 31, 2014 to Series E Unitholders of record on

March 31, 2014. As at the date hereof, there are an aggregate of

4,000,000 Series E Units issued and outstanding.

Artis is a diversified Canadian real estate investment trust

investing in office, industrial and retail properties. Since 2004,

Artis has executed an aggressive but disciplined growth strategy,

building a portfolio of commercial properties in Canada and the

United States, with a major focus on Western Canada. As of today's

date, Artis' commercial property comprises nearly 25.0 million

square feet of leasable area.

At December 31, 2013, actual year-to-date Property Net Operating

Income ("Property NOI") by asset class was approximately 25.6%

retail, 50.5% office and 23.9% industrial. Property NOI by

geographical region was approximately 9.0% in British Columbia,

38.7% in Alberta, 6.9% in Saskatchewan, 12.3% in Manitoba, 13.2% in

Ontario and 19.9% in the U.S.

Property NOI is a non-GAAP measure. Artis calculates Property

NOI as revenues, measured in accordance with International

Financial Reporting Standards, less property operating expenses

such as taxes, utilities, repairs and maintenance, and does not

include charges for interest and amortization or income from joint

arrangements accounted for as equity investments.

The Toronto Stock Exchange has not reviewed and does not

accept responsibility for the adequacy or accuracy of this press

release.

Artis Real Estate Investment TrustMr. Armin MartensPresident and

Chief Executive Officer1.204.947.1250204.947.0453Artis Real Estate

Investment TrustMr. Jim GreenChief Financial

Officer1.204.947.1250204.947.0453Artis Real Estate Investment

TrustMs. Kirsty StevensChief Administrative

Officer1.204.947.1250204.947.0453www.artisreit.com

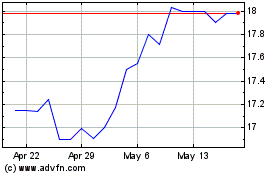

Artis Real Estate Invest... (TSX:AX.PR.E)

Historical Stock Chart

From Jun 2024 to Jul 2024

Artis Real Estate Invest... (TSX:AX.PR.E)

Historical Stock Chart

From Jul 2023 to Jul 2024