Allied to Offer Entire UDC Portfolio for Sale

January 16 2023 - 7:25AM

Allied Properties Real Estate Investment Trust ("Allied") (TSX:

"AP.UN") recently completed the initial phase of its exploration of

the sale of its network-dense, carrier-neutral, urban-data-centre

(UDC) portfolio in Downtown Toronto (the “Portfolio”). Scotiabank

acted as Allied’s exclusive financial advisor in this regard.

The Portfolio is comprised of freehold interests

in 151 Front Street West (“151 Front”) and 905 King Street West

(“905 King”) and a leasehold interest in 250 Front Street West

(“250 Front”). Allied has connected the properties through

high-count, diverse fibre, enabling the Portfolio to support more

telecommunication, cloud and content networks than any other

data-centre portfolio in Canada. The Portfolio is unencumbered and

does not include 20 York Street, the site for Union Centre.

Allied has drawn the following conclusions from

the initial phase of its exploration: (i) that selling the

Portfolio in its entirety now is optimal financially and

operationally; and (ii) that the sale of the Portfolio in its

entirety can best be achieved by implementing a comprehensive sale

process through Scotiabank and CBRE Limited as exclusive selling

agents.

“Our principal motivation here is two-fold,”

said Michael Emory, President & CEO. “First, we want to

reaffirm our mission and pursue it over the next few years with

low-cost capital. Second, we want to supercharge our balance sheet

and reduce our dependence on the capital markets going forward.” If

successful in selling the Portfolio, Allied expects to use a

significant portion of the sale proceeds to retire debt and the

balance to fund its current development activity. Allied may elect

to use a portion of the sale proceeds to buy back units under its

NCIB.

Reaffirmation of Mission

Allied is first, foremost and above all an

operator of distinctive urban workspace in Canada’s major cities.

Allied’s mission is to serve knowledge-based organizations ever

more successfully over time. The sale of the Portfolio will enable

Allied to reaffirm its mission and to propel continued growth with

low-cost capital. “Our UDC portfolio was connected to our mission

from the beginning, but it is not core to our mission in the way

urban workspace is,” Mr. Emory added. “As a stabilized asset in a

currently favoured sector, the portfolio represents a promising and

timely monetization opportunity, one that could enable Allied to

grow its business going forward in the most flexible and prudent

manner.”

Allied continues to have deep confidence in, and

commitment to, its strategy of consolidating and intensifying

distinctive urban workspace in Canada’s major cities. Allied firmly

believes that its strategy is underpinned by the most important

secular trends in Canadian and global real estate.

Commitment to the Balance

Sheet

Allied has demonstrated an unwavering commitment

to the balance sheet over its life as a public real estate entity.

Allied utilized its balance-sheet flexibility and leverage capacity

over the past three years to fund upgrade and development activity

and to take advantage of compelling in-fill acquisition

opportunities that would not have arisen in a stable economic

environment, pushing its debt-metrics to the high end of

Management’s target ranges.

If successful in selling the Portfolio, Allied

will bring its debt-metrics squarely within target ranges,

establishing a solid basis for further improvement as development

completions contribute to earnings over the next few years.

Management expects the interest savings to offset fully the decline

in earnings resulting from the sale of the Portfolio.

Cautionary Statements

This press release may contain forward-looking

statements with respect to (i) Allied, (ii) its operations,

strategy, financial performance and condition and (iii) the

expected impact of the transactions contemplated in this press

release. These statements generally can be identified by use of

forward-looking words such as “may”, “will”, “expect”, “estimate”,

“anticipate”, “intends”, “believe” or “continue” or the negative

thereof or similar variations. In particular, this news release

contains forward-looking statements pertaining to a possible

transaction related to the Portfolio.

Such statements are qualified in their entirety

by the inherent risks and uncertainties surrounding future

expectations, including that the transactions contemplated herein

are completed and have the expected impact on funding and earnings.

Important factors that could cause actual results to differ

materially from expectations include, among other things, general

economic and market conditions, competition, changes in government

regulations and the factors described under “Risk Factors” in

Allied’s Annual Information Form, which is available at

www.sedar.com. These cautionary statements qualify all

forward-looking statements attributable to Allied and persons

acting on Allied’s behalf. Unless otherwise stated, all

forward-looking statements speak only as of the date of this press

release and Allied has no obligation to update such statements.

About Allied

Allied is a leading operator of distinctive

urban workspace in Canada’s major cities and network-dense UDC

space in Toronto. Allied’s mission is to provide knowledge-based

organizations with workspace and UDC space that is sustainable and

conducive to human wellness, creativity, connectivity and

diversity. Allied’s vision is to make a continuous contribution to

cities and culture that elevates and inspires the humanity in all

people.

FOR FURTHER INFORMATION, PLEASE

CONTACT:

Michael EmoryPresident & Chief Executive Officer(416)

977-0643memory@alliedreit.com

Tom BurnsExecutive Vice President & Chief Operating

Officer(416) 977-9002tburns@alliedreit.com

Cecilia WilliamsExecutive Vice President & Chief Financial

Officer(416) 977-9002cwilliams@alliedreit.com

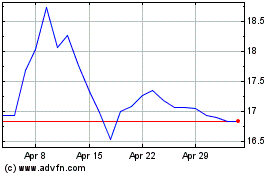

Allied Properties Real E... (TSX:AP.UN)

Historical Stock Chart

From Oct 2024 to Nov 2024

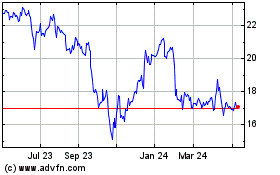

Allied Properties Real E... (TSX:AP.UN)

Historical Stock Chart

From Nov 2023 to Nov 2024