Accord Announces Normal Course Issuer Bid

August 01 2012 - 3:12PM

PR Newswire (Canada)

TORONTO, Aug. 2, 2012 /CNW/ - Accord Financial Corp. , a leading

North American provider of factoring and other asset-based

financial services to businesses, today announced that Toronto

Stock Exchange (the "TSX") has accepted for filing a Notice of

Intention to Make a Normal Course Issuer Bid (the "Bid"). Under the

Bid, the Company may purchase up to 424,594 common shares during

the next 12 months being 5% of the 8,491,898 issued and outstanding

common shares as at July 31, 2012. All shares purchased

pursuant to the Bid will be cancelled. Share purchases will

be made through facilities of the TSX or other alternative Canadian

trading platforms and will be in accordance with the TSX's rules

and policies. Pursuant to TSX policies, daily purchases made by the

Company will not exceed 1,000 common shares, subject to a

prescribed exception that allows for one block purchase per

calendar week. The Bid will commence on August 8, 2012 and

terminate on the earlier of the date on which the Company completes

its purchases pursuant to the Bid or August 7, 2013. Under

the Company's existing Bid, which commenced August 8, 2011 and

expires August 7, 2012, 446,000 shares have been repurchased for

cancellation at an average price of $6.78 for a total consideration

of $3,025,151. The Company believes that it may be advantageous to

engage in repurchases of its common shares, from time to time, when

they are trading at prices which the Company believes reflect a

discount from the underlying value of its common shares. Accord

Financial Corp. CONTACT: Stuart AdairVice President, Chief

Financial OfficerAccord Financial Corp.77 Bloor Street West, 18th

floorToronto, OntarioM5S 1M2(416) 961-0304 ext.

207sadair@accordfinancial.com

Copyright

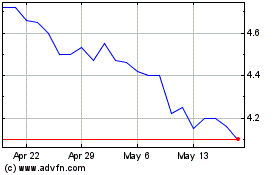

Accord Financial (TSX:ACD)

Historical Stock Chart

From Jun 2024 to Jul 2024

Accord Financial (TSX:ACD)

Historical Stock Chart

From Jul 2023 to Jul 2024