Sartorius, a leading international laboratory and pharmaceutical

equipment provider, closed the year 2012 with double-digit sales

growth and increased its earnings by a good 20%. At the annual

press conference of the company in Goettingen, Germany, Group CEO

Dr. Joachim Kreuzburg pointed out that beyond the company’s

economic success, 2012 was also an intensive and successful

financial year: “2012 marks the first full year in which we have

executed on our growth initiatives that we are pursuing as part of

our long-term strategy, ‘Sartorius 2020’. Specifically, in 2012 we

implemented our new division structure, substantially expanded

manufacturing capacities, started up a new, standardized and

expandable ERP system, invested heavily in the expansion of our

sales organizations in North America and Asia, and further

reinforced our product portfolio by acquisitions and alliances. I

find it very remarkable what our teams across the globe have

accomplished in parallel over the past year in these areas.”

For 2013, Sartorius expects sales revenue to grow by

approximately 6% to 9% in constant currencies and its operating

profit margin to increase to about 16.5%. “Aside from driving

further incremental expansion of sales revenue and earnings, we

will be especially focusing in the coming months on continuing to

fast-track our growth initiatives. For North America and selected

Asian countries, above all, we have set ourselves ambitious goals

and are aiming at achieving double-digit sales growth in these

regions in the current fiscal year as well,” said Dr.

Kreuzburg.

Dynamic Growth of Sales Revenue and Order Intake

In fiscal 2012, Sartorius generated consolidated sales revenue

of 845.7 million euros, up from 733.1 million euros a year ago.

This equates to an increase of 15.4%, or 11.7% in constant

currencies. The Biohit Liquid Handling business acquired at the end

of 2011 added approximately six percentage points to this expansion

in sales revenue. The gain in order intake reached a similarly

strong level: it jumped 15.7%, or 12.0% in constant currencies, to

866.8 million euros.

All divisions contributed to this positive business performance.

Accounting for more than half of consolidated revenue, the

Bioprocess Solutions Division continued on track, extending its

success of the previous year: It reported strong organic sales

growth of 15.6%, or 11.8% in constant currencies, to 474.2 million

euros and an increase in order intake of 11.0%, or 7.3% in constant

currencies, to 479.5 million euros. Demand was especially high for

single-use products for biopharmaceutical manufacture, and the

division posted solid growth for its equipment business with

biotech production systems, primarily in North America.

The Lab Products & Services Division, a supplier of premium

laboratory instruments and lab consumables, reported a significant

gain of 21.1%, or 17.1%, based on constant currencies, in sales

revenue, which soared to 268.9 million euros. Compared with sales,

order intake rose at a slightly sharper rate, 30.5%, or 26.2% in

constant currencies, to 282.0 million euros. Initial consolidation

of the Biohit Liquid Handling business contributed around 19.0

percentage points in constant currencies to this growth.

The smallest Group division, Industrial Weighing, showed stable

development, as projected. Its sales revenue of 102.7 million euros

reached the good level reported for the previous year (+1.8%;

currency-adjusted: -0.2%). Its order intake moved up 3.9%, or 1.9%

in constant currencies, to 105.4 million euros.

Regionally, Sartorius reported the highest dynamics in North

America, with sales revenue up 18.9%. The key growth driver in this

region was the excellent performance of both its laboratory and

bioprocess businesses. The company’s business also saw double-digit

growth, at 13.0%, in Asia as well. In Europe, where the economic

environment was weaker on the whole, Sartorius expanded its

business at 8.6%. (All regional figures in constant currencies)

Substantial Increase in Earnings

Despite the heavy investments made in new production capacity

and the expansion of its sales structures as planned, Sartorius

further increased its profitability in the reporting year. Based on

dynamic sales growth, the Group’s operating earnings surged 20.3%

from 112.2 million euros in the previous year to 135.0 million

euros. The respective margin for the Group rose from 15.3% a year

earlier to 16.0% and, therefore, marks a new high. Besides the

expansion of sales volume, the favorable currency environment

contributed to positive development of consolidated earnings.

In view of the divisions, the Bioprocess Solutions Division, in

particular, significantly expanded its operating earnings at growth

rates of 22.9%, from 71.6 million euros a year ago to 88.0 million

euros. The underlying EBITA margin for this division climbed from

17.5% to 18.6%. The Lab Products & Services Division reported

operating earnings of 36.9 million euros, up from 30.7 million

euros in the year before. This equates to an increase of 20.1% and

an approximately constant margin of 13.7% (previous year: 13.8%).

The Industrial Weighing Division posted earnings of 10.1 million

euros and a margin of 9.9%, up from 9.9 million euros and 9.8%,

respectively, a year earlier.

Including extraordinary items of -13.9 million euros (previous

year: -11.3 million euros), Group EBITA rose year on year from

100.9 million euros to 121.1 million euros and its respective

margin increased from 13.8% to 14.3%. These extraordinary expenses

primarily were related to the transfer of single-use bag

manufacture from California, USA, to Puerto Rico, the integration

of the Biohit Liquid Handling business, and to further Group

projects.

The Group’s relevant net profit totaled 63.0 million euros, up

from 52.8 million euros a year ago. Its respective earnings per

ordinary share are at 3.69 euros, up from 3.09 euros a year

earlier, and per preference share, at 3.71 euros, up from 3.11

euros a year ago. Unadjusted consolidated net profit after

non-controlling interest amounts to 48.5 million euros, up year on

year from 41.6 million.

In 2012, net operating cash flow was at 53.2 million euros

(previous year: 79.0 million euros) and was used, inter alia, for

financing investments to substantially expand capacity levels. The

key financial indicator, the ratio of net debt to underlying

EBITDA, remained constant at 1.9 (previous year: 1.9) in spite of

the high investments made, and thus continues to remain at a

comfortable level. In view of the company’s increased balance sheet

total, the equity ratio for the Sartorius Group was at 37.7%,

approximately at the year-earlier level of 38.1%.

R&D Expenditures Rose

In fiscal 2012, Sartorius spent 48.1 million euros on research

and development, up 8.6% compared with the year-earlier figure of

44.3 million euros. Its ratio of R&D costs to sales revenue was

at 5.7% (previous year: 6.0%).

Investments at a High Level

Against the background of its strong growth, Sartorius invested

substantially in 2012 in the expansion of its production

capacities. Investments were at 74.2 million euros, up 51.8 million

euros a year ago; the company’s investment ratio was at 8.8%.

Workforce Increased

As of December 31, 2012, the Sartorius Group employed 5,491

people, 604 persons or 12.4% more than a year earlier. A major

reason for this increase besides dynamic growth was the integration

of around 400 employees who joined the workforce as a result of the

acquisition of Biohit Liquid Handling. In 2011, the number of

employees including headcount for this acquisition would have been

5,299.

Dividends Set to Rise by Around 17%

The Executive Board and the Supervisory Board will submit a

proposal to the Annual Shareholders’ Meeting on April 18, 2013, to

raise dividends to 0.96 euro per preference share (previous year:

0.82 euro) and 0.94 euro per ordinary share (previous year: 0.80

euro), respectively. Compared with the previous year (13.8 million

euros), the total amount disbursed under this proposal would thus

rise 17.3% to 16.2 million euros.

Positive Outlook for Fiscal 2013

Sartorius is set to further grow in the current year as well:

For 2013, the company projects that sales revenue on the basis of

constant currencies will increase by approximately 6% to 9%. Along

with growth in sales, profitability is forecasted to rise again.

Without any currency effects considered, the underlying EBITA

margin at Group level is expected to increase to about 16.5%.

In view of the three divisions, company management anticipates

that sales for Bioprocess Solutions will grow by approximately 9%

to 12%. Cooperation in cell culture media, based on the agreement

signed in December 2012 with the Swiss life science group Lonza, is

projected to contribute around three to four percentage points to

this growth. Management forecasts that the division’s underlying

EBITA margin will increase to approximately 19%. For the Lab

Products & Services Division, the company expects sales to grow

by around 3% to 6% and its underlying EBITA margin to reach

approximately 14%. The Industrial Weighing Division projects sales

revenue to rise by about 0% to 3% and its underlying EBITA margin

to reach approximately 10%. (All figures currency adjusted)

“The majority of our business areas are driven by stable and

long-term trends; this is why we have set ambitious goals again for

2013,” commented Dr. Kreuzburg about the forecast. “For part

of our business, however, further economic development will play a

role, especially in Europe.”

* Sartorius uses earnings before interest, taxes and

amortization (EBITA) as the key profitability measure. To enable a

more meaningful comparison with the year-earlier figures, the

company reports earnings adjusted for extraordinary items (=

underlying EBITA or operating earnings) in addition to EBITA.

Key Performance Indicators for 2012 at a Glance

In millions of euros(unless otherwise specified)

Sartorius Group Bioprocess

SolutionsDivision Lab Products &

ServicesDivision Industrial

WeighingDivision 2012 2011 Δ

in %

2012 2011 Δ

in %

2012 2011 Δ

in %

2012 2011 Δ

in %

Order intake

866.8 749.5 15.7

479.5 432.0 11.0

282.0 216.0 30.5

105.4 101.4 3.9 Sales revenue

845.7 733.1 15.4

474.2 410.2 15.6

268.9 222.0

21.1

102.7 100.9 1.8 Underlying EBITDA1)

163.6 136.6

19.8

104.7 87.7 19.4

46.8 37.0 26.6

12.1 11.9

1.5 EBITDA margin1)

19.3% 18.6%

22.1% 21.4%

17.4% 16.7%

11.8% 11.8%

Underlying EBITA1)

135.0 112.2 20.3

88.0 71.6 22.9

36.9 30.7 20.1

10.1 9.9 2.6 EBITA margin1)

16.0% 15.3%

18.6% 17.5%

13.7%

13.8%

9.9% 9.8% Extraordinary expenses

13.9 11.3 22.8

Group net profit1)2)

63.0 52.8 19.3

Earnings per ordinary share1)2) in €

3.69 3.09 19.4

Earnings

per preference share1)2) in €

3.71 3.11 19.3

1) Adjusted for extraordinary items (underlying)

2) Relevant consolidated net profit = underlying net profit

after non-controlling interest, excluding non-cash amortization and

fair value adjustments of hedging instruments

Current Image Files:

Dr. Joachim Kreuzburg, CEO and Executive Board Chairman of

Sartorius

AG:www.sartorius.com/fileadmin/media/global/company/joachim_kreuzburg_1.jpg

Sartorius products used in the manufacture of

medications:www.sartorius.com/fileadmin/media/global/company/pr_20120419_bioprocess_solutions.jpg

Sartorius products used in laboratory

research:www.sartorius.com/fileadmin/media/global/company/pr_20120419_lab_products_services.jpg

Upcoming Financial Dates

April 18, 2013 Annual Shareholders‘ Meeting in Goettingen,

Germany April 23, 2013 Publication of first-quarter figures (Jan. –

March 2013)

This is a translation of the original German-language press

release. Sartorius shall not assume any liability for the

correctness of this translation. The original German press release

is the legally binding version. Furthermore, Sartorius reserves the

right not to be responsible for the topicality, correctness,

completeness or quality of the information provided. Liability

claims regarding damage caused by the use of any information

provided, including any kind of information which is incomplete or

incorrect, will therefore be rejected.

A Profile of Sartorius

The Sartorius Group is a leading international laboratory and

process technology provider covering the segments of Bioprocess

Solutions, Lab Products & Services and Industrial Weighing. In

2012, the technology group earned sales revenue of 845.7 million

euros. Founded in 1870, the Goettingen-based company currently

employs around 5,500 persons. The major areas of activity of its

Bioprocess Solutions segment cover filtration, fluid management,

fermentation, cell cultivation and purification, and focus on

production processes in the biopharmaceutical industry. The Lab

Products & Services segment primarily manufactures laboratory

instruments and lab consumables. Industrial Weighing concentrates

on weighing, monitoring and control applications in the

manufacturing processes of the food, chemical and pharma sectors.

Sartorius has its own production facilities in Europe, Asia and

America as well as sales subsidiaries and local commercial agencies

in more than 110 countries.

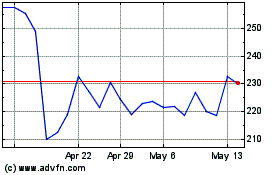

Sartorius (TG:SRT)

Historical Stock Chart

From Nov 2024 to Dec 2024

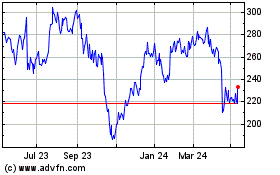

Sartorius (TG:SRT)

Historical Stock Chart

From Dec 2023 to Dec 2024