Today Sartorius (FWB:SRT), a leading international process and

laboratory technology provider, reported its nine-month results for

2009. Third-quarter business of both Group divisions showed a

highly divergent pattern of development, similar to that in the

previous quarters. While the Biotechnology Division achieved strong

sales gains and overproportionate increases in earnings,

development in the Mechatronics Division continued to be

considerably impacted by the global downturn. However, the latter

division’s second- and third-quarter order intake and sales

stabilized at a lower level. Due to the extensive cost-saving

measures implemented, operating earnings of the Mechatronics

Division moved back into the profit zone in the third quarter.

Business Development of the DivisionsSartorius Stedim

BiotechThe Biotechnology Division (Sartorius Stedim

Biotech/SSB), which contributes approx. two-thirds to consolidated

sales, was able to continue its dynamic growth trend into the third

quarter of 2009 as well. After nine months of business activity,

its order intake was at 303.4 million euros and thus up 12.7% from

a year ago (currency-adjusted: 10.3%). Again, business with

single-use products fueled this increase by generating strong

double-digit growth rates. In addition to its already positive

development, Sartorius Stedim Biotech profited from the strong

demand generated by its customers from the vaccine industry. By

contrast, business with large-scale bioreactor systems declined

slightly due to market conditions.Considering sales revenue, the

Biotechnology Division also posted sizeable gains. In the reporting

period, its sales climbed 9.0% (currency-adjusted: 6.7%) from 273.3

million euros a year earlier to 298.0 million euros. All business

regions with their significantly positive growth rates contributed

to the successful development of sales.

This strong sales development is also reflected by the

Biotechnology Division’s nine-month earnings. Operating earnings

(earnings before interest, taxes and amortization and adjusted for

extraordinary expenses = underlying EBITA) showed significantly

overproportionate improvement, surging 58.9% to 46.3 million euros.

In the year-earlier period, they were at 29.1 million euros. The

corresponding margin rose from 10.7% to 15.5% in the current

reporting period. Besides the uplift in sales volume, the

Biotechnology Division’s enhanced product mix favoring high-margin

single-use products especially contributed to this surge in

profitability.

“The earnings of Sartorius Stedim Biotech impressively show that

we are on the right track with our business strategy and our

product portfolio," commented Sartorius CEO Joachim Kreuzburg. "For

our customers in the biopharmaceutical industry, we are now

excellently positioned as a total solution provider with a high

proportion of innovative single-use products.”

Sartorius MechatronicsThe Mechatronics Division continued

to be heavily impacted by the global downturn. In the reporting

period, the division received orders valued at 151.4 million euros.

In comparison with the year-ago figure, order intake thus fell

18.0% (currency-adjusted: -20.6%). In the second and third

quarters, this decline hit industrial weighing equipment business

particularly hard, but laboratory business also substantially

contracted. By contrast, service business showed relatively stable

development. Sales revenue reported by the Mechatronics Division

fell 18.5% from 180.0 million euros a year ago to 146.8 million

euros (currency-adjusted: -21.1%). The regional pattern shows that

the division’s decline in revenue was less pronounced for

Asia/Pacific than for Europe and North America.

Nine-month operating earnings for the Mechatronics Division was

-2.4 million euros (Q1–Q3 2008: 11.4 million euros) as a result of

the drop in sales. Following losses in the first and second

quarters of the current year, the division reported slightly

positive operating earnings in the third quarter. This was due to

cost-reduction measures that have already been implemented for the

most part.

The Mechatronics Division has extended its package of

cost-cutting and restructuring measures for the Mechatronics

Division. Its target is to achieve a sustainable reduction in its

annual cost base by more than 30 million euros (so far more than 25

million euros). This program is targeted at reducing approximately

250 positions. The majority of the division’s cost-cutting measures

were completed in the third quarter.

“The cutbacks in the Mechatronics Division are painful, but

essential, in order to reverse the effects of the global recession

on our company and to create a stable starting position for

ourselves in this division for the future," said Joachim Kreuzburg.

"Now that we are nearing successful completion of our

cost-reduction program, we will focus fully on the further

development of our strategic positioning and on tapping into

additional business segments in Mechatronics."

Business Development of the Sartorius GroupAt the Group

level, order intake at 454.8 million euros attained the

year-earlier level of 454.0 million euros (+0.2%;

currency-adjusted: -2.3%). Nine-month consolidated sales revenue

was 444.7 million euros compared with 453.4 million euros a year

ago, and therefore eased 1.9% (currency-adjusted: -4.3%) relative

to the year-earlier period. Regarding consolidated operating

earnings, strong development in the Biotechnology Division

compensated for the weak earnings contribution in Mechatronics,

which was due to the recession: Operating earnings rose from 40.6

million euros to 43.9 million euros.The corresponding margin

increased from 8.9% to 9.9%. Extraordinary expenses totaled

24.7 million euros, which essentially entail provisions for

the restructuring program already implemented in the Mechatronics

Division to a large extent. Unadjusted consolidated EBITA was 19.2

million euros (Q1–Q3 2008: 40.6 million euros).

Without the two non-cash items of amortization and interest for

share price warrants, consolidated underlying net profit after

minority interest was at 13.9 million euros, up from

13.7 million euros a year earlier; the corresponding

earnings per share were at 0.81 euro, up from 0.80 euro

in the previous year.

OutlookFor the last three months of the current fiscal

year, company management expects the Biotechnology Division’s

revenue to increase and its earnings to rise overproportionately

relative to the fourth quarter in 2008. The company continues to

expect exceptionally difficult market conditions for the

Mechatronics Division. However, management anticipates a slightly

positive fourth-quarter underlying EBITA for this division because

of its successfully implemented cost-reduction program.

Current Image Files:Joachim Kreuzburg, CEO of

Sartorius:http://www.sartorius.com/media/content/press/support/Dr_Kreuzburg_3.jpghttp://www.sartorius.com/fileadmin/Image_Archive/sartorius_media/portraits/2009_DrKreuzburg.jpg

Sartorius | Biotechnology Division (Sartorius Stedim

Biotech):http://www.sartorius.com/media/content/press/support/Sartorius_0095_PG4.jpg

Sartorius | Mechatronics

Division:http://www.sartorius.com/media/content/press/support/Mechatronics_AR_2008.jpg

Conference Call and Webcast:Dr. Joachim Kreuzburg, CEO

and Executive Board Chairman of Sartorius, will discuss the

nine-month figures with analysts and investors today, October 22,

2009, at 3:00 p.m. Central European Time (CET), in a

teleconference. You may dial into the teleconference starting at

2:45 p.m. CET at the following numbers:

Germany: +49 (0)69 9897 2623France: +33 (0)1 70 99 42 84UK: +44

(0)20 7138 0845USA: +1 212 444 0896

The dial-in code is: 4830253; to view the webcast, log onto:

http://www.sartorius.com

Upcoming Financial Dates:February 2010 Publication of the

preliminary figures for fiscal 2009March 9, 2010 Annual press

conference in Goettingen, GermanyApril 21, 2010 Annual

Shareholders’ Meeting in Goettingen, GermanyApril 2010 Publication

of the first-quarter figures (Jan. – March 2010)

This press release contains statements about the future

development of the Sartorius Group. The content of these statements

cannot be guaranteed as they are based on assumptions and estimates

that harbor certain risks and uncertainties.

A Profile of SartoriusThe Sartorius Group is a leading

international laboratory and process technology provider covering

the segments of biotechnology and mechatronics. In 2008, the

technology group earned sales revenue of 611.6 million euros.

Founded in 1870, the Goettingen-based company currently employs

approximately 4,450 persons. The major areas of activity in its

biotechnology segment focus on fermentation, filtration,

purification, fluid management and laboratory applications. In the

mechatronics segment, the company primarily manufactures equipment

and systems featuring weighing, measurement and automation

technology for laboratory and industrial applications. Key

Sartorius customers are from the pharmaceutical, chemical and food

and beverage industries and from numerous research and educational

institutes of the public sector. Sartorius has its own production

facilities in Europe, Asia and America as well as sales

subsidiaries and local commercial agencies in more than 110

countries.

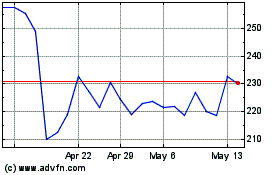

Sartorius (TG:SRT)

Historical Stock Chart

From Oct 2024 to Nov 2024

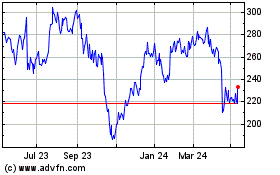

Sartorius (TG:SRT)

Historical Stock Chart

From Nov 2023 to Nov 2024