Success of the Simplified Cash Tender Offer for the Shares & bons de souscription d’actions of Novagali Pharma SA by Santen...

December 21 2011 - 12:00PM

Business Wire

Regulatory News:

Santen Pharmaceutical Co., Ltd. (“Santen”) and Novagali Pharma

SA (“Novagali”) announced today the success of the simplified cash

tender offer for the shares and bons de souscription d’actions

(“BSAs”) of Novagali (Paris:NOVA) initiated by Santen (the

“Offer”).

The Autorité des Marchés Financiers (“AMF”) published today the

results of the Offer which took place from December 2, 2011 to

December 15, 2011 included. Over the course of the Offer, 7,545,247

shares, 700 2014 BSAs and 5,406 2019 BSAs1 have been tendered, for

€6.15 per share, €4.03 per 2014 BSA and €2.75 per 2019 BSA.

Taking into account the shares held prior to the opening of the

Offer, Santen now holds directly:

- 15,788,594 shares representing 96.73%

of the share capital and of the voting rights of Novagali on the

basis of a share capital consisting in 16,322,484 shares

representing an equal amount of voting rights (and 96.91% of the

share capital and voting rights of Novagali when excluding the

30,148 Novagali treasury shares not tendered into the Offer),

- 700 2014 BSAs, representing 100% of the

outstanding 2014 BSAs, and

- 5,406 2019 BSAs, representing 100% of

the outstanding 2019 BSAs.

Following the Offer period, the shares not held by Santen

represent less than 5% of Novagali’s share capital or voting rights

when excluding Novagali’s treasury shares.

Consequently, in accordance with its intentions disclosed in the

Offer Document, Santen will provide to each shareholder who

tendered its shares, via the centralised procedure, an additional

consideration of ten eurocents (€0.10) per share tendered in the

Offer (i.e., an aggregate price of €6.25 per share tendered into

the Offer).

In addition, Santen intends, as announced in the Offer Document,

to request from the AMF, pursuant to Article L.433-4 III of the

French Monetary and Financial Code and Articles 237-14 et seq. of

the General Regulations of the AMF, the implementation of a

squeeze-out for the Novagali shares not tendered into the Offer

within a 3-month period starting at the end of the Offer, i.e.,

March 15, 2011 at the latest and for a price corresponding to the

price paid in the Offer, i.e., €6.25 per share, including the

additional consideration mentioned above.

The AMF will publish the implementation date of the squeeze-out

and the related procedure will be announced in a press release.

Upon completion of the squeeze-out, the shares of Novagali shall be

delisted from Euronext Paris.

Jérôme Martinez, CEO of Novagali, concludes: "We are very happy

that so many of our shareholders have shared our enthusiasm for the

alliance between Novagali and Santen. The success of Santen' s

Offer, and the following mandatory squeeze-out of the remaining

Novagali Pharma financial instruments, mark the beginning of a new

era for Novagali as, after only one year as a listed company,

Novagali Pharma has now a new strong ally to continue its growth.

On this day, I want to express my greatest gratitude to our

longstanding shareholders and to those who have joined us since the

listing, for their trust and their loyalty and to assure them of

the determination of our teams to further develop our truly

innovative solutions for the treatment of ophtalmic diseases."

Akira Kurokawa, President and CEO of Santen quotes: “We are very

pleased with the successful results of the Offer. The management

and the people at Novagali and Santen are excited that the initial

stage of the integration process has completed successfully. Both

companies have already commenced specific discussions with a view

to achieve mutual goals. We are convinced that together we will be

able to deliver innovative ophthalmology treatments to patients all

over the world, especially in Europe, and contribute to the

improvement of the quality of life of those patients and their

relatives.”

About Santen Pharmaceutical Co.

Ltd.

Founded in 1890, Santen is a global pharmaceutical company

specialized in the fields of ophthalmology and ant-rheumatics,

which is headquartered in Osaka, Japan. Among prescription

ophthalmic pharmaceuticals, Santen holds the top share within the

Japanese market and is one of the leading ophthalmic companies

worldwide. Santen has subsidiaries in the U.S., Europe, and Asia,

including its Emeryville, California based Santen Inc., its

Tampere, Finland based Santen OY, its Suzhou, China based Santen

Pharmaceutical (China) Co., Ltd. and its Bangalore, India based

Santen India Private Limited.

For more information, visit www.santen.com.

About Novagali Pharma

S.A.

Founded in 2000, Novagali Pharma SA is a pharmaceutical company

that develops and commercializes ophthalmic innovative products for

all segments of the eye. Thanks to its three proprietary technology

platforms, the Company has an advanced portfolio of highly

innovative products, one of which is already on sale and two of

which have ongoing undergoing phase III clinical trial programs.

Since July 2010 Novagali Pharma has been listed on NYSE Euronext

Paris - Compartment C.

For further information on Novagali Pharma S.A.:

www.novagali.com

1 The 13,624 2019 BSAs have been exercised during the Offer

period and the corresponding shares have been tendered into the

Offer.

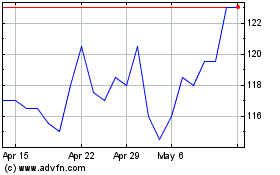

Novo Nordisk (TG:NOVA)

Historical Stock Chart

From Oct 2024 to Nov 2024

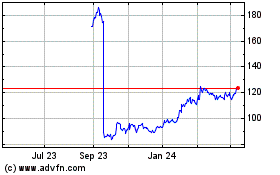

Novo Nordisk (TG:NOVA)

Historical Stock Chart

From Nov 2023 to Nov 2024