Novagali Pharma: Revenue for the 3rd quarter of 2011

November 14 2011 - 12:50PM

Business Wire

Regulatory News:

Novagali Pharma (Paris:NOVA), a pharmaceutical company that

develops and markets innovative ophthalmic products, today

announces its revenue for the first nine months of 2011.

Third-quarter and 9-month revenue to

September 30th, 2011

In thousands of euros - IFRS*

Q3 2011 Q3

2010 9 months 2011 9 months 2010

Sales

199 160

568 396

Research contracts and licence revenue

0 10

0 10

Subsidies, public funding and research tax credit

437

443

1 454 862

Total revenue

636 613

2,022 1,268

* Unaudited

Quarterly revenues

In thousands of euros - IFRS*

Q3 2011 Q2

2011 Q1 2011 Q3 2010 Q2

2010 Q1 2010 Sales

199 238

131 160 129 107 Research contracts and

licence revenue

0 0 0 10 0 0 Subsidies, public funding and

research tax credit

437 639 379

443 211 208

Total revenue 636

877 510 613 340 315

* Unaudited

For the 3rd quarter of 2011, Novagali Pharma’s earnings,

reflecting sales of Cationorm®, totalled €199k, up more than 24%

compared to the 3rd quarter of 2010. This pursuance in sales growth

is associated with the upramping of sales in countries where the

product was already marketed. Total revenue was €636k over the

quarter, a slight increase of 3.8%.

Over the first nine months of 2011, total revenue was up more

than 59% at €2.0m, compared to €1.3m over the same period of 2010.

This growth was the result of a 43.4% increase in Cationorm® sales

and a 68.7% increase in “Subsidies, public funding and research tax

credit” to €1.4m over the period. The latter notably includes the

first payments of the OSEO ISI operating subsidy, for €190k,

relative to the launch of the VITRENA project concerning diabetic

retinopathy.

Milestones and recent

events

- Clinical

developments

- Positive results for the phase II

clinical trial carried out in the United States regarding the

efficiency and innocuousness of Catioprost® amongst

patients with concomitant glaucoma and eye surface problems

(September 2011). The trial achieved its objectives by revealing a

reduction in intraocular pressure and an improvement in the signs

and symptoms of OSD (ocular surface disease) compared to the

Travatan Z® control group.

- Commercial

developments:

- The required authorisations have been

granted for the marketing of Cationorm® in the United

Arab Emirates and the launch of the product in Saudi

Arabia.

- Majority stake

for Santen Pharmaceutical Co., Ltd.

- On October 11th, 2011, Japanese

pharmaceutical leader Santen Pharmaceutical Co., Ltd. and Novagali

Pharma announced Santen’s acquisition of 50.55% of Novagali

Pharma’s capital.

- As a result of this acquisition, Santen

will soon table a mandatory takeover bid with the AMF for the

remaining shares and securities it does not yet hold. This offer

would be followed by the delisting of the remaining Novagali Pharma

shares, assuming that Santen holds at least 95% of Novagali

Pharma’s capital and voting rights after the takeover offer.

Outlook

- Cationorm®: the launch of

the product in the United States and Saudi Arabia is currently

being prepared. Cationorm® will also be available in a multi-dose

bottle with no preservatives. Furthermore, the Company is involved

in discussions regarding the product’s launch in other countries,

notably in Europe.

- Cyclokat®: the

recruitment of patients for the phase III confirmatory trial in

Europe is continuing, with results expected in mid-2012.

About NOVAGALI Pharma

(www.novagali.com)

Founded in 2000, Novagali Pharma SA is a pharmaceutical company

that develops ophthalmic innovative products for all segments of

the eye. Thanks to its three proprietary technology platforms, the

Company has an advanced portfolio of highly innovative products,

one of which is already on sale and two of which are undergoing

phase III clinical trials.

In 2009, Frost & Sullivan recognised Novagali with the Award

for Industry Innovation & Advancement of the Year, for its

proprietary emulsion technology platforms, and Siemens awarded the

company the “Health Award” Grand Prix de l’Innovation for

Novasorb®. Novagali Pharma carried out a successful IPO in July

2010 enabling the Company to raise €22 million.

Novagali Pharma is listed on NYSE Euronext Paris - Compartment

C. ISIN code: FR0010915553 - Ticker: NOVA.

Disclaimer

This press release contains forward-looking statements. Although

Novagali Pharma considers these statements to be based on

reasonable assumptions, they could be affected by risks and

uncertainties causing actual results to differ significantly from

these forward-looking statements. For details of the risks and

uncertainties that could potentially affect Novagali Pharma’s

results, financial situation, performances or achievements and thus

result in a variation in these figures compared to the

forward-looking statements contained in this document, please refer

to the Risk Factors section of the Document de Base source document

registered with the French Autorité des Marches Financiers (“AMF”)

under number R. 11-021 on April 29th, 2011 and available on the AMF

(http://www.amf-france.org) and Novagali Pharma (www.novagali.com)

websites.

This press release and the information contained herein do not

constitute an offer to sell or subscribe to, or a solicitation of

an offer to buy or subscribe to, shares in Novagali Pharma in any

country.

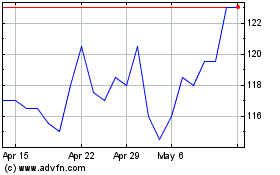

Novo Nordisk (TG:NOVA)

Historical Stock Chart

From Oct 2024 to Nov 2024

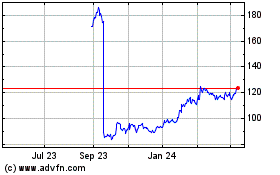

Novo Nordisk (TG:NOVA)

Historical Stock Chart

From Nov 2023 to Nov 2024