UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of August 2024

Commission File Number: 001-40253

Zhihu Inc.

(Registrant’s Name)

18 Xueqing Road

Haidian District,

Beijing 100083

People’s Republic

of China

(Address of Principal Executive Offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Zhihu Inc. |

| |

|

| |

By |

: |

/s/ Han Wang |

| |

Name |

: |

Han Wang |

| |

Title |

: |

Chief Financial Officer |

Date:

August 27, 2024

Exhibit

99.1

Hong

Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement,

make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising

from or in reliance upon the whole or any part of the contents of this announcement.

This

announcement has been prepared pursuant to, and in order to comply with, the Listing Rules and the Codes, and does not constitute

an invitation or offer to acquire, purchase or subscribe for securities of the Company nor shall there be any sale, purchase or subscription

for securities of the Company in any jurisdiction in which such offer, solicitation or sale would be unlawful absent the filing of a

registration statement or the availability of an applicable exemption from registration or other waiver.

Zhihu

Inc.

(A

company controlled through weighted voting rights and incorporated in the Cayman Islands with limited liability)

(NYSE:

ZH; HKEX: 2390)

ANNOUNCEMENT

PURSUANT

TO RULE 3.8 OF THE TAKEOVERS CODE

This

announcement is made by Zhihu Inc. (the “Company”) pursuant to Rule 3.8 of The Hong Kong Code on Takeovers and

Mergers.

Reference

is made to (i) the announcement of the Company dated July 19, 2024 in relation to, among other things, the Offer (the “3.5

Announcement”); and (ii) the announcements of the Company pursuant to Rule 3.8 of the Takeovers Code published on

July 23, 2024, August 1, 2024 and August 6, 2024. Unless otherwise defined herein, capitalized terms used herein shall

have the same meanings as those defined in the 3.5 Announcement.

UPDATE

ON THE NUMBER OF RELEVANT SECURITIES OF THE COMPANY

The

Board wishes to announce that on August 26, 2024, 510 options granted under the 2012 Plan have been cancelled pursuant to the 2012

Plan, 1,797 options granted under the 2012 Plan have been lapsed pursuant to the 2012 Plan, 7,248 restricted shares granted under the

2012 Plan have been cancelled pursuant to the 2012 Plan, and 1,200 restricted share units granted under the 2022 Plan have been cancelled

pursuant to the 2022 Plan. In addition, on August 26, 2024, 1,956 Bulk Issuance Shares (as defined below) in the form of ADSs were

used to settle the exercise or vesting of awards granted under the 2012 Plan and the 2022 Plan.

Details

of all classes of relevant securities (as defined in Note 4 to Rule 22 of the Takeovers Code) issued by the Company and the numbers

of such securities in issue as of the date of this announcement are as follows:

| (i) | a

total of 294,641,758 Shares issued and outstanding, which comprised 277,248,092 Class A

Ordinary Shares and 17,393,666 Class B Ordinary Shares issued and outstanding. This

total number of issued and outstanding Shares excludes the Class A Ordinary Shares issued

to the depositary for bulk issuance of ADSs reserved for future issuances upon the exercise

or vesting of awards granted under the 2012 Plan and the 2022 Plan (“Bulk Issuance

Shares”), which amounted to 326,193 Class A Ordinary Shares; |

| (ii) | a

total of 1,767,442 outstanding options entitling the holders to acquire an aggregate of 1,767,442

Class A Ordinary Shares under the 2012 Plan; |

| (iii) | a

total of 241,842 outstanding restricted shares entitling the holders to acquire an aggregate

of 241,842 Class A Ordinary Shares under the 2012 Plan; and |

| (iv) | a

total of 16,826,954 outstanding restricted share units entitling the holders to acquire an

aggregate of 16,826,954 Class A Ordinary Shares under the 2022 Plan. |

As

of the date of this announcement, save as disclosed above, the Company has no other outstanding options, derivatives, warrants or securities

which are convertible or exchangeable into Shares and the Company has no other relevant securities (as defined in Note 4 to Rule 22

of the Takeovers Code).

DEALING

DISCLOSURE

The

associates (as defined in Note 4 to Rule 22 of the Takeovers Code) of the Company are hereby reminded to disclose their dealings

in the relevant securities (as defined in Note 4 to Rule 22 of the Takeovers Code) of the Company under Rule 22 of the Takeovers

Code during the Offer Period.

In

accordance with Rule 3.8 of the Takeovers Code, reproduced below is the full text of Note 11 to Rule 22 of the Takeovers Code:

“Responsibilities

of stockbrokers, banks and other intermediaries

Stockbrokers,

banks and others who deal in relevant securities on behalf of clients have a general duty to ensure, so far as they are able, that those

clients are aware of the disclosure obligations attaching to associates of an offeror or the offeree company and other persons under

Rule 22 and that those clients are willing to comply with them. Principal traders and dealers who deal directly with investors should,

in appropriate cases, likewise draw attention to the relevant Rules. However, this does not apply when the total value of dealings (excluding

stamp duty and commission) in any relevant security undertaken for a client during any 7 day period is less than $1 million.

This

dispensation does not alter the obligation of principals, associates and other persons themselves to initiate disclosure of their own

dealings, whatever total value is involved.

Intermediaries

are expected to co-operate with the Executive in its dealings enquiries. Therefore, those who deal in relevant securities should appreciate

that stockbrokers and other intermediaries will supply the Executive with relevant information as to those dealings, including identities

of clients, as part of that co-operation.”

WARNING:

The Offer is conditional upon the satisfaction of the Condition as described in this announcement in all aspects. Accordingly, the Offer

may or may not become unconditional. Shareholders, ADS holders and/or potential investors of the Company should therefore exercise caution

when dealing in the securities of the Company. Persons who are in doubt as to the action they should take should consult their licensed

securities dealers or registered institutions in securities, bank managers, solicitors, professional accountants or other professional

advisers.

| |

|

By order of the board |

| |

|

Zhihu Inc. |

| |

|

Yuan Zhou |

| |

|

Chairman |

| |

|

|

| Hong Kong, August 27, 2024 |

|

|

As

of the date of this announcement, the board of Directors comprises Mr. Yuan Zhou as an executive Director, Mr. Dahai Li, Mr. Zhaohui

Li, and Mr. Bing Yu as non-executive Directors, and Mr. Hanhui Sam Sun, Ms. Hope Ni, and Mr. Derek Chen as independent

non-executive Directors.

The

Directors jointly and severally accept full responsibility for the accuracy of the information contained in this announcement and confirm,

having made all reasonable enquiries, that to the best of their knowledge, opinions expressed in this announcement have been arrived

at after due and careful consideration and there are no other facts not contained in this announcement, the omission of which would make

any statement in this announcement misleading.

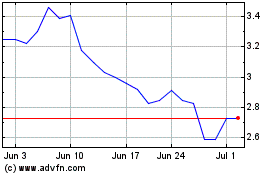

Zhihu (NYSE:ZH)

Historical Stock Chart

From Oct 2024 to Nov 2024

Zhihu (NYSE:ZH)

Historical Stock Chart

From Nov 2023 to Nov 2024