+6% GAAP Operating Profit Growth and +10%

Core Operating Profit Growth Taco Bell Same-Store Sales

Growth +5%; KFC Unit Growth +8%

Yum! Brands, Inc. (NYSE: YUM) today reported results for the

second-quarter ended June 30, 2024. Worldwide system sales,

excluding foreign currency translation, grew 3% including a 1%

same-store sales decline. Second-quarter GAAP operating profit grew

6% and second-quarter core operating profit grew 10%.

Second-quarter GAAP EPS was $1.28 and second-quarter EPS excluding

Special Items was $1.35. Our year-over-year EPS excluding Special

Items results reflect a $0.20 negative impact from a higher current

year tax rate and lower investment income. Foreign currency

translation also unfavorably impacted our EPS by $0.03.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20240804393634/en/

DAVID GIBBS COMMENTS

David Gibbs, CEO, said “I’m incredibly pleased with how well our

teams have managed through a challenging operating environment to

deliver a 10% increase in Core Operating Profit. Our twin growth

engines of Taco Bell U.S. and KFC International combined delivered

5% system sales growth led by 8% unit growth. Second-quarter

results most clearly showcased the power of the Taco Bell brand

thanks to unmatched, crave-worthy innovation and a successful menu

expansion to a new platform offering, Cantina Chicken. Based on our

first half results, we continue to expect to deliver at least 8%

Core Operating Profit growth this year. Meanwhile, as we progress

into the next phase of our technology and digital journey, we are

laying the groundwork for another promising year in 2025 as

evidenced by the expansion of drive-thru Voice AI technology at

Taco Bell.”

SECOND-QUARTER

HIGHLIGHTS

- Worldwide system sales grew 3%, excluding foreign currency

translation, with KFC at 2%, Taco Bell at 7% and Pizza Hut

flat.

- Unit count increased 5% including 894 gross new units in the

quarter.

- Robust digital sales of nearly $8 billion, with digital mix

over 50%.

- GAAP operating profit grew 6%, and core operating profit grew

10%.

- Foreign currency translation unfavorably impacted divisional

operating profit by $12 million.

Reported Results

% Change

System Sales

Ex F/X

Same-Store Sales

Units

GAAP Operating Profit

Core

Operating Profit1

KFC Division

+2

(3)

+8

+3

+6

Taco Bell Division

+7

+5

+3

+10

+10

Pizza Hut Division

Even

(3)

+3

+4

+6

Worldwide

+3

(1)

+5

+6

+10

Second-Quarter

Year-to-Date

2024

2023

% Change

2024

2023

% Change

GAAP EPS

$1.28

$1.46

(12)

$2.38

$2.51

(5)

Less Special Items EPS1

$(0.07)

$0.05

NM

$(0.12)

$0.05

NM

EPS Excluding Special Items

$1.35

$1.41

(4)

$2.50

$2.46

+1

1 See reconciliation of Non-GAAP

Measurements to GAAP Results within this release for further detail

of Core Operating Profit and Special Items.

All comparisons are versus the same period

a year ago.

System sales growth figures exclude

foreign currency translation ("F/X") and core operating profit

growth figures exclude F/X and Special Items. Special Items are not

allocated to any segment and therefore only impact worldwide GAAP

results. See reconciliation of Non-GAAP Measurements to GAAP

Results within this release for further details.

Digital system sales includes all

transactions at system restaurants where consumers utilize ordering

interaction that is primarily facilitated by automated

technology.

KFC DIVISION

Second-Quarter

Year-to-Date

%/ppts Change

%/ppts Change

2024

2023

Reported

Ex F/X

2024

2023

Reported

Ex F/X

Restaurants

30,689

28,500

+8

N/A

30,689

28,500

+8

N/A

System Sales ($MM)

8,226

8,298

(1)

+2

16,354

16,355

Even

+3

Same-Store Sales Growth (%)

(3)

+13

NM

NM

(3)

+11

NM

NM

Franchise and Property Revenues ($MM)

405

416

(3)

Even

802

828

(3)

(1)

Operating Profit ($MM)

334

326

+3

+6

647

631

+3

+6

Operating Margin (%)

46.6

47.7

(1.1)

(0.4)

48.0

46.0

+2.0

+2.7

Second-Quarter (%

Change)

Year-to-Date (%

Change)

International

U.S.

International

U.S.

System Sales Growth Ex F/X

+3

(7)

+5

(7)

Same-Store Sales Growth

(3)

(5)

(2)

(6)

- KFC Division opened 598 gross new restaurants across 57

countries.

- Foreign currency translation unfavorably impacted operating

profit by $10 million.

KFC Markets1

Percent of KFC System

Sales2

System Sales Growth Ex

F/X

Second-Quarter

(% Change)

Year-to-Date

(% Change)

China

27%

+5

+7

United States

15%

(7)

(7)

Europe

11%

+9

+8

Asia

10%

(10)

(8)

Australia

7%

+3

+4

Latin America

7%

+20

+21

United Kingdom

6%

(3)

(2)

Middle East / Turkey / North Africa

6%

(11)

(8)

Africa

5%

+10

+10

Thailand

2%

+8

+8

Canada

2%

+5

+4

India

2%

+9

+10

1Refer to

investors.yum.com/financial-information/financial-reports/ for a

list of the countries within each of the markets.

2Reflects Full Year 2023.

TACO BELL DIVISION

Second-Quarter

Year-to-Date

%/ppts Change

%/ppts Change

2024

2023

Reported

Ex F/X

2024

2023

Reported

Ex F/X

Restaurants

8,565

8,320

+3

N/A

8,565

8,320

+3

N/A

System Sales ($MM)

4,017

3,760

+7

+7

7,614

7,224

+5

+5

Same-Store Sales Growth (%)

+5

+4

NM

NM

+3

+6

NM

NM

Franchise and Property Revenues ($MM)

234

218

+7

+7

444

419

+6

+6

Operating Profit ($MM)

250

228

+10

+10

458

432

+6

+6

Operating Margin (%)

37.5

36.8

0.7

0.7

36.3

36.2

0.1

0.1

- Taco Bell Division opened 56 gross new restaurants across 11

countries.

- Taco Bell U.S. system sales grew 7% and Taco Bell International

system sales excluding foreign currency grew 4%.

- Taco Bell U.S. same-store sales grew 5% and Taco Bell

International same-store sales declined 1%.

- Company-owned restaurant margins were 25.6%, flat

year-over-year.

PIZZA HUT DIVISION

Second-Quarter

Year-to-Date

%/ppts Change

%/ppts Change

2024

2023

Reported

Ex F/X

2024

2023

Reported

Ex F/X

Restaurants

19,864

19,242

+3

N/A

19,864

19,242

+3

N/A

System Sales ($MM)

3,140

3,201

(2)

Even

6,307

6,537

(4)

(2)

Same-Store Sales Growth (%)

(3)

+4

NM

NM

(5)

+5

NM

NM

Franchise and Property Revenues ($MM)

148

149

Even

+1

296

304

(3)

(1)

Operating Profit ($MM)

94

91

+4

+6

187

195

(4)

(2)

Operating Margin (%)

39.3

37.3

2.0

2.5

39.2

39.3

(0.1)

0.3

Second-Quarter (%

Change)

Year-to-Date (%

Change)

International

U.S.

International

U.S.

System Sales Growth Ex F/X

Even

(1)

(1)

(3)

Same-Store Sales Growth

(4)

(1)

(6)

(3)

- Pizza Hut Division opened 236 gross new restaurants across 30

countries.

- Foreign currency translation unfavorably impacted operating

profit by $2 million.

Pizza Hut Markets1

Percent of Pizza Hut System

Sales2

System Sales Growth Ex

F/X

Second-Quarter

(% Change)

Year-to-Date

(% Change)

United States

41%

(1)

(3)

China

18%

+10

+4

Asia

13%

(5)

(5)

Europe

12%

(6)

(5)

Latin America

6%

+1

+2

Middle East / Africa

5%

(6)

(6)

Canada

3%

+7

+5

India

2%

+4

+1

1Refer to

investors.yum.com/financial-information/financial-reports/ for a

list of the countries within each of the markets.

2Reflects Full Year 2023.

HABIT BURGER GRILL

DIVISION

- The Habit Burger Grill Division opened 4 gross new restaurants

this quarter.

- The Habit Burger Grill Division system sales declined 1% with

same-store sales declining 6%.

OTHER ITEMS

- See reconciliation of Non-GAAP Measurements to GAAP results

within this release for further detail of Special Items by

financial statement line item including the impact of Special Items

on General and administrative expenses.

- In June 2024, the Company completed a strategic transaction to

transfer certain rights related to trademarks of the Jeno’s and

Telepizza brands in Colombia and Chile to restaurant operator Food

Delivery Brands, S.A. As a result of the transaction, approximately

120 Jeno’s and Telepizza branded restaurant units were removed from

Pizza Hut’s global unit count.

- Disclosures pertaining to outstanding debt in our Restricted

Group capital structure will be provided at the time of the filing

of the second-quarter Form 10-Q.

CONFERENCE CALL

Yum! Brands, Inc. will host a conference call to review the

company's financial performance and strategies at 8:15 a.m. Eastern

Time August 6, 2024. The number is 404/975-4839 for U.S. callers,

833/950-0062 for Canada callers, and 929/526-1599 for international

callers, conference ID 125949.

The call will be available for playback beginning at 10:00 a.m.

Eastern Time August 6, 2024 through August 15, 2024. To access the

playback, dial 866/813-9403 in the U.S., 226/828-7578 in Canada,

0204/525-0658 for U.K. (local), and +44/204-525-0658

internationally, conference ID 908951.

The webcast and the playback can be accessed by visiting Yum!

Brands' website, investors.yum.com/events-and-presentations and

selecting “Q2 2024 Yum! Brands, Inc. Earnings Call.”

ADDITIONAL INFORMATION

ONLINE

Quarter-end dates for each division, restaurant count details,

definitions of terms and Restricted Group financial information are

available at investors.yum.com. Reconciliation of non-GAAP

financial measures to the most directly comparable GAAP measures

are included in our Condensed Consolidated Summary of Results.

FORWARD-LOOKING

STATEMENTS

This announcement may contain “forward-looking statements”

within the meaning of Section 27A of the Securities Act of 1933 and

Section 21E of the Securities Exchange Act of 1934. We intend all

forward-looking statements to be covered by the safe harbor

provisions of the Private Securities Litigation Reform Act of 1995.

Forward-looking statements generally can be identified by the fact

that they do not relate strictly to historical or current facts and

by the use of forward-looking words such as “expect,”

“expectation,” “believe,” “anticipate,” “may,” “could,” “intend,”

“belief,” “plan,” “estimate,” “target,” “predict,” “likely,”

“seek,” “project,” “model,” “ongoing,” “will,” “should,”

“forecast,” “outlook” or similar terminology. These statements are

based on and reflect our current expectations, estimates,

assumptions and/ or projections, our perception of historical

trends and current conditions, as well as other factors that we

believe are appropriate and reasonable under the circumstances.

Forward-looking statements are neither predictions nor guarantees

of future events, circumstances or performance and are inherently

subject to known and unknown risks, uncertainties and assumptions

that could cause our actual results to differ materially from those

indicated by those statements. There can be no assurance that our

expectations, estimates, assumptions and/or projections, including

with respect to the future earnings and performance or capital

structure of Yum! Brands, will prove to be correct or that any of

our expectations, estimates or projections will be achieved.

Numerous factors could cause our actual results and events to

differ materially from those expressed or implied by

forward-looking statements, including, without limitation: food

safety and food- or beverage-borne illness concerns; adverse

impacts of health epidemics, deterioration in public health

conditions or the occurrence of other catastrophic or unforeseen

events; the success of our concepts’ franchisees; the success of

our development strategy; anticipated benefits from past or

potential future acquisitions, investments, other strategic

transactions or initiatives, or our portfolio business model; our

significant exposure to the Chinese market; our global operations

and related exposure to geopolitical instability; foreign currency

risks and foreign exchange controls; our ability to protect the

integrity or availability of IT systems or the security of

confidential information and other cybersecurity risks; compliance

with data privacy and data protection legal requirements; our

ability to successfully implement technology initiatives, including

utilization of artificial intelligence; our increasing dependence

on digital commerce platforms; the impact of social media; our

ability to protect our trademarks or other intellectual property;

shortages or interruptions in the availability and the delivery of

food, equipment and other supplies; the loss of key personnel,

labor shortages and increased labor costs, including as a result of

state and local legislation related to wages and working

conditions; changes in food prices and other operating costs; our

corporate reputation, the value and perception of our brands and

changes in consumer preferences and wellness trends; evolving

expectations and requirements with respect to social and

environmental sustainability matters; adverse effects of severe

weather and climate change; pending or future litigation and legal

claims or proceedings; changes in, or noncompliance with, legal

requirements; tax matters, including changes in tax rates or laws,

impositions of new taxes, tax implications of our restructurings,

or disagreements with taxing authorities; changes in consumer

discretionary spending and macroeconomic conditions, including

inflationary pressures and elevated interest rates; competition

within the retail food industry; risks relating to our level of

indebtedness. In addition, other risks and uncertainties not

presently known to us or that we currently believe to be immaterial

could affect the accuracy of any such forward-looking statements.

All forward-looking statements should be evaluated with the

understanding of their inherent uncertainty.

The forward-looking statements included in this announcement are

only made as of the date of this announcement and we disclaim any

obligation to publicly update any forward-looking statement to

reflect subsequent events or circumstances. You should consult our

filings with the Securities and Exchange Commission (including the

information set forth under the captions “Risk Factors” and

“Forward-Looking Statements” in our most recently filed Annual

Report on Form 10-K and Quarterly Report on Form 10-Q) for

additional detail about factors that could affect our financial and

other results.

Yum! Brands, Inc., based in Louisville, Kentucky, and its

subsidiaries franchise or operate a system of over 59,000

restaurants in more than 155 countries and territories under the

company’s concepts – KFC, Taco Bell, Pizza Hut and the Habit Burger

Grill. The Company's KFC, Taco Bell and Pizza Hut brands are global

leaders of the chicken, Mexican-style food, and pizza categories,

respectively. The Habit Burger Grill is a fast casual restaurant

concept specializing in made-to-order chargrilled burgers,

sandwiches and more. In 2024, Yum! was named to the Dow Jones

Sustainability Index North America for the eighth consecutive year,

and the company was recognized among TIME Magazine’s list of Best

Companies for Future Leaders, Newsweek’s list of America’s Most

Responsible Companies and USA Today’s America’s Climate Leaders.

Yum! also received widespread recognition in 2023, including being

listed on the Bloomberg Gender-Equality Index; and Forbes’ list of

America’s Best Employers for Diversity. In addition, KFC, Taco Bell

and Pizza Hut brands were ranked in the top five of Entrepreneur’s

Top Global Franchises Ranking for 2023.

Category: Earnings

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240804393634/en/

Analysts are invited to contact: Matt Morris, Head of Investor

Relations at 888/298-6986 Members of the media are invited to

contact: Virginia Ferguson, Vice President, Public Relations, at

502/874-8200

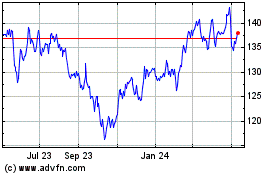

Yum Brands (NYSE:YUM)

Historical Stock Chart

From Oct 2024 to Nov 2024

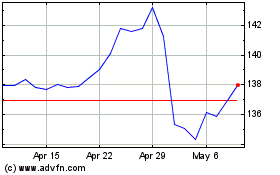

Yum Brands (NYSE:YUM)

Historical Stock Chart

From Nov 2023 to Nov 2024