false000010851600001085162024-05-292024-05-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported) May 29, 2024 |

WORTHINGTON ENTERPRISES, INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Ohio |

001-08399 |

31-1189815 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

200 West Old Wilson Bridge Road |

|

Columbus, Ohio |

|

43085 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (614) 438-3210 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Shares, Without Par Value |

|

WOR |

|

The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01 Other Events.

On May 29, 2024, Worthington Enterprises, Inc. (the "Registrant") announced that it has entered into a definitive agreement to acquire Hexagon Ragasco AS ("Ragasco"), a leading manufacturer of composite propane cylinders, from Hexagon Composites ASA ("Hexagon"). The purchase price for the acquisition of Ragasco, which is expected to close on June 3, 2024, will be approximately $98.0 million, subject to closing adjustments and a potential earnout that could, based upon Ragasco’s performance through 2024, either increase the purchase price by up to $9.0 million, or reduce the purchase price by up to $5.0 million. The purchase price will be sourced primarily from the Registrant’s existing cash.

Ragasco, which will operate within the Registrant’s Building Products segment, employs approximately 130 people and is headquartered in Raufoss, Norway.

The Registrant also announced on May 29, 2024 that it has entered into a joint venture with Hexagon, which will be comprised of the operating businesses that make up the Registrant’s Sustainable Energy Solutions segment. Pursuant to the transaction, which closed on May 29, 2024, Hexagon acquired a 49% stake in the joint venture for approximately $10 million. The Registrant holds a 49% stake in the joint venture, and the remaining 2% is held by members of the existing management team of the Registrant’s Sustainable Energy Solutions segment. In connection with the formation of the joint venture, the Registrant will record a one-time pre-tax loss, which, subject to an on-going analysis, is estimated to be in excess of $50.0 million.

The joint venture with Hexagon, will be based in Europe, employing approximately 500 people and operating facilities in Austria, Germany and Poland.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

WORTHINGTON ENTERPRISES, INC. |

|

|

|

|

Date: |

May 29, 2024 |

By: |

/s/Patrick J. Kennedy |

|

|

|

Patrick J. Kennedy, Vice President -

General Counsel and Secretary |

Worthington Enterprises Announces Planned Acquisition of Hexagon Ragasco and Sustainable Energy Solutions Joint Venture with Hexagon Composites

COLUMBUS, OHIO (May 29, 2024) – Worthington Enterprises (NYSE: WOR), a designer and manufacturer of market-leading brands that enable people to live safer, healthier and more expressive lives, today announced the signing of two definitive agreements with Hexagon Composites ASA (OSE: HEX.OL) of Norway. One agreement is to acquire 100 percent of Hexagon Ragasco and a second agreement is to sell 49 percent of Worthington’s Sustainability Energy Solutions (SES) business segment to Hexagon Composites forming a joint venture with the company. The two transactions will extend Worthington’s global position in cylinder manufacturing and strengthen its position to capitalize on the storage, transport and distribution of gases supporting the global clean energy transition including propane (LPG), hydrogen and compressed natural gas. The formation of the joint venture was completed today, and the acquisition of Hexagon Ragasco is expected to close on or around June 3, 2024.

Acquisition of Hexagon Ragasco

Worthington plans to acquire Hexagon Ragasco, a global market leader in lightweight, customizable LPG composite cylinders used for leisure, household and industrial applications, for approximately $98 million, which is subject to customary closing adjustments and a potential earn out based on the financial performance of the business through the remainder of calendar year 2024. Hexagon Ragasco had adjusted calendar year 2023 sales of approximately $64 million and EBITDA of $12.7 million. The business employs approximately 130 people in Norway and sells its products in more than 100 countries.

Hexagon Ragasco manufactures its cylinders in an automated facility in Raufoss, Norway. The company’s innovative and technology-enabled manufacturing capabilities, along with its ability to easily customize cylinders, make Hexagon Ragasco’s cylinders among the most efficiently produced and quality-consistent composite LPG cylinders in the world. The addition of Hexagon Ragasco furthers Worthington’s interests in advancing the use of clean fuels as part of the global energy transition.

Hexagon Ragasco will become part of the Building Products segment at Worthington Enterprises that delivers products and solutions for heating, cooling, construction and water applications worldwide. Worthington Enterprises is one of the world’s leading manufacturers of cylinders for these markets. The planned acquisition also expands the Company’s operational footprint in Europe where its Amtrol-Alfa facility in Portugal makes a wide range of cylinders.

“Hexagon Ragasco is one of the pioneers of the composite cylinder,” said Jimmy Bowes, president, Building Products, Worthington Enterprises. “They’ve been bringing innovative products to the market for more than 20 years that are raising expectations of the performance, quality and capabilities of an LPG cylinder. We’ve followed their growth closely and believe that their composite cylinders are a great

complement to our existing cylinder business. We can’t wait to get started with the exceptional team at Hexagon Ragasco.”

Creation of Worthington Enterprises and Hexagon Composites Joint Venture

Hexagon Composites acquired 49 percent of Worthington’s SES business segment for approximately $10 million to form a joint venture focused on capitalizing on the global clean energy transition specific to the storage, transport and distribution of hydrogen and compressed natural gas. Worthington Enterprises will maintain 49 percent ownership and the existing executive management team will hold the remaining two percent. Based in Europe, the SES business segment has more than 500 employees working in its Austria, Germany and Poland facilities.

Andy Rose, president and chief executive officer, Worthington Enterprises, said, “The creation of a joint venture with Hexagon is an opportunity to bring in an experienced partner and work together to develop the next phase of the SES business in an evolving marketplace. Their investment reflects the strength of our reputation, achievements to date and the potential of the business. We are grateful to our SES team for their dedication, and we look forward to continuing to support their efforts.”

Worthington Enterprises has a long history of effectively leveraging joint ventures as part of its growth strategy bringing together two partners to make a business stronger and more successful. Currently, the Company participates in two primary joint ventures. Worthington Armstrong Venture (WAVE), which was formed in 1992, provides ceiling solutions for commercial and residential locations, and ClarkDietrich, which was formed in 2011, offers products and services for cold-formed steel framing and drywall/plastering finishing systems.

A presentation with more information on the transactions can be found on the investor relations section of the Company’s website.

About Worthington Enterprises

Worthington Enterprises (NYSE: WOR) is a designer and manufacturer of market-leading brands that help enable people to live safer, healthier and more expressive lives. The Company operates with three business segments: Building Products, Consumer Products and Sustainable Energy Solutions. Worthington’s emphasis on innovation and transformation extends to building products including heating and cooling solutions, water systems, architectural and acoustical grid ceilings and metal framing and accessories, and consumer products in tools, outdoor living and celebrations categories sold under brand names Balloon Time®, Bernzomatic®, Coleman®, Garden-Weasel®, General®, HALO™, Hawkeye™, Level5 Tools®, Mag Torch®, Pactool International® and Well-X-Trol®. The Company serves the growing global hydrogen ecosystem through on-board fueling systems and gas containment solutions.

Headquartered in Columbus, Ohio, Worthington Enterprises employs approximately 5,000 people throughout North America and Europe.

Founded in 1955 as Worthington Industries, Worthington Enterprises follows a people-first Philosophy with earning money for its shareholders as its first corporate goal. Worthington Enterprises achieves this outcome by empowering its employees to innovate, thrive and grow with leading brands in attractive markets that improve everyday life. The Company engages deeply with local communities where it has

operations through volunteer efforts and The Worthington Companies Foundation, participates actively in workforce development programs and reports annually on its corporate citizenship and sustainability efforts. For more information, visit worthingtonenterprises.com.

Forward-Looking Statements

Statements by Worthington Enterprises that are not limited to historical information constitute “forward-looking statements” under federal securities laws. Forward-looking statements are subject to various risks, uncertainties and other factors that may cause actual results to differ materially from those expected by Worthington Enterprises. Readers should evaluate forward-looking statements in the context of such risks, uncertainties and other factors, many of which are described in Worthington Enterprises’ filings with the Securities and Exchange Commission (“SEC”). Forward-looking statements are qualified by the cautionary statements included in Worthington Enterprises’ SEC filings and other public communications. This press release speaks only as of the date hereof. Worthington Enterprises does not undertake any obligation to update or revise its forward-looking statements except as required by applicable law or regulation.

###

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

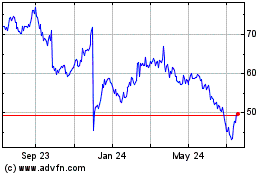

Worthington Enterprises (NYSE:WOR)

Historical Stock Chart

From Jun 2024 to Jul 2024

Worthington Enterprises (NYSE:WOR)

Historical Stock Chart

From Jul 2023 to Jul 2024