- Increased quarterly cash distribution

by 2.9% sequentially, or 12% compared to the fourth quarter 2017

distribution, to $0.4328 per unit, the 16th consecutive quarterly

increase in distributions

- Trailing twelve-month coverage ratio of

1.12x

- Achieved record production at OpCo in

2018

Westlake Chemical Partners LP (NYSE: WLKP) (the "Partnership")

today reported net income attributable to the Partnership of $11.9

million, or $0.37 per limited partner unit, for the three months

ended December 31, 2018, a decrease of $3.6 million compared

to fourth quarter 2017 net income attributable to the Partnership

of $15.5 million. The decrease in net income was primarily due

to lower margins on Westlake Chemical OpCo LP’s (“OpCo”) third

party sales and higher interest expense when compared to the

prior-year period. Cash flows from operating activities in the

fourth quarter of 2018 were $106.1 million, a decrease of

$29.3 million compared to fourth quarter 2017 cash flows from

operating activities of $135.4 million. This decrease in cash flow

from operations is primarily attributable to a reduction in

receivables from Westlake Chemical Corporation (“Westlake”) in the

fourth quarter of 2017 and lower margins on OpCo’s third party

sales volumes, partially offset by increased production at OpCo, as

compared to the prior-year period. For the three months ended

December 31, 2018, MLP distributable cash flow of

$14.5 million decreased by $2.3 million from fourth quarter

2017 MLP distributable cash flow of $16.8 million. This

decrease was primarily due to lower margins on OpCo’s third party

sales volumes, partially offset by increased production at

OpCo.

Fourth quarter 2018 net income attributable to the Partnership

was $11.9 million, a decrease of $0.5 million from third

quarter 2018 net income attributable to the Partnership of $12.4

million. Fourth quarter 2018 cash flows from operating activities

of $106.1 million decreased by $3.3 million compared to third

quarter 2018 cash flows from operating activities of $109.4

million. This decrease was primarily due to lower margins on OpCo’s

third party sales volumes and a reduction in receivables from

Westlake, partially offset by an increase in third party

receivables. Fourth quarter 2018 MLP distributable cash flow of

$14.5 million decreased by $0.5 million compared to third

quarter 2018 MLP distributable cash flow of $15.0 million,

primarily due to higher maintenance capital, partially offset by

higher production at OpCo.

Net income attributable to the Partnership of $49.3 million, or

$1.51 per limited partner unit, for the twelve months ended

December 31, 2018 increased by $0.6 million compared to 2017

net income attributable to the Partnership of $48.7 million. The

increase in net income attributable to the Partnership as compared

to the prior year was primarily due to the Partnership’s increased

ownership in OpCo following the acquisition of an additional 5%

interest in the third quarter of 2017 and record production at

OpCo, partially offset by lower margins on OpCo’s third party sales

volumes. Cash flows from operating activities for 2018 were

$436.2 million, a decrease of $101.2 million compared to

2017 cash flows from operating activities of $537.4 million. This

decrease was primarily due to a reduction in receivables from

Westlake that occurred in 2017 and lower margins on OpCo’s third

party sales volumes, partially offset by higher production at OpCo

and lower turnaround expenditures. For the twelve months ended

December 31, 2018, MLP distributable cash flow of

$60.0 million increased by $5.3 million compared to 2017

MLP distributable cash flow of $54.7 million. The increase in MLP

distributable cash flow as compared to the prior year was due to

the Partnership’s increased ownership in OpCo and record production

and lower maintenance capital expenditures at OpCo, partially

offset by lower margins on OpCo’s third party sales.

On July 27, 2018, the Board of Directors of Westlake

Chemical Partners GP LLC, the general partner of the Partnership,

and Westlake, the Partnership’s sponsor and holder of the

Partnership’s incentive distribution rights (“IDRs”), agreed to

reset the Partnership’s target distribution tiers pursuant to which

the IDRs are calculated, with the first target quarterly

distribution threshold increasing from $0.3163 to $1.2938 per unit.

This reset is expected to allow the Partnership to increase its

distribution per unit in line with historical growth rates for over

10 years before the next IDR payment may occur.

On January 25, 2019, the Board of Directors of Westlake Chemical

Partners GP LLC announced a quarterly distribution for the fourth

quarter of 2018 of $0.4328 per limited partner unit to be payable

on February 20, 2019 to unit holders of record as of

February 5, 2019. The fourth quarter 2018 distribution increased by

12% compared to the fourth quarter 2017 distribution and 2.9%

compared to the third quarter 2018 distribution. MLP distributable

cash flow provided trailing twelve month coverage of 1.12x the

declared distributions for the fourth quarter of 2018.

OpCo's Ethylene Sales Agreement with Westlake is designed to

provide for stable and predictable cash flows. The agreement

provides that 95% of OpCo's ethylene production is sold to Westlake

for a cash margin of $0.10 per pound, net of operating costs,

maintenance capital expenditures and reserves for future turnaround

expenditures.

"We are pleased with the Partnership's performance in 2018. As

we enter 2019, we are continuing to reap benefits of the

investments made over the past few years to grow our earnings, cash

flows and production, including the expansion of OpCo’s ethylene

facilities in both Lake Charles, Louisiana and Calvert City,

Kentucky, and increasing our ownership interest in OpCo in both

2015 and 2017," said Albert Chao, President and Chief Executive

Officer. “Demonstrated by the resetting of our IDRs and previous

drop downs, Westlake has established an ongoing commitment to the

Partnership. This has allowed continued distribution growth to

unitholders - with distribution growth of over 150% since our IPO

just over four years ago.”

The statements in this release and the related teleconference

relating to matters that are not historical facts, such as those

with respect to increasing distributions, the potential for future

drop-down transaction and the timing of the next IDR payment are

forward-looking statements. These forward-looking statements are

subject to significant risks and uncertainties. Actual results

could differ materially, based on factors including, but not

limited to, operating difficulties; the volume of ethylene that we

are able to sell; the price at which we are able to sell ethylene;

changes in the price and availability of feedstocks; changes in

prevailing economic conditions; actions of Westlake Chemical

Corporation; actions of third parties; inclement or hazardous

weather conditions, including flooding, and the physical impacts of

climate change; environmental hazards; changes in laws and

regulations (or the interpretation thereof); inability to acquire

or maintain necessary permits; inability to obtain necessary

production equipment or replacement parts; technical difficulties

or failures; labor disputes; difficulty collecting receivables;

inability of our customers to take delivery; fires, explosions or

other industrial accidents; our ability to borrow funds and access

capital markets; and other risk factors. For more detailed

information about the factors that could cause actual results to

differ materially, please refer to the Partnership's Annual Report

on Form 10-K for the year ended December 31, 2017, which

was filed with the SEC in March 2018.

This release is intended to be a qualified notice under Treasury

Regulation Section 1.1446-4(b). Brokers and nominees should treat

one hundred percent (100.0%) of the Partnership's distributions to

non-U.S. investors as being attributable to income that is

effectively connected with a United States trade or

business. Accordingly, the Partnership's distributions to non-U.S.

investors are subject to federal income tax withholding at the

highest applicable effective tax rate.

Use of Non-GAAP Financial Measures

This release makes reference to certain "non-GAAP" financial

measures, such as MLP distributable cash flow and EBITDA, as

defined in Regulation G of the U.S. Securities Exchange Act of

1934, as amended. We report our financial results in accordance

with U.S. generally accepted accounting principles ("GAAP"), but

believe that certain non-GAAP financial measures, such as MLP

distributable cash flow and EBITDA, provide useful supplemental

information to investors regarding the underlying business trends

and performance of our ongoing operations and are useful for

period-over-period comparisons of such operations. These non-GAAP

financial measures should be considered as a supplement to, and not

as a substitute for, or superior to, the financial measures

prepared in accordance with GAAP. A reconciliation of MLP

distributable cash flow and EBITDA to net income and net cash

provided by operating activities can be found in the financial

schedules at the end of this release. We define distributable cash

flow as net income plus depreciation, amortization and disposition

of property, plant and equipment, less contributions from

turnaround reserves and maintenance capital expenditures. We define

MLP distributable cash flow as distributable cash flow less

distributable cash flow attributable to Westlake's noncontrolling

interest in OpCo and distributions attributable to the incentive

distribution rights holder. MLP distributable cash flow does not

reflect changes in working capital balances. We define EBITDA as

net income before interest expense, income taxes, depreciation and

amortization. Because MLP distributable cash flow and EBITDA may be

defined differently by other companies in our industry, our

definitions of MLP distributable cash flow and EBITDA may not be

comparable to similarly titled measures of other companies.

Westlake Chemical Partners LP

Westlake Chemical Partners is a limited partnership formed by

Westlake Chemical Corporation to operate, acquire and develop

ethylene production facilities and other qualified assets.

Headquartered in Houston, the Partnership owns an 18.3% interest in

Westlake Chemical OpCo LP. Westlake Chemical OpCo LP's assets

consist of three ethylene production facilities in Calvert City,

Kentucky, and Lake Charles, Louisiana and an ethylene pipeline. For

more information about Westlake Chemical Partners LP, please visit

http://www.wlkpartners.com.

Westlake Chemical Partners LP Conference Call Information:

A conference call to discuss Westlake Chemical Partners' fourth

quarter and full year 2018 results will be held Tuesday, February

19, 2019 at 12:00 PM Eastern Time (11:00 AM Central Time). To

access the conference call, dial (855) 765-5686 or (234) 386-2848

for international callers, approximately 10 minutes prior to the

scheduled start time and reference passcode 2638219.

A replay of the conference call will be available beginning two

hours after its conclusion until 11:59 p.m. Eastern Time on

February 26, 2019. To hear a replay, dial (855) 859-2056

or (404) 537-3406 for international callers. The replay passcode is

2638219.

The conference call will also be available via

webcast at: https://edge.media-server.com/m6/p/x5mphzie and

the earnings release can be obtained via the Partnership web page

at: http://investors.wlkpartners.com/CorporateProfile.

WESTLAKE CHEMICAL PARTNERS LP

("WESTLAKE PARTNERS") CONSOLIDATED STATEMENTS OF

OPERATIONS (Unaudited)

Three Months Ended December 31,

Twelve Months Ended December

31,

2018 2017 2018

2017 (In thousands of dollars, except per unit

data) Revenue Net sales—Westlake Chemical Corporation

("Westlake") $ 272,872 $ 261,113 $ 1,074,957 $ 973,081 Net

co-product, ethylene and other sales—third parties 62,853

47,532 210,665 199,900

Total net sales 335,725 308,645 1,285,622 1,172,981 Cost of

sales 242,096 197,913 908,463

769,314 Gross profit 93,629 110,732 377,159

403,667 Selling, general and administrative expenses 7,173

7,741 27,590 29,260

Income from operations 86,456 102,991 349,569 374,407

Other income (expense) Interest expense—Westlake (5,381 )

(4,269 ) (21,433 ) (21,861 ) Other income (expense), net 715

(52 ) 2,457 1,792 Income

before income taxes 81,790 98,670 330,593 354,338 Provision for

income taxes 208 355 22

1,280 Net income 81,582 98,315 330,571 353,058

Less: Net income attributable to

noncontrolling interests in

Westlake Chemical OpCo LP ("OpCo")

69,699 82,769 281,224

304,388

Net income attributable to Westlake

Partners $ 11,883 $ 15,546

$ 49,347 $ 48,670

Net income per limited partner unit

attributable to

Westlake Partners (basic and diluted) Common units $ 0.37 $ 0.46 $

1.51 $ 1.72 Subordinated units $ — $ — $ — $

1.43 Distributions declared per unit $ 0.4328

$ 0.3864 $ 1.6598 $ 1.4819 MLP

distributable cash flow $ 14,524 $ 16,808 $ 60,024

$ 54,700 Distribution declared Limited partner

units—public $ 7,845 $ 6,999 $ 30,077 $ 23,114 Limited partner

units—Westlake 6,112 5,457 23,439 20,928 Incentive distribution

rights — 614 733

1,666 Total distribution declared $ 13,957 $ 13,070

$ 54,249 $ 45,708 EBITDA $ 113,837 $

130,422 $ 460,868 $ 490,184

WESTLAKE CHEMICAL PARTNERS LP

("WESTLAKE PARTNERS") CONDENSED CONSOLIDATED BALANCE

SHEETS (Unaudited) December 31,

2018 December 31, 2017 (In thousands

of dollars) ASSETS Current assets Cash and cash

equivalents $ 19,744 $ 27,008 Receivable under the Investment

Management Agreement— Westlake Chemical Corporation ("Westlake")

148,956 136,510 Accounts receivable, net—Westlake 57,280 43,884

Accounts receivable, net—third parties 16,404 18,083 Inventories

4,388 5,590 Prepaid expenses and other current assets 370

314 Total current assets 247,142 231,389

Property, plant and equipment, net 1,148,265 1,196,245 Other

assets, net 66,718 87,642

Total

assets $ 1,462,125 $

1,515,276 LIABILITIES AND EQUITY

Current liabilities (accounts payable and accrued liabilities) $

48,772 $ 40,240 Long-term debt payable to Westlake 477,608 473,960

Other liabilities 1,664 2,327 Total

liabilities 528,044 516,527 Common

unitholders—public 409,608 411,228 Common unitholder—Westlake

48,774 50,265 Subordinated unitholder—Westlake — — General

partner—Westlake (242,572 ) (241,958 ) Accumulated other

comprehensive income — 279 Total

Westlake Partners partners' capital 215,810 219,814 Noncontrolling

interest in OpCo 718,271 778,935 Total

equity 934,081 998,749

Total

liabilities and equity $ 1,462,125

$ 1,515,276

WESTLAKE CHEMICAL PARTNERS LP ("WESTLAKE PARTNERS")

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

Twelve Months Ended December

31,

2018 2017 (In thousands of

dollars) Cash flows from operating activities Net income

$ 330,571 $ 353,058 Adjustments to reconcile net income to net cash

provided by operating activities: Depreciation and amortization

108,842 113,985 Other balance sheet changes (3,262 )

70,314 Net cash provided by operating activities

436,151 537,357

Cash flows from investing

activities Additions to property, plant and equipment (39,862 )

(68,858 ) Maturities of investments with Westlake under the

Investment Management Agreement 372,050 62,828 Investments with

Westlake under the Investment Management Agreement (384,000 )

(199,000 ) Other — 1,801 Net cash used

for investing activities (51,812 ) (203,229 )

Cash

flows from financing activities Net proceeds from common unit

offering — 110,698 Proceeds from debt payable to Westlake 3,648

165,257 Repayment of debt payable to Westlake — (285,926 )

Quarterly distributions to noncontrolling interest retained in OpCo

by Westlake (341,888 ) (343,932 ) Quarterly distributions to

unitholders (53,363 ) (42,117 ) Net cash used for

financing activities (391,603 ) (396,020 ) Net

decrease in cash and cash equivalents (7,264 ) (61,892 ) Cash and

cash equivalents at beginning of the year 27,008

88,900 Cash and cash equivalents at end of the year $

19,744 $ 27,008

WESTLAKE CHEMICAL PARTNERS LP ("WESTLAKE

PARTNERS") RECONCILIATION OF MLP DISTRIBUTABLE CASH

FLOW TO NET INCOME AND NET CASH PROVIDED BY OPERATING

ACTIVITIES (Unaudited)

Three

MonthsEndedSeptember 30,

Three Months Ended December 31,

Twelve Months Ended December

31,

2018 2018 2017 2018

2017 (In thousands of dollars)

Net cash provided by

operating activities $ 109,433 $

106,147 $ 135,441 $ 436,151

$ 537,357

Changes in operating assets and

liabilities and other (25,634 ) (24,565 )

(37,126 ) (105,580 ) (184,299 )

Net Income

$ 83,799 $ 81,582

$ 98,315 $ 330,571

$ 353,058 Add:

Depreciation, amortization and

disposition of property, plant and

equipment 26,918 27,922 27,889 110,691 117,128

Mark-to-market adjustment loss on

derivative contracts — 62 — 62 — Less: Contribution to turnaround

reserves

(4,250 ) (4,238 ) (7,939 ) (16,840 ) (30,580 ) Maintenance capital

expenditures (8,380 ) (9,297 ) (9,694 ) (31,481 ) (37,775 )

Incentive distribution rights — — (614 ) (733 ) (1,666 )

Distributable cash flow attributable

to noncontrolling interest in OpCo (83,063 ) (81,507

) (91,149 ) (332,246 ) (345,465 )

MLP

distributable cash flow $ 15,024 $

14,524 $ 16,808 $

60,024 $ 54,700

WESTLAKE CHEMICAL

PARTNERS LP ("WESTLAKE PARTNERS") RECONCILIATION OF

EBITDA TO NET INCOME AND NET CASH PROVIDED BY OPERATING

ACTIVITIES (Unaudited)

Three

MonthsEndedSeptember 30,

Three Months Ended December 31,

Twelve Months Ended December

31,

2018 2018 2017 2018

2017 (In thousands of dollars)

Net cash provided by

operating activities $ 109,433 $

106,147 $ 135,441 $ 436,151

$ 537,357

Changes in operating assets and

liabilities and other (25,634 ) (24,565 )

(37,126 ) (105,580 ) (184,299 )

Net Income

$ 83,799 $ 81,582

$ 98,315 $ 330,571

$ 353,058 Add: Depreciation and amortization

26,892 26,666 27,483 108,842 113,985 Interest expense 5,639 5,381

4,269 21,433 21,861 Income tax provision (benefit) (772 )

208 355 22 1,280

EBITDA $ 115,558 $

113,837 $ 130,422 $

460,868 $ 490,184

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190219005289/en/

Investors—Steve Bender—(713) 585-2900Media—L. Benjamin

Ederington—(713) 585-2900

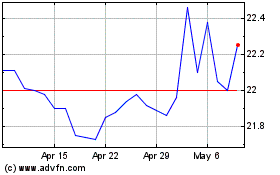

Westlake Chemical Partners (NYSE:WLKP)

Historical Stock Chart

From Jun 2024 to Jul 2024

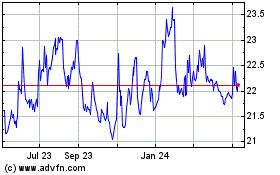

Westlake Chemical Partners (NYSE:WLKP)

Historical Stock Chart

From Jul 2023 to Jul 2024