0001288403

false

0001288403

2023-09-21

2023-09-21

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Current

Report

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event

reported): September 21, 2023

W&T Offshore, Inc.

(Exact name of registrant

as specified in its charter)

| |

1-32414 |

|

| |

(Commission

File Number) |

|

| Texas |

|

72-1121985 |

(State or

Other Jurisdiction of

Incorporation) |

|

(IRS

Employer Identification No.) |

5718 Westheimer Road, Suite 700

Houston, Texas 77057

(Address of Principal

Executive Offices)

713.626.8525

(Registrant’s Telephone

Number, Including Area Code)

N/A

(Former Name or Former

Address, If Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading Symbol |

|

Name of

each exchange on which registered |

| Common Stock, par value $0.00001 |

|

WTI |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ¨

Item 7.01 Regulation FD Disclosure.

On September 21, 2023, W&T Offshore, Inc.

(the “Company”) issued a press release announcing that it has completed the acquisition of working interests in eight shallow

water oil and gas producing assets in the central and eastern shelf region of the Gulf of Mexico from an undisclosed private seller. A

copy of the press release is attached hereto, furnished as Exhibit 99.1 to this Current Report on Form 8-K and incorporated into

this Item 7.01 by reference.

The information set forth in this Item 7.01 (including

Exhibit 99.1) shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as

amended (the “Exchange Act”), nor shall such information be deemed incorporated by reference in any filing under the Securities

Act of 1933, as amended, or the Exchange Act, regardless of the general incorporation language of such filing, except as shall be expressly

set forth by specific reference in such filing.

| Item 9.01 | Financial Statements and Exhibits. |

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

W&T OFFSHORE, INC.

(Registrant) |

| |

|

|

| Dated: September 21, 2023 |

By: |

/s/ Jonathan Curth |

| |

Name: |

Jonathan Curth |

| |

Title: |

Executive Vice President, General Counsel and Corporate Secretary |

Exhibit 99.1

|

PRESS

RELEASE |

| |

|

|

|

|

| |

CONTACTS: |

Al Petrie |

|

Sameer Parasnis |

| FOR

IMMEDIATE RELEASE |

|

Investor Relations Coordinator |

|

Executive VP and CFO |

| |

investorrelations@wtoffshore.com |

|

sparasnis@wtoffshore.com |

| |

|

713-297-8024 |

|

713-513-8654 |

| |

|

|

|

|

W&T Offshore Announces Accretive Acquisition

of Producing Properties in the Gulf of Mexico

HOUSTON, September 21, 2023 –

W&T Offshore, Inc. (NYSE: WTI) (the “Company” or “W&T”) today announced that it has completed the

acquisition of working interests in eight shallow water oil and gas producing assets (the “Assets”) in the central and eastern

shelf region of the Gulf of Mexico (“GOM”) from an undisclosed private seller. The acquisition has a closing date of September 20,

2023, and an effective date of June 1, 2023. The Assets were acquired for a gross consideration of $32 million, subject to normal

and customary post-effective date purchase price adjustments. W&T used its cash on the balance sheet to pay the net purchase price.

Key highlights of the transaction are as follows:

| · | Provides additional producing properties located

within W&T’s existing area of operations in water depths ranging from 25 to 265 feet; |

| · | High average working interest of around 72%; |

| · | Includes estimated production as of September 12,

2023, of approximately 2,400 barrels of oil equivalent per day (42% oil) – around two thirds of the production is operated; |

| · | Adds proved reserves of 3.2 million barrels of

oil equivalent (49% oil) – 100% of the reserves are proved developed; and |

| · | Accretive gross purchase price multiple of approximately

1.0x last twelve months cash flows as of effective date and production multiple of approximately $13,500 per barrel of oil equivalent

per day (based on production as of September 12, 2023). |

|

|

Tracy W. Krohn, Chairman, President and CEO, commented,

“All of the producing properties included in the acquisition announced today meet the time-tested investment criteria we have used

for our prior successful acquisitions. These Assets have strong production rates, are generating positive free cash flow, and have a solid

base of proved developed reserves and identified upside potential with strong 2P reserves. We also see the opportunity to reduce operating

costs to further increase free cash flow. We continue to utilize our strong cash position and expertise in acquiring complementary GOM

assets to enhance the scale of W&T. Acquisitions have been a key component of how we have grown reserves and production at W&T.

We believe that these properties are another great example of an acquisition that adds value for our stockholders. We remain well positioned

to continue to enhance our portfolio through additional attractive opportunities that present themselves.”

In summary, the Assets include 30,646 gross acres

(22,079 net acres) and are currently producing approximately 2,400 barrels of oil equivalent per day, of which 42% is oil. Estimated proved

reserves as of June 1, 2023, for the eight properties totaled 3.2 million barrels of oil equivalent (49% oil) of which 100% are proved

developed. In addition, the 2P reserves for the acquired properties are estimated to be 5.1 million barrels of oil equivalent (48% oil).

All reserve numbers are based on an internally prepared reserve report utilizing September 12, 2023, NYMEX strip pricing.

About W&T Offshore

W&T Offshore, Inc. is an independent

oil and natural gas producer with operations offshore in the Gulf of Mexico and has grown through acquisitions, exploration and development.

As of June 30, 2023, the Company had working interests in 46 fields in federal and state waters (which include 38 fields in federal

waters and eight in state waters). The Company has under lease approximately 578,000 gross acres (419,000 net acres) spanning across the

outer continental shelf off the coasts of Louisiana, Texas, Mississippi and Alabama, with approximately 8,000 gross acres in Alabama State

waters, 416,500 gross acres on the conventional shelf and approximately 153,500 gross acres in the deepwater. A majority of the Company’s

daily production is derived from wells it operates. For more information on W&T, please visit the Company’s website at www.wtoffshore.com.

Forward-Looking and Cautionary Statements

This press release contains forward-looking statements

within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act

of 1934, as amended. These forward-looking statements, including but not limited to, any statements regarding the benefits of the acquisition,

the integration of the Assets, including expected G&A costs, the production rates, the cash flow generated by the Assets, and other

similar statements herein reflect our current views with respect to future events, based on what we believe are reasonable estimates and

assumptions. No assurance can be given, however, that these events will occur or that our expectations will be correct. These statements

are subject to risks and uncertainties that could cause actual results to differ materially including, among other things, risk pertaining

to the integration of the Assets, market conditions, commodity price volatility, uncertainties inherent in oil and gas production operations

and estimating reserves, uncertainties of the timing and impact of bringing new wells online and repairing and restoring infrastructure

due to hurricane damage, the ability to achieve leverage targets, unexpected future capital expenditures, competition, the success of

our risk management activities, governmental regulations, uncertainties and other factors described or referenced in W&T’s Annual

Report on Form 10-K for the year ended December 31, 2022 and subsequent Quarterly Reports on Form 10-Q found at www.sec.gov

or on our website at www.wtoffshore.com under the Investor Relations section. Our forward-looking statements in this press release are

based upon assumptions made, and information known, by the Company as of the date of this release; it should not be assumed that the Company

will undertake to revise or update any such forward-looking statements as such assumptions and information changes, except as required

under applicable law. Investors are urged to consider closely the disclosures and risk factors in these reports.

v3.23.3

Cover

|

Sep. 21, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Sep. 21, 2023

|

| Entity File Number |

1-32414

|

| Entity Registrant Name |

W&T Offshore, Inc.

|

| Entity Central Index Key |

0001288403

|

| Entity Tax Identification Number |

72-1121985

|

| Entity Incorporation, State or Country Code |

TX

|

| Entity Address, Address Line One |

5718 Westheimer Road

|

| Entity Address, Address Line Two |

Suite 700

|

| Entity Address, City or Town |

Houston

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

77057

|

| City Area Code |

713

|

| Local Phone Number |

626.8525

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.00001

|

| Trading Symbol |

WTI

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

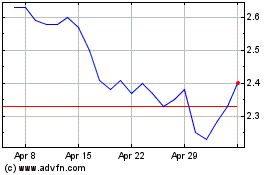

W and T Offshore (NYSE:WTI)

Historical Stock Chart

From Apr 2024 to May 2024

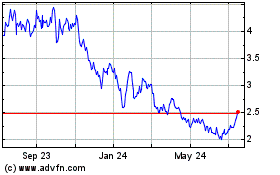

W and T Offshore (NYSE:WTI)

Historical Stock Chart

From May 2023 to May 2024