false

0001163302

UNITED STATES STEEL CORP

0001163302

2024-05-21

2024-05-21

0001163302

exch:XNYS

2024-05-21

2024-05-21

0001163302

exch:XCHI

2024-05-21

2024-05-21

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of

report (Date of earliest event reported):

May 21, 2024

United States Steel Corporation

(Exact Name of Registrant as Specified in Charter)

| Delaware |

|

1-16811 |

|

25-1897152 |

|

(State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

600 Grant Street,

Pittsburgh, PA 15219-2800

(Address of Principal Executive Offices,

and Zip Code)

(412) 433-1121

Registrant’s Telephone Number,

Including Area Code

(Former Name or Former Address, if Changed

Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

| |

¨ |

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

¨ |

Pre-commencement communication pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

¨ |

Pre-commencement communication pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name

of each exchange on which registered |

| Common Stock |

X |

New York Stock Exchange

|

| Common Stock |

X |

Chicago Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 7.01. |

Regulation FD Disclosure |

On May 21, 2024, United States Steel Corporation issued a press

release titled “United States Steel’s Board of Directors ‘Corrects the Record’ on Transaction with Nippon Steel.”

A copy of that press release is attached hereto as Exhibit 99.1.

In accordance with General Instruction B.2 of Form 8-K, the information

contained in Item 7.01 and the press release attached herewith are being furnished and shall not be deemed “filed” for purposes

of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities

of that section, nor shall such information and exhibits be incorporated by reference into any filing under the Securities Act of 1933,

as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

| Item 9.01. |

Financial Statements and Exhibits |

(d) Exhibits:

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

UNITED STATES STEEL CORPORATION

| By |

/s/ Manpreet S. Grewal |

|

| |

Manpreet

S. Grewal |

|

| |

Vice

President, Controller & Chief Accounting Officer |

|

Dated: May 21, 2024

Exhibit 99.1

|

U. S. Steel Media Relations

T - (412) 433-1300

E - media@uss.com |

NEWS RELEASE

|

For Immediate release

United

States Steel’s Board of Directors

“Corrects the Record” on Transaction with

Nippon Steel

The all-cash offer delivers significant value for investors and provides job security, growth

and

opportunity for employees, communities and other stakeholders.

PITTSBURGH

May 21, 2024 – The Board of Directors of U. S. Steel (NYSE: X) today published a letter in response to the “long-running

misinformation campaign” regarding the pending all-cash transaction with Nippon Steel Corporation (NSC).

Citing the imperative

to “correct the record,” the letter outlines multiple benefits of NSC’s investment in U. S. Steel. The full text of

the letter is below and also on https://www.bestdealforamericansteel.com:

Dear U. S. Steel Investors, Employees, Stakeholders

and Other Interested Parties,

It is not often that the full Board of Directors

releases a communication to stakeholders outside of significant breaking news, but unfortunately, we have found ourselves in the midst

of a long-running misinformation campaign targeting our company, our investors, our employees and our business partners. For that reason,

we must correct the record.

As has been disclosed and widely reported on,

following a robust and lengthy strategic alternatives review process, we approved an all-cash transaction with Nippon Steel Corporation

(NSC). The transaction delivers significant value for our investors, as was validated by their overwhelming approval on April 12.

It also importantly provides job security, growth and opportunity for our employees, our communities and other stakeholders. It’s

a clear win-win-win.

| ©2024 U. S. Steel. All

Rights Reserved |

www.ussteel.com |

United States Steel Corporation |

NEWS RELEASE

The investment by NSC has been under

attack since day one by one of our competitors and unsuccessful bidder – Cleveland-Cliffs – who have been sowing

misinformation to our stakeholders in a relentless and unbridled effort to derail the transaction. While Cleveland-Cliffs is pushing

false rumors to influence the market into believing we are working to unwind the transaction, nothing could be further from the

truth. Both NSC and U. S. Steel remain as fully committed as ever to completing the transaction that will protect and grow U. S.

Steel for generations to come, bolster competition and innovation in the American steel industry for the benefit of American

consumers and enhance U.S. national security.

Cleveland-Cliffs participated in our strategic

review process as a bidder and potential partner. Throughout the process, we – the Board, our management team and advisors –

engaged respectfully and fairly with Cleveland-Cliffs. Their offers and the corresponding risks and benefits were comprehensively assessed

and considered. In the end, the NSC transaction was superior and offered the most value. The Board found that the significant antitrust

approval risk and associated valuation implications from a deal with Cleveland-Cliffs, among other risks, made their cash and stock proposal

inferior to the higher, all-cash offer presented by NSC. Those antitrust and divestiture risks have subsequently been confirmed by multiple,

independent sources1.

As a reminder, the NSC investment in U. S. Steel

has the following benefits, which are verifiable and have been endorsed by third parties:

| o | Pro-Competitive: By transacting with a partner who has a limited U.S. footprint, the transaction ensures that the

American steel industry will remain competitive for both our customers and employees, in addition to the unions who negotiate to advance

the interests of their members.2+3 |

| o | Pro-National Security:

This transaction will provide investment into the United States from one of our closest allies,

enhancing our industrial base and supply chain resiliency and creating a stronger steel industry

in the United States to combat the challenges from our common competitors in China and the

deleterious impact from their excess capacity.4 |

1 https://www.wsj.com/business/inside-the-steel-deal-that-has-biden-on-edge-b8dcc44c

2 https://www.autosinnovate.org/posts/letters/Auto%20Innovators%20Letter%20to%20Congress%20on%20Cleveland-Cliffs%20U.S.%20Steel%20October%202023.pdf

3 https://www.autosinnovate.org/association-update/Alliance%20for%20Automotive%20Innovation%20Letter%20to%20NEC%20on%20U.S.%20Steel%20-%20March%202024.pdf

4 https://www.newsweek.com/believe-it-not-sale-us-steel-good-american-industry-opinion-1856263

| ©2024 U. S. Steel. All

Rights Reserved |

www.ussteel.com |

United States Steel Corporation |

NEWS RELEASE

| o | Pro-Employee: The transaction is a positive for employees, as NSC has committed to continuity for our employees with

the assumption of the labor agreements, no change in compensation and benefits for unionized employees and retirees, no change in operating

footprint, financial backing and guarantees that do not exist today supporting all USW agreements for active employees and retirees, and

providing new investment from a larger reserve of capital. |

| o | Pro-Community: NSC has committed to maintain and expand the U.S. headquarters in Pennsylvania, and to contribute

new capital and technological advances to U. S. Steel to support jobs and increase operating efficiency at our integrated steel facilities

across the United States. These commitments will ensure that U. S. Steel will continue as a contributor to the overall livelihood of the

communities where we all work and live. |

We are pleased to have received the overwhelming

support of our stockholders, as well as approval by the vast majority of the needed foreign regulators. However, we also know we have

more to do to get to the finish line and see these benefits come to fruition. That’s why our management team continues to engage

with our employees and community leaders. We are committed to an ongoing and open dialogue to ensure our stakeholders are informed so

they can make their own decisions and not fall prey to misinformation.

Following the closing of the transaction with

NSC, the introduction of NSC’s advanced technologies will enhance the competitiveness of the NAFR business and improve our blast

furnace technology. In the meantime, our team will continue to do what it does best – operate safely and with integrity. Our strategic

projects continue to progress, most recently with the direct reduced iron-grade pellet line at our Minnesota Ore Operations at Keetac

that provides for sustainable steel production, our galvanizing line at Big River Steel in Arkansas which will serve the growing construction

markets, and Big River 2, our state-of-the-art mini mill nearing completion later this year.

For all the reasons noted above, this is not

only the best deal for U. S. Steel and its stockholders, but also for our employees, the communities in which we operate, our customers,

U.S. national security and the American economy overall. We look forward to closing in the second half of this year and moving forward

together with NSC as the “Best Steelmaker with World-Leading Capabilities.”

Thank you for your continued interest in U.

S. Steel.

The United States Steel Corporation Board of

Directors

| ©2024 U. S. Steel. All

Rights Reserved |

www.ussteel.com |

United States Steel Corporation |

NEWS RELEASE

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This press release contains information regarding the Company and NSC

that may constitute “forward-looking statements,” as that term is defined under the Private Securities Litigation Reform Act

of 1995 and other securities laws, that are subject to risks and uncertainties. We intend the forward-looking statements to be covered

by the safe harbor provisions for forward-looking statements in those sections. Generally, we have identified such forward-looking statements

by using the words “believe,” “expect,” “intend,” “estimate,” “anticipate,”

“project,” “target,” “forecast,” “aim,” “should,” “plan,” “goal,”

“future,” “will,” “may” and similar expressions or by using future dates in connection with any discussion

of, among other things, statements expressing general views about future operating or financial results, operating or financial performance,

trends, events or developments that we expect or anticipate will occur in the future, anticipated cost savings, potential capital and

operational cash improvements and changes in the global economic environment, the construction or operation of new or existing facilities

or capabilities, statements regarding our greenhouse gas emissions reduction goals, as well as statements regarding the proposed transaction,

including the timing of the completion of the transaction. However, the absence of these words or similar expressions does not mean that

a statement is not forward-looking. Forward-looking statements include all statements that are not historical facts, but instead represent

only the Company’s beliefs regarding future goals, plans and expectations about our prospects for the future and other events, many

of which, by their nature, are inherently uncertain and outside of the Company’s or NSC’s control. It is possible that the

Company’s or NSC’s actual results and financial condition may differ, possibly materially, from the anticipated results and

financial condition indicated in these forward-looking statements. Management of the Company or NSC, as applicable, believes that these

forward-looking statements are reasonable as of the time made. However, caution should be taken not to place undue reliance on any such

forward-looking statements because such statements speak only as of the date when made. In addition, forward looking statements are subject

to certain risks and uncertainties that could cause actual results to differ materially from the Company’s or NSC’s historical

experience and our present expectations or projections. Risks and uncertainties include without limitation: the ability of the parties

to consummate the proposed transaction on a timely basis or at all; the timing, receipt and terms and conditions of any required governmental

and regulatory approvals of the proposed transaction; the occurrence of any event, change or other circumstances that could give rise

to the termination of the definitive agreement and plan of merger relating to the proposed transaction (the “Merger Agreement”);

the risk that the parties to the Merger Agreement may not be able to satisfy the conditions to the proposed transaction in a timely manner

or at all; risks related to disruption of management time from ongoing business operations due to the proposed transaction; certain restrictions

during the pendency of the proposed transaction that may impact the Company’s ability to pursue certain business opportunities or

strategic transactions; the risk that any announcements relating to the proposed transaction could have adverse effects on the market

price of the Company’s common stock or NSC’s common stock or American Depositary Receipts; the risk of any unexpected costs

or expenses resulting from the proposed transaction; the risk of any litigation relating to the proposed transaction; the risk that the

proposed transaction and its announcement could have an adverse effect on the ability of the Company or NSC to retain customers and retain

and hire key personnel and maintain relationships with customers, suppliers, employees, stockholders and other business relationships

and on its operating results and business generally; and the risk the pending proposed transaction could distract management of the Company.

The Company directs readers to its Quarterly Report on Form 10-Q for the quarter ended September 30, 2023 and Form 10-K

for the year ended December 31, 2023, and the other documents it files with the SEC for other risks associated with the Company’s

future performance. These documents contain and identify important factors that could cause actual results to differ materially from those

contained in the forward-looking statements.

###

2024-020

About U. S. Steel

Founded in 1901, United States Steel Corporation

is a leading steel producer. With an unwavering focus on safety, the Company’s customer-centric Best for All® strategy

is advancing a more secure, sustainable future for U. S. Steel and its stakeholders. With a renewed emphasis on innovation, U. S. Steel

serves the automotive, construction, appliance, energy, containers, and packaging industries with high value-added steel products such

as U. S. Steel’s proprietary XG3® advanced high-strength steel. The Company also maintains competitively advantaged

iron ore production and has an annual raw steelmaking capability of 22.4 million net tons. U. S. Steel is headquartered in Pittsburgh,

Pennsylvania, with world-class operations across the United States and in Central Europe. For more information, please visit www.ussteel.com.

| ©2024 U. S. Steel. All

Rights Reserved |

www.ussteel.com |

United States Steel Corporation |

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

dei_EntityListingsExchangeAxis=exch_XNYS |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

dei_EntityListingsExchangeAxis=exch_XCHI |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

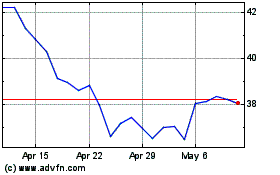

US Steel (NYSE:X)

Historical Stock Chart

From Nov 2024 to Dec 2024

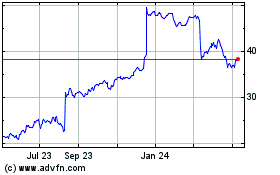

US Steel (NYSE:X)

Historical Stock Chart

From Dec 2023 to Dec 2024