0000798783false00007987832024-07-242024-07-24

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 24, 2024

UNIVERSAL HEALTH REALTY INCOME TRUST

(Exact name of Registrant as Specified in Its Charter)

|

|

|

Maryland |

1-9321 |

23-6858580 |

(State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

|

|

|

Universal Corporate Center 367 South Gulph Road King of Prussia, Pennsylvania |

|

19406 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s Telephone Number, Including Area Code: (610) 265-0688

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Shares of beneficial interest, $0.01 par value |

|

UHT |

|

New York Stock Exchange |

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On July 24, 2024, the Trust made its second quarter, 2024 earnings release. A copy of the Trust’s press release is furnished as exhibit 99.1 to this Form 8-K and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

Exhibit Index

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

UNIVERSAL HEALTH REALTY INCOME TRUST |

|

|

|

|

Date: July 24, 2024 |

|

By: |

/s/ Charles F. Boyle |

|

|

Name: |

Charles F. Boyle |

|

|

Title: |

Senior Vice President and Chief Financial Officer |

Exhibit 99.1

|

|

|

|

|

UNIVERSAL HEALTH REALTY INCOME TRUST |

|

Universal Corporate Center |

|

|

|

|

367 S. Gulph Road |

|

|

|

|

P.O. Box 61558 |

|

|

|

|

King of Prussia, PA 19406 |

|

|

|

|

(610) 265-0688 |

|

FOR IMMEDIATE RELEASE |

CONTACT: |

|

Charles Boyle |

|

July 24, 2024 |

|

|

Chief Financial Officer |

|

|

|

|

(610) 768-3300 |

|

|

UNIVERSAL HEALTH REALTY INCOME TRUST

REPORTS 2024 SECOND QUARTER FINANCIAL RESULTS

Consolidated Results of Operations - Three-Month Periods Ended June 30, 2024 and 2023:

KING OF PRUSSIA, PA - Universal Health Realty Income Trust (NYSE:UHT) announced today that for the three-month period ended June 30, 2024, net income was $5.3 million, or $.38 per diluted share, as compared to $3.5 million, or $.25 per diluted share, during the second quarter of 2023.

The increase in our net income of $1.8 million, or $.13 per diluted share, during the second quarter of 2024, as compared to the comparable quarter of 2023, consisted of the following: (i) an increase of $1.5 million, or $.11 per diluted share, resulting from a reduction in the expenses related to our property located in Chicago, Illinois, including $862,000 from demolition expenses incurred during the second quarter of 2023, and $563,000 related to a property tax reduction recorded during the second quarter of 2024 which related primarily to prior periods; (ii) an increase of $706,000, or $.05 per diluted share, resulting from an aggregate net increase in the income generated at various properties, partially offset by; (iii) a decrease of $404,000, or $.03 per diluted share, resulting from an increase in interest expense due primarily to increases in our average borrowing rate as well as our average outstanding borrowings.

As calculated on the attached Schedule of Non-GAAP Supplemental Information (“Supplemental Schedule”), our funds from operations ("FFO") were $12.4 million, or $.90 per diluted share, during the second quarter of 2024, as compared to $10.6 million, or $.77 per diluted share during the second quarter of 2023. The increase of $1.8 million, or $.13 per diluted share, was due primarily to the above-mentioned increase in our net income during the second quarter of 2024, as compared to the second quarter of 2023.

Consolidated Results of Operations - Six-Month Periods Ended June 30, 2024 and 2023:

For the six-month period ended June 30, 2024, net income was $10.6 million, or $.76 per diluted share, as compared to $7.9 million, or $0.57 per diluted share during the first six months of 2023.

The increase in our net income of $2.6 million, or $.19 per diluted share, during the first six months of 2024, as compared to the comparable period of 2023, consisted of the following: (i) an increase of $2.1 million, or $.15 per diluted share, resulting from an aggregate net increase in the income generated at various properties; (ii) an increase of $1.8 million, or $.13 per diluted share, resulting from a reduction in the expenses related to our property located in Chicago, Illinois, including $1.1 million from demolition expenses incurred during the first six months of 2023, and $563,000 related to a property tax reduction recorded during the first six months of 2024 which related primarily to prior periods, partially offset by; (iii) a decrease of $1.3 million, or $.09 per diluted share, resulting from an increase in interest

expense due primarily to increases in our average borrowing rate as well as our average outstanding borrowings.

As calculated on the attached Supplemental Schedule, our FFO were $24.8 million, or $1.79 per diluted share, during the first six months of 2024, as compared to $22.0 million, or $1.59 per diluted share during the comparable period of 2023. The increase of $2.8 million, or $.20 per diluted share, was due primarily to the above-mentioned increase in our net income during the first six months of 2024, as compared to the first six months of 2023, as well as an increase in depreciation and amortization expense.

Dividend Information:

The second quarter dividend of $.73 per share, or $10.1 million in the aggregate, was declared on June 5, 2024 and paid on June 28, 2024.

Capital Resources Information:

At June 30, 2024, we had $342.9 million of borrowings outstanding pursuant to the terms of our $375 million revolving credit agreement and $32.1 million of available borrowing capacity as of that date, net of outstanding borrowings.

Sierra Medical Plaza I:

In March, 2023, construction was substantially completed on the Sierra Medical Plaza I, an 86,000 square foot MOB located in Reno, Nevada. This MOB is located on the campus of the Northern Nevada Sierra Medical Center, a hospital that is owned and operated by a wholly-owned subsidiary of UHS, which was completed and opened during April, 2022. The master flex lease agreement in connection with this building, which commenced in March, 2023 and has a ten-year term scheduled to expire on March 31, 2033, covers approximately 68% of the rentable square feet of the MOB at an initial minimum rent of $1.3 million annually, plus a pro-rata share of the common area maintenance expenses. This master flex lease agreement is subject to reduction based upon the execution of third-party leases. The aggregate cost of the MOB is estimated to be approximately $35 million, approximately $30 million of which was incurred as of June 30, 2024.

Vacant Land/Specialty Facility:

Demolition of the former specialty hospital located in Chicago, Illinois, was completed during 2023. The aggregate demolition expenses amounted to approximately $1.5 million ($1.1 million of which were incurred during the first and second quarters of 2023 and $332,000 of which were incurred during the fourth quarter of 2022). In addition, in December, 2023, we sold the vacant specialty facility located in Corpus Christi, Texas.

We continue to market the vacant properties located in Chicago, Illinois and Evansville, Indiana. Future operating expenses related to these properties, will be incurred by us during the time they remain owned and unleased.

General Information, Forward-Looking Statements and Risk Factors and Non-GAAP Financial Measures:

Universal Health Realty Income Trust, a real estate investment trust, invests in healthcare and human-service related facilities including acute care hospitals, behavioral health care hospitals, specialty facilities, medical/office buildings, free-standing emergency departments and childcare centers. We have investments or commitments in seventy-six properties located in twenty-one states.

This press release contains forward-looking statements based on current management expectations. Numerous factors, including those disclosed herein, as well as the operations and financial results of each of our tenants, those related to healthcare industry trends and those detailed in our filings with the

Securities and Exchange Commission (as set forth in Item 1A-Risk Factors and in Item 7- Forward-Looking Statements in our Form 10-K for the year ended December 31, 2023 and in Item 7 - Forward-Looking Statements and Certain Risk Factors in our Form 10-Q for the quarter ended March 31, 2024), may cause the results to differ materially from those anticipated in the forward-looking statements. Readers should not place undue reliance on such forward-looking statements which reflect management’s view only as of the date hereof. We undertake no obligation to revise or update any forward-looking statements, or to make any other forward-looking statements, whether as a result of new information, future events or otherwise.

Many of the factors that could affect our future results are beyond our control or ability to predict. Future operations and financial results of our tenants, and in turn ours, could be materially impacted by various developments including, but not limited to, decreases in staffing availability and related increases to wage expense experienced by our tenants resulting from the nationwide shortage of nurses and other clinical staff and support personnel, the impact of government and administrative regulation of the health care industry; declining patient volumes and unfavorable changes in payer mix caused by deteriorating macroeconomic conditions (including increases in uninsured and underinsured patients as the result of business closings and layoffs); potential disruptions related to supplies required for our tenants’ employees and patients; and potential increases to other expenditures.

In addition, the increase in interest rates has substantially increased our borrowings costs and reduced our ability to access the capital markets on favorable terms. Additional increases in interest rates could have a significant unfavorable impact on our future results of operations and the resulting effect on the capital markets could adversely affect our ability to carry out our strategy.

We believe that, if and when applicable, adjusted net income and adjusted net income per diluted share (as reflected on the Supplemental Schedule), which are non-GAAP financial measures (“GAAP” is Generally Accepted Accounting Principles in the United States of America), are helpful to our investors as measures of our operating performance. In addition, we believe that, when applicable, comparing and discussing our financial results based on these measures, as calculated, is helpful to our investors since it neutralizes the effect in each year of material items that are non-recurring or non-operational in nature including items such as, but not limited to, gains on transactions.

Funds from operations (“FFO”) is a widely recognized measure of performance for Real Estate Investment Trusts (“REITs”). We believe that FFO and FFO per diluted share, which are non-GAAP financial measures, are helpful to our investors as measures of our operating performance. We compute FFO, as reflected on the attached Supplemental Schedules, in accordance with standards established by the National Association of Real Estate Investment Trusts (“NAREIT”), which may not be comparable to FFO reported by other REITs that do not compute FFO in accordance with the NAREIT definition, or that interpret the NAREIT definition differently than we interpret the definition. FFO adjusts for the effects of certain items, such as gains or losses on transactions that occurred during the periods presented. FFO does not represent cash generated from operating activities in accordance with GAAP and should not be considered to be an alternative to net income determined in accordance with GAAP. In addition, FFO should not be used as: (i) an indication of our financial performance determined in accordance with GAAP; (ii) an alternative to cash flow from operating activities determined in accordance with GAAP; (iii) a measure of our liquidity, or; (iv) an indicator of funds available for our cash needs, including our ability to make cash distributions to shareholders. A reconciliation of our reported net income to FFO is reflected on the Supplemental Schedules included below.

To obtain a complete understanding of our financial performance these measures should be examined in connection with net income, determined in accordance with GAAP, as presented in the condensed consolidated financial statements and notes thereto in this report or in our other filings with the Securities and Exchange Commission including our Report on Form 10-K for the year ended

December 31, 2023 and our Report on Form 10-Q for the quarter ended March 31, 2024. Since the items included or excluded from these measures are significant components in understanding and assessing financial performance under GAAP, these measures should not be considered to be alternatives to net income as a measure of our operating performance or profitability. Since these measures, as presented, are not determined in accordance with GAAP and are thus susceptible to varying calculations, they may not be comparable to other similarly titled measures of other companies. Investors are encouraged to use GAAP measures when evaluating our financial performance.

(more)

Universal Health Realty Income Trust

Consolidated Statements of Income

For the Three and Six Months Ended June 30, 2024 and 2023

(amounts in thousands, except share information)

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Six Months Ended |

|

|

|

June 30, |

|

|

June 30, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

Lease revenue - UHS facilities (a.) |

|

$ |

8,454 |

|

|

$ |

8,236 |

|

|

$ |

17,118 |

|

|

$ |

16,023 |

|

Lease revenue - Non-related parties |

|

|

14,359 |

|

|

|

13,668 |

|

|

|

28,846 |

|

|

|

27,029 |

|

Other revenue - UHS facilities |

|

|

220 |

|

|

|

245 |

|

|

|

440 |

|

|

|

476 |

|

Other revenue - Non-related parties |

|

|

342 |

|

|

|

292 |

|

|

|

751 |

|

|

|

773 |

|

Interest income on financing leases - UHS facilities |

|

|

1,359 |

|

|

|

1,365 |

|

|

|

2,720 |

|

|

|

2,731 |

|

|

|

|

24,734 |

|

|

|

23,806 |

|

|

|

49,875 |

|

|

|

47,032 |

|

Expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

6,806 |

|

|

|

6,849 |

|

|

|

13,615 |

|

|

|

13,467 |

|

Advisory fees to UHS |

|

|

1,369 |

|

|

|

1,323 |

|

|

|

2,707 |

|

|

|

2,625 |

|

Other operating expenses |

|

|

6,975 |

|

|

|

8,250 |

|

|

|

14,506 |

|

|

|

15,771 |

|

|

|

|

15,150 |

|

|

|

16,422 |

|

|

|

30,828 |

|

|

|

31,863 |

|

Income before equity in income of unconsolidated limited liability companies ("LLCs") and interest expense |

|

|

9,584 |

|

|

|

7,384 |

|

|

|

19,047 |

|

|

|

15,169 |

|

Equity in income of unconsolidated LLCs |

|

|

272 |

|

|

|

268 |

|

|

|

656 |

|

|

|

639 |

|

Interest expense, net |

|

|

(4,580 |

) |

|

|

(4,176 |

) |

|

|

(9,127 |

) |

|

|

(7,873 |

) |

Net income |

|

$ |

5,276 |

|

|

$ |

3,476 |

|

|

$ |

10,576 |

|

|

$ |

7,935 |

|

Basic earnings per share |

|

$ |

0.38 |

|

|

$ |

0.25 |

|

|

$ |

0.77 |

|

|

$ |

0.58 |

|

Diluted earnings per share |

|

$ |

0.38 |

|

|

$ |

0.25 |

|

|

$ |

0.76 |

|

|

$ |

0.57 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of shares outstanding - Basic |

|

|

13,798 |

|

|

|

13,784 |

|

|

|

13,795 |

|

|

|

13,781 |

|

Weighted average number of shares outstanding - Diluted |

|

|

13,832 |

|

|

|

13,809 |

|

|

|

13,828 |

|

|

|

13,806 |

|

|

(a.) Includes bonus rental on McAllen Medical Center, a UHS acute care hospital facility, of $758 and $730 for the three-month periods ended June 30, 2024 and 2023, respectively, and $1,541 and $1,495 for the six-month periods ended June 30, 2024 and 2023, respectively. |

Universal Health Realty Income Trust

Schedule of Non-GAAP Supplemental Information (“Supplemental Schedule”)

For the Three Months Ended June 30, 2024 and 2023

(amounts in thousands, except share information)

(unaudited)

Calculation of Adjusted Net Income

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Three Months Ended |

|

|

|

June 30, 2024 |

|

|

June 30, 2023 |

|

|

|

Amount |

|

|

Per

Diluted Share |

|

|

Amount |

|

|

Per

Diluted Share |

|

Net income |

|

$ |

5,276 |

|

|

$ |

0.38 |

|

|

$ |

3,476 |

|

|

$ |

0.25 |

|

Adjustments |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

Subtotal adjustments to net income |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

Adjusted net income |

|

$ |

5,276 |

|

|

$ |

0.38 |

|

|

$ |

3,476 |

|

|

$ |

0.25 |

|

Calculation of Funds From Operations (“FFO”)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Three Months Ended |

|

|

|

June 30, 2024 |

|

|

June 30, 2023 |

|

|

|

Amount |

|

|

Per

Diluted Share |

|

|

Amount |

|

|

Per

Diluted Share |

|

Net income |

|

$ |

5,276 |

|

|

$ |

0.38 |

|

|

$ |

3,476 |

|

|

$ |

0.25 |

|

Plus: Depreciation and amortization expense: |

|

|

|

|

|

|

|

|

|

|

|

|

Consolidated investments |

|

|

6,806 |

|

|

|

0.50 |

|

|

|

6,849 |

|

|

|

0.50 |

|

Unconsolidated affiliates |

|

|

303 |

|

|

|

0.02 |

|

|

|

298 |

|

|

|

0.02 |

|

FFO |

|

$ |

12,385 |

|

|

$ |

0.90 |

|

|

$ |

10,623 |

|

|

$ |

0.77 |

|

Dividend paid per share |

|

|

|

|

$ |

0.730 |

|

|

|

|

|

$ |

0.720 |

|

Universal Health Realty Income Trust

Schedule of Non-GAAP Supplemental Information (“Supplemental Schedule”)

For the Six Months Ended June 30, 2024 and 2023

(amounts in thousands, except share information)

(unaudited)

Calculation of Adjusted Net Income

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Six Months Ended |

|

|

Six Months Ended |

|

|

|

June 30, 2024 |

|

|

June 30, 2023 |

|

|

|

Amount |

|

|

Per

Diluted Share |

|

|

Amount |

|

|

Per

Diluted Share |

|

Net income |

|

$ |

10,576 |

|

|

$ |

0.76 |

|

|

$ |

7,935 |

|

|

$ |

0.57 |

|

Adjustments |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

Subtotal adjustments to net income |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

Adjusted net income |

|

$ |

10,576 |

|

|

$ |

0.76 |

|

|

$ |

7,935 |

|

|

$ |

0.57 |

|

Calculation of Funds From Operations (“FFO”)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Six Months Ended |

|

|

Six Months Ended |

|

|

|

June 30, 2024 |

|

|

June 30, 2023 |

|

|

|

Amount |

|

|

Per

Diluted Share |

|

|

Amount |

|

|

Per

Diluted Share |

|

Net income |

|

$ |

10,576 |

|

|

$ |

0.76 |

|

|

$ |

7,935 |

|

|

$ |

0.57 |

|

Plus: Depreciation and amortization expense: |

|

|

|

|

|

|

|

|

|

|

|

|

Consolidated investments |

|

|

13,615 |

|

|

|

0.99 |

|

|

|

13,467 |

|

|

|

0.98 |

|

Unconsolidated affiliates |

|

|

607 |

|

|

|

0.04 |

|

|

|

591 |

|

|

|

0.04 |

|

FFO |

|

$ |

24,798 |

|

|

$ |

1.79 |

|

|

$ |

21,993 |

|

|

$ |

1.59 |

|

Dividend paid per share |

|

|

|

|

$ |

1.455 |

|

|

|

|

|

$ |

1.435 |

|

Universal Health Realty Income Trust

Consolidated Balance Sheets

(amounts in thousands, except share information)

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

June 30, |

|

|

December 31, |

|

|

|

2024 |

|

|

2023 |

|

Assets: |

|

|

|

|

|

|

Real Estate Investments: |

|

|

|

|

|

|

Buildings and improvements and construction in progress |

|

$ |

651,638 |

|

|

$ |

649,374 |

|

Accumulated depreciation |

|

|

(274,622 |

) |

|

|

(262,449 |

) |

|

|

|

377,016 |

|

|

|

386,925 |

|

Land |

|

|

56,870 |

|

|

|

56,870 |

|

Net Real Estate Investments |

|

|

433,886 |

|

|

|

443,795 |

|

Financing receivable from UHS |

|

|

83,043 |

|

|

|

83,279 |

|

Net Real Estate Investments and Financing receivable |

|

|

516,929 |

|

|

|

527,074 |

|

Investments in limited liability companies ("LLCs") |

|

|

14,328 |

|

|

|

9,102 |

|

Other Assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

|

5,577 |

|

|

|

8,212 |

|

Lease and other receivables from UHS |

|

|

6,816 |

|

|

|

6,180 |

|

Lease receivable - other |

|

|

7,905 |

|

|

|

8,166 |

|

Intangible assets (net of accumulated amortization of $11.4 million and

$12.5 million, respectively) |

|

|

8,193 |

|

|

|

9,110 |

|

Right-of-use land assets, net |

|

|

10,932 |

|

|

|

10,946 |

|

Deferred charges, notes receivable and other assets, net |

|

|

15,871 |

|

|

|

17,579 |

|

Total Assets |

|

$ |

586,551 |

|

|

$ |

596,369 |

|

Liabilities: |

|

|

|

|

|

|

Line of credit borrowings |

|

$ |

342,900 |

|

|

$ |

326,600 |

|

Mortgage notes payable, non-recourse to us, net |

|

|

19,970 |

|

|

|

32,863 |

|

Accrued interest |

|

|

1,024 |

|

|

|

490 |

|

Accrued expenses and other liabilities |

|

|

10,145 |

|

|

|

13,500 |

|

Ground lease liabilities, net |

|

|

10,932 |

|

|

|

10,946 |

|

Tenant reserves, deposits and deferred and prepaid rents |

|

|

10,879 |

|

|

|

11,036 |

|

Total Liabilities |

|

|

395,850 |

|

|

|

395,435 |

|

Equity: |

|

|

|

|

|

|

Preferred shares of beneficial interest,

$.01 par value; 5,000,000 shares authorized;

none issued and outstanding |

|

|

- |

|

|

|

- |

|

Common shares, $.01 par value;

95,000,000 shares authorized; issued and outstanding: 2024 - 13,848,950;

2023 - 13,823,899 |

|

|

138 |

|

|

|

138 |

|

Capital in excess of par value |

|

|

270,592 |

|

|

|

270,398 |

|

Cumulative net income |

|

|

836,637 |

|

|

|

826,061 |

|

Cumulative dividends |

|

|

(923,107 |

) |

|

|

(902,975 |

) |

Accumulated other comprehensive income |

|

|

6,441 |

|

|

|

7,312 |

|

Total Equity |

|

|

190,701 |

|

|

|

200,934 |

|

Total Liabilities and Equity |

|

$ |

586,551 |

|

|

$ |

596,369 |

|

v3.24.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

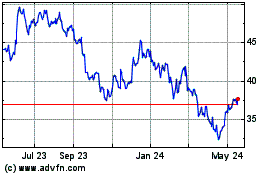

Universal Health Realty ... (NYSE:UHT)

Historical Stock Chart

From Nov 2024 to Dec 2024

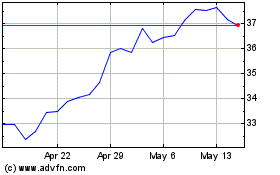

Universal Health Realty ... (NYSE:UHT)

Historical Stock Chart

From Dec 2023 to Dec 2024