Uber Co-Founder Travis Kalanick Quits Board After Selling Entire Stake

December 24 2019 - 1:40PM

Dow Jones News

By Eliot Brown

Travis Kalanick is parting ways with Uber Technologies Inc., the

company he co-founded and turned into an icon of startup ambition

before his tumultuous ouster as CEO in 2017.

Uber announced Tuesday that Mr. Kalanick would leave the board

of directors at the end of the year. The decision comes as Mr.

Kalanick has sold out his entire position in Uber over the past two

months, according to his spokeswoman, netting over $2.7

billion.

Mr. Kalanick said in a statement that "it seems like the right

moment for me to focus on my current business and philanthropic

pursuits."

The exit punctuates a decade in which Silicon Valley investors

pumped startups with extraordinary sums of money and granted their

founders vast power and a mandate to grow at breakneck speeds.

Uber and Mr. Kalanick were the archetype of this model, as Mr.

Kalanick raised over $14 billion in equity and debt from outside

investors who bought into his expansive vision and energetic

approach. At its peak, Uber was the most valuable startup in the

U.S., with a valuation of about $68 billion.

But Mr. Kalanick's reign as chief executive was marked by a

pileup of scandals, including the use of software meant to evade

regulators, and complaints about a chauvinistic workplace culture

at Uber. Such revelations were not only distasteful to many of his

investors, but led Uber's market share to fall and allowed its main

U.S. competitor Lyft Inc. to raise new money while it was on the

verge of running out of funds.

The scandals culminated in Mr. Kalanick's spectacular ouster by

his investors in 2017, but he remained one of its biggest

shareholders and an important presence on the board.

Uber has said it has discontinued the regulatory evasion

technique and it has sought to reshape its culture.

The tumult atop Uber shared similarities with that of WeWork,

which was the country's most valuable startup earlier this year.

After an aborted IPO in September, investors pushed out WeWork

founder and Chief Executive, Adam Neumann, amid concerns about the

company's swelling losses, conflicts of interest with Mr. Neumann

and his erratic management style.

In the announcement Tuesday, Uber CEO Dara Khosrowshahi said all

of Uber wishes Mr. Kalanick well.

"I'm enormously grateful for Travis' vision and tenacity," he

said.

Still, Mr. Kalanick's relationship with the current Uber

management team has been far from cheery. He felt snubbed when he

wasn't invited on stage with the team for the ceremonial bell

ringing to mark the start of trading at the New York Stock Exchange

on the day of Uber's initial public offering in May. And Mr.

Kalanick's recruitment of Uber staff to his new startup has caused

grumbling at the ride-hailing giant, people familiar with the

matter said.

The move by Mr. Kalanick to sell his shares was set in place

multiple months ago, said people familiar with the matter, and

called for him to sell shares daily until his holdings wound down

to zero.

The results are far less lucrative than he or others had hoped

earlier this year. Uber's stock has performed terribly since its

May IPO, down more than 30% from the $45 a share offering, even as

the company's performance has exceeded analyst forecasts. Shares

gained about 0.7% Tuesday.

Uber's market woes come as Wall Street investors have proven far

more skeptical of the heavy doses of red ink coming out of Silicon

Valley startups than investors and Uber predicted a few years ago,

when private investors poured billions into such companies. Uber

lost $1.2 billion in the third quarter alone, and has said it would

be 2021 before it reports positive earnings -- and then only when

excluding costs like interest, taxes and depreciation.

Uber's future has also been clouded by the rapid growth of

competitors like DoorDash in the food delivery space, which has

overtaken Uber's Eats operation and leads the U.S. market.

In its main ride-hailing business, governments around the globe

are gradually layering on new rules and fees, catching up for what

regulators view as years of lax oversight.

Despite efforts by the company to speed up a turn to

profitability, some early investors in the company have grown

weary.

"There's very little at the company to be excited about," said

Bradley Tusk, CEO of Tusk Holdings who got Uber shares when he

helped the company break into the New York City market early in its

history. He said he recently sold all his Uber stock.

Mr. Kalanick has turned his attention to a new business not

terribly far from the one he built this past decade. His startup

CloudKitchens builds commissary kitchens for restaurants that want

space to prepare food for delivery-only. Drivers from Uber Eats,

DoorDash and others shuttle the food to customers.

While he has been funding the business with some of his personal

wealth, he also raised $400 million from a Saudi Arabia

sovereign-wealth fund earlier this year, people familiar with the

matter have said.

--Micah Maidenberg contributed to this article.

Write to Eliot Brown at eliot.brown@wsj.com

(END) Dow Jones Newswires

December 24, 2019 13:25 ET (18:25 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

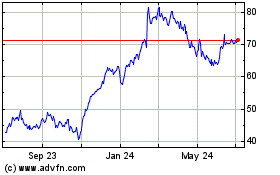

Uber Technologies (NYSE:UBER)

Historical Stock Chart

From Apr 2024 to May 2024

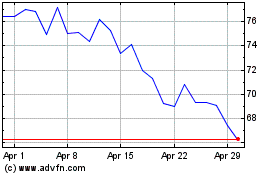

Uber Technologies (NYSE:UBER)

Historical Stock Chart

From May 2023 to May 2024