TXO Partners Declares a Third Quarter 2023 Distribution of $0.52 on Common Units; Files Quarterly Report on Form 10-Q

November 07 2023 - 4:05PM

Business Wire

TXO Partners, L.P. (NYSE: TXO) announced today that the Board of

Directors of its general partner declared a distribution of $0.52

per common unit for the quarter ended September 30, 2023. The

quarterly distribution will be paid on November 27, 2023, to

eligible unitholders of record as of the close of trading on

November 17, 2023.

“With the ongoing challenges in the world, we are proud to offer

a secure asset base and a confident business strategy for our

owners,” stated Bob R. Simpson, Chairman and CEO. “Given the

positive back-drop of commodity pricing, we foresee our current $2

per unit yearly distribution expectation moving higher in

2024.”

“Our financial focus is straightforward. We strive to generate

cash flow through efficient operations that provide substantial

distributions and propel value creation,” further commented,

President of Business Operations and CFO, Brent Clum. “Our team

added modestly to our operations during the quarter which gives

further support for out years.”

“Beginning in August, shut-in time at our plant in the Vacuum

Field affected production. We expect facility repairs and upgrades

to continue into the fourth quarter as we expand for our future,”

also stated Keith A. Hutton, President of Production and

Development. “Our legacy reservoirs, particularly the Vacuum Field,

are rich with reserves that our team is focused on developing over

the long term. This means investment in our facilities and recovery

techniques.”

Quarterly Report on Form 10-Q

TXO's financial statements and related footnotes will be

available in the Quarterly Report on Form 10-Q for the quarter

ended September 30, 2023, which TXO will file with the Securities

and Exchange Commission (SEC) today. The 10-Q will be available on

TXO's Investor Relations website at www.txopartners.com/investors

or on the SEC's website at www.sec.gov.

Non-U.S. Withholding Information

This press release is intended to be a qualified notice under

Treasury Regulations Section 1.1446-4(b). Brokers and nominees

should treat one hundred percent (100%) of TXO’s distribution to

foreign unitholders as being attributable to income that is

effectively connected with a United States trade or business.

Accordingly, TXO’s distributions to foreign unitholders are subject

to federal income tax withholding at the highest applicable

effective tax rate. For purposes of Treasury Regulations Section

1.1446(f)-4(c)(2)(iii), brokers and nominees should treat one

hundred percent (100%) of the distributions as being in excess of

cumulative net income for purposes of determining the amount to

withhold. Nominees, and not TXO, are treated as withholding agents

responsible for any necessary withholding on amounts received by

them on behalf of foreign unitholders.

About TXO Partners, L.P.

TXO Partners, L.P. is a master limited partnership focused on

the acquisition, development, optimization and exploitation of

conventional oil, natural gas, and natural gas liquid reserves in

North America. TXO’s current acreage positions are concentrated in

the Permian Basin of West Texas and New Mexico and the San Juan

Basin of New Mexico and Colorado.

Cautionary Statement Concerning Forward-Looking

Statements

Certain statements contained in this press release constitute

“forward-looking statements” within the meaning of the Private

Securities Litigation Reform Act of 1995. These forward-looking

statements include the words such as “may,” “assume,” “forecast,”

“could,” “should,” “will,” “plan,” “believe,” “anticipate,”

“intend,” “estimate,” “expect,” “project,” “budget” and similar

expressions, although not all forward-looking statements contain

such identifying words. These forward-looking statements include

our 2023 and 2024 distribution outlook, our ability to increase oil

production and reserves, our ability to execute our strategy, the

timing of completion of plant repairs and upgrades and the impacts

of future commodity price changes. These forward-looking statements

are based on management’s current belief, based on currently

available information, as to the outcome and timing of future

events at the time such statement was made, and it is possible that

the results described in this press release will not be achieved.

Our assumptions and future performance are subject to a wide range

of business risks, uncertainties and factors, including, without

limitation, the following: our ability to meet distribution

expectations and projections; the volatility of oil, natural gas

and NGL prices; our ability to safely and efficiently operate TXO’s

assets; uncertainties about our estimated oil, natural gas and NGL

reserves, including the impact of commodity price declines on the

economic producibility of such reserves, and in projecting future

rates of production; and the risks and other factors disclosed in

TXO’s filings with the SEC, including its Annual Report on Form

10-K, Quarterly Reports on Form 10-Q and Current Reports on Form

8-K.

Any forward-looking statement speaks only as of the date on

which it is made, and, except as required by law, TXO does not

undertake any obligation to update or revise any forward-looking

statement, whether as a result of new information, future events or

otherwise. New factors emerge from time to time, and it is not

possible for TXO to predict all such factors.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231107799329/en/

TXO Partners Brent W. Clum President, Business Operations &

CFO 817.334.7800 ir@txoenergy.com

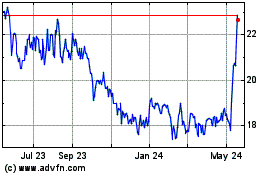

TXO Partners (NYSE:TXO)

Historical Stock Chart

From Nov 2024 to Dec 2024

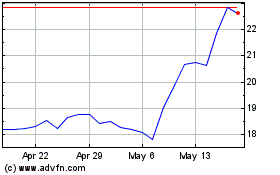

TXO Partners (NYSE:TXO)

Historical Stock Chart

From Dec 2023 to Dec 2024