TXO Partners Declares a Second Quarter 2023 Distribution of $.48 on Common Units; Files Quarterly Report on Form 10-Q

August 08 2023 - 4:19PM

Business Wire

TXO Partners, L.P. (NYSE: TXO) announced today that the Board of

Directors of its general partner declared TXO’s second quarter

distribution of $0.48 per common unit for quarter ended June 30,

2023. The quarterly distribution will be paid on August 25, 2023,

to eligible unitholders of record as of the close of trading on

August 18, 2023.

“The strength of TXO Partners is defined by our legacy producing

properties and our focus on distributions to our partners,” stated

Bob R. Simpson, Chairman and CEO. “With the supportive back-drop of

commodity pricing, we continue to expect at least $2 per unit of

distributions for the full year.”

President of Business Operations and CFO, Brent Clum, further

commented, “Our stated strategy to deliver distributions while

creating future value served us well in the second quarter. Our

team added ownership in the prolific Vacuum Field operations as we

expanded our infield development. The net result is cash flow for

today with more oil production and reserves for tomorrow.”

Keith A. Hutton, President of Production and Development, also

offers his insight: “With our technical focus on oil projects, we

accelerated spending in the first half of 2023 with the goal of

advancing production results in the back half of the year. Our goal

will always be dynamic management of our activities for long-term

confidence.”

Quarterly Report on Form 10-Q

TXO's financial statements and related footnotes will be

available in the Quarterly Report on Form 10-Q for the quarter

ended June 30, 2023, which TXO will file with the Securities and

Exchange Commission (SEC) today. The 10-Q will be available on

TXO's Investor Relations website at www.txopartners.com/investors

or on the SEC's website at www.sec.gov.

Non-U.S. Withholding Information

This press release is intended to be a qualified notice under

Treasury Regulations Section 1.1446-4(b). Brokers and nominees

should treat one hundred percent (100%) of TXO’s distribution to

foreign unitholders as being attributable to income that is

effectively connected with a United States trade or business.

Accordingly, TXO’s distributions to foreign unitholders are subject

to federal income tax withholding at the highest applicable

effective tax rate.

About TXO Partners, L.P.

TXO Partners, L.P. is a master limited partnership focused on

the acquisition, development, optimization and exploitation of

conventional oil, natural gas, and natural gas liquid reserves in

North America. TXO’s current acreage positions are concentrated in

the Permian Basin of West Texas and New Mexico and the San Juan

Basin of New Mexico and Colorado.

Cautionary Statement Concerning Forward-Looking

Statements

Certain statements contained in this press release constitute

“forward-looking statements” within the meaning of the Private

Securities Litigation Reform Act of 1995. These forward-looking

statements include the words such as “may,” “assume,” “forecast,”

“could,” “should,” “will,” “plan,” “believe,” “anticipate,”

“intend,” “estimate,” “expect,” “project,” “budget” and similar

expressions, although not all forward-looking statements contain

such identifying words. These forward-looking statements include

our 2023 distribution outlook, our ability to increase oil

production and reserves, our ability to execute our strategy and

the impacts of future commodity price changes. These

forward-looking statements are based on management’s current

belief, based on currently available information, as to the outcome

and timing of future events at the time such statement was made,

and it is possible that the results described in this press release

will not be achieved. Our assumptions and future performance are

subject to a wide range of business risks, uncertainties and

factors, including, without limitation, the following: our ability

to meet distribution expectations and projections; the volatility

of oil, natural gas and NGL prices; our ability to safely and

efficiently operate TXO’s assets; uncertainties about our estimated

oil, natural gas and NGL reserves, including the impact of

commodity price declines on the economic producibility of such

reserves, and in projecting future rates of production; and the

risks and other factors disclosed in TXO’s filings with the SEC,

including its Annual Report on Form 10-K, Quarterly Reports on Form

10-Q and Current Reports on Form 8-K.

Any forward-looking statement speaks only as of the date on

which it is made, and, except as required by law, TXO does not

undertake any obligation to update or revise any forward-looking

statement, whether as a result of new information, future events or

otherwise. New factors emerge from time to time, and it is not

possible for TXO to predict all such factors.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230808094437/en/

TXO Partners Brent W. Clum President, Business Operations &

CFO 817.334.7800 ir@txopartners.com

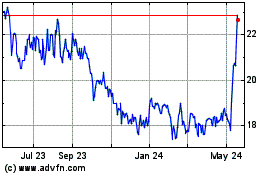

TXO Partners (NYSE:TXO)

Historical Stock Chart

From Nov 2024 to Dec 2024

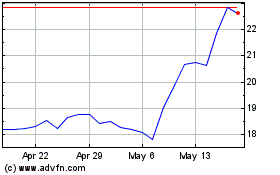

TXO Partners (NYSE:TXO)

Historical Stock Chart

From Dec 2023 to Dec 2024