Current Report Filing (8-k)

November 02 2022 - 7:31AM

Edgar (US Regulatory)

0001465740

false

--12-31

0001465740

2022-10-27

2022-10-27

0001465740

us-gaap:CommonStockMember

2022-10-27

2022-10-27

0001465740

us-gaap:SeriesAPreferredStockMember

2022-10-27

2022-10-27

0001465740

us-gaap:SeriesBPreferredStockMember

2022-10-27

2022-10-27

0001465740

us-gaap:SeriesCPreferredStockMember

2022-10-27

2022-10-27

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Current Report

Pursuant to Section 13

or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 2, 2022 (October 27, 2022)

Two Harbors Investment

Corp.

(Exact name of registrant

as specified in its charter)

| Maryland |

|

001-34506 |

|

27-0312904 |

(State or

other jurisdiction of incorporation or

organization) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification No.) |

| 1601 Utica Avenue South, Suite 900 |

St. Louis Park, MN |

55416 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

(612) 453-4100

Registrant’s telephone number, including area code

Not Applicable

(Former name or former address,

if changed since last report)

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities Registered Pursuant to Section 12(b) of the Act:

| Title of Each Class: |

|

Trading

Symbol(s) |

|

Name of Exchange on Which Registered: |

| Common Stock, par value $0.01 per share |

|

TWO |

|

New York Stock Exchange |

| 8.125% Series A Cumulative Redeemable Preferred Stock |

|

TWO PRA |

|

New York Stock Exchange |

| 7.625% Series B Cumulative Redeemable Preferred Stock |

|

TWO PRB |

|

New York Stock Exchange |

| 7.25% Series C Cumulative Redeemable Preferred Stock |

|

TWO PRC |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934

(17 CFR §240.12b-2).

Emerging

Growth Company ¨

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 3.03. Material Modifications

to Rights of Security Holders.

On October 27, 2022, Two Harbors

Investment Corp. (the “Company”), in connection with the previously announced one-for-four reverse stock split (the “Reverse

Stock Split”) of its outstanding shares of common stock, par value $0.01 per share, filed two Articles of Amendment to its charter

(the “First Amendment” and the “Second Amendment”) with the Maryland State Department of Assessments and Taxation. The

First Amendment, effective as of 5:01 p.m. Eastern Time on November 1, 2022 (the “Effective Time”), converted every four shares

of the Company’s issued and outstanding common stock into one share of common stock, par value $0.04 per share. Pursuant to

the First Amendment, any fractional share of common stock that would otherwise have resulted from the Reverse Stock Split was settled

by cash payment, calculated on the basis of the volume weighted average price of the common stock on November 1, 2022, on the New York

Stock Exchange (the “NYSE”). The Second Amendment, effective as of 5:02 p.m. Eastern Time on November 1, 2022, reverted

the par value of the Company’s issued and outstanding common stock to $0.01 per share. The second amendment also reduced the number

of shares of common stock that the Company is authorized to issue from 700 million to 175 million. The Company’s common stock will

continue trading on the NYSE under the symbol “TWO” with a new CUSIP number (90187B804).

The Reverse Stock Split affected

all holders of common stock uniformly and did not affect any common stockholder’s percentage ownership interest in the Company,

except for de minimus changes as a result of the elimination of fractional shares. As a result of the Reverse Stock Split, the number

of shares of the Company’s common stock outstanding was reduced from approximately 345 million shares to approximately 86 million

shares.

Holders of the Company’s

common stock who hold in “street name” in their brokerage accounts were not required to take any action as a result of the

Reverse Stock Split. Their accounts were automatically adjusted to reflect the number of shares owned. A letter of transmittal relating

to the Reverse Stock Split will be sent to record holders of certificates of common stock promptly following the Effective Time. Stockholders

who receive this letter of transmittal should follow the instructions in such letter.

The Reverse Stock Split did

not affect the number of authorized or outstanding shares of the Company’s 8.125% Series A Fixed-to-Floating Rate Cumulative Redeemable

Preferred Stock, par value $0.001 per share (the “Series A Preferred Stock”), 7.625% Series B Fixed-to-Floating Rate Cumulative

Redeemable Preferred Stock, par value $0.001 per share (the “Series B Preferred Stock”), or 7.25% Series C Fixed-to-Floating

Rate Cumulative Redeemable Preferred Stock, par value $0.001 per share (the “Series C Preferred Stock”), or the dividend rate

of any outstanding shares of Series A Preferred Stock, Series B Preferred Stock or Series C Preferred Stock.

The foregoing description

of the two Articles of Amendment does not purport to be complete and is qualified in its entirety by reference to the complete Articles

of Amendment, copies of which are filed as Exhibit 3.1 and Exhibit 3.2 to this Current Report on Form 8-K and are incorporated herein

by reference.

Item 5.03 Amendments to Articles of Incorporation

or Bylaws; Change in Fiscal Year.

The disclosure in Item 3.03

above is incorporated by reference herein.

Item 8.01 Other Events.

The Company issued a press

release in connection with the Reverse Stock Split, which is filed as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated

herein by reference.

At-the-Market Offering

The Company is party to an

amended and restated equity distribution agreement under which the Company may sell shares of its common stock from time to time in any

method permitted by law deemed to be an “at the market” offering as defined in Rule 415 under the Securities Act of 1933,

as amended. Immediately prior to the Effective Time, an aggregate of 35 million shares of the Company’s common stock were authorized

for issuance under the equity distribution agreement, and the Company had sold 4,747,500 shares pursuant to such equity distribution agreement. As a result of the Reverse Stock Split, an aggregate of 7,563,125 post-Reverse Stock Split shares

remain available for sale pursuant to the equity distribution agreement.

Dividend Reinvestment and Direct Stock Purchase

Plan

The Company sponsors a

dividend reinvestment and direct stock purchase plan through which stockholders may purchase additional shares of the

Company’s common stock by reinvesting some or all of the cash dividends received on shares of the Company’s common

stock. Stockholders may also make optional cash purchases of shares of the Company’s common stock subject to certain

limitations detailed in the plan prospectus. Immediately prior to the Effective Time, an aggregate of 3.75 million shares of the

Company’s common stock were authorized for issuance under the plan, and the Company had sold 449,531 shares pursuant to the

plan. As a result of the Reverse Stock Split, an aggregate of 825,117 post-Reverse Stock

Split shares remain available for sale pursuant to the plan.

Equity Incentive Plans

The Company’s 2021 Equity

Incentive Plan (the “2021 Plan”) and Second Restated 2009 Equity Incentive Plan (the “2009 Plan”) were adopted

by its board of directors and approved by its stockholders for the purpose of enabling the Company to provide equity compensation to attract

and retain qualified directors, officers, advisers, consultants and other personnel. Immediately prior to the Effective Time, an aggregate

of 17 million and 6.5 million shares of the Company’s common stock were authorized for issuance under the 2021 Plan and the 2009

Plan, of which 465,380 and 5,803,978 shares had been utilized. As a result of the Reverse Stock Split, an aggregate of

4,133,564 post-Reverse Stock Split shares remain available for issuance pursuant to the 2021 Plan and an aggregate of 173,990 post-Reverse

Stock Split shares remain available for issuance pursuant to the 2009 Plan; however, following stockholder approval of the 2021 Plan,

no new awards will be granted under the 2009 Plan. As a result of the Reverse Stock Split, the number of shares subject to each issued

and outstanding award under the 2021 Plan or the 2009 Plan were proportionately adjusted to reflect the Reverse Stock Split. Any other

affected terms of the 2021 Plan or the 2009 Plan and any awards thereunder were adjusted to the extent necessary to reflect proportionately

the Reverse Stock Split.

Share Repurchase Program

The Company’s share

repurchase program allows for the repurchase of shares of the Company’s common stock from time to time through privately negotiated

transactions or open market transactions. Immediately prior to the Effective Time, an aggregate of 37.5 million shares of the Company’s

common stock were authorized for repurchase pursuant to the plan, of which a total of 12,174,300 shares had been repurchased. As a result of the Reverse Stock Split, an aggregate of 6,331,425 post-Reverse Stock Split shares remain

available for repurchase pursuant to the program.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

TWO HARBORS INVESTMENT CORP. |

| |

|

|

| |

By: |

/s/ REBECCA B. SANDBERG |

| |

|

Rebecca B. Sandberg |

| |

|

General Counsel and Secretary |

| |

|

|

| Date: November 2, 2022 |

|

|

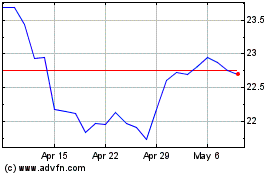

Two Harbors Investment (NYSE:TWO-B)

Historical Stock Chart

From Aug 2024 to Sep 2024

Two Harbors Investment (NYSE:TWO-B)

Historical Stock Chart

From Sep 2023 to Sep 2024