Current Report Filing (8-k)

May 05 2021 - 5:13PM

Edgar (US Regulatory)

false2020-12-31000129067700012906772021-05-052021-05-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): May 5, 2021

TURNING POINT BRANDS, INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

001-37763

|

20-0709285

|

|

(State or other Jurisdiction of Incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

|

5201 Interchange Way, Louisville, KY

|

|

40229

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (502) 778-4421

N/A

(Former name, former address and former fiscal year, if changed since last report.)

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, $0.01 par value

|

TPB

|

New York Stock Exchange

|

Check the appropriate box below if the Form 8–K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions:

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule

12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised

financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

This Current Report on Form 8-K is being filed by Turning Point Brands, Inc. (the “Company”) to recast certain information in the Annual Report on

Form 10-K for the year ended December 31, 2020 (the”2020 Form 10-K”), which the Company filed on February 19, 2021. The Company is filing herewith financial statements and notes thereto and a Management’s Discussion and Analysis of Financial

Condition and Results of Operations (“MD&A”) item for the period included in the 2020 Form 10-K that reflect retrospective adjustments resulting from a change in accounting principle for inventory valuation method effective January 1, 2021

and the retrospective adjustment resulting from the adoption of ASU 2020-06, Debt - Debt with Conversion and Other Options (Subtopic 470-20) and Derivatives and Hedging - Contracts in Entity’s Own Equity (Subtopic 815-40) effective January 1, 2021.

Specifically, Exhibits 99.1 and 99.2, which are incorporated

herein by reference, present a recast of Part II, Items 7 and 8 of the Company’s 2020 Form 10-K, which have been retrospectively adjusted to reflect the change in accounting principle for inventory valuation from the last-in, first-out (“LIFO”)

method to the first-in, first-out (“FIFO”) method for inventories, to reflect the change upon the adoption of ASU 2020-06, Debt - Debt with Conversion and Other Options (Subtopic 470-20) and Derivatives and Hedging - Contracts in Entity’s Own Equity (Subtopic 815-40), and provide an updated Report of Independent Registered Accounting Firm. The disclosures filed as Exhibits 99.1 and 99.2 replace the corresponding portions of the

2020 Form 10-K.

Effective January 1, 2021, the Company changed its method of accounting for inventory from the LIFO method to

the FIFO method. The Company believes the FIFO method is preferable because it: (i) conforms the accounting for all inventory with the method utilized for the majority of its inventory; (ii) better represents how management assesses and

reports on the performance of the tobacco and other LIFO product lines as LIFO is excluded from management’s economic decision making; (iii) better aligns the accounting with the physical flow of that inventory; and (iv) better reflects

inventory at more current costs. This change impacted the Zig-Zag Products segment by increasing gross profit by $46 thousand for the three months ended December

31, 2020 and impacted the Stoker’s Products segment by decreasing gross profit by $156 thousand for the three months ended June 30, 2020 and increasing gross profit by $464 thousand for the three months ended December 31, 2020.

The information in this Current Report on Form 8-K is presented in connection with the change in accounting principle

described above and is not an amendment to or restatement of the Company’s 2020 Form 10-K. Except as specifically set forth herein no revisions have been made to the 2020 Form 10-K to update for other information, developments, or events that

have occurred since our 2020 Form 10-K was filed (including, without limitation, in MD&A for any information, uncertainties, risks, events or trends occurring or known to management subsequent to the date of filing of the 2020 From 10-K).

This Current Report on Form 8-K should be read in conjunction with the 2020 Form 10-K and the Company’s quarterly report on Form 10-Q for the quarter ended March 31, 2021. We provided a description of the changes in accounting principle in our

Quarterly Report on Form 10-Q for the fiscal quarter ended March 31, 2021 filed on May 5, 2021.

|

Item 9.01.

|

Financial Statements and Exhibits.

|

|

|

Consent of RSM US LLP

|

|

|

Recast of Part II, Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations of the Company’s 2020 Form 10-K

|

|

|

Recast of Part II, Item 8, Financial Statements and Supplementary Data, and update of Report of Independent Registered Public Accounting Firm of the Company’s

2020 Form 10-K

|

|

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

|

|

TURNING POINT BRANDS, INC.

|

|

|

|

|

|

|

|

Dated: May 5, 2021

|

By:

|

/s/ Brittani N. Cushman

|

|

|

|

|

Brittani N. Cushman

|

|

|

|

|

Senior Vice President, General Counsel and Secretary

|

|

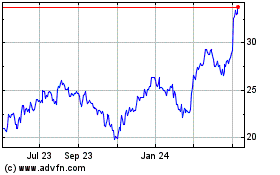

Turning Point Brands (NYSE:TPB)

Historical Stock Chart

From Aug 2024 to Sep 2024

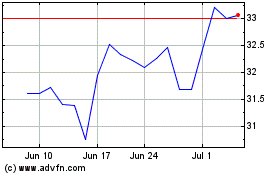

Turning Point Brands (NYSE:TPB)

Historical Stock Chart

From Sep 2023 to Sep 2024