false00018355120001835512us-gaap:WarrantMember2024-08-212024-08-2100018355122024-08-212024-08-210001835512us-gaap:CommonStockMember2024-08-212024-08-21

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): August 21, 2024 |

TERRAN ORBITAL CORPORATION

(Exact name of Registrant as Specified in Its Charter)

|

|

|

Delaware |

001-40170 |

98-1572314 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

6800 Broken Sound Parkway NW, Suite 200 |

|

|

Boca Raton, Florida 33487 |

|

|

(Address of Principal Executive Offices) |

|

|

(561) 988-1704 |

|

|

(Registrant's telephone number, including area code) |

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

x Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbols |

|

Name of each exchange on which registered

|

Common stock, par value $0.0001 per share |

|

LLAP |

|

New York Stock Exchange |

Preferred Stock Purchase Rights |

|

|

|

New York Stock Exchange |

Warrants to purchase one share of common stock, each at an exercise price of $11.50 per share |

|

LLAP WS |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 3.01. Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

Terran Orbital Corporation, a Delaware corporation (the “Company” or “Terran Orbital”), maintains warrants that are currently listed to trade on the New York Stock Exchange (the “NYSE”) under the symbol “LLAP WS” (the “Warrants”). Each Warrant is exercisable for one share of the Company’s common stock, par value $0.0001 per share (the “Common Stock”), at an exercise price of $11.50 per share. On August 21, 2024, the NYSE notified the Company, and subsequently publicly announced, that the NYSE has determined to (a) commence proceedings to delist the Warrants and (b) immediately suspend trading in the Warrants due to “abnormally low selling price” levels pursuant to Section 802.01D of the NYSE Listed Company Manual. The Company has until September 5, 2024 to appeal the NYSE’s determination with respect to the Warrants.

The delisting procedures for the Warrants will not affect the trading in the Company’s Common Stock, which will continue on the NYSE under the symbol “LLAP.” Continued trading of the Company’s Common Stock remains subject to the Company’s ability to regain compliance with the continued listing standard set forth in Section 802.01C of the NYSE’s Listed Company Manual prior to the expiration of the previously announced six-month cure period on December 17, 2024, unless otherwise extended until the Company’s next annual stockholder’s meeting, and continued compliance with the NYSE’s other continued listing requirements. Furthermore, delisting of the Warrants is not anticipated to impact the ongoing business operations of the Company, our previously announced merger transaction or the Company’s reporting requirements with the SEC.

Additional Information and Where to Find It

This communication may be deemed to be solicitation material in respect of the proposed acquisition of Terran Orbital by Lockheed Martin Corporation (“Lockheed Martin”). In connection with the proposed transaction, Terran Orbital intends to file with the Securities and Exchange Commission (the “SEC”) a proxy statement on Schedule 14A. Promptly after filing its definitive proxy statement with the SEC, Terran Orbital intends to mail the definitive proxy statement and a proxy card to each stockholder entitled to vote at the special meeting relating to the proposed transaction. STOCKHOLDERS OF TERRAN ORBITAL ARE URGED TO READ THE PROXY STATEMENT (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) AND ANY OTHER RELEVANT DOCUMENTS IN CONNECTION WITH THE PROPOSED TRANSACTION THAT TERRAN ORBITAL FILES WITH THE SEC WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. The definitive proxy statement, the preliminary proxy statement and any other documents filed by Terran Orbital with the SEC may be obtained free of charge at the SEC’s website at www.sec.gov or at Terran Orbital’s website at www.terranorbital.com.

Participants in the Solicitation

Terran Orbital, Lockheed Martin and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from Terran Orbital’s stockholders with respect to the proposed transaction. Information regarding the identity of participants in the solicitation of proxies, and their direct or indirect interests in the proposed transaction, by security holdings or otherwise, will be set forth in the proxy statement and other materials to be filed with the SEC in connection with the proposed transaction. Additional information about Terran Orbital’s directors and executive officers and their ownership of Terran Orbital common stock is set forth in Terran Orbital’s definitive proxy statement for its 2024 annual meeting of stockholders filed with the SEC on April 10, 2024 (the “Terran Orbital 2024 Proxy Statement”), under “Board of Directors and Corporate Governance,” “Executive Officers,” “Executive Compensation” and “Security Ownership of Certain Beneficial Owners and Management.” To the extent that holdings of Terran Orbital’s securities by directors and executive officers have changed since the amounts disclosed in the Terran Orbital 2024 Proxy Statement, such changes have been or will be reflected on Initial Statements of Beneficial Ownership on Form 3 and Statements of Changes in Ownership on Form 4 filed with the SEC. Information about Lockheed Martin’s directors and executive officers is set forth in Lockheed Martin’s definitive proxy statement for its 2024 annual meeting of stockholders filed with the SEC on March 15, 2024 (the “Lockheed Martin 2024 Proxy Statement”), under “Director Nominees,” “Executive Compensation” and “Security Ownership of Management and Certain Beneficial Owners.” To the extent holdings of Lockheed Martin’s securities by directors and executive officers have changed since the amounts disclosed in the Lockheed Martin 2024 Proxy Statement, such changes have been or will be reflected on Initial Statements of Beneficial Ownership on Form 3 and Statements of Changes in Ownership on Form 4 filed with the SEC. You can obtain free copies of these documents at the SEC’s website at www.sec.gov or by accessing the respective companies’ websites at www.terranorbital.com (Terran Orbital) and www.lockheedmartin.com (Lockheed Martin).

Forward-Looking Statements

This communication contains statements that, to the extent they are not recitations of historical fact, constitute “forward-looking statements” within the meaning of the federal securities laws, and are based on Terran Orbital’s current expectations and assumptions, including, among other things, statements regarding the proposed transaction and the expected benefits of the proposed transaction; the anticipated timing of the proposed transaction and financing of the proposed transaction; and the future performance of Terran Orbital’s business if the proposed transaction is completed. The words “believe,” “estimate,” “anticipate,” “project,” “intend,” “expect,” “plan,”

“outlook,” “will,” “should,” “could,” “scheduled,” “forecast,” and similar expressions are intended to identify forward-looking statements. There can be no assurance that the proposed transaction or any other future events will occur as anticipated, if at all, or that actual results will be as expected. These statements are not guarantees of future performance and are subject to risks and uncertainties. Actual results may differ materially due to factors such as: the failure to obtain, delays in obtaining, or adverse conditions contained in any required regulatory or other approvals for consummation of the proposed transaction, the possibility that Terran Orbital stockholders may not approve the proposed transaction; the failure to consummate or a delay in consummating the proposed transaction for other reasons; the occurrence of any event, change or other circumstance or condition that could give rise to the termination of the merger agreement related to the proposed transaction; Terran Orbital’s business being disrupted due to transaction-related uncertainty; the diversion of Terran Orbital’s management’s or employees’ attention during the pendency of the proposed transaction Terran Orbital’s ongoing business operations and other opportunities; the failure to successfully and timely integrate Terran Orbital and realize the benefits of the proposed transaction; the risk of litigation relating to the proposed transaction; competitive responses to the proposed transaction; unexpected liabilities, costs, charges or expenses resulting from the proposed transaction; and potential adverse reactions or changes to business relationships from the announcement or completion of the proposed transaction. These are only some of the factors that may affect the forward-looking statements contained in this news release. For a discussion identifying additional important factors that could cause actual results to differ materially from those anticipated in the forward-looking statements, see Terran Orbital’s filings with the SEC, including, but not limited to, Terran Orbital’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023, filed with the SEC on April 1, 2024, its Quarterly Report on Form 10-Q for the quarter ended June 30, 2024 filed with the SEC on August 12, 2024, and the prospectus supplements dated September 18, 2023 and July 23, 2024, each related to its Registration Statement on Form S-3, as amended (File No. 333-271093), which was declared effective by the SEC on April 18, 2023. Terran Orbital’s filings may be accessed through the investor relations page of its website, www.investors.terranorbital.com or through the website maintained by the SEC at www.sec.gov. Except where required by applicable law, Terran Orbital expressly disclaims a duty to provide updates to forward-looking statements after the date of this communication to reflect subsequent events, changed circumstances, changes in expectations, or the estimates and assumptions associated with them. The forward-looking statements in this communication are intended to be subject to the safe harbor protection provided by the federal securities laws.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

TERRAN ORBITAL CORPORATION |

|

|

|

|

Date: |

August 26, 2024 |

By: |

/s/ Marc Bell |

|

|

|

Marc Bell Chairman and CEO |

v3.24.2.u1

Document and Entity Information

|

Aug. 21, 2024 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Aug. 21, 2024

|

| Entity Registrant Name |

TERRAN ORBITAL CORPORATION

|

| Entity Incorporation, State or Country Code |

DE

|

| Securities Act File Number |

001-40170

|

| Entity Tax Identification Number |

98-1572314

|

| Entity Address, Address Line One |

6800 Broken Sound Parkway NW

|

| Entity Address, Address Line Two |

Suite 200

|

| Entity Address, City or Town |

Boca Raton

|

| Entity Address, State or Province |

FL

|

| Entity Address, Postal Zip Code |

33487

|

| City Area Code |

(561)

|

| Local Phone Number |

988-1704

|

| Written Communications |

false

|

| Soliciting Material |

true

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Entity Ex Transition Period |

false

|

| Entity Central Index Key |

0001835512

|

| Amendment Flag |

false

|

| Common Stock [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common stock, par value $0.0001 per share

|

| Trading Symbol |

LLAP

|

| Security Exchange Name |

NYSE

|

| Warrant [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Warrants to purchase one share of common stock, each at an exercise price of $11.50 per share

|

| Trading Symbol |

LLAP WS

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_WarrantMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

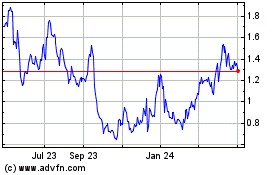

Terran Orbital (NYSE:LLAP)

Historical Stock Chart

From Nov 2024 to Dec 2024

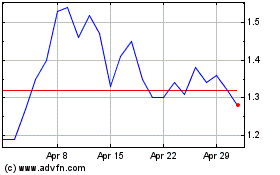

Terran Orbital (NYSE:LLAP)

Historical Stock Chart

From Dec 2023 to Dec 2024