|

|

UNITED STATES |

|

|

|

SECURITIES AND EXCHANGE COMMISSION |

|

|

|

Washington, D.C. 20549 |

|

|

|

|

|

|

|

SCHEDULE 13D

(Rule 13d-101) |

|

Under the Securities Exchange Act of 1934

Summit Midstream Partners, LP

(Name of Issuer)

(Title of Class of Securities)

(CUSIP Number)

Andrew Singer

11943 El Camino Real

Suite 220

San Diego, California 92130

Telephone: 858-703-4400

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

(Date of Event Which Requires Filing of this Statement)

If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of Rule 13d-1(e), 13d-1(f) or 13d-1(g), check the following box. o

Note: Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See Rule 13d-7 for other parties to whom copies are to be sent.

* The remainder of this cover page shall be filled out for a reporting person's initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page shall not be deemed to be "filed" for the purpose of Section 18 of the Securities Exchange Act of 1934 ("Act") or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

|

|

1 |

Names of Reporting Persons

I.R.S. Identification Nos. of Above Persons (Entities Only)

Energy Capital Partners II, LLC |

|

|

|

|

2 |

Check the Appropriate Box if a Member of a Group |

|

|

|

(a) |

o |

|

|

|

(b) |

o |

|

|

|

|

3 |

SEC Use Only |

|

|

|

|

4 |

Source of Funds (See Instructions)

OO |

|

|

|

|

5 |

Check Box if Disclosure of Legal Proceedings Is Required Pursuant to Item 2(d) or 2(e) o |

|

|

|

|

6 |

Citizenship or Place of Organization

Delaware |

|

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

7 |

Sole Voting Power

0 |

|

|

|

8 |

Shared Voting Power

31,327,154 (a) |

|

|

|

9 |

Sole Dispositive Power

0 |

|

|

|

10 |

Shared Dispositive Power

31,327,154 (a) |

|

|

|

|

11 |

Aggregate Amount Beneficially Owned by Each Reporting Person *

31,327,154 (a) |

|

|

|

|

12 |

Check Box if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) o |

|

|

|

|

13 |

Percent of Class Represented by Amount in Row (11)

47.13%(b) |

|

|

|

|

14 |

Type of Reporting Person

OO (Limited Liability Company) |

|

|

|

|

|

|

(a) Represents (i) 1,472,573 common units representing limited partner interests of the Issuer (“Common Units”) held directly by SMLP Holdings, LLC (“SMLP Holdings”), 151,160 Common Units held directly by Summit Midstream Partners, LLC (“Summit”) and 5,293,571 Common Units held directly by Summit Midstream Partners Holdings, LLC (“SMPH”), which cumulatively represent 10.41% of the outstanding Common Units, and (ii) 24,409,850 subordinated units representing limited partner interests (“Subordinated Units”), or 100% of the outstanding Subordinated Units, in the Issuer held directly by SMPH. Summit is the sole member of SMPH. Energy Capital Partners II, LP and its parallel and co-investment funds, as applicable (collectively, the “ECP Funds”), hold, in the aggregate, greater than a majority of the membership interests in Summit and all of the membership interests in SMLP Holdings. Energy Capital Partners II, LLC (“ECP II,” and together with the ECP Funds, “ECP”) is the general partner of the general partner of each ECP Fund that holds membership interests in Summit and SMLP Holdings and has voting and investment control over the securities held thereby. Accordingly, ECP II may be deemed to indirectly beneficially own the Common Units and the Subordinated Units of the Issuer held by Summit, SMPH and SMLP Holdings.

(b) Based upon 42,062,644 Common Units and 24,409,850 Subordinated Units outstanding as of October 31, 2015, as set forth in the Issuers’ Quarterly Report on Form 10-Q filed on November 9, 2015. The Subordinated Units may be converted into Common Units on a one for one basis after the expiration of the subordination period (as defined in the Issuer’s First Amended and Restated Agreement of Limited Partnership (the “Partnership Agreement”). Since the Issuer’s initial public offering (“IPO”) in October 2012, the Issuer has paid at least the minimum quarterly distribution on the Common Units, the Subordinated Units and the corresponding distribution on the general partner interest each quarter. The subordination period is therefore expected to end on the first business day following February 12, 2016, the date on which the Issuer has announced that it will pay the distribution for the quarter ending December 31, 2015.

2

|

|

1 |

Names of Reporting Persons

I.R.S. Identification Nos. of Above Persons (Entities Only)

SMLP Holdings, LLC |

|

|

|

|

2 |

Check the Appropriate Box if a Member of a Group |

|

|

|

(a) |

o |

|

|

|

(b) |

o |

|

|

|

|

3 |

SEC Use Only |

|

|

|

|

4 |

Source of Funds (See Instructions)

OO |

|

|

|

|

5 |

Check Box if Disclosure of Legal Proceedings Is Required Pursuant to Item 2(d) or 2(e) o |

|

|

|

|

6 |

Citizenship or Place of Organization

Delaware |

|

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

7 |

Sole Voting Power

1,472,573(a) |

|

|

|

8 |

Shared Voting Power

0 |

|

|

|

9 |

Sole Dispositive Power

1,472,573(a) |

|

|

|

10 |

Shared Dispositive Power

0 |

|

|

|

|

11 |

Aggregate Amount Beneficially Owned by Each Reporting Person *

1,472,573(a) |

|

|

|

|

12 |

Check Box if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) o |

|

|

|

|

13 |

Percent of Class Represented by Amount in Row (11)

2.2%(b) |

|

|

|

|

14 |

Type of Reporting Person

OO (Limited Liability Company) |

|

|

|

|

|

|

(a) Represents 1,472,573 Common Units, or 2.2% of the outstanding Common Units.

(b) Based upon 42,062,644 Common Units and 24,409,850 Subordinated Units outstanding as of October 31, 2015, as set forth in the Issuers’ Quarterly Report on Form 10-Q filed on November 9, 2015. The Subordinated Units may be converted into Common Units on a one for one basis after the expiration of the subordination period (as defined in the Partnership Agreement). Since the Issuer’s IPO in October 2012, the Issuer has paid at least the minimum quarterly distribution on the Common Units, the Subordinated Units and the corresponding distribution on the general partner interest each quarter. The subordination period is therefore expected to end on the first business day following February 12, 2016, the date on which the Issuer has announced that it will pay the distribution for the quarter ending December 31, 2015.

3

Explanatory Note: Energy Capital Partners II, LLC, a Delaware limited liability company (“ECP II”), Summit Midstream Partners, LLC, a Delaware limited liability company (“Summit”), and Summit Midstream Partners Holdings, LLC, a Delaware limited liability company (“SMPH”), previously filed statements of beneficial ownership on Schedule 13G pursuant to Section 13(g) of the Securities Exchange Act of 1934, as amended (the “Act”), and Rule 13d-1(d) thereunder (see Schedule 13G filed with the Securities and Exchange Commission (“SEC”) on February 19, 2013, as last amended by filing a Schedule 13G/A with the SEC on February 10, 2015). However, in December 2015, Summit and SMLP Holdings, LLC (“SMLP Holdings”) began purchasing outstanding common units representing limited partner interests in the Issuer (“Common Units”) in open market transactions as described in Item 3, and on January 22, 2016, the combined purchases of SMLP Holdings and Summit within the previous 12 months, exceeded two percent of the outstanding Common Units and subordinated units representing limited partner interests (“Subordinated Units”) in the Issuer (Subordinated Units may be converted into Common Units on a one-for-one basis after the expiration of the subordination period (as defined in the Issuer’s First Amended and Restated Agreement of Limited Partnership (the “Partnership Agreement”), which is incorporated by reference herein), which is expected to occur on February 15, 2016). Energy Capital Partners II, LP and its parallel and co-investment funds, as applicable (collectively, the “ECP Funds,” and together with ECP II, “ECP”), hold, in the aggregate, greater than a majority of the membership interests in Summit and all of the membership interests in SMLP Holdings. ECP II is the general partner of the general partner of each ECP Fund that holds membership interests in Summit and SMLP Holdings and has voting and investment control over the securities held thereby. As a result, ECP II may be deemed to have acquired more than two percent of the outstanding Common Units and Subordinated Units on an as-converted basis. Accordingly, ECP is filing this statement with the SEC on Schedule 13D pursuant to Section 13(d) of the Act and Rule 13d-1(a) thereunder. As a result of transactions pursuant to the 10b5-1 Plan (defined below), ECP expects that SMLP Holdings may directly acquire in excess of five percent of the outstanding Common Units of the Issuer in the near future and has therefore included SMLP Holdings as a Reporting Person (as defined below). Since Summit’s acquisitions did not exceed two percent of the outstanding Common Units and Subordinated Units on an as-converted basis, Summit and SMPH will continue as Schedule 13G filers.

Item 1. Security and Issuer

This statement on Schedule 13D (“Schedule 13D”) relates to Common Units and Subordinated Units of Summit Midstream Partners, LP, a Delaware limited partnership (the “Issuer”). The Subordinated Units convert into Common Units on a one-for-one basis upon the expiration of the subordination period. As described in the Partnership Agreement, the subordination period expires on the first business day after the Issuer has earned and paid at least the minimum quarterly distribution on each outstanding Common Unit and Subordinated Unit and the corresponding distribution on the two percent general partner interest in the Issuer for each of three consecutive, non-overlapping four quarter period ending on or after December 31, 2015. The subordination period is expected to end on the first business day following February 12, 2016, the date on which the Issuer has announced that it will pay the distribution for the quarter ending December 31, 2015. Since the Issuer’s initial public offering (“IPO”) in October 2012, the Issuer has paid at least the minimum quarterly distribution on the Common Units, the Subordinated Units and the corresponding distribution on the general partner interest each quarter. The subordination period is therefore expected to end on the first business day following February 12, 2016, the date on which the Issuer has announced that it will pay the distribution for the quarter ending December 31, 2015. The principal executive offices of the Issuer are located at 1790 Hughes Landing Blvd, Suite 500, The Woodlands, TX 77380.

Item 2. Identity and Background

(a) This Schedule 13D is filed by (i) ECP II and (ii) SMLP Holdings. The entities filing this Schedule 13D are collectively referred to herein as the “Reporting Persons.” ECP holds, in the aggregate, greater than a majority of the membership interests in Summit and is entitled to elect five of the five directors of Summit. Summit is the sole member of Summit Midstream Partners Holdings, LLC (“SMPH”). The ECP Funds also hold all of the membership interests in SMLP Holdings. ECP II is the general partner of the general partner of each ECP Fund that holds membership interests in Summit and SMLP Holdings and has voting and investment control over the securities held thereby. Accordingly, ECP II may be deemed to indirectly beneficially own the Common Units and the Subordinated Units of the Issuer held by Summit, SMPH and SMLP Holdings.

4

Information concerning the managing members or executive officers, where applicable, of the Reporting Persons (collectively, the “Listed Persons”), required by Item 2 of Schedule 13D is provided on Schedule I and is incorporated by reference herein.

(b) The business address of ECP II and SMLP Holdings, LLC is 51 John F. Kennedy Parkway, Suite 200, Short Hills, NJ 07078.

(c) ECP II’s principal business is managing investments in North America’s energy infrastructure. SMLP Holdings was formed to purchase and hold Common Units of the Issuer until their disposition or distribution at the direction of ECP II. ECP II also indirectly controls Summit Midstream Partners GP, LLC, a Delaware limited liability company (“Issuer GP”), which is the general partner of the Issuer and owns a two percent general partner interest and all of the incentive distribution rights in the Issuer.

(d)-(e) During the last five years, none of the Reporting Persons or, to the knowledge of the Reporting Persons, any Listed Person, has been (i) convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors) or (ii) a party to a civil proceeding of a judicial or administrative body of competent jurisdiction and as a result of such proceeding was or is subject to a judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities subject to, federal or state securities laws or finding any violation with respect to such laws.

(f) The citizenship or place of organization of each of the Reporting Persons is set forth on the cover pages of this Schedule 13D and the citizenship of each of the Listed Persons is set forth on Schedule I, which information is incorporated herein by reference.

5

Item 3. Source and Amount of Funds or Other Consideration

Prior to the IPO, Summit was the owner of a 100% limited partner interest in the Issuer. In connection with the closing of the IPO and pursuant to a Contribution, Conveyance and Assumption Agreement dated as of October 3, 2012, Summit conveyed certain assets to the Issuer in exchange for (i) 10,029,850 Common Units, (ii) 24,409,850 Subordinated Units, (iii) the right to receive $88.0 million in cash as reimbursement for certain capital expenditures made with respect to the contributed assets, (iv) the continuation of its two percent general partner interest in the Issuer and (v) all of the incentive distribution rights in the Issuer. The foregoing description of the Contribution, Coneyance and Assumption Agreement does not purport to be complete and is qualified in its entirety by reference to the Contribution, Conveyance and Assumption Agreement filed as Exhibit 10.1 to the Issuer’s Current Report on Form 8-K dated October 4, 2012, which exhibit is incorporated in its entirety herein. Summit subsequently conveyed the 10,029,850 Common Units and 24,409,850 Subordinated Units to SMPH.

Pursuant to a Contribution Agreement, on June 4, 2013, the Issuer issued to SMPH and SMPH acquired, 1,553,849 Common Units as partial consideration for SMPH’s contribution of all of the issued and outstanding membership interests of Bison Midstream, LLC to the Issuer. The foregoing description of the Contribution Agreement does not purport to be complete and is qualified in its entirety by reference to the Contribution Agreement filed as Exhibit 10.1 to the Issuer’s Current Report on Form 8-K filed on June 5, 2013, which exhibit is incorporated in its entirety herein.

On June 4, 2013, the Issuer entered into a Purchase and Sale Agreement with an affiliate of MarkWest Energy Partners, LP, pursuant to which the Issuer acquired certain natural gas gathering assets that serve exploration and production customers in the Marcellus Shale Play for $210 million (the “Mountaineer Acquisition”). The Issuer partially funded the consideration for the Mountaineer Acquisition with approximately $100 million in proceeds from the sale of 3,107,698 Common Units to SMPH pursuant to a Unit Purchase Agreement. The foregoing description of the Unit Purchase Agreement does not purport to be complete and is qualified in its entirety by reference to the Unit Purchase Agreement filed as Exhibit 10.3 to the Issuer’s Current Report on Form 8-K filed on June 5, 2013, which exhibit is incorporated in its entirety herein.

On March 17, 2014, pursuant to an Underwriting Agreement with Barclays Capital Inc. (“Barclays”) as representative of the underwriters named therein, SMPH sold 5,050,000 Common Units, including 1,350,000 Common Units sold pursuant to the underwriters’ option to purchase additional Common Units, in a public underwritten offering at a price of $38.75 per Common Unit.

On September 9, 2014, pursuant to an Underwriting Agreement with Merrill Lynch, Pierce, Fenner & Smith Incorporated as representative of the underwriters named therein, SMPH sold 4,347,826 Common Units in a public underwritten offering at a price of $53.88 per Common Unit.

On December 11, 2015, Summit issued a press release stating that ECP had approved the purchase of up to $100 million of the Issuer’s outstanding Common Units. Beginning on December 14, 2015 and ending on December 15, 2015, Summit purchased 151,160 Common Units in open market transactions for an aggregate purchase price of $2,417,151.18. The purchase of the Common Units was funded by using cash contributed to Summit by the ECP Funds.

On December 15, 2015, ECP authorized a 10b5-1 plan (the “10b5-1 Plan”) that instructed Barclays to purchase up to an aggregate of $97,500,000 Common Units on behalf of SMLP Holdings during the period beginning on and including December 30, 2015 and ending on and including June 30, 2016 (the “Execution Period”). Pursuant to the 10b5-1 Plan, Barclays is instructed to purchase Common Units daily during the Execution Period subject to certain pricing thresholds and compliance with the conditions of Rule 10b-18 under the Act. The form of the 10b5-1 Plan is set forth in Exhibit 99.4.

As of the date of this filing, 1,472,530 Common Units, with an aggregate purchase price of $25,342,012.81, have been purchased pursuant to the 10b5-1 Plan. The purchases of Common Units are funded by using cash contributed to SMLP Holdings by the ECP Funds.

6

4. Purpose of Transaction

The Reporting Persons acquired the securities described in this Schedule 13D for investment purposes and they intend to review their investments in the Issuer on a continuing basis. The Reporting Persons may, at any time and from time to time, review or reconsider their position, change their purpose or formulate plans or proposals with respect thereto. ECP indirectly controls through Summit all of the membership interests of Issuer GP and has the power to elect all of the members of the board of directors of Issuer GP. Summit indirectly owns, operates and is developing various natural gas, crude oil and produced water-related midstream energy infrastructure assets in the Utica Shale in southeastern Ohio, the Bakken Shale in northwestern North Dakota, and the DJ Basin in northeastern Colorado. Summit also indirectly owns a 40% interest in a joint venture that is developing natural gas gathering and condensate stabilization infrastructure in the Utica Shale in southeastern Ohio.

In determining from time to time whether to acquire more securities of the Issuer, sell the securities reported as beneficially owned in this Schedule 13D (and in what amounts) or to retain such securities, the Reporting Persons will take into consideration such factors as they deem relevant, including, but not limited to: an ongoing evaluation of the Issuer’s business, financial condition, operations and prospects; price levels of the Issuer’s securities; general market, industry and economic conditions; the relative attractiveness of alternative business and investment opportunities; and other future developments. The Reporting Persons reserve the right to acquire additional securities of the Issuer in the open market, in privately negotiated transactions (which may be with the Issuer or with third parties) or otherwise, to dispose of all or a portion of their holdings of securities of the Issuer or to change their intention with respect to any or all of the matters referred to in this Item 4.

In addition, the Reporting Persons may engage in discussions with management, the board of directors, and unitholders of the Issuer and other relevant parties or encourage such persons to consider or explore extraordinary corporate transactions, such as: a merger; sales or acquisitions of assets or businesses; changes to the capitalization or distribution policy of the Issuer; or other material changes to the Issuer’s business or corporate structure.

(a)-(j) Except for the matters set forth in Items 3 and 5 and the first paragraph of this Item 4, the Reporting Persons have no plans or proposals which relate to, or could result in, any of the matters referred to in paragraphs (a) through (j) inclusive of the instructions to Item 4 of Schedule 13D. The Reporting Persons may, at any time and from time to time, review or reconsider their position, change their purpose or formulate plans or proposals with respect thereto.

Item 5. Interest in Securities of the Issuer

|

|

|

ECP II |

|

SMLP Holdings |

|

|

(a) Amount beneficially owned |

|

31,327,154 |

(1) |

1,472,573 |

(2) |

|

(b) Percent of Class (3) |

|

47.13 |

% |

2.22 |

% |

|

(c) Number of shares as to which such person has: |

|

|

|

|

|

|

(i) Sole power to vote or to direct the vote: |

|

|

|

1,472,573 |

(2) |

|

(ii) Shared power to vote or to direct the vote: |

|

31,327,154 |

(1) |

|

|

|

(iii) Sole power to dispose or to direct the disposition of: |

|

|

|

1,472,573 |

(2) |

|

(iv) Shared power to dispose or to direct the disposition of: |

|

31,327,154 |

(1) |

|

|

(1) Represents (i) 31,327,154 Common Units held directly by SMLP Holdings, 151,160 Common Units held directly by Summit and 5,293,571 Common Units held directly by SMPH, which cumulatively represent 10.41% of the outstanding Common Units, and (ii) 24,409,850 Subordinated Units, or 100% of the outstanding Subordinated Units, in the Issuer held directly by SMPH. Summit is the sole member of SMPH. The ECP Funds, as applicable, hold, in the aggregate, greater than a majority of the membership interests in Summit and all of the membership interests in SMLP Holdings. ECP II is the general partner of the general partner of each ECP Fund that holds membership interests in Summit and SMLP Holdings and has voting and investment control over the securities held thereby. Accordingly, ECP II may be deemed to

7

indirectly beneficially own the Common Units and the Subordinated Units of the Issuer held by Summit, SMPH and SMLP Holdings.

(2) Represents Common Units held directly by SMLP Holdings.

(3) Based upon 42,062,644 Common Units and 24,409,850 Subordinated Units outstanding as of October 31, 2015, as set forth in the Issuers’ Quarterly Report on Form 10-Q filed on November 9, 2015 The Subordinated Units may be converted into Common Units on a one for one basis after the expiration of the subordination period (as defined in the Partnership Agreement). Since the Issuer’s initial public offering in October 2012, the Issuer has paid at least the minimum quarterly distribution on the Common Units, the Subordinated Units and the corresponding distribution on the general partner interest each quarter. The subordination period is therefore expected to end on the first business day following February 12, 2016, the date on which the Issuer has announced that it will pay the distribution for the quarter ending December 31, 2015.

(c) Except as described in Item 3 above and on Schedule II of this Schedule 13D, none of the Reporting Persons has effected any transactions in the common units during the past 60 days.

(d) Not applicable.

(e) Not applicable.

Item 6. Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer

The information provided or incorporated by reference in Item 3 and Item 4 is hereby incorporated by reference herein.

Partnership Agreement

Subject to the terms and conditions of the Partnership Agreement, Issuer GP and its affiliates (including the Reporting Persons) have the right to cause the Issuer to register for resale under the Securities Act of 1933 and applicable state securities laws partnership interests other than the general partner units and the general partner interest represented thereby. The Issuer is obligated to pay all expenses incidental to the registration, excluding underwriting discounts and commissions. The Partnership Agreement additionally contains various provisions with respect to the Common Units and Subordinated Units governing, among other matters, distributions, transfers and allocations of profits and losses to the partners.

References to, and descriptions of, the Partnership Agreement as set forth in this Item 6 are qualified in their entirety by reference to the First Amended and Restated Agreement of Limited Partnership of the Issuer filed as Exhibit 3.1 to the Issuer’s Current Report on Form 8-K filed on October 4, 2012, which is incorporated in its entirety in this Item 6.

Item 7. Material to Be Filed as Exhibits

|

99.1 |

|

First Amended and Restated Agreement of Limited Partnership of Summit Midstream Partners, LP, dated as of October 3, 2012 (Incorporated herein by reference to Exhibit 3.1 to SMLP’s Current Report on Form 8-K dated October 4, 2012. |

|

|

|

|

|

99.2 |

|

Contribution, Conveyance and Assumption Agreement, dated as of June 4, 2013, by and among Summit Midstream Partners Holdings, LLC, Bison Midstream, LLC and Summit Midstream Partners, LP (Incorporated herein by reference to Exhibit 10.1 to SMLP’s Current Report on Form 8-K dated June 5, 2013. |

|

|

|

|

|

99.3 |

|

Unit Purchase Agreement, dated as of June 4, 2013, by and between, Summit Midstream Partners, LP and Summit Midstream Partners Holdings, LLC (Incorporated herein by reference to Exhibit 10.3 to SMLP’s Current Report on Form 8-K dated June 5, 2013. |

8

|

99.4 |

|

Press Release issued on December 11, 2015 announcing purchase program. |

|

|

|

|

|

99.5 |

|

Form of 10b5-1 Purchase Plan. |

9

SIGNATURE

After reasonable inquiry and to the best of the undersigned’s knowledge and belief, the undersigned certify that the information set forth in this statement is true, complete and correct.

Dated: February 1, 2016

|

|

Energy Capital Partners II, LLC |

|

|

|

|

|

|

By: |

/s/ Christopher M. Leininger |

|

|

|

Christopher M. Leininger |

|

|

|

Managing Director and Deputy General Counsel |

|

|

|

|

|

SMLP Holdings, LLC |

|

|

|

|

|

|

|

|

|

By: |

/s/ Enoch O. Varner |

|

|

|

|

Enoch O. Varner |

|

|

|

|

Vice President |

10

JOINT FILING AGREEMENT

In accordance with Rule 13(d)-1(k)(1) under the Securities Exchange Act of 1934, as amended, the undersigned hereby agree to the joint filing with each other of the attached statement on Schedule 13D and to all amendments to such statement.

IN WITNESS WHEREOF, the undersigned hereby executed this Agreement as of February 1, 2016.

|

|

Energy Capital Partners II, LLC |

|

|

|

|

|

|

By: |

/s/ Christopher M. Leininger |

|

|

|

|

Christopher M. Leininger |

|

|

|

|

Managing Director and Deputy General Counsel |

|

|

|

|

|

|

|

SMLP Holdings, LLC |

|

|

|

|

|

|

|

|

|

By: |

/s/ Enoch O. Varner |

|

|

|

|

Enoch O. Varner |

|

|

|

|

Vice President |

SCHEDULE I

The name and business address of each of the executive officers and directors of the Reporting Persons are set forth below. The present principal occupation or employment of each of the executive officers and directors of the Reporting Persons are also set forth below (outside of similar positions held with respect to other entities directly or indirectly managed or advised by the Issuer or the Reporting Persons).

Energy Capital Partners II, LLC

Executive Officers

|

Name |

|

Present Principal Occupation or

Employment |

|

Business

Address |

|

Citizenship |

|

Douglas W. Kimmelman |

|

President/Chief Executive Officer |

|

(1) |

|

United States |

|

Thomas K. Lane |

|

Executive Vice President |

|

(2) |

|

United States |

|

Andrew D. Singer |

|

Executive Vice President, Secretary, General Counsel |

|

(1) |

|

United States |

|

Peter Labbat |

|

Executive Vice President |

|

(2) |

|

United States |

|

Tyler Reeder |

|

Executive Vice President |

|

(2) |

|

United States |

|

Rahman D’Argenio |

|

Executive Vice President |

|

(1) |

|

United States |

|

Murray Karp |

|

Chief Financial Officer/Chief Operating Officer |

|

(2) |

|

United States |

Managing Members and Partner

|

Name |

|

Present Principal Occupation or

Employment |

|

Business

Address |

|

Citizenship |

|

Douglas W. Kimmelman |

|

Managing Member |

|

(1) |

|

United States |

|

Thomas K. Lane |

|

Managing Member |

|

(2) |

|

United States |

|

Andrew D. Singer |

|

Managing Member |

|

(1) |

|

United States |

|

Peter Labbat |

|

Managing Member |

|

(2) |

|

United States |

|

Tyler Reeder |

|

Managing Member |

|

(2) |

|

United States |

|

Rahman D’Argenio |

|

Partner |

|

(1) |

|

United States |

Investment Committee

The Managing Members and Partner serve as the investment committee.

SMLP Holdings, LLC

Executive Officers

|

Name |

|

Present Principal Occupation or

Employment |

|

Business

Address |

|

Citizenship |

|

Thomas K. Lane |

|

President / Chief Executive Officer |

|

(2) |

|

United States |

|

Scott Rogan |

|

Executive Vice President |

|

(2) |

|

United States |

|

Jeffrey Spinner |

|

Vice President |

|

(2) |

|

United States |

|

Matthew Delaney |

|

Vice President |

|

(2) |

|

United States |

|

Enoch Varner |

|

Vice President |

|

(2) |

|

United States |

Board of Managers

Indirectly managed by Energy Capital Partners II,

LLC

(1) 11943 El Camino Real, Suite 220, San Diego, California 92130.

(2) 51 John F. Kennedy Parkway, Suite 200, Short Hills, NJ 07078.

Schedule II

Recent Open Market Transactions by Summit Midstream Partners, LLC in the Securities of the Issuer

|

Date of Transaction |

|

Number of Common Units

Purchased |

|

Weighted Average Price

Per Common Units |

|

Price Range |

|

|

December 14, 2015 |

|

75,277 |

|

$ |

16.05 |

|

$ |

15.79-16.49 |

|

|

December 15, 2015 |

|

68,364 |

|

$ |

15.86 |

|

$ |

15.21-16.17 |

|

|

December 15, 2015 |

|

7,519 |

|

$ |

16.59 |

|

$ |

16.24-16.90 |

|

Recent Open Market Transactions by SMLP Holdings, LLC in the Securities of the Issuer

|

Date of Transaction |

|

Number of Common Units

Purchased |

|

Weighted Average Price

Per Common Unit |

|

Price Range |

|

|

December 30, 2015 |

|

89,723 |

|

$ |

18.64 |

|

$ |

19.11-17.80 |

|

|

December 31, 2015 |

|

55,231 |

|

$ |

18.43 |

|

$ |

19.27-17.92 |

|

|

January 4, 2016 |

|

23,040 |

|

$ |

19.01 |

|

$ |

19.25-18.81 |

|

|

January 5, 2016 |

|

17,940 |

|

$ |

19.19 |

|

$ |

19.50-18.90 |

|

|

January 6, 2016 |

|

115,724 |

|

$ |

18.72 |

|

$ |

19.25-18.26 |

|

|

January 7, 2016 |

|

96,448 |

|

$ |

17.39 |

|

$ |

17.20-17.88 |

|

|

January 8, 2016 |

|

39,835 |

|

$ |

18.01 |

|

$ |

17.71-18.30 |

|

|

January 11, 2016 |

|

98,627 |

|

$ |

17.49 |

|

$ |

16.95-17.92 |

|

|

January 11, 2016 |

|

9,122 |

|

$ |

18. 29 |

|

$ |

17.98-18.50 |

|

|

January 12, 2016 |

|

81,114 |

|

$ |

17.02 |

|

$ |

17.20-17.88 |

|

|

January 13, 2016 |

|

107,279 |

|

$ |

16.87 |

|

$ |

16.54-17.36 |

|

|

January 14, 2016 |

|

104,912 |

|

$ |

16.86 |

|

$ |

16.59-17.20 |

|

|

January 15, 2016 |

|

55,762 |

|

$ |

16.30 |

|

$ |

16.11-16.45 |

|

|

January 19, 2016 |

|

85,189 |

|

$ |

15.94 |

|

$ |

15.24-16.25 |

|

|

January 19, 2016 |

|

21,787 |

|

$ |

15.09 |

|

$ |

14.91-15.21 |

|

|

January 20, 2016 |

|

57,614 |

|

$ |

14.58 |

|

$ |

14.23-14.95 |

|

|

January 21, 2016 |

|

30,901 |

|

$ |

15.12 |

|

$ |

15.10-15.17 |

|

|

January 21, 2016 |

|

76,075 |

|

$ |

14.71 |

|

$ |

14.10-15.08 |

|

|

January 22, 2016 |

|

44,492 |

|

$ |

16.39 |

|

$ |

15.89-16.78 |

|

|

January 25, 2016 |

|

37,718 |

|

$ |

16.67 |

|

$ |

16.14-16.90 |

|

|

January 25, 2016 |

|

25,000 |

|

$ |

17.17 |

|

$ |

17.00-17.50 |

|

|

January 26, 2016 |

|

3,400 |

|

$ |

16.48 |

|

$ |

16.06-16.80 |

|

|

January 26, 2016 |

|

12,683 |

|

$ |

17.31 |

|

$ |

17.17-17.46 |

|

|

January 27, 2016 |

|

91,379 |

|

$ |

17.79 |

|

$ |

17.47-18.02 |

|

|

January 28, 2016 |

|

42,172 |

|

$ |

18.46 |

|

$ |

18.25-19.00 |

|

|

January 29, 2016 |

|

49,406 |

|

$ |

19.03 |

|

$ |

18.95-19.13 |

|

The Reporting Persons undertake to provide to the Issuer, any security holder of the Issuer, or the staff of the Securities and Exchange Commission, upon request, full information regarding the number of Common Units purchased at each separate price within the ranges set forth above.

Exhibit 99.4

|

|

|

|

|

Summit Midstream Partners, LLC

1790 Hughes Landing Blvd, Suite 500

The Woodlands, TX 77380

Summit Midstream Partners, LP

1790 Hughes Landing Blvd, Suite 500

The Woodlands, TX 77380 |

Summit Investments Announces Conclusion of

Energy Capital Partners Review of Strategic Alternatives

· ECP has finalized its formal review and concluded that its continued ownership in Summit Investments is the most attractive option for enhancing the value of its investment in Summit Investments and SMLP

· Summit Investments will provide support to SMLP to execute drop-downs in a manner that is expected to eliminate any need for equity issuance in 2016

· ECP authorizes Summit Investments to initiate a program to acquire up to $100 million of SMLP units via open market purchases

· SMLP reaffirms financial guidance for fiscal year 2015

The Woodlands, Texas (December 11, 2015) — Summit Midstream Partners, LLC (“Summit Investments”) and Summit Midstream Partners, LP (NYSE: SMLP) announced today that Energy Capital Partners (“ECP”), the private equity firm that controls Summit Investments, has concluded its previously announced strategic review process regarding Summit Investments. ECP has determined that continuing its ownership and pursuing a course of action that includes, but is not limited to, continuing to offer to drop down assets at Summit Investments to SMLP is presently the best way to enhance the value of ECP’s investment in Summit Investments and SMLP.

Summit Investments is expected to provide support to SMLP to facilitate a drop-down strategy such that SMLP will not need to issue equity to finance the purchase of drop-down assets in 2016. Summit Investments continues to evaluate specific drop-down alternatives including, among other things, materially accelerating the timing of Summit Investments’ previously announced plan to execute $400.0 million to $800.0 million of drop-down transactions each year through 2017. Summit Investments has had preliminary discussions with the Conflicts Committee of SMLP’s general partner concerning the evaluation of Summit Investments’ portfolio of midstream assets in the context of a potential offer for SMLP to acquire all, or a portion of, such assets as early as the first quarter of 2016. Neither the board of managers of Summit Investments nor ECP has made a formal proposal to SMLP with respect to such a transaction, nor can there be any assurance that such a transaction will be proposed or consummated.

Furthermore, ECP has approved a unit purchase program at Summit Investments of up to $100 million of common units of SMLP (the “Purchase Program”), demonstrating ECP’s continued confidence in the near term and long term outlook for SMLP. Unit purchases are expected to commence as early as December 14, 2015. Units may be purchased under the Purchase Program in open market transactions, in privately negotiated transactions, or otherwise. The Purchase Program does not require Summit Investments to purchase a specific number of units. There can be no assurance that Summit Investments will purchase any units under the Purchase Program, and unit purchases, if any, made under the Purchase Program will not impact the total number of units outstanding.

Doug Kimmelman, ECP’s Senior Partner commented, “What began in the second quarter of 2015 as a process to evaluate strategic alternatives to enhance the value of ECP’s investment in Summit Investments and SMLP is now complete. Summit Investments’ ownership of approximately 30 million SMLP units and 100% of the incentive distribution rights provides ECP with a powerful economic incentive to drop down assets from Summit Investments to SMLP on an accretive basis to facilitate future distribution growth. Our goal is to structure drop downs in a manner that eliminates the equity capital market risk in 2016 for SMLP, strengthens growth and coverage of SMLP, and improves the long term credit profile of the partnership.

We feel strongly that SMLP’s current unit price undervalues the future distribution potential of SMLP. In light of this belief, ECP has authorized an additional $100 million investment into Summit Investments to be used to institute a program to acquire SMLP units, including open market purchases, as market conditions and other factors permit from time to time.”

Steve Newby, President and CEO of Summit Investments commented, “After careful consideration with ECP of all alternatives available to Summit Investments, we agree with ECP that the value creation available to SMLP unitholders and their investment in Summit Investments is best realized by continuing the drop down of our

significant and attractive asset base at Summit Investments. We look forward to working with ECP and the board of SMLP’s general partner during 2016 to transform SMLP from a drop down story to an organic growth story through the contribution of assets that are located in some of the highest growth basins in the country. We believe the cash flow contribution and growth profile associated with these assets will significantly enhance EBITDA growth, distribution coverage, and the credit profile of SMLP.”

Financial Guidance

While the fourth quarter of 2015 is not yet complete, SMLP expects adjusted EBITDA for the full 2015 calendar year and distribution growth per unit to be at or slightly below its previously issued guidance of $210 million to $220 million for adjusted EBITDA and 4.0% to 6.0% for distribution growth per unit. SMLP measures its distribution per unit growth rates in the context of annualizing the distribution paid for the most recent quarter in the current year compared to the comparable quarter of the preceding year. SMLP expects to provide financial guidance for fiscal 2016 in the first quarter of 2016. Our actual results may differ materially from these estimates due to developments that may arise between now and the end of the fourth quarter of 2015.

About Summit Midstream Partners, LP

SMLP is a growth-oriented limited partnership focused on developing, owning and operating midstream energy infrastructure assets that are strategically located in the core producing areas of unconventional resource basins, primarily shale formations, in North America. SMLP currently provides natural gas, crude oil and produced water gathering services pursuant to primarily long-term and fee-based gathering and processing agreements with customers and counterparties in four unconventional resource basins: (i) the Appalachian Basin, which includes the Marcellus Shale formation in northern West Virginia; (ii) the Williston Basin, which includes the Bakken and Three Forks shale formations in northwestern North Dakota; (iii) the Fort Worth Basin, which includes the Barnett Shale formation in north-central Texas; and (iv) the Piceance Basin, which includes the Mesaverde formation as well as the Mancos and Niobrara shale formations in western Colorado and eastern Utah. SMLP owns and operates more than 2,600 miles of pipeline and is headquartered in The Woodlands, Texas with regional corporate offices in Denver, Colorado and Atlanta, Georgia.

About Summit Midstream Partners, LLC

Summit Investments indirectly owns a 43.8% limited partner interest in SMLP and indirectly owns and controls the general partner of SMLP, Summit Midstream GP, LLC, which has sole responsibility for conducting the business and managing the operations of SMLP. Summit Investments owns, operates and is developing various natural gas, crude oil and produced water-related midstream energy infrastructure assets in the Utica Shale in southeastern Ohio, the Bakken Shale in northwestern North Dakota, and the DJ Basin in northeastern Colorado. Summit Investments also owns a 40% interest in a joint venture that is developing natural gas gathering and condensate stabilization infrastructure in the Utica Shale in southeastern Ohio. Summit Investments is a privately held company controlled by Energy Capital Partners II, LLC, and certain of its affiliates.

Forward-Looking Statements

This press release includes certain statements concerning expectations for the future that are forward-looking within the meaning of the federal securities laws. Forward-looking statements include, without limitation, any statement that may project, indicate or imply future results, events, performance or achievements, and may contain the words “expect,” “intend,” “plan,” “anticipate,” “estimate,” “believe,” “will be,” “will continue,” “will likely result,” and similar expressions, or future conditional verbs such as “may,” “will,” “should,” “would” and “could.” Without limiting the generality of the foregoing, forward-looking statements contained in this press release specifically include statements regarding ECP’s review of strategic alternatives for Summit Investments statements related to future potential purchases of SMLP common units and future potential drop-downs and the potential structures surrounding any such drop-downs, and statements included under the heading “Financial Guidance.” Forward- looking statements contain known and unknown risks and uncertainties (many of which are difficult to predict and beyond management’s control) that may cause SMLP’s actual results in future periods to differ materially from anticipated or projected results. An extensive list of specific material risks and uncertainties affecting SMLP is contained in its 2014 Annual Report on Form 10-K as updated and superseded by our Current Report on Form 8-K filed with the Securities and Exchange Commission on September 11, 2015 and as amended and updated from time to time. Further, SMLP is subject to the risks and uncertainties of any strategic alternative, including whether any strategic alternative will be identified and, if identified, whether it will be pursued and consummated. Any forward-looking statements in this press release are made as of the date of this press release and SMLP undertakes no obligation to update or revise any forward-looking statements to reflect new information or events.

Contact: Marc Stratton, Senior Vice President and Treasurer, 832-608-6166, ir@summitmidstream.com

SOURCE: Summit Midstream Partners, LLC and Summit Midstream Partners, LP

2

Exhibit 99.5

FORM OF UNIT PURCHASE AND 10b5-1 TRADING PLAN

1. This agreement constitutes a written plan (the “Plan”) for the purchase of Summit Midstream Partners, LP’s (the “Issuer’s”) common units, representing limited partner interests, of the Issuer (hereinafter referred to as the “Units”). The parties intend that the Plan shall constitute a binding contract or instruction satisfying the requirements of Rule 10b5-1(c) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

2. SMLP Holdings, LLC (the “Purchaser”) hereby authorizes Barclays Capital Inc. (“Barclays”) to purchase Units on behalf of the Purchaser in accordance with the following terms:

|

· |

Class of Securities subject to the Plan: Common Units, representing limited partner interests, of the Issuer (ticker symbol: “SMLP”). |

|

|

|

|

· |

Name of primary listing exchange for the Units (the “Exchange”): New York Stock Exchange. |

|

|

|

|

· |

Aggregate amount of Units covered by the Plan: Refer to Schedule A, attached hereto and incorporated herein by this reference. |

|

|

|

|

· |

Commencement date of purchases under the Plan: Refer to Schedule A. |

|

|

|

|

· |

Purchase price for purchases under the Plan: Refer to Schedule A. |

During the term of the Plan, the Purchaser will not exercise or attempt to exercise authority, influence or control over any purchases executed by Barclays or its affiliates pursuant to the Plan.

3. Representations, Warranties and Agreements:

(a) The Purchaser agrees to pay Barclays for all Units purchased under the Plan (including all commissions in an amount of [ cents ($. )] per unit) on or prior to the regular settlement date for such Units (currently, T + 3), as instructed by Barclays.

The Purchaser acknowledges and agrees that any failure to make any payment may result in all or part of the Plan not being executed or the Plan being terminated. Against such payment, Barclays shall transfer pursuant to the delivery instructions set forth in Schedule A, all Units so purchased.

(b) The Purchaser directs Barclays, subject to the limitations set forth in Schedule A, to exercise its professional trading discretion and execute the purchases specified in the Plan in compliance with all applicable and required laws, rules and regulations. If Barclays does not purchase the full number of Units to be purchased in any trading center (as defined in Rule 600(b)(78) of Regulation NMS) on any Trading Day (as defined below) during the term of the Plan pursuant to Schedule A, the Purchaser directs Barclays [not] to increase the number of Units to be purchased in any subsequent Trading Day during the term of the Plan, except as provided otherwise in Schedule A. Barclays will provide purchase information to the Purchaser daily by phone or e-mail, and trade confirmations will be sent following the transaction date (any such information sent by e-mail shall be sent to [OFFICER’S E-MAIL ADDRESS], or such other e-mail address as the Purchaser may specify from time to time; fax delivery shall be made in accordance with the provisions of section 3(n) below).

(c) All purchases will only be executed on Trading Days that occur during the Execution Period (as defined in Schedule A). A “Trading Day” is any day that the Exchange or a trading center is open for business and the Units trade regular way thereon.

(d) Any fractional number of Units pursuant to the Plan will be rounded down to the closest whole number. In the event of any stock split, reverse stock split or stock dividend with respect to the Units or any change in capitalization with respect to the Issuer that occurs during the term of the Plan, this Plan shall automatically terminate unless the parties agree otherwise in writing in accordance with paragraph 3(o) below.

(e) The Purchaser acknowledges and agrees that Barclays may elect not to purchase Units pursuant to the Plan at any time when (i) Barclays, in its sole discretion, has determined that a market disruption, banking moratorium, outbreak or escalation of hostilities or other crisis or calamity has occurred or (ii) Barclays, in its sole discretion, has determined that it is prohibited from doing so by a legal, regulatory (including without limitation Regulation M), reputational, contractual or other restriction applicable to it or its affiliates or to the Issuer or the Issuer’s affiliates. In any such event, Barclays shall provide to Purchaser prompt notice of such election.

(f) The Plan shall terminate on the earliest to occur of (i) the close of business on [ENTER DATE], (ii) the date on which Barclays completes the purchase of the full dollar value of Units that may be purchased during the Execution Period in accordance with Schedule A, (iii) the date that the Issuer or any other person publicly announces a tender or exchange offer with respect to the Units, (iv) the date of public announcement of a merger, acquisition, reorganization, recapitalization or comparable transaction affecting the securities of the Issuer as a result of which the Units are to be exchanged or converted into securities of another company, (v) the date of public announcement of the voluntary or involuntary liquidation, bankruptcy, insolvency, or nationalization of, or any analogous proceeding affecting, the Issuer, and (vi) the first Trading Day after the Purchaser or Barclays, as the case may be, notifies the other in writing that the Plan shall terminate.

(g) The Purchaser represents and warrants that it is not, on the date hereof, in possession of any material non-public information regarding the Issuer or the Units. Information is “Material” if there is a substantial likelihood that a reasonable investor would consider it important in making an investment decision. Information is “Non-public” if it has not been disseminated in a manner making it available to investor generally. The Purchaser agrees not to communicate, directly or indirectly, any material non-public information relating to the Units or the Purchaser to any employee of Barclays or its affiliates who is involved, directly or indirectly, in executing the Plan at any time while the Plan is in effect.

(h) The Purchaser represents and warrants that they are currently in an open trading window, that the Plan does not violate the Issuers trading policy and that the Plan complies with Rule 10b5-1.

(i) The Purchaser represents and warrants that the Plan does not violate or conflict with any law, regulation, contract, policy, judgment, order, decree or undertaking applicable to the Purchaser or to which the Purchaser is a party. The Purchaser agrees to notify Barclays in writing if it becomes subject to a legal, regulatory, contractual or other restriction that would cause transactions pursuant to the Plan to violate or conflict with any such law, regulation, contract, policy, judgment, order, decree or undertaking (it being understood that the Purchaser coming into possession of material non-public information during the term of the Plan shall not constitute such a restriction).

(j) The Purchaser further represents and warrants that any consents or authorizations required to be obtained with respect to the Plan and use of the Account to effect the Plan under any such law, regulation, contract, policy, judgment, order, decree, board resolution or undertaking have been obtained and are in full force and effect and that all conditions of any such consents and authorizations have been complied with. The Purchaser also represents and warrants that the purchase of Units pursuant to the Plan has been duly authorized by the Issuer and is consistent with the Purchaser’s publicly announced unit purchase program.

(k) The Purchaser agrees that it shall not (except through Barclays or an affiliate thereof), and its affiliated purchasers (as defined in Rule 10b-18 of the Exchange Act (“Rule 10b-18” or the “safe harbor”)) shall not, directly or indirectly (including by means of a derivative instrument) enter into any transaction to purchase any Units during the Execution Period.

(l) The Purchaser acknowledges that neither Barclays nor any of its affiliates has advised the Issuer with respect to any legal, regulatory, tax, accounting or economic consequences arising from the Plan or any transactions under the Plan.

(m) The Purchaser represents and warrants that the Plan is being entered into in good faith and is not part of a plan or scheme to evade the prohibitions of Rule 10b5-1. While the Plan is in effect, the Purchaser agrees not to enter into or alter, either directly or indirectly through an affiliated entity, any corresponding or hedging transaction or position with respect to the Units covered by the Plan and agrees not to alter (except as provided in paragraph 3(s) below) or deviate from, or attempt to exercise any influence over how, when or whether transactions are executed pursuant to, the terms of the

2

Plan. The Purchaser further agrees not to (i) enter into a binding contract with respect to the purchase or sale of Units during the Execution Period with another broker, dealer or financial institution, (ii) instruct another Financial Institution to purchase or sell Units during the Execution Period or (iii) adopt a plan for trading the Units during the Execution Period except through Barclays or an affiliate thereof,. In addition, the Purchaser represents that no such contract, instruction or plan is currently in effect.

(n) The Purchaser agrees to indemnify and hold harmless Barclays and its directors, officers, employees and affiliates from and against all claims, losses, damages and liabilities (including, without limitation, any legal or other expenses reasonably incurred in connection with defending or investigating any such action or claim) arising out of or relating to the Plan (including, but not limited to, a breach of the Purchaser’s representations, warranties or covenants in the Plan), except to the extent that such claims or cause of actions arise out of or relate to Barclays’ failure to perform or fulfill any of its covenants or obligations under paragraph 3(k) of this Plan or Barclays’ acts of willful misconduct or bad faith. This indemnification shall survive termination of the Plan.

(o) The Purchaser understands that, while the Barclays Equity Corporate Services Desk is executing transactions on behalf of the Purchaser pursuant to this Plan, other desks at Barclays that are not participating in such transactions and are not aware of the Purchaser’s purchases may continue making a market in the Units or otherwise trade the Units in Barclay’s own account or to facilitate client transactions.

(p) Barclays agrees that at no time shall its trading in the market on behalf of the Purchaser employ manipulative or deceptive devices or contrivances in violation of Section 10(b) of the Exchange Act. Further; Barclays acknowledges the interest of the Purchaser in connection with such purchases to avail itself of the safe harbor provided by Rule 10b-18 and Barclays agrees to comply with the conditions of Rule 10b-18(b)(2)-(4), and with respect to the price conditions set forth in Rule 10b-18(b)(3), Barclays shall not knowingly exceed the highest independent bid or the last independent transaction price, whichever is higher, quoted or reported in the consolidated system at the time the Rule 10b-18 purchase is effected.

(q) Notwithstanding any other provision hereof, Barclays shall not be liable to the Purchaser for (i) special, indirect, punitive, exemplary or consequential damages, or incidental losses or damages of any kind, even if advised of the possibility of such losses or damages or if such losses or damages could have been reasonably foreseen or (ii) any failure to perform or to cease performance or any delay in performance that results from a cause or circumstance that is beyond its reasonable control, including but not limited to failure of electronic or mechanical equipment, strikes, failure of common carrier or utility systems, severe weather, market disruptions or other causes commonly known as “acts of God”.

(r) The Purchaser acknowledges and agrees that the Plan is a “securities contract,” as such term is defined in Section 741(7) of Title 11 of the United States Code (the “Bankruptcy Code”), entitled to all of the protections given such contracts under the Bankruptcy Code.

(s) All notices to Barclays under the Plan shall be given to Barclays in the manner specified by the Plan by telephone at (212) 526-7850, by facsimile at (212) 526-3319 or (646) 758-3693 or by certified mail or nationally recognized overnight courier to the address below:

Equity Corporate Services

Barclays Capital Inc.

745 Seventh Avenue, 3rd Floor

New York, NY 10019-6801

Telephone: 212-526-5249

Attention: Robert Arrix, Director

Email: Robert.Arrix@barclayscapital.com

All notices to the Purchaser under this Plan shall be given by facsimile to the number set forth below or by nationally recognized overnight courier or certified mail to the address below:

3

SMLP Holdings, LLC

c/o Energy Capital Partners

1000 Louisiana Street, 52nd Floor

Houston, Texas 77002

Facsimile: 713.469.3101

For the avoidance of doubt, any notice or other document which may be given or served by either party to the other shall be deemed to have been duly given or served on the other parties when actually received. In the case of sending by fax as aforesaid any such notice shall be deemed to have been received upon written or oral confirmation of receipt by the parties.

(t) Any modification or amendment by the parties further requires (i) the written consent of Barclays, which consent shall specify the effective date of the modified or amended Plan and (ii) (1) a certificate signed by the Purchaser certifying that the representations and warranties in this Plan are true and correct at and as of the date of such certificate as if made at and as of such date, or (2) the execution of a new Plan, as determined by Barclays in its sole discretion. The Purchaser may not assign the Purchaser’s rights or obligations under the Plan without the written permission of Barclays and any such assignment without such permission shall be void. The Plan shall be subject to the terms and conditions of any Barclays standard account opening documentation, including but not limited to, the Account Agreement between Barclays and Purchaser and, in the event of any conflicts between these two such documents, the terms and conditions of this Plan shall prevail.

(u) The Plan shall be governed by and construed in accordance with the laws of the State of New York and may be modified or amended only by a writing signed by the Purchaser and Barclays.

(v) This Plan constitutes the entire agreement between the Purchaser and Barclays with respect to the Plan and supersedes any prior agreements or understandings with regard to the Plan.

IN WITNESS WHEREOF, the parties hereto have executed this Agreement as of [DATE], 2015.

SMLP Holdings, LLC

|

By: |

|

|

|

|

|

|

|

|

Name: |

|

|

|

|

|

|

|

|

|

Title: |

|

|

|

|

|

|

|

|

|

|

BARCLAYS CAPITAL INC. |

|

|

|

|

|

|

By: |

|

|

|

|

|

|

|

|

Name: |

|

|

|

|

|

|

|

|

|

Title: |

|

|

4

SAMPLE SCHEDULE A

PURCHASE INSTRUCTIONS

A. For purposes of this Plan, the term “Execution Period” shall mean the following period(s):

(i) From and including [September 4, 2013] through and including [September 13, 2013];

(ii) From and including [October 1, 2013] through and including [October 10, 2013];

(iii) From and including [November 5, 2013] through and including [November 14, 2013]; and

(iv) From and including [December 3, 2013] through and including [December 12, 2013].

Barclays shall not purchase Common Units, representing limited partner interests of Summit Midstream Partners, LP (the “Units”) under this Plan either prior to [September 4, 2013], during the time periods between the Execution Periods, or after [December 12, 2013].

B. During each Execution Period, Barclays shall purchase up to the Daily Purchase Amount (as defined in paragraph C below) for the Purchaser on each Trading Day under ordinary principles of best execution at the then-prevailing market price, except that Barclays shall not purchase:

(i) more than [Five Hundred Thousand] ([500,000]) Units pursuant to this Plan on any single Trading Day (except as provided in paragraph D below);

(ii) more than [Fifty Million Dollars] ($[50,000,000.00]) in Units pursuant to this Plan during any single Execution Period; or

(iii) any Units at a price higher than the Maximum Purchase Price (as defined below).

C. The “Daily Purchase Amount” for any Trading Day shall be the number of Units set forth on the grid below opposite the per unit price range that corresponds to the reported price of the opening reported market transaction in the Units on such Trading Day, subject to the provisions of the two paragraphs immediately following the table.

|

Reported Unit Price |

|

Daily Purchase Amount |

|

|

If the price is at or above $[23.50] (the “Maximum Purchase Price”) |

|

0 Units |

|

|

If the price is greater than or equal to $[22.00] and less than or equal to $[23.50] |

|

[125,000] Units |

|

|

If the price is greater than or equal to $[20.00] and less than $[22.00] |

|

[250,000] Units |

|

|

If the price is less than $[20.00] |

|

[500,000] Units |

|

5

If the price drops into a lower price range during a given Exchange Business Day, then so long as the price remains in such lower price range, Barclays shall increase purchases to buy up to the Daily Purchase Amount for the corresponding lower price range.

If the price increases to a higher price range during a given Trading Day and Barclays has already exceeded the Daily Purchase Amount corresponding to the higher price range, then Barclays shall not make any additional purchases within such higher price range; however, if Barclays has not exceeded the Daily Purchase Amount in the higher price range, then Barclays shall continue to buy Units up to the Daily Purchase Amount for such higher price range.

D. Notwithstanding anything to the contrary contained herein, Barclays may execute one or more block trades (as such term is defined in Rule 10b-18 under the Exchange Act) in Units under the following circumstances:

(i) only one block trade may be made on any single Trading Day, and no other purchases may be made on the same Trading Day;

(ii) the per unit price for each such block trade must be less than $[20.00] per unit;

(iii) neither a Daily Purchase Amount nor the overall daily purchase limitation set forth in paragraph B(i) above shall apply to any such block trade;

(iv) the overall purchase limitation set forth in paragraph B(ii) shall continue to apply to all purchases made in the applicable Execution Period, including, without limitation, all block trades made during that Execution Period; and

(v) each block trade must be executed in full compliance with Rule 10b-18 under the Exchange Act.

E. Barclays shall transfer all Units purchased under this Plan to the Purchaser’s transfer agent (which shall be [NAME AND CONTACT INFORMATION OF TRANSFER AGENT], until the Purchaser provides written notice to Barclays of a change in the identity of the transfer agent) prior to the date of settlement.

6

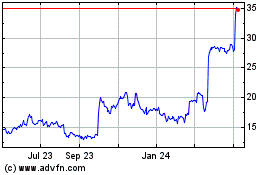

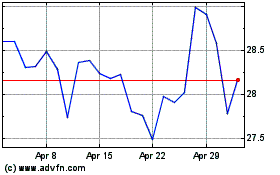

Summit Midstream Partners (NYSE:SMLP)

Historical Stock Chart

From Jun 2024 to Jul 2024

Summit Midstream Partners (NYSE:SMLP)

Historical Stock Chart

From Jul 2023 to Jul 2024