First quarter revenue increased 21%

year-over-year to $1,195 million

Daily Active Users increased 10% year-over-year

to 422 million

First quarter operating cash flow of $88

million and Free Cash Flow of $38 million

Snap Inc. (NYSE: SNAP) today announced financial results for the

quarter ended March 31, 2024.

“The value we provide our community and advertising partners has

translated into improved financial performance,” said Evan Spiegel,

CEO. “Our large, growing, and hard-to-reach community, brand-safe

environment, and full-funnel advertising solutions have made us an

increasingly important partner for businesses of all sizes.”

Q1 2024 Financial Summary

- Revenue was $1,195 million, compared to $989 million in the

prior year, an increase of 21% year-over-year.

- Net loss was $305 million, compared to $329 million in the

prior year.

- Adjusted EBITDA was $46 million, compared to $1 million in the

prior year.

- Operating cash flow was $88 million, compared to $151 million

in the prior year.

- Free Cash Flow was $38 million, compared to $103 million in the

prior year.

Three Months Ended

March 31,

Percent Change

2024

2023

(in thousands, except

per share amounts)

(Unaudited)

(NM = Not Meaningful)

Revenue

$

1,194,773

$

988,608

21%

Operating loss

$

(333,232

)

$

(365,264

)

9%

Net loss

$

(305,090

)

$

(328,674

)

7%

Adjusted EBITDA (1)

$

45,659

$

813

NM

Net cash provided by (used in) operating

activities

$

88,352

$

151,102

(42)%

Free Cash Flow (2)

$

37,904

$

103,472

(63)%

Diluted net loss per share attributable to

common stockholders

$

(0.19

)

$

(0.21

)

10%

Non-GAAP diluted net income (loss) per

share (3)

$

0.03

$

0.01

200%

(1)

See page 10 for a reconciliation

of net loss to Adjusted EBITDA. Total restructuring charges

included in our consolidated statement of operations for the three

months ended March 31, 2024 and excluded from Adjusted EBITDA were

$70.1 million.

(2)

See page 10 for a reconciliation

of net cash provided by (used in) operating activities to Free Cash

Flow.

(3)

See page 11 for a reconciliation

of diluted net loss per share to non-GAAP diluted net income (loss)

per share.

Q1 2024 Summary & Key Highlights

We grew and deepened our engagement with our

community:

- DAUs were 422 million in Q1 2024, an increase of 39 million, or

10%, year-over-year.

- Total time spent watching Spotlight content increased more than

125% year-over-year.

- The growth in the Snap Star program has been an important

driver of engagement in North America, with total time spent

watching Stories from Snap Stars growing more than 55%

year-over-year in North America.

- We onboarded over 1,500 Snap Stars in Q1, which has helped

generate quarter-over-quarter growth in Story posts, Spotlight

posts, and Stories time spent for Snap Stars globally.

- We introduced new tools to help our community make more

creative Snaps, including new Creative Templates, the ability to

post longer videos, and access to AI-powered AR Lens creation.

We are focused on accelerating and diversifying our revenue

growth:

- Snapchat+ subscribers more than tripled year-over-year,

surpassing 9 million subscribers in Q1.

- The number of small and medium sized advertisers on Snapchat

increased 85% year-over-year.

- Ongoing momentum with our 7-0 Pixel Purchase optimization model

led to a more than 75% increase in purchase related conversions

year-over-year.

- We launched a new and improved version of Conversions API

(CAPI) available to all advertisers that offers easier set up with

reduced integration times.

- We partnered with Snowflake to enable advertisers to easily

implement our CAPI solutions without needing to build a bespoke

back-end integration.

- Our improvements to CAPI and improved collaboration with

advertisers has resulted in CAPI integrations growing approximately

300% year-over-year in Q1 2024.

- We launched Sponsored AR Filters, our new AR ad offering that

expands advertisers’ reach via the Snapchat Camera and enables

Snapchatters to overlay sponsored AR content on their Snaps after a

photo or video is captured.

- We announced partnerships with Traackr, Lumen Research, OMD,

Amplified Intelligence, and Fospha to empower advertisers with more

campaign tools and insights.

- We announced two new brand safety solutions for advertisers: a

third-party measurement product in partnership with Integral Ad

Science, a leading global media measurement and optimization

platform, to provide advertisers with increased transparency across

their Snapchat campaigns, and a first-party tool that allows

advertisers greater control over where their ads appear.

We invested in our augmented reality platform:

- We continue to invest in Generative AI models and automation

for the creation of ML and AI Lenses, which contributed to the

number of ML and AI Lenses viewed by Snapchatters increasing by

more than 50% year-over-year.

- We invested in relationship-centered AR Formats that drove

outsized sharing among US Snapchatters including “Friend Lenses”

that feature friends in Quizzes and other experiences, and “Q&A

Lenses” that prompt Snapchatters to send fun text and image

responses to their Friends.

- We implemented an improved AR Carousel ranking model that

refreshes AR lenses more frequently, making it easier to discover

new Lenses, driving a more than 50% increase in the number of new

Lenses seen in the carousel by Snapchatters since launch.

- We integrated a new AI Assistant in Lens Studio that answers

developer questions based on our documentation and tutorials to

guide developers and help build Lenses more easily.

- We launched a new Compression tool in Lens Studio to easily

reduce the size of assets and optimize Lenses in order to improve

the Lens creation experience on Snapchat.

- We launched an Animation Curve Editor in Lens Studio, a new

interface for developers to edit animations inside Lens Studio —

the first of many foundational animation tools coming soon.

- At Super Bowl LVIII, the NFL integrated Snapchat's Camera Kit

technology at Allegiant Stadium in Las Vegas — the first time a

Super Bowl host stadium has integrated our technology.

Q2 2024 Outlook

As we enter Q2, we anticipate continued growth of our global

community, and as a result, our Q2 guidance is built on the

assumption that DAU will be approximately 431 million in Q2. We are

focused on executing against our roadmap to deliver improvements to

our DR advertising platform to drive improved results for our

advertising partners and accelerate topline growth. Our Q2 guidance

range for revenue is $1,225 million to $1,255 million, implying

year-over-year revenue growth of 15% to 18%. Given the revenue

range above, and our investment plans for the quarter ahead, we

estimate that Adjusted EBITDA will be between $15 million and $45

million in Q2.

Conference Call Information

Snap Inc. will host a conference call to discuss the results at

2:30 p.m. Pacific / 5:30 p.m. Eastern today. The live audio webcast

along with supplemental information will be accessible at

investor.snap.com. A recording of the webcast will also be

available following the conference call.

Snap Inc. uses its websites (including snap.com and

investor.snap.com) as means of disclosing material non-public

information and for complying with its disclosure obligation under

Regulation FD.

Definitions

Free Cash Flow is defined as net cash provided by (used in)

operating activities, reduced by purchases of property and

equipment.

Common shares outstanding plus shares underlying stock-based

awards includes common shares outstanding, restricted stock units,

restricted stock awards, and outstanding stock options.

Adjusted EBITDA is defined as net income (loss), excluding

interest income; interest expense; other income (expense), net;

income tax benefit (expense); depreciation and amortization;

stock-based compensation expense; payroll and other tax expense

related to stock-based compensation; and certain other items

impacting net income (loss) from time to time.

A Daily Active User (DAU) is defined as a registered and

logged-in Snapchat user who visits Snapchat through our

applications or websites at least once during a defined 24-hour

period. We calculate average DAUs for a particular quarter by

adding the number of DAUs on each day of that quarter and dividing

that sum by the number of days in that quarter. At the beginning of

the first quarter of 2024, we updated the definition of DAU to

include web platform use. Incremental DAU from web platform use has

not been material prior to this update or in the first quarter of

2024.

Average revenue per user (ARPU) is defined as quarterly revenue

divided by the average DAUs.

A Monthly Active User (MAU) is defined as a registered and

logged-in Snapchat user who visits Snapchat through our

applications or websites at least once during the 30-day period

ending on the calendar month-end. We calculate average Monthly

Active Users for a particular quarter by calculating the average of

the MAUs as of each calendar month-end in that quarter. At the

beginning of the first quarter of 2024, we updated the definition

of MAU to include web platform use. Incremental MAU from web

platform use has not been material prior to this update or in the

first quarter of 2024.

Note: For adjustments and additional information regarding the

non-GAAP financial measures and other items discussed, please see

“Non-GAAP Financial Measures,” “Reconciliation of GAAP to Non-GAAP

Financial Measures,” and “Supplemental Financial Information and

Business Metrics.”

About Snap Inc.

Snap Inc. is a technology company. We believe the camera

presents the greatest opportunity to improve the way people live

and communicate. We contribute to human progress by empowering

people to express themselves, live in the moment, learn about the

world, and have fun together. For more information, visit

snap.com.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended, or the Securities Act, and Section 21E of the Securities

Exchange Act of 1934, as amended, or the Exchange Act, about us and

our industry that involve substantial risks and uncertainties. All

statements other than statements of historical facts contained in

this press release, including statements regarding guidance, our

future results of operations or financial condition, future stock

repurchase programs or stock dividends, business strategy and

plans, user growth and engagement, product initiatives, objectives

of management for future operations, and advertiser and partner

offerings, are forward-looking statements. In some cases, you can

identify forward-looking statements because they contain words such

as “anticipate,” “believe,” “contemplate,” “continue,” “could,”

“estimate,” “expect,” “going to,” “intend,” “may,” “plan,”

“potential,” “predict,” “project,” “should,” “target,” “will,” or

“would” or the negative of these words or other similar terms or

expressions. We caution you that the foregoing may not include all

of the forward-looking statements made in this press release.

You should not rely on forward-looking statements as predictions

of future events. We have based the forward-looking statements

contained in this press release primarily on our current

expectations and projections about future events and trends,

including our financial outlook, macroeconomic uncertainty, and

geo-political conflicts, that we believe may continue to affect our

business, financial condition, results of operations, and

prospects. These forward-looking statements are subject to risks

and uncertainties related to: our financial performance; our

ability to attain and sustain profitability; our ability to

generate and sustain positive cash flow; our ability to attract and

retain users, partners, and advertisers; competition and new market

entrants; managing our growth and future expenses; compliance with

new laws, regulations, and executive actions; our ability to

maintain, protect, and enhance our intellectual property; our

ability to succeed in existing and new market segments; our ability

to attract and retain qualified team members and key personnel; our

ability to repay or refinance outstanding debt, or to access

additional financing; future acquisitions, divestitures, or

investments; and the potential adverse impact of climate change,

natural disasters, health epidemics, macroeconomic conditions, and

war or other armed conflict, as well as risks, uncertainties, and

other factors described in “Risk Factors” and elsewhere in our most

recent periodic report filed with the U.S. Securities and Exchange

Commission, or SEC, which is available on the SEC’s website at

www.sec.gov. Additional information will be made available in our

periodic report that will be filed with the SEC for the period

covered by this press release and other filings that we make from

time to time with the SEC. In addition, any forward-looking

statements contained in this press release are based on assumptions

that we believe to be reasonable as of this date. We undertake no

obligation to update any forward-looking statements to reflect

events or circumstances after the date of this press release or to

reflect new information or the occurrence of unanticipated events,

including future developments related to geo-political conflicts

and macroeconomic conditions, except as required by law.

Non-GAAP Financial Measures

To supplement our consolidated financial statements, which are

prepared and presented in accordance with GAAP, we use certain

non-GAAP financial measures, as described below, to understand and

evaluate our core operating performance. These non-GAAP financial

measures, which may be different than similarly titled measures

used by other companies, are presented to enhance investors’

overall understanding of our financial performance and should not

be considered a substitute for, or superior to, the financial

information prepared and presented in accordance with GAAP.

We use the non-GAAP financial measure of Free Cash Flow, which

is defined as net cash provided by (used in) operating activities,

reduced by purchases of property and equipment. We believe Free

Cash Flow is an important liquidity measure of the cash that is

available, after capital expenditures, for operational expenses and

investment in our business and is a key financial indicator used by

management. Additionally, we believe that Free Cash Flow is an

important measure since we use third-party infrastructure partners

to host our services and therefore we do not incur significant

capital expenditures to support revenue generating activities. Free

Cash Flow is useful to investors as a liquidity measure because it

measures our ability to generate or use cash. Once our business

needs and obligations are met, cash can be used to maintain a

strong balance sheet and invest in future growth.

We use the non-GAAP financial measure of Adjusted EBITDA, which

is defined as net income (loss), excluding interest income;

interest expense; other income (expense), net; income tax benefit

(expense); depreciation and amortization; stock-based compensation

expense; payroll and other tax expense related to stock-based

compensation; and certain other items impacting net income (loss)

from time to time. We believe that Adjusted EBITDA helps identify

underlying trends in our business that could otherwise be masked by

the effect of the expenses that we exclude in Adjusted EBITDA.

We use the non-GAAP financial measure of non-GAAP net income

(loss), which is defined as net income (loss), excluding

amortization of intangible assets; stock-based compensation

expense; payroll and other tax expense related to stock-based

compensation; certain other items impacting net income (loss) from

time to time; and related income tax adjustments. Non-GAAP net

income (loss) and weighted average diluted shares are then used to

calculate non-GAAP diluted net income (loss) per share. Similar to

Adjusted EBITDA, we believe these measures help identify underlying

trends in our business that could otherwise be masked by the effect

of the expenses we exclude in the measure.

We believe that these non-GAAP financial measures provide useful

information about our financial performance, enhance the overall

understanding of our past performance and future prospects, and

allow for greater transparency with respect to key metrics used by

our management for financial and operational decision-making. We

are presenting these non-GAAP measures to assist investors in

seeing our financial performance through the eyes of management,

and because we believe that these measures provide an additional

tool for investors to use in comparing our core financial

performance over multiple periods with other companies in our

industry.

For a reconciliation of these non-GAAP financial measures to the

most directly comparable GAAP financial measure, please see

“Reconciliation of GAAP to Non-GAAP Financial Measures.”

Snap Inc., “Snapchat,” and our other registered and common law

trade names, trademarks, and service marks are the property of Snap

Inc. or our subsidiaries.

SNAP INC.

CONSOLIDATED STATEMENTS OF

CASH FLOWS

(in thousands, unaudited)

Three Months Ended March

31,

2024

2023

Cash flows from operating

activities

Net loss

$

(305,090

)

$

(328,674

)

Adjustments to reconcile net loss to net

cash provided by (used in) operating activities:

Depreciation and amortization

41,713

35,220

Stock-based compensation

263,752

314,931

Amortization of debt issuance costs

1,742

1,836

Losses (gains) on debt and equity

securities, net

8,968

(10,833

)

Other

(16,612

)

(10,396

)

Change in operating assets and

liabilities, net of effect of acquisitions:

Accounts receivable, net of allowance

162,207

288,373

Prepaid expenses and other current

assets

(13,629

)

(13,204

)

Operating lease right-of-use assets

13,575

17,658

Other assets

(5,142

)

850

Accounts payable

(34,089

)

(36,972

)

Accrued expenses and other current

liabilities

(18,381

)

(90,191

)

Operating lease liabilities

(13,930

)

(18,550

)

Other liabilities

3,268

1,054

Net cash provided by (used in) operating

activities

88,352

151,102

Cash flows from investing

activities

Purchases of property and equipment

(50,448

)

(47,630

)

Purchases of strategic investments

—

(4,480

)

Purchases of marketable securities

(465,672

)

(874,053

)

Sales of marketable securities

—

5,351

Maturities of marketable securities

384,928

924,323

Other

9

2,327

Net cash provided by (used in) investing

activities

(131,183

)

5,838

Cash flows from financing

activities

Proceeds from the exercise of stock

options

69

29

Repurchases of Class A non-voting common

stock

(235,114

)

—

Deferred payments for acquisitions

—

(2,028

)

Repurchases of convertible notes

(440,706

)

—

Net cash provided by (used in) financing

activities

(675,751

)

(1,999

)

Change in cash, cash equivalents, and

restricted cash

(718,582

)

154,941

Cash, cash equivalents, and restricted

cash, beginning of period

1,782,462

1,423,776

Cash, cash equivalents, and restricted

cash, end of period

$

1,063,880

$

1,578,717

SNAP INC.

CONSOLIDATED STATEMENTS OF

OPERATIONS

(in thousands, except per share

amounts, unaudited)

Three Months Ended March

31,

2024

2023

Revenue

$

1,194,773

$

988,608

Costs and expenses:

Cost of revenue

574,749

439,986

Research and development

449,759

455,112

Sales and marketing

276,034

268,433

General and administrative

227,463

190,341

Total costs and expenses

1,528,005

1,353,872

Operating loss

(333,232

)

(365,264

)

Interest income

39,898

37,948

Interest expense

(4,743

)

(5,885

)

Other income (expense), net

(81

)

11,372

Loss before income taxes

(298,158

)

(321,829

)

Income tax benefit (expense)

(6,932

)

(6,845

)

Net loss

$

(305,090

)

$

(328,674

)

Net loss per share attributable to Class

A, Class B, and Class C common stockholders:

Basic

$

(0.19

)

$

(0.21

)

Diluted

$

(0.19

)

$

(0.21

)

Weighted average shares used in

computation of net loss per share:

Basic

1,647,387

1,581,370

Diluted

1,647,387

1,581,370

SNAP INC.

CONSOLIDATED BALANCE

SHEETS

(in thousands, except par

value)

March 31, 2024

December 31,

2023

(unaudited)

Assets

Current assets

Cash and cash equivalents

$

1,060,393

$

1,780,400

Marketable securities

1,850,622

1,763,680

Accounts receivable, net of allowance

1,108,357

1,278,176

Prepaid expenses and other current

assets

167,385

153,587

Total current assets

4,186,757

4,975,843

Property and equipment, net

426,363

410,326

Operating lease right-of-use assets

511,117

516,862

Intangible assets, net

127,658

146,303

Goodwill

1,691,524

1,691,827

Other assets

223,982

226,597

Total assets

$

7,167,401

$

7,967,758

Liabilities and Stockholders’

Equity

Current liabilities

Accounts payable

$

246,217

$

278,961

Operating lease liabilities

36,649

49,321

Accrued expenses and other current

liabilities

829,579

805,836

Total current liabilities

1,112,445

1,134,118

Convertible senior notes, net

3,301,466

3,749,400

Operating lease liabilities,

noncurrent

553,741

546,279

Other liabilities

68,401

123,849

Total liabilities

5,036,053

5,553,646

Commitments and contingencies

Stockholders’ equity

Class A non-voting common stock, $0.00001

par value. 3,000,000 shares authorized, 1,437,758 shares issued,

1,388,965 shares outstanding at March 31, 2024, and 3,000,000

shares authorized, 1,440,541 shares issued, 1,391,341 shares

outstanding at December 31, 2023.

14

14

Class B voting common stock, $0.00001 par

value. 700,000 shares authorized, 22,528 shares issued and

outstanding at March 31, 2024 and December 31, 2023.

—

—

Class C voting common stock, $0.00001 par

value. 260,888 shares authorized, 231,627 shares issued and

outstanding at March 31, 2024 and December 31, 2023.

2

2

Treasury stock, at cost. 48,793 and 49,200

shares of Class A non-voting common stock at March 31, 2024 and

December 31, 2023, respectively.

(475,939

)

(479,903

)

Additional paid-in capital

14,873,261

14,613,404

Accumulated deficit

(12,266,740

)

(11,726,536

)

Accumulated other comprehensive income

(loss)

750

7,131

Total stockholders’ equity

2,131,348

2,414,112

Total liabilities and stockholders’

equity

$

7,167,401

$

7,967,758

SNAP INC.

RECONCILIATION OF GAAP TO

NON-GAAP FINANCIAL MEASURES

(in thousands, unaudited)

Three Months Ended

March 31,

2024

2023

Free Cash Flow reconciliation:

Net cash provided by (used in) operating

activities

$

88,352

$

151,102

Less:

Purchases of property and equipment

(50,448

)

(47,630

)

Free Cash Flow

$

37,904

$

103,472

Three Months Ended

March 31,

2024

2023

Adjusted EBITDA reconciliation:

Net loss

$

(305,090

)

$

(328,674

)

Add (deduct):

Interest income

(39,898

)

(37,948

)

Interest expense

4,743

5,885

Other (income) expense, net

81

(11,372

)

Income tax (benefit) expense

6,932

6,845

Depreciation and amortization

38,098

35,220

Stock-based compensation expense

254,715

314,931

Payroll and other tax expense related to

stock-based compensation

15,970

15,926

Restructuring charges (1)

70,108

—

Adjusted EBITDA

$

45,659

$

813

(1)

Restructuring charges primarily

include $68.2 million of cash severance, stock-based compensation

expense, and other charges associated with the 2024 restructuring.

These charges are not reflective of underlying trends in our

business.

Total depreciation and amortization expense by function:

Three Months Ended

March 31,

2024

2023

Depreciation and amortization expense

(1):

Cost of revenue

$

2,150

$

3,226

Research and development

27,598

24,139

Sales and marketing

4,577

5,073

General and administrative

7,388

2,782

Total

$

41,713

$

35,220

(1)

Depreciation and amortization

expense for the three months ended March 31, 2024 includes

restructuring charges.

SNAP INC.

RECONCILIATION OF GAAP TO

NON-GAAP FINANCIAL MEASURES (continued)

(in thousands, except per share

amounts, unaudited)

Total stock-based compensation expense by

function:

Three Months Ended

March 31,

2024

2023

Stock-based compensation expense

(1):

Cost of revenue

$

1,815

$

1,885

Research and development

174,519

219,850

Sales and marketing

54,656

54,939

General and administrative

32,762

38,257

Total

$

263,752

$

314,931

(1)

Stock-based compensation expense

for the three months ended March 31, 2024 includes restructuring

charges.

Three Months Ended

March 31,

2024

2023

Non-GAAP net income (loss)

reconciliation:

Net loss

$

(305,090

)

$

(328,674

)

Amortization of intangible assets

15,443

17,755

Stock-based compensation expense

254,715

314,931

Payroll and other tax expense related to

stock-based compensation

15,970

15,926

Restructuring charges (1)

70,108

—

Income tax adjustments

(2,000

)

32

Non-GAAP net income (loss)

$

49,147

$

19,970

Weighted-average common shares -

Diluted

1,647,387

1,581,370

Non-GAAP diluted net income (loss) per

share reconciliation:

Diluted net loss per share

$

(0.19

)

$

(0.21

)

Non-GAAP adjustment to net loss

0.22

0.22

Non-GAAP diluted net income (loss) per

share

$

0.03

$

0.01

(1)

Restructuring charges primarily

include $68.2 million of cash severance, stock-based compensation

expense, and other charges associated with the 2024 restructuring.

These charges are not reflective of underlying trends in our

business.

SNAP INC.

SUPPLEMENTAL FINANCIAL

INFORMATION AND BUSINESS METRICS

(dollars and shares in thousands,

except per user amounts, unaudited)

Q4 2022

Q1 2023

Q2 2023

Q3 2023

Q4 2023

Q1 2024

(NM = Not Meaningful)

Cash Flows and Shares

Net cash provided by (used in) operating

activities

$

125,291

$

151,102

$

(81,936

)

$

12,781

$

164,574

$

88,352

Net cash provided by (used in) operating

activities - YoY (year-over-year)

(32

)%

19

%

34

%

(77

)%

31

%

(42

)%

Net cash provided by (used in) operating

activities - TTM (trailing twelve months)

$

184,614

$

208,257

$

250,402

$

207,238

$

246,521

$

183,771

Purchases of property and equipment

$

(46,925

)

$

(47,630

)

$

(36,943

)

$

(73,435

)

$

(53,719

)

$

(50,448

)

Purchases of property and equipment -

YoY

91

%

125

%

58

%

94

%

14

%

6

%

Purchases of property and equipment -

TTM

$

(129,306

)

$

(155,761

)

$

(169,334

)

$

(204,933

)

$

(211,727

)

$

(214,545

)

Free Cash Flow

$

78,366

$

103,472

$

(118,879

)

$

(60,654

)

$

110,855

$

37,904

Free Cash Flow - YoY

(51

)%

(3

)%

19

%

(435

)%

41

%

(63

)%

Free Cash Flow - TTM

$

55,308

$

52,496

$

81,068

$

2,305

$

34,794

$

(30,774

)

Common shares outstanding

1,574,086

1,595,205

1,616,119

1,638,905

1,645,496

1,643,120

Common shares outstanding - YoY

(3

)%

(2

)%

(2

)%

2

%

5

%

3

%

Shares underlying stock-based awards

131,718

128,218

149,065

154,525

157,981

146,240

Shares underlying stock-based awards -

YoY

59

%

71

%

62

%

63

%

20

%

14

%

Total common shares outstanding plus

shares underlying stock-based awards

1,705,804

1,723,423

1,765,184

1,793,430

1,803,477

1,789,360

Total common shares outstanding plus

shares underlying stock-based awards - YoY

—

%

1

%

2

%

5

%

6

%

4

%

Results of Operations

Revenue

$

1,299,735

$

988,608

$

1,067,669

$

1,188,551

$

1,361,287

$

1,194,773

Revenue - YoY

0.1

%

(7

)%

(4

)%

5

%

5

%

21

%

Revenue - TTM

$

4,601,847

$

4,527,728

$

4,484,488

$

4,544,563

$

4,606,115

$

4,812,280

Revenue by region (1)

North America

$

880,310

$

639,896

$

686,829

$

786,154

$

899,542

$

743,131

North America - YoY

(6

)%

(16

)%

(13

)%

(3

)%

2

%

16

%

North America - TTM

$

3,235,854

$

3,117,489

$

3,018,637

$

2,993,189

$

3,012,421

$

3,115,656

Europe

$

218,552

$

157,760

$

182,109

$

200,272

$

238,253

$

195,844

Europe - YoY

5

%

(3

)%

7

%

24

%

9

%

24

%

Europe - TTM

$

712,177

$

707,805

$

719,817

$

758,693

$

778,394

$

816,478

Rest of World

$

200,873

$

190,952

$

198,731

$

202,125

$

223,492

$

255,798

Rest of World - YoY

28

%

34

%

28

%

30

%

11

%

34

%

Rest of World - TTM

$

653,816

$

702,434

$

746,034

$

792,681

$

815,300

$

880,146

Operating loss

$

(287,597

)

$

(365,264

)

$

(404,339

)

$

(380,063

)

$

(248,713

)

$

(333,232

)

Operating loss - YoY

NM

(35

)%

(1

)%

13

%

14

%

9

%

Operating loss - Margin

(22

)%

(37

)%

(38

)%

(32

)%

(18

)%

(28

)%

Operating loss - TTM

$

(1,395,306

)

$

(1,489,043

)

$

(1,492,442

)

$

(1,437,263

)

$

(1,398,379

)

$

(1,366,347

)

Net income (loss)

$

(288,460

)

$

(328,674

)

$

(377,308

)

$

(368,256

)

$

(248,247

)

$

(305,090

)

Net income (loss) - YoY

NM

9

%

11

%

(2

)%

14

%

7

%

Net income (loss) - TTM

$

(1,429,653

)

$

(1,398,703

)

$

(1,353,944

)

$

(1,362,698

)

$

(1,322,485

)

$

(1,298,901

)

Adjusted EBITDA

$

233,275

$

813

$

(38,479

)

$

40,094

$

159,149

$

45,659

Adjusted EBITDA - YoY

(29

)%

(99

)%

(635

)%

(45

)%

(32

)%

NM

Adjusted EBITDA - Margin (2)

18

%

0.1

%

(4

)%

3

%

12

%

4

%

Adjusted EBITDA - TTM

$

377,573

$

313,918

$

268,249

$

235,703

$

161,577

$

206,423

(1)

Total revenue for geographic

reporting is apportioned to each region based on our determination

of the geographic location in which advertising impressions are

delivered, as this approximates revenue based on user activity.

This allocation is consistent with how we determine ARPU.

(2)

We define Adjusted EBITDA margin

as Adjusted EBITDA divided by GAAP revenue.

SNAP INC.

SUPPLEMENTAL FINANCIAL

INFORMATION AND BUSINESS METRICS (continued)

(dollars and shares in thousands,

except per user amounts, unaudited)

Q4 2022

Q1 2023

Q2 2023

Q3 2023

Q4 2023

Q1 2024

Other

DAU (in millions) (1)

375

383

397

406

414

422

DAU - YoY

17

%

15

%

14

%

12

%

10

%

10

%

DAU by region (in millions)

North America

100

100

101

101

100

100

North America - YoY

3

%

3

%

2

%

1

%

—

%

(1

)%

Europe

92

93

94

95

96

96

Europe - YoY

12

%

10

%

9

%

7

%

4

%

4

%

Rest of World

183

190

202

211

218

226

Rest of World - YoY

31

%

27

%

25

%

21

%

19

%

19

%

ARPU

$

3.47

$

2.58

$

2.69

$

2.93

$

3.29

$

2.83

ARPU - YoY

(15

)%

(19

)%

(16

)%

(6

)%

(5

)%

10

%

ARPU by region

North America

$

8.77

$

6.37

$

6.83

$

7.82

$

8.96

$

7.44

North America - YoY

(9

)%

(18

)%

(14

)%

(4

)%

2

%

17

%

Europe

$

2.38

$

1.70

$

1.93

$

2.11

$

2.49

$

2.04

Europe - YoY

(6

)%

(12

)%

(2

)%

15

%

5

%

20

%

Rest of World

$

1.10

$

1.00

$

0.98

$

0.96

$

1.03

$

1.13

Rest of World - YoY

(2

)%

6

%

3

%

8

%

(7

)%

13

%

Employees (full-time; excludes part-time,

contractors, and temporary personnel)

5,288

5,201

5,286

5,367

5,289

4,835

Employees - YoY

(7

)%

(15

)%

(18

)%

(6

)%

—

%

(7

)%

Depreciation and amortization

expense

Cost of revenue

$

8,114

$

3,226

$

3,170

$

3,184

$

3,171

$

2,150

Research and development

29,834

24,139

24,847

26,252

31,040

27,598

Sales and marketing

6,130

5,073

5,605

5,466

10,017

4,577

General and administrative

4,413

2,782

6,066

6,307

8,096

7,388

Total

$

48,491

$

35,220

$

39,688

$

41,209

$

52,324

$

41,713

Depreciation and amortization expense -

YoY

39

%

(8

)%

(50

)%

14

%

8

%

18

%

Stock-based compensation

expense

Cost of revenue

$

4,248

$

1,885

$

2,365

$

2,640

$

2,665

$

1,815

Research and development

319,447

219,850

217,565

234,615

220,996

174,519

Sales and marketing

69,346

54,939

57,597

72,783

70,369

54,656

General and administrative

57,533

38,257

40,416

47,895

39,167

32,762

Total

$

450,574

$

314,931

$

317,943

$

357,933

$

333,197

$

263,752

Stock-based compensation expense - YoY

51

%

14

%

—

%

4

%

(26

)%

(16

)%

(1)

Numbers may not foot due to

rounding.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240425227092/en/

Investors and Analysts: ir@snap.com

Press: press@snap.com

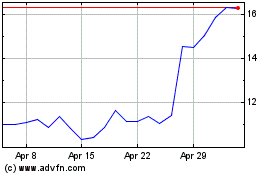

Snap (NYSE:SNAP)

Historical Stock Chart

From Nov 2024 to Dec 2024

Snap (NYSE:SNAP)

Historical Stock Chart

From Dec 2023 to Dec 2024