UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

For the month of May 2024

SKEENA

RESOURCES LIMITED

(Translation

of Registrant's Name into English)

| |

001-40961 |

|

| |

(Commission

File Number) |

|

| |

|

|

| 1133

Melville Street, Suite 2600, Vancouver, British Columbia, V6E 4E5, Canada |

| (Address

of Principal Executive Offices) |

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F:

Form 20-F ¨ Form 40-F x

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

Exhibits 99.1 through 99.5 to this report, furnished on Form 6-K,

are furnished, not filed, and will not be incorporated by reference into any registration statement filed by the registrant under the

Securities Act of 1933, as amended.

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: May 21, 2024

| |

SKEENA RESOURCES LIMITED |

| |

|

|

| |

By: |

/s/ Andrew MacRitchie |

| |

|

Andrew MacRitchie |

| |

|

Chief Financial Officer |

Exhibit

99.1

NOTICE

OF ANNUAL GENERAL MEETING OF SHAREHOLDERS

NOTICE

IS HEREBY GIVEN that the Annual General Meeting (the “Meeting”) of shareholders of Skeena Resources Limited

(the “Company” or “Skeena”) will be held at 2600 – 1133 Melville Street, Vancouver, BC, Canada V6E

4E5 on Monday, June 17, 2024 at 10:00 a.m. (Vancouver time) for the following purposes:

| 1. | to

receive the Company’s audited financial statements for the financial years ended December

31, 2023 and December 31, 2022, together with the auditor’s report thereon, as well

as the interim financial statements for the period ended March 31, 2024; |

| | |

| 2. | to

set the number of directors of the Company at six (6) for the ensuing year; |

| | |

| 3. | to

elect the directors of the Company for the ensuing year; |

| | |

| 4. | to

appoint KPMG LLP, Chartered Professional Accountants, as the auditor of the Company for the

ensuing year and to authorize the directors to fix the auditor’s remuneration; and |

| | |

| 5. | to

transact such other business as may properly come before the Meeting or any adjournment or

postponement thereof. |

The

specific details of the matters proposed to be put before the Meeting are set forth in the Management Information Circular (the “Information

Circular”) accompanying and forming part of this Notice. You should also find enclosed a Proxy or Voting Instruction Form (“VIF”).

The

Board of Directors of the Company has fixed the record date for the determination of the Shareholders entitled to receive this Notice

and to vote at the Meeting as the close of business on May 13, 2024.

Shareholders

of the Company who are unable to attend the Meeting in person are requested to complete, date and sign the enclosed Proxy or VIF.

| A) | Registered

shareholders can return their completed Proxy to our transfer agent, Computershare Investor

Services Inc., in one of the following ways: |

| 1. | through

the internet at www.investorvote.com; |

| | | |

| 2. | by

telephone at 1-866-732-8683 (toll free); |

| | | |

| 3. | by

mail or by hand to Computershare Investor Services Inc., 8th Floor, 100 University

Avenue, Toronto, Ontario, M5J 2Y1; or |

| | | |

| 4. | by

facsimile to 416-263-9524 or 1-866-249-7775 |

You

will require your 15 digit control number found on your Proxy to vote through the internet or by telephone. In order to be valid, Proxies

must be received by Computershare Investor Services Inc., the Company’s transfer agent, at 8th Floor, 100 University

Avenue, Toronto, Ontario, M5J 2Y1 by 10:00 a.m., Pacific time, on June 13, 2024 or be provided to the Chairman of the Meeting.

| B) | Beneficial

or non-registered shareholders of the Company should follow the instructions on the VIF provided

by the intermediaries with respect to the procedures to be followed for voting at the Meeting. |

Further

instructions for voting by registered Shareholders or for providing voting instructions by non- registered Shareholders by mail, by phone

and over the internet are included in the Information Circular.

Non-registered

(beneficial) Shareholders who plan to attend the Meeting must follow the instructions set out in the Proxy or VIF to ensure their shares

are voted at the Meeting. If you hold your shares in a brokerage account, you are a non-registered (beneficial) Shareholder.

If

you are a non-registered Shareholder and a non-objecting beneficial owner, and receive a VIF, please complete and return the form in

accordance with the instructions. If you do not complete and return the form in accordance with such instructions, you may lose your

right to vote at the Meeting, either in person or by proxy.

If

you are a non-registered Shareholder and an objecting beneficial owner and receive these materials through your broker or through another

intermediary, please complete and return the materials in accordance with the instructions provided to you by your broker or such other

intermediary. If you do not complete and return the materials in accordance with such instructions, you may lose your right to vote at

the Meeting, either in person or by proxy.

Please

advise the Company of any change in your address.

DATED

at the City of Vancouver, in the Province of British Columbia, as of May 13, 2024.

| |

BY ORDER OF THE BOARD OF DIRECTORS |

|

| |

|

|

|

| |

(Signed) |

“Walter Coles, Jr.” |

|

| |

|

Walter Coles, Jr., |

|

| |

|

Executive Chairman |

|

Exhibit 99.2

| TABLE

OF CONTENTS |

|

| TABLE

OF CONTENTS |

ii |

| GLOSSARY |

iii |

| INFORMATION

ABOUT VOTING |

1 |

| SOLICITATION

OF PROXIES |

1 |

| VOTING

PROXIES AND VIFs |

1 |

| VOTING

SECURITIES AND PRINCIPAL HOLDERS THEREOF |

4 |

| ADVANCE

NOTICE MATTERS |

4 |

| INTEREST

OF CERTAIN PERSONS IN MATTERS TO BE ACTED UPON |

5 |

| INTEREST

OF INFORMED PERSONS IN MATERIAL TRANSACTIONS |

5 |

| INDEBTEDNESS

OF DIRECTORS AND OFFICERS |

5 |

| BUSINESS

AT THE MEETING |

6 |

| FINANCIAL

STATEMENTS |

6 |

| NUMBER

OF DIRECTORS |

7 |

| ELECTION

OF DIRECTORS |

7 |

| APPOINTMENT

AND REMUNERATION OF AUDITOR |

15 |

| OTHER

BUSINESS |

15 |

| COMPENSATION

DISCUSSION AND ANALYSIS |

16 |

| KEY

HIGHLIGHTS OF THE COMPANY’S EXECUTIVE AND DIRECTOR COMPENSATION PROGRAMS |

16 |

| COMPENSATION

GOVERNANCE |

17 |

| EXECUTIVE

COMPENSATION OBJECTIVES AND PHILOSOPHY |

17 |

| COMPENSATION

REVIEW PROCESS |

19 |

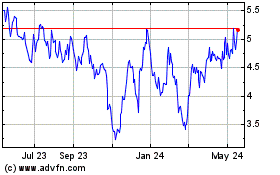

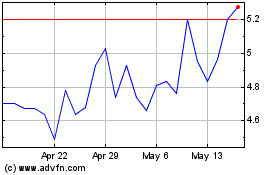

| COMPENSATION

VS. SHARE PRICE PERFORMANCE |

36 |

| CONTRACTS

WITH NAMED EXECUTIVE OFFICERS |

38 |

| DIRECTOR

COMPENSATION |

43 |

| DIRECTOR

SHARE OWNERSHIP GUIDELINES |

45 |

| SECURITIES

AUTHORIZED FOR ISSUANCE UNDER EQUITY COMPENSATION PLANS |

49 |

| ANNUAL

BURN RATE |

50 |

| ENVIRONMENTAL,

SOCIAL, AND GOVERNANCE |

50 |

| ENVIRONMENTAL |

50 |

| SOCIAL |

51 |

| GOVERNANCE |

51 |

| AUDIT

COMMITTEE |

56 |

| INFORMATION

SECURITY |

59 |

| ADDITIONAL

INFORMATION |

59 |

GLOSSARY

In

this Circular, unless otherwise stated, the following capitalized terms have the meanings set out below:

“BCBCA”

means the Business Corporations Act (British Columbia).

“Board”

means the board of directors of Skeena.

“Circular”

means this management information circular of the Company.

“Dollars”

or “$” means Canadian dollars, unless otherwise specified.

“DSU”

means deferred share units that may be granted pursuant to the Omnibus Plan.

“EDGAR”

means the Electronic Data Gathering, Analysis, and Retrieval system section of the U.S. Securities and Exchange Commission’s website

at www.sec.gov.

“ESG”

means environmental, social, and governance.

“Meeting”

means the annual general and special meeting of Shareholders that is to be held on June 17, 2024 or any adjournment or postponement

thereof.

“Named

Executive Officers” or “NEOs” means:

| (a) | an

individual who acted as chief executive officer of the Company, or acted in a similar capacity,

for any part of the most recently completed financial year (“CEO”); |

| (b) | an

individual who acted as chief financial officer of the Company, or acted in a similar capacity,

for any part of the most recently completed financial year (“CFO”); and |

| (c) | each

of the three most highly compensated executive officers of the Company, including any of

our subsidiaries, or the three most highly compensated individuals acting in a similar capacity,

other than the CEO and CFO, at the end of the most recently completed financial year whose

total compensation was, individually, more than $150,000 for that financial year. |

“NI

54-101” means National Instrument 54-101 - Communication with Beneficial Owners of Securities of a Reporting Issuer of

the Canadian Securities Administrators.

“NYSE”

means the New York Stock Exchange.

“Omnibus

Plan” means the Company’s 2023 Omnibus Equity Incentive Plan that was adopted by the Board on May 16, 2023 and ratified

by Shareholders on June 22, 2023.

“Options”

means incentive stock options to purchase Shares.

“Participant”

means a Service Provider that has been granted an award under the Omnibus Plan.

“Person”

means an individual or a company and includes any corporation, incorporated association or organization, body corporate, partnership,

trust, association or other entity other than an individual.

“PSU”

means performance share units that may be granted pursuant to the Omnibus Plan.

“Record

Date” means May 13, 2024.

“RSU”

means restricted share units that may be granted pursuant to the RSU Plan.

“RSU

Plan” means the Restricted Share Unit Plan of Skeena that was adopted by the Board on September 15, 2020 and ratified

by Shareholders on October 15, 2020.

“SEDAR+”

means the System for Electronic Document Analysis and Retrieval filing system, available at www.sedarplus.ca.

“Share

Compensation Arrangement” means any Option under the Stock Option Plan but also includes any other stock option, stock option

plan, employee stock purchase plan or any other compensation or incentive mechanism, including but not limited to, the RSU Plan, involving

the issuance or potential issuance of common shares to a Service Provider (as defined in the Stock Option Plan).

“Shareholder”

or “Shareholders” means a holder or holders of Shares, as applicable.

“SRP”

means the Company Shareholder Rights Plan.

“Shares”

means common shares in the capital of the Company, each of which carries the right to vote in all circumstances.

“Share

Units” refers collectively to Restricted Share Units, Deferred Share Units, and Performance Share Units.

“Skeena”

or the “Company” means Skeena Resources Limited.

“Stock

Option Plan” means the amended Stock Option Plan of Skeena that was adopted by the Board effective June 30, 2021, replacing

the previous stock option plan (the “Prior Stock Option Plan”) which was adopted by the Board on September 15,

2020 and ratified by the Shareholders on October 15, 2020.

“Options”

means the stock options of the Company governed by the Stock Option Plan.

“TSX”

means the Toronto Stock Exchange.

"VIF”

means Voting Instruction Form.

(All

information set out in this Information Circular is as at May 13, 2024 unless otherwise noted)

This

Circular, together with the Notice of Meeting and the Proxy (collectively, the “Meeting Materials”) are being furnished in

connection with the solicitation of proxies (“Proxies”) being made by the management of Skeena for use at our annual general

and special meeting of the Shareholders of the Company (the “Meeting”) and any adjournment or postponement thereof.

These

Meeting Materials are being sent directly to registered Shareholders. In accordance with the provisions of NI 54-101, the Company has

elected to deliver the Meeting Materials to the beneficial (or unregistered) Shareholders indirectly through intermediaries (as defined

below). If you hold Shares through an Intermediary, but have not received the Meeting Materials from the Intermediary, you should contact

your Intermediary for instructions and assistance in voting.

The

Meeting is being held on Thursday, June 17, 2024, at 10:00 a.m. (Vancouver time) at the Company’s

head office at 2600 – 1133 Melville Street, Vancouver, BC, Canada for the purposes set forth in the accompanying Notice of Meeting.

Registered shareholders and duly appointed proxyholders will be able to vote in person and ask questions at the Meeting by following

the instructions set out in this Information Circular. Non-registered shareholders who have not duly appointed themselves as proxyholders

may attend the Meeting as guests. Guests may listen but cannot vote at the Meeting or ask questions.

INFORMATION

ABOUT VOTING

SOLICITATION

OF PROXIES

While

it is expected that the solicitation of proxies will be made primarily by mail, proxies may also be solicited personally or by telephone

by directors, officers or employees of the Company. The cost of this solicitation is expected to be nominal and will be borne by the

Company.

Skeena

is not using the ‘Notice and Access’ procedures available under NI 54-101 in respect of the Meeting.

VOTING

PROXIES AND VIFs

Voting

Voting

at the Meeting will be by a show of hands unless a poll is required or requested. Each registered Shareholder and each person representing

a registered or unregistered Shareholder through a Proxy or VIF (a “Proxyholder”) is entitled to one vote, unless

a poll is required or requested, in which case each such Shareholder and each Proxyholder is entitled to one vote for each Share held

or represented, respectively.

To

approve a motion proposed at the Meeting, a majority of greater than 50% of the votes cast will be required (an ‘ordinary resolution’)

unless the motion requires a ‘special resolution’ in which case a majority of 66⅔%

of the votes cast will be required. An ordinary resolution is required to pass the resolutions described herein.

Appointment

of Proxyholders

The

persons named in the enclosed form of Proxy as Proxyholders are directors or officers of the Company. A Shareholder has the right

to appoint a person (who need not be a Shareholder) other than the persons named in the Proxy as Proxyholders to attend and vote on the

Shareholder’s behalf at the Meeting. To exercise this right, the Shareholder must insert the name of the Shareholder’s nominee

in the space provided or complete another appropriate form of Proxy permitted by law, and in either case send or deliver the completed

Proxy following the instructions set out below.

| Information Circular 2023 | | 1 |

If

the instructions in a Proxy are certain, the Shares represented thereby will be voted or withheld from voting in accordance with such

instructions on any poll that may be called for, and, where a choice with respect to any matter to be acted upon has been specified in

the Proxy, the shares represented thereby will, on a poll, be voted accordingly.

If

a Shareholder wishes to confer a discretionary authority with respect to any matter, then the space should be left blank. Where no choice

has been specified by the Shareholder and the management Proxyholders named in the form of Proxy have been appointed, such Shares will

be voted in accordance with the recommendations of management as set out on the form of Proxy.

The

enclosed form of Proxy, when properly completed and delivered and not revoked, confers discretionary authority upon the persons appointed

Proxyholders thereunder to vote with respect to any amendments or variations of matters identified in the Notice of Meeting and with

respect to other matters which may properly come before the Meeting. At the time of the printing of this Circular, the management

of the Company knows of no such amendment, variation or other matter which may be presented to the Meeting. If, however, other matters

which are not now known to the management of the Company should properly come before the Meeting, the Proxies hereby solicited will be

exercised on such matters in accordance with the best judgment of the nominees.

The

Proxy must be dated and signed by the Shareholder or the Shareholder’s attorney authorized in writing in order to be valid. In

the case of a corporation, the Proxy must be dated and executed under its corporate seal or signed by a duly authorized officer of, or

attorney for, the corporation.

Shareholders

must return their completed Proxies, together with the power of attorney or other authority, if any, under which it was signed or a notarial

certified copy thereof, in accordance with the instructions thereon. Proxies may also be returned to the Company’s transfer

agent, Computershare Investor Services Inc. (Attn: Proxy Department), by mail to 8th Floor, 100 University Avenue, Toronto,

Ontario, M5J 2Y1. In order to ensure your Proxy is valid and able to be acted upon at the Meeting, it must be received not less than

48 hours (excluding weekends and holidays) before the time set for holding of the Meeting or any adjournment or postponement thereof.

Proxies received after that time may be accepted or rejected by the Chairman of the Meeting in the Chairman’s discretion.

Registered

Shareholders

Only

persons registered as Shareholders in the Company’s central securities register as of the close of business on the Record Date,

or duly appointed Proxyholders, will be recognized to make motions at the Meeting.

Unregistered

Shareholders

Most

shareholders of the Company are “beneficial” or “unregistered” Shareholders.

You

are an unregistered Shareholder if you beneficially own Shares that are held in the name of an intermediary (such as stockbrokers, securities

dealers, banks, trust companies, trustees and their agents and nominees; each an “Intermediary”, and collectively,

“Intermediaries”). The following information is of significant importance to Shareholders who do not hold Shares

in their own name.

| Information Circular 2023 | | 2 |

Unregistered

Shareholders should note that the only Proxies that can be recognized and acted upon at the Meeting are those deposited by registered

Shareholders or as set out in the following disclosure. If Shares are listed in an account statement provided to a Shareholder by an

Intermediary, those Shares are probably not registered in the Shareholder’s name. Such Shares will probably be registered in the

name of the Intermediary, or its nominee, and can only be voted through a duly completed Proxy given by the Intermediary. In Canada,

the vast majority of such Shares are registered under the name of CDS & Co. (the registration name for The Canadian Depository

for Securities Limited, which acts as nominee for many Canadian brokerage firms). Intermediaries are required to seek voting instructions

from unregistered Shareholders in advance of meetings of shareholders. Every Intermediary has its own mailing procedures and provides

its own return instructions to clients. Without specific instructions, Intermediaries are prohibited from voting Shares for their

clients. Therefore, each unregistered Shareholder should ensure that voting instructions are communicated to the appropriate party

well in advance of the Meeting.

There

are two kinds of unregistered Shareholders – those who object to their name being made known to the issuers of securities which

they own (called “OBOs” for Objecting Beneficial Owners) and those who do not object to the issuers of securities

they own knowing who they are (called “NOBOs” for Non Objecting Beneficial Owners).

In

accordance with 54-101, the Company has elected to deliver the Meeting Materials indirectly through Intermediaries for onward distribution

to NOBOs and OBOs (unless such Shareholder has waived the right to receive such materials). The Company does not intend to pay for Intermediaries

to forward to OBOs, under NI 54-101, the Meeting Materials and Form 54-101F7 – Request for Voting Instructions Made by

Intermediary, and in the case of an OBO, the OBO will not receive these materials unless the OBO’s Intermediary assumes the

cost of delivery.

Generally,

unregistered Shareholders who have not waived the right to receive proxy-related materials will be given a Voting Instruction Form (“VIF”)

which must be completed and signed by the unregistered Shareholder in accordance with the directions in the VIF. Unregistered Shareholders

should follow the instructions of their Intermediary carefully to ensure that their Shares are voted at the Meeting. The VIF or proxy

supplied to you by your broker will be similar to the proxy provided to registered Shareholders by the Company; however, its purpose

is limited to instructing the Intermediary on how to vote your Shares on your behalf.

Most

Intermediaries in Canada and the United States of America delegate responsibility for obtaining instructions from clients to a third-party

corporation such as Broadridge Financial Solutions, Inc. Unregistered shareholders will receive a VIF in lieu of the Proxy provided

by the Company. By default, the VIF will name the same persons as the Company’s Proxy to represent your Shares at the Meeting.

However, you have the right to appoint a person (who need not be a Shareholder of the Company), other than any of the persons designated

in the VIF, to represent your Shares at the Meeting and that person may be you. To exercise this right, specify the name of the desired

representative (which may be you) in accordance with the instructions provided in the VIF. The completed VIF must then be returned to

Computershare by mail or facsimile or given to Computershare by phone or over the internet, in accordance with Computershare’s

instructions. Computershare then tabulates the results of all instructions received and provides appropriate instructions respecting

the voting of Shares to be represented at the Meeting and the appointment of any Shareholder’s representative.

If

you receive a VIF on behalf of the Company, the VIF must be completed and returned to Computershare, in accordance with its instructions,

well in advance of the Meeting in order to have your Shares voted or to have an alternative representative duly appointed to attending

the Meeting and vote your Shares at the Meeting.

Shareholders

with questions respecting the voting of Shares held through an Intermediary should contact that Intermediary for assistance.

| Information Circular 2023 | | 3 |

Revocation

of Proxies and VIFs

Shareholders

have the power to revoke Proxies previously given by them. Revocation can be effected by an instrument in writing (which includes a Proxy

or VIF, as applicable, bearing a later date) signed by a Shareholder or the Shareholder’s attorney authorized in writing and, for

a corporation, executed under its corporate seal or signed by a duly authorized officer or attorney for the corporation. Such instrument

must be delivered to Computershare as set out under the heading ‘Information about Voting – Appointment of Proxyholders’

above, to the Company as set out under the heading ‘Additional Information’ below or to the Company’s registered

office (at Suite # 2600 - 1133 Melville Street, Vancouver, BC, Canada V6E 4E5 or by fax to (+1) 604-558-7695 any time up to and

including the last business day preceding the day of the Meeting, or any adjournment thereof, or deposited

with the Chairman of the Meeting prior to the commencement of the Meeting.

VOTING

SECURITIES AND PRINCIPAL HOLDERS THEREOF

The

Shares are the only class of shares of the Company entitled to be voted at the Meeting. All issued Shares are entitled to be voted at

the Meeting and each has one non-cumulative vote. Only Shareholders of record as at the close of business on May 13, 2024 (the “Record

Date”) will be entitled to vote at the Meeting or any adjournment

thereof. As at the Record Date, the Company has 90,806,169 Shares issued and outstanding.

To

the knowledge of the directors and senior officers of the Company, as at the Record Date, the following are the only persons beneficially

owning, directly or indirectly, or exercising control or direction over voting securities carrying more than 10% of the voting rights

attached to any class of voting securities of the Company:

| Name | |

Number of Voting Securities as at Record Date(2) | | |

Percentage of Issued Voting Securities | |

| Deutsche Balaton Aktiengesellschaft (“DB”)(1) | |

| 10,896,930 | | |

| 12.00 | % |

| BlackRock, Inc. | |

| 13,009,498 | | |

| 14.33 | % |

| (1) | DB,

together with DELPHI Unternehmensberatung AG (“DU”), Sparta AG (“SP”),

and 2invest AG (“2i”) whose principal businesses are to invest their own

funds are together hereinafter referred to as “Joint Actors”. DB owns a majority

interest in SP. DU indirectly owns a majority interest in DB. Wilhelm Konrad Thomas Zours,

an individual and the sole member of the board of management

of DU, owns a majority interest in DU. The Company believes that the Joint Actors directly

or indirectly, have control and direction over the number and percentage of Shares indicated

above. |

| (2) | Based

on available public filings. |

ADVANCE

NOTICE MATTERS

Effective

November 14, 2023, the Board of Directors put in place a Shareholder Rights Plan (“SRP”). The SRP was

valid for six months unless approved by shareholders. Since no meeting of the shareholders will have been held by May 13, 2024,

the SRP is expected to expire on that date.

| Information Circular 2023 | | 4 |

INTEREST

OF CERTAIN PERSONS IN MATTERS TO BE ACTED UPON

Other

than as disclosed in this Circular, no connected person has any substantial or material interest, directly or indirectly, by way of beneficial

ownership of securities or otherwise, in any matter to be acted on at the Meeting, other than the election of directors or the appointment

of auditors. For the purpose of this paragraph, “connected person” shall include each person or company: (a) who has

been a director or executive officer of the Company at any time since the commencement of the Company’s prior financial

year; (b) who is a proposed nominee for election as a director of the Company; or (c) who is

an associate or affiliate of the foregoing person or company.

INTEREST

OF INFORMED PERSONS IN MATERIAL TRANSACTIONS

Other

than as disclosed herein, since the commencement of the Company’s most recently completed financial year, no informed person of

the Company, proposed director or any associate or affiliate of an informed person or nominee had any material interest, direct or indirect,

in any transaction or any proposed transaction which, in either case, has materially affected or would materially affect Skeena or any

of its subsidiaries.

An

“informed person” means:

| a) | a

director or executive officer of the Company, |

| b) | a

director or executive officer of a person or company that is itself an informed person or

subsidiary of the Company, |

| c) | any

person or company who beneficially owns, directly or indirectly, voting securities of the

Company or who exercises control or direction over voting securities of the Company or a

combination of both carrying more than 10% of the voting rights

attached to all outstanding voting securities of the Company other than voting securities

held by the person or company as underwriter in the course of a distribution; and |

| d) | the

Company itself, if and for so long as it holds any of its securities that it has purchased,

redeemed or otherwise acquired. |

INDEBTEDNESS

OF DIRECTORS AND OFFICERS

None

of the current or former directors, executive officers or employees of the Company or any subsidiary are indebted to the Company or any

subsidiary as at the date hereof, nor were any of them indebted to the Company or any subsidiary during the financial year ended December 31,

2023.

None

of the current or former directors and executive officers of the Company, proposed nominees for election as directors of the Company

or associates of any such persons are, as at the date hereof or at any time during the financial year ended December 31, 2023 have

been, indebted to the Company, any subsidiary or to any third party to which the Company or any subsidiary have provided a guarantee,

support agreement, letter of credit or other similar arrangement or understanding in connection with a securities purchase or other program.

| Information Circular 2023 | | 5 |

BUSINESS

AT THE MEETING

The

following business will be conducted at the meeting:

| |

Business

at the Meeting |

Board

Voting Recommendation |

Page Reference |

| 1. |

Shareholders

to receive the audited financial statements of the Company for the years ended December 31, 2023 and December 31, 2022

and the auditor’s report thereon, together with the interim financial statements for the period ended March 31, 2024 |

n/a |

6 |

| 2. |

To

set the number of directors of the Company at six (6) |

FOR |

7 |

| 3. |

To

elect Walter Coles, Jr., Randy Reichert, Craig Parry, Sukhjit (Suki) Gill, Greg Beard, and Nathalie Sajous as directors of the

Company for the ensuing year |

FOR |

7 |

| 4. |

To

appoint KPMG LLP Chartered Professional Accountants as the Company’s auditor for the ensuing year and to authorize the directors

to fix the auditor’s remuneration |

FOR |

15 |

| 6. |

To

consider such other business as may properly come before the Meeting |

n/a |

15 |

FINANCIAL

STATEMENTS

Our

audited consolidated financial statements and management’s discussion and analysis for the years ended December 31, 2023 and

2022 are available upon request from the Company. These documents were previously sent to shareholders in accordance with applicable

corporate and securities laws and can also be found on the Investors section of our website at www.skeenaresources.com

or under our profile on SEDAR+ at www.sedarplus.ca and on EDGAR at www.sec.gov.

The

audited consolidated financial statements of the Company for the fiscal years ended December 31, 2023 and December 31, 2022

together with the auditor’s report thereon, as well as the interim financial statements of the Company for the three-month period

ended March 31, 2024, will be placed before the Shareholders at the Meeting, but no Shareholder vote is required in connection with

these documents.

| Information Circular 2023 | | 6 |

NUMBER

OF DIRECTORS

Management

proposes that the number directors on the Company’s Board be set at six (6) for the ensuing year.

Shareholders

will be asked at the Meeting to approve an ordinary resolution to set the number of directors elected for the ensuing year at six (6),

subject to such increases as may be permitted by the Articles of the Company and the provisions of the BCBCA.

We

recommend a vote “FOR” the approval of the resolution setting the number of directors for the ensuing year at six (6).

In

the absence of a contrary instruction, the persons designated by management of the Company in the enclosed form of Proxy intend to vote

FOR the approval of the resolution setting the number of directors for the ensuing year at six (6).

ELECTION

OF DIRECTORS

Each

director elected holds office until our next annual general meeting, or until his or her successor is elected or appointed, unless his

or her office is earlier vacated in accordance with our Articles or with the provisions of the BCBCA.

Shareholders

will be asked at the Meeting to vote for the election of the six (6) director nominees proposed by management. Each Shareholder

will be entitled to cast their votes for or withhold their votes from the election of each director nominee.

We

recommend a vote “FOR” the election of each of the director nominees.

In

the absence of a contrary instruction, the persons designated by management of the Company in the enclosed form of Proxy intend to vote

FOR the election of the six (6) director nominees.

Director

Nominees

The

persons below are management’s nominees to the Board. The following disclosure sets out brief biographies and other relevant information

for each of the nominees proposed for election to the Board. Management contemplates that each of the following six (6) nominees

will be able to serve as director.

None

of the proposed directors is to be elected under any arrangement or understanding between the proposed director and a third party.

The

following information concerning the directors has been furnished by each of them.

| Information Circular 2023 | | 7 |

*Skeena

engaged with a number of shareholders to understand Mr. Parry’s low number of “votes-for” received at the June 22,

2023 AGM and understands that it was due to a perceived high number of other public board directorships. Skeena explained

that most of these directorships are for early-stage companies, and that the time commitment required for directorship of an early-stage

company (ie. a company listed on the TSX-Venture exchange) is typically substantially less than the time commitment required for a company

listed on a senior exchange, such as the TSX or NYSE. Further, Skeena’s view is that the connection and influence of directors holding

multiple other directorships is beneficial to Skeena, as it increases our directors’ informed industry insight, their profile and

their connections within the industry. Finally, it is evidence of their desirability as a board member. Notably, all directors have exhibited

perfect attendance at every board meeting held in the past four plus years.

| (1) | Includes principal occupation for preceding five years. |

| (2) | See "Director Compensation" section below for more information. |

| (3) | Nathalie Sajous replaced Craig Parry on the Nomination and Corporate Governance Committee for the third

meeting of 2023. |

| (4) | The approximate number of Shares, Options and Share Units of the Company as December 31, 2023 beneficially

owned, directly or indirectly, or over which control or direction is expected to be exercised by each director, is presented on a non-diluted

basis. No director, together with the director’s associates and affiliates beneficially own, directly or indirectly, or exercise

control or direction over more than 10% of the Shares. Percentages are on an undiluted basis. |

| (5) | See “Director Share Ownership Guidelines” section below for more information. |

| Information Circular 2023 | | 8 |

*Skeena engaged with a number of shareholders

to understand Mr. Beard’s low number of “votes-for” received at the June 22, 2023 AGM and understands that

it was due to Mr. Beard holding executive positions at two public companies. As of May 13, 2024, Mr. Beard only holds one

executive position with a public company.

| (1) | Includes principal occupation for preceding five years. |

| (2) | See “Director Compensation” section below for more information. |

| (3) | The approximate number of Shares, Options and Share Units of the Company as December 31, 2023 beneficially

owned, directly or indirectly, or over which control or direction is expected to be exercised by each director, is presented on a non-diluted

basis. No director, together with the director’s associates and affiliates beneficially own, directly or indirectly, or exercise

control or direction over more than 10% of the Shares. Percentages are on an undiluted basis. |

| (4) | See “Director Share Ownership Guidelines” section below for more information. |

| Information Circular 2023 | | 9 |

| (1) | Includes principal occupation for preceding five years. |

| (2) | See “Director Compensation” section below for more information. |

| (3) | Nathalie Sajous replaced Craig Parry on the Nomination and Corporate Governance Committee for the third

meeting of 2023, and on the Audit Committee on April 1, 2024. |

| (4) | The approximate number of Shares, Options and Share Units of the Company as December 31, 2023 beneficially

owned, directly or indirectly, or over which control or direction is expected to be exercised by each director, is presented on a non-diluted

basis. No director, together with the director’s associates and affiliates beneficially own, directly or indirectly, or exercise

control or direction over more than 10% of the Shares. Percentages are on an undiluted basis. |

| (5) | See “Director Share Ownership Guidelines” section below for more information. |

| Information Circular 2023 | | 10 |

| (1) | Includes principal occupation for preceding five years. |

| (2) | See "Director Compensation" section below for more information. |

| (3) | The approximate number of Shares, Options and Share Units of the Company as December 31, 2023 beneficially

owned, directly or indirectly, or over which control or direction is expected to be exercised by each director, is presented on a non-diluted

basis. No director, together with the director’s associates and affiliates beneficially own, directly or indirectly, or exercise

control or direction over more than 10% of the Shares. Percentages are on an undiluted basis. |

| (4) | See “Director Share Ownership Guidelines” section below for more information. |

| Information Circular 2023 | | 11 |

| (1) | Includes principal occupation for preceding five years. |

| (2) | See "Director Compensation" section below for more information. |

| (3) | The approximate number of Shares, Options and Share Units of the Company as December 31, 2023 beneficially

owned, directly or indirectly, or over which control or direction is expected to be exercised by each director, is presented on a non-diluted

basis. No director, together with the director’s associates and affiliates beneficially own, directly or indirectly, or exercise

control or direction over more than 10% of the Shares. Percentages are on an undiluted basis. |

| (4) | See “Director Share Ownership Guidelines” section below for more information. |

| Information Circular 2023 | | 12 |

| (1) | Includes principal occupation for preceding five years. |

| (2) | See "Director Compensation" section below for more information. |

| (3) | The approximate number of Shares, Options and Share Units of the Company as December 31, 2023 beneficially

owned, directly or indirectly, or over which control or direction is expected to be exercised by each director, is presented on a non-diluted

basis. No director, together with the director’s associates and affiliates beneficially own, directly or indirectly, or exercise

control or direction over more than 10% of the Shares. Percentages are on an undiluted basis. |

| (4) | See “Director Share Ownership Guidelines” section below for more information. |

| Information Circular 2023 | | 13 |

Corporate

Cease Trade Orders, Bankruptcies, Penalties or Sanctions

Other

than as set forth below, to the best of management’s knowledge no proposed director is, or has been within the last ten years,

a director, or executive officer of any company (including the Company) that:

| a) | while

that person was acting in that capacity, was the subject of a cease trade or similar order

or an order that denied the relevant company access to any exemption under securities legislation,

for a period of more than 30 consecutive days (hereinafter referred to as an “Order”);

or |

| b) | after

that person ceased to be a director or executive officer, was subject to an Order which resulted

from an event that occurred while that person was acting in the capacity as a director, chief

executive officer or chief financial officer; or |

| c) | while

that person was acting in that capacity or within a year of that person ceasing to act in

that capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy

or insolvency or was subject to or instituted any proceedings, arrangement or compromise

with creditors or had a receiver, receiver manager or trustee appointed to hold its assets. |

Other

than as set forth below, to the best of management’s knowledge no proposed director has, within the 10 years prior to the date

of this Circular, become bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency or become subject to or

instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold

the assets of the proposed director.

Mr. Beard

was a director of EP Energy Corp., which is an oil and gas company that is publicly traded on the OTC Markets, incorporated in Delaware

and active in Texas and Utah. In October of 2019, EP Energy Corp. sought a Chapter 11 reorganization in the U.S. Bankruptcy Court

for the Southern District of Texas.

No

proposed director has been subject to: (a) any penalties or sanctions imposed by a court relating to securities legislation or by

a securities regulatory authority or has entered into a settlement agreement with a securities regulatory authority; or (b) any

other penalties or sanctions imposed by a court or regulatory body that would likely be considered important to a reasonable investor

in making an investment decision.

The

foregoing information, not being within the knowledge of the Company, has been furnished by the respective proposed directors.

Conflicts

of Interest

There

does not exist any conflict of interest or potential material conflict of interest between the Company and any director of officer of

the Company.

Skeena

may, from time to time, become involved in transactions in which directors and officers of the Company have a direct interest or influence.

The interests of these persons could conflict with those of the Company, and fiduciary duty may be impaired as a result. Conflicts of

interest, if any, will be subject to the procedures and remedies provided under applicable laws, as well as the Company’s Code

of Business Conduct & Ethics. In particular, in the event that such a conflict of interest arises at a meeting of directors,

a director who has such a conflict will abstain from voting for or against the approval of such participation or such terms. In accordance

with applicable laws, the directors of the Company are required to act honestly, in good faith, and in the best interests of the Company.

| Information Circular 2023 | | 14 |

Majority

Voting Policy

The

Board has adopted a Majority Voting Policy for the election of directors in uncontested elections. Under this policy, if the number of

Shares withheld from voting exceeds the number of Shares voted in favor of a nominee, that nominee will be considered not to have received

the support of the Shareholders, even though he or she may have been duly elected as a matter of corporate law.

A

person elected as a director who is considered under the foregoing threshold not to have the confidence of Shareholders must immediately

submit to the Board his or her resignation for consideration by the Board. Any director who tenders his or her resignation pursuant to

the Majority Voting Policy may not participate in or attend any meeting of the Board to consider whether his or her resignation should

be accepted, unless his or her attendance is required to obtain quorum. If the director attends a meeting solely in order to permit the

Board to attain quorum, he or she must attend in silence, may not contribute to any discussion and must abstain from all votes of the

Board.

The

resignation will be considered by the Board as soon as possible, but in any case, within 30 days after the Shareholder meeting at which

the election of directors occurred. The Board will accept the resignation, absent exceptional circumstances. Following the Board’s

decision, the Company will promptly issue a press release disclosing the Board’s determination (and, if applicable, the reasons

for rejecting the resignation). The resignation will be effective when accepted by the Board.

If

the Board accepts any tendered resignation in accordance with the Majority Voting Policy, subject to any corporate law restrictions,

the Board may: (a) proceed to fill the vacancy through the appointment of a new director whom the Board considers to merit the confidence

of the Shareholders; (b) determine not to fill the vacancy until the next annual meeting; (c) call a special meeting of Shareholders

at which time there will be presented one or more management nominees to fill the vacant position; or (d) reduce the size of the

Board.

The

Majority Voting Policy does not apply in respect of any contested Shareholders’ meeting, which means any meeting of Shareholders

where the number of directors nominated for election and voted on is greater than the number of seats available on the Board.

APPOINTMENT

AND REMUNERATION OF AUDITOR

Shareholders

will be asked to approve the appointment of KPMG LLP, Chartered Professional Accountants (“KPMG”) as our auditor to

hold office until the next Annual General Meeting of Shareholders at remuneration to be fixed by the directors.

KPMG

has served as our auditor since January 6, 2022.

We

recommend a vote “FOR” the appointment of KPMG LLP, Chartered Professional Accountants, of Vancouver, British Columbia, as

our auditor to hold office until the next Annual General Meeting of Shareholders at remuneration to be fixed by the directors.

In

the absence of a contrary instruction, the persons designated by management of the Company in the enclosed form of Proxy intend to vote

FOR the appointment of KPMG at remuneration to be fixed by the directors.

OTHER

BUSINESS

It

is not known that any other matters will come before the Meeting other than as set forth above and in the Notice of Meeting accompanying

this Circular, but if such should occur, you (or your proxyholder if you are voting by proxy) can vote as you see fit. The persons named

in the accompanying Form of Proxy intend to vote on any such matters in accordance with their best judgement, exercising discretionary

authority with respect to amendments or variations of matters identified in the Notice of Meeting and other matters which may properly

come before the Meeting or any adjournment thereof.

| Information Circular 2023 | | 15 |

COMPENSATION

DISCUSSION AND ANALYSIS

KEY

HIGHLIGHTS OF THE COMPANY’S EXECUTIVE AND DIRECTOR COMPENSATION PROGRAMS

Provided

below are highlights of the Company’s compensation programs covering both the NEOs and non-executive directors:

| · | Pay

for performance – The vast majority of NEO compensation is tied to “at risk”

pay in the form of annual incentives and long-term incentives (including Options and Share

Units). For the Executive Chairman and CEO positions, 71% of target compensation is at risk,

and the average target for the other three current NEOs is 57% at risk. |

| · | Regular

review of peer group – The Compensation Committee regularly reviews the continued

relevance of the compensation peer group for NEOs and directors and adjusts the peer group

annually, as necessary, to ensure the peer group fairly reflects the ever-evolving size and

scope of the Company’s operations. |

| · | Relevant

performance metrics – The performance metrics and expected performance levels for

the annual incentive plan are reviewed on an annual basis to ensure that the metrics and

targets a) appropriately focus the NEOs on relevant activities for the business and b) tie

incentive plan awards to achieving positive outcomes for the Company and our Shareholders.

For 2023, metrics incorporated operational execution on the Eskay Creek and Snip projects,

positive year-over-year share price performance, resource growth, performance against budget

as well as regulatory, environmental and safety initiatives. |

| · | Threshold

performance expectations before incentive payouts are made – Threshold performance

expectations are set to make sure that a minimum level of performance is achieved against

annual incentive performance metrics before any payout is made for that metric. If threshold

performance is not achieved under an annual incentive performance metric then no annual incentive

will be paid for that metric. The annual incentive plan is also set so that if minimum performance

is not achieved for any of the metrics set out for the year then no annual incentive payment

will be earned or paid. Option grants, due to the requirement for the Company’s share

price to exceed the exercise price on grant date for value to be earned upon exercise, also

ensure a minimum share-performance level in order for an incentive to be payable. |

| · | Caps

on incentive payouts – Annual short-term incentive payouts are capped at 150% of

target for each NEO to ensure affordability for the Company. |

| · | Modest

benefits – Benefits are set at competitive levels, but represent a small part of

total executive compensation. These represent an investment in the health and wellbeing of

our executives and contribute to attracting and retaining top talent. |

| · | Independent

advice on compensation levels and structure – The Compensation Committee has engaged

with Global Governance Advisors since 2020 to support the Compensation Committee in making

decisions regarding executive and Board compensation at the Company (see “Compensation

Review Process” below for more information). |

| · | Share

ownership requirements – In May 2023, the Company expanded the application

of minimum share ownership requirements from independent directors to also include NEOs.

Owning an equity stake in our Company is intended to promote an alignment of interests between

the Company’s directors and Shareholders. |

| Information Circular 2023 | | 16 |

| · | Clawback

Policy – In May 2023, the Company adopted a Clawback Policy permitting the

Company to recoup any excess short-term or long-term incentive compensation, whether cash

or non-cash, received by an executive officer over the prior three years, where it is later

determined that materially non-compliant financial statements caused the executive officer

to receive excess incentive compensation. |

| · | Limits

on equity compensation to independent directors – In 2021, to help preserve director-independence,

the Company imposed a restriction limiting equity compensation to non-executive directors

to $150,000 per calendar year (with the exception of equity granted in lieu of cash fees). |

| · | Review

of compensation risk – The Compensation Committee monitors the risk inherent within

its compensation program at least annually to ensure the program does not encourage excessive

risk-taking. |

| · | No

guaranteed increases in executive employment agreements – NEO employment agreements

do not contain any guaranteed increases in compensation levels, and in fact NO INCREASES

to 2022 base-salaries were granted to NEO’s during 2023. |

| · | No

re-pricing, backdating or exchanges of long-term incentive awards – Skeena does

not re-price, backdate or exchange long-term incentive awards. |

| · | No

excessive Change of Control or Termination without Cause severance obligations –

NEO severance obligations are capped at no higher than 24 months in the case of a change

of control of the Company and no higher than 18 months in the case of termination without

cause which falls within acceptable market norms. |

| · | No

hedging of Skeena securities – The Company’s Corporate Disclosure &

Insider Trading Policy includes the prohibition of hedging or derivative trading of Skeena

securities for NEOs and non-executive directors. |

| · | No

single-trigger change of control provisions – Change of control provisions in the

Company’s employment agreements only trigger when there is both a change in control

of the Company and a subsequent termination of employment. |

COMPENSATION

GOVERNANCE

During

2023, the Company had a fully independent Compensation Committee comprised of two members (Craig Parry and Suki Gill), with Craig Parry

being Committee Chair. Each of the members of the Compensation Committee have experience in the areas of human resources and compensation

that is relevant to overseeing and advising on the Company’s executive compensation practices. Mr. Parry is a current and

former director and officer of various publicly traded mineral exploration companies. In those roles, he has reviewed and analyzed compensation

strategy, practices and structures at both the Board and management levels. The Compensation Committee members had the necessary experience

to enable them to make decisions on the suitability of the Company’s compensation policies or practices during 2023. The Compensation

Committee’s responsibilities, powers and operation are summarized in the section below and are described in detail in the Compensation

Committee Charter which is available on the governance page of our website.

EXECUTIVE

COMPENSATION OBJECTIVES AND PHILOSOPHY

The

Board recognizes that the Company’s success depends greatly on its ability to attract, retain and motivate high performing employees,

which can only occur if the Company has an appropriately structured and implemented compensation program.

| Information Circular 2023 | | 17 |

The

executive compensation program is intended to motivate our executive officers to achieve Skeena’s strategic objectives and operational

plans and create outstanding shareholder value, while staying true to our mission, vision and values.

Our

executive compensation philosophy has the following four core goals:

| 1. | to

assist the Company in attracting and retaining high quality employees and executives with

the requisite skill set; |

| 2. | to

align our executive team’s interests with those of our Shareholders; |

| 3. | to

encourage and motivate outsized performance by reflecting each executive’s performance,

expertise, and impact; and |

| 4. | to

be responsive to the Company’s past performance and current state of development. |

Since

2020, the Company, through the Compensation Committee, has engaged Global Governance Advisors (“GGA”), an independent

compensation advisor with significant global executive and director compensation experience, to evaluate and provide recommendations

on formalizing the Company’s executive and director compensation programs to be market-competitive among a defined “Peer

Group” (as detailed below) and in the overall mining marketplace. This evaluation included analysis of the Company’s Peer

Group and comparison of total direct compensation (base salary plus short-term incentive and long-term incentive) levels along with analysis

of the Company’s short and long-term design practices relative to the competitive market. The Company’s Peer Group is reviewed

periodically to ensure it remains generally aligned with the current size and scope of the Company’s operations. The Peer Group

is aimed at companies that generally meet the following criteria:

| · | Companies

with a market capitalization between 25% and 400% of Skeena; |

| · | Companies

within the same industry segment as Skeena (i.e. gold and precious metals mining); |

| · | Companies

who are generally in the feasibility study, construction or early production phase; |

| · | Companies

with a similar business strategy and scope of operations to Skeena; and |

| · | Publicly

traded companies on major North American exchanges. |

The

Company’s current Peer Group consists of the following companies:

| Argonaut Gold Inc. |

Orla Mining Ltd. |

| Artemis Gold Inc. |

Osisko Mining Inc. |

| Ero Copper Corp. |

Seabridge Gold Inc. |

| Lithium Americas Corp. |

Silvercorp Metals Inc. |

| MAG Silver Corp. |

SilverCrest Metals Inc. |

| Marathon Gold Corp. |

--------- |

As

compared with the prior year, Sabina Gold & Silver Corp., and Orezone Gold Corp were removed from the peer group either due

to their size no longer being relevant or due to their having been acquired. One new company, Lithium Americas Corp., was added during

the year in order to maintain the approximate size of the Peer Group.

| Information Circular 2023 | | 18 |

Similar

to past years, Peer Group data is also supplemented by data for similar-sized companies in the broader mining industry from GGA’s

compensation database as an additional reference point in the Company’s review of executive and director compensation.

GGA

last completed a compensation review for the Company’s executives and non-employee directors in the fall of 2023, which took into

account Skeena’s market capitalization and dual-listing in Canada and the United States. The Peer Group is intended to evolve over

time as the nature of Skeena’s operations changes and as the Company moves closer to a construction decision on the Eskay Creek

Project.

The

Company’s compensation program is designed to motivate and reward an executive officer’s current and future expected performance.

Individual performance of executive officers is based on quantitative evaluations of the Company’s achievement of specific corporate

objectives for which the executive has sole or shared responsibility.

The

Board has adopted a Corporate Disclosure & Insider Trading Policy which includes the prohibition of hedging and derivative trading

for members of the Board and senior management of the Company. During 2023, no Named Executive Officer or director, directly or indirectly,

purchased any financial instruments or employed a strategy to hedge or offset a decrease in market value of equity securities granted

as compensation or held.

COMPENSATION

REVIEW PROCESS

The

Compensation Committee is tasked with the responsibility of, among other things, recommending to the Board compensation policies and

guidelines for executives and directors, and for implementing and overseeing compensation policies approved by the Board. It is assisted

in this by an external compensation consultant (GGA) who performs a benchmarking of Skeena’s compensation structure against a group

of peer companies, and provides suggestions and guidance to the Compensation Committee in their recommending appropriate levels of remuneration

and an appropriate compensation structure for selected senior employees within the company.

The

Compensation Committee is required to pre-approve any compensation-related engagements by GGA. Although management of the Company may

work with GGA on compensation specifics, GGA reports directly to the Compensation Committee in all engagements undertaken. The Company

incurred the following fees for GGA’s work over the past two years:

| Year | |

Executive Compensation Related Fees | | |

All Other Fees | |

| 2023 | |

$ | 72,900 | | |

$ | 59,441 | |

| 2022 | |

$ | 22,100 | | |

$ | 45,575 | |

During

2022 and 2023, the Compensation Committee engaged GGA to review the Company’s peer group as well as provide a comprehensive compensation

benchmark analysis for our Named Executive Officers and non-employee directors against the approved peer group. This work included analysis

of competitive compensation levels, and also a review of short and long-term incentive plan designs at the Company, along with a comparison

to our peers. They also have assisted the Company in reviewing its Management Information Circular the last two years as well. In 2023

GGA specifically assisted with a number of additional special projects, including:

| i) | the

development of the Omnibus Plan which was approved at the June 22, 2023 AGM; |

| ii) | stress-testing

the Company’s equity incentive plans under various share price, burn rate and LTIP

forecast scenarios in order to help guide the Company as to future structure; |

| Information Circular 2023 | | 19 |

| iii) | reviewing

the Company’s clawback policy prior to implementation in 2023; |

| iv) | reviewing

the Company’s share ownership guideline policy prior to implementation in 2023; and |

| v) | reviewing

and recommending updates to board-committee charters as part of a broad governance review. |

Additionally,

in assessing compensation levels, the Compensation Committee relies on the experience of their members as officers, directors and auditors

of other publicly traded mineral exploration and development companies. The purpose of this assessment process is to:

| · | evaluate

the trends in executive and non-employee director compensation design; |

| · | understand

the competitiveness of current pay levels for each executive position relative to companies

with similar business characteristics; |

| · | identify

and understand any gaps that may exist between the Company’s compensation rates and

compensation paid by other companies; and |

| · | establish

a basis for developing salary adjustments and short-term and long-term incentive awards. |

The

Compensation Committee reviews on an annual basis the cash compensation, performance and overall compensation package of each executive

officer, including the Named Executive Officers. It then submits to the Board recommendations for each executive officer with respect

to base salary, bonus, and participation in equity compensation under the Omnibus Plan.

The

Compensation Committee considered the implications of the risks associated with the Company’s compensation policies and practices

and concluded that, given the nature of the Company’s business and the role of the Compensation Committee in overseeing the Company’s

executive compensation practices, the compensation policies and practices do not serve to encourage any Named Executive Officer to take

inappropriate or excessive risks, and no risks were identified arising from the Company’s compensation policies and practices that

were reasonably likely to have a material adverse effect on the Company.

Clawback

Policy

In

response to GGA’s recommendations and regulatory requirements, Skeena adopted a clawback policy in May 2023 covering our Named

Executive Officers which provides that - in the event of a required accounting restatement - the Compensation Committee will seek reimbursement

of any incentive-based compensation that would not have been paid had our financial statements been correctly stated. This policy is

available on the governance page of our website.

Elements

of the Executive Compensation Program

The

Company’s compensation program is comprised of five (5) components:

| a. | Base

salary; |

| b. | Incentive

bonus (short term); |

| c. | Annual

grants of equity compensation, through the Omnibus Plan (long term); |

| d. | Periodic

special milestone grants of performance-linked equity compensation, through the Omnibus Plan

(long term); and |

| e. | Employee

group benefits. |

| Information Circular 2023 | | 20 |

| Component |

Rationale &

Process |

| Base

Salary |

· Forms

the basis for attracting talent, and comparing to and remaining competitive with the market.

· Fixed

in amount, and is the basis for other elements of the compensation program.

· The

Compensation Committee performs an assessment of the compensation of the NEOs at the beginning of the year based on benchmarking

performed by an independent compensation consultant, grounded in market-based data. The base salary for each NEO is generally targeted

at the median of the peer group, while taking into account an assessment of the current competitive market, economic conditions,

company performance (both on an absolute basis and relative to the peer group), levels of responsibility, internal equity, and the

particular skills of each NEO such as leadership ability, management effectiveness, prior experience, technical skill, breadth of

knowledge and proven or expected performance of the particular individual.

· The

Compensation Committee then makes a recommendation for base salary levels of the NEOs to the Board of Directors who make the final

decision. |

Incentive

Bonus

(short term) |

· Links

pay to corporate, team and individual achievements for the year.

· Overall

incentive bonus opportunity is targeted at the median of the peer group with the ability to pay above median when superior results

are achieved.

· Incentive

bonus criteria are established at the start of the year and include specific criteria aligned with Company goals. Successful achievement

of a specific incentive bonus criteria will trigger a partial incentive bonus payout using a balanced scorecard approach. The Compensation

Committee assesses NEO performance against the incentive bonus criteria annually and, if criteria are met, approves the payment of

incentive bonuses. If a minimum ‘threshold’ level of performance is not achieved then no incentive bonus is paid to an

NEO. |

Annual

Equity Compensation

(long term) |

· Links

pay to the longer-term performance of the Company’s shares.

· The

level of equity compensation granted is targeted at the median of the peer group with the ability to realize value from equity above

median when superior share price performance is achieved for the Company’s Shareholders.

· The

Company has historically granted long-term incentives in the form of Options, which have a 5-year term to expiry, and Share Units,

both of which typically vest over a three-year period.

· Equity

compensation helps reduce cash needs, promotes retention of key executives and helps align the interests of management with the interests

of Shareholders by linking a component of executive compensation to the longer-term performance of the Company’s Shares. This

is designed to reduce the risk of management pursuing short term gains which sacrifice longer term value. Also, in combination with

the minimum share ownership guidelines, equity compensation encourages share ownership among management. |

| Information Circular 2023 | | 21 |

| Component |

Rationale &

Process |

Special

Performance-Linked Equity Compensation

(long term) |

· Designed

to encourage the achievement of very significant multi-year value-creation milestones, e.g.

the Definitive Feasibility Study for Eskay Creek.

· Not

designed to be awarded annually, but can be during periods of achieving significant milestones.

· Performance

linked:

· Better

performance drives larger award, within boundaries.

· No

award for below threshold performance.

· No

award if gating criteria not satisfied.

· Specific

performance metrics for the Definitive Feasibility Study included:

· A

threshold-NPV of greater than $1.4B and up to $1.6B, given specified inputs, a pre-production CAPEX of less than $800M, and a requirement

to be published by December 31, 2023.

· Gating

criteria included:

a) Environment:

projected greenhouse gas intensity of less than 0.295 t CO2 per ounce of gold equivalent produced.

b) Diversity:

employing at least 33% more than the BC Mining Industry average within two under-represented groups: women and Indigenous persons.

|

| Employee

Group Benefits |

· Participation

in the Company’s competitive employee group benefits plans is offered to each member

of management, and includes: health and dental coverage; life and accident insurance coverage;

short-term and long-term disability coverage; and health spending accounts.

· There

is NO employee share purchase plan, NO RRSP matching and NO pension plan.

· Employee

group benefits are designed to be competitive overall with equivalent positions in the mining industry of similar size and scope. |

Base

Salary

In

determining the annual base salary, the Board, with the recommendation of the Compensation Committee, considered the following factors:

| · | current

competitive market and economic conditions; |

| · | compensation

levels within the peer group; |

| · | Company

performance as compared with the peer group, including share-price performance; |

| · | internal

equity; |

| · | levels

of responsibility and particular skills of each NEO, including leadership ability, management

effectiveness, prior experience, technical skill, breadth of knowledge and proven or expected

performance of the particular individual; and |

| · | the

Company’s overall advancement of the Eskay Creek project toward commercial production. |

Notably,

NO INCREASES to base-salaries were granted to NEOs during 2023.

| Information Circular 2023 | | 22 |

The

annual base salaries for NEOs were as follows:

| Named Executive Officer and Position | |

2023 Base

Salary ($) | | |

2022 Base

Salary ($) | | |

% change

YOY | |

| Walter Coles, Jr., Executive Chairman | |

$ | 600,000 | | |

$ | 600,000 | | |

| 0 | % |

| Randy Reichert, President and CEO | |

$ | 600,000 | | |

$ | 600,000 | (1) | |

| 0 | % |

| Andrew MacRitchie, CFO | |

$ | 400,000 | | |

$ | 400,000 | | |

| 0 | % |

| Shane Williams, Chief Operating Officer (“COO”) | |

$ | 450,000 | (2) | |

$ | 450,000 | | |

| 0 | % |

| Paul Geddes, SVP Exploration & Resource Development | |

$ | 350,000 | | |

$ | 350,000 | | |

| 0 | % |

| Justin Himmelright, SVP External Affairs | |

$ | 350,000 | | |

$ | 350,000 | | |

| 0 | % |

| (1) | Mr. Reichert

began 2022 as a Director of the Company. Mr. Reichert was appointed as President on

April 16, 2022 and as CEO on October 31, 2022. The 2022 Base Salary figure shown

in the table represents Mr. Reichert’s annualized base salary as after his appointment

as President, CEO, and Director during 2022. The actual base salary received by Mr. Reichert

in 2022 totalled $413,081. |

| (2) | Mr. Williams

ceased being an officer of the Company January 9, 2023. The 2023 Base Salary figure

shown in the table represents Mr. Williams’ annualized base salary for 2023. The

actual base salary received by Mr. Williams in 2023, including accrued vacation paid

out, totalled $56,492. |

Incentive

Bonus Payments

The

incentive bonuses are payable in cash, and the amount payable is based on the Compensation Committee’s assessment of performance

against pre-established objectives and targets in a balanced scorecard. While the objectives are largely tied to Company results, the

specific metrics, scorecard weightings and performance expectations are tailored to each executive to ensure appropriate line-of-sight

between the results achieved and the incentive bonus payout earned.

The

table below summarizes the 2023 target incentive bonus opportunity as a percentage of base salary established by the Compensation Committee

at the beginning of the year.

| Named Executive Officer and Position | |

Target Incentive Bonus

Opportunity (% of Base Salary) | |

| Walter Coles, Jr., Executive Chairman | |

| 100 | % |

| Randy Reichert, President and CEO | |

| 100 | % |

| Andrew MacRitchie, CFO | |

| 60 | % |

| Paul Geddes, SVP Exploration & Resource Development | |

| 50 | % |

| Justin Himmelright, SVP External Affairs | |

| 50 | % |

In

respect of the 2023 financial year, the Board, with the recommendation of the Compensation Committee, awarded performance bonuses to

the NEOs. The Board completed the final assessment of 2023 performance in December 2023.

| Information Circular 2023 | | 23 |

Balanced

scorecard criteria for the determination of the NEOs’ 2023 incentive bonus amounts fell into the following categories:

| Named

Executive Officer | |

Share

Price

Return | | |

Achieve

Budget | | |

Safety &

Environment | | |

Investor

Interest | | |

Resource

Growth | | |

Project

Milestones | | |

Systems &

Processes | |

| Executive

Chairman | |

| 10 | % | |

| 15 | % | |

| 10 | % | |

| 25 | % | |

| 20 | % | |

| 20 | % | |

| | |

| President &

CEO | |

| 10 | % | |

| 15 | % | |

| 10 | % | |

| 25 | % | |

| 20 | % | |

| 20 | % | |

| | |

| CFO | |

| 10 | % | |

| 32.5 | % | |

| 10 | % | |

| 30 | % | |

| | | |

| | | |

| 17.5 | % |

| SVP Exploration &

Resource Development | |

| 10 | % | |

| 20 | % | |

| 15 | % | |

| | | |

| 25 | % | |

| 30 | % | |

| | |

| SVP External

Affairs | |

| 10 | % | |

| 20 | % | |

| 15 | % | |

| | | |

| 12.5 | % | |

| 42.5 | % | |

| | |

The

following table shows the performance factors awarded against each of the 2023 performance measures, and indicates which measures were

“Corporate” or company-wide, and which were team-specific.

| Category |

2023

Performance Measure |

2023

Performance

Factor |

Corporate

or Team |

| Share

Price Return |

Share

price increase of 33% to 100% |

0% |

Corporate |

| Achieve

Budget |

Achieve

corporate objectives within budget |

100% |

Corporate |

| Safety |

Improve

safety performance |

0% |

Corporate |

| Reduce