U.S. Silica Holdings, Inc. (NYSE: SLCA) announced today net

income of $17.3 million or $0.33 per basic and $0.32 per diluted

share for the first quarter ended March 31, 2013 compared with net

income of $19.1 million or $0.37 per basic and diluted share for

the same period in 2012. Earnings per share in the quarter were

negatively impacted by $1.9 million on a pre-tax basis or $0.03 per

share due to certain non-recurring charges related to our secondary

offering in March and M&A and business development activities.

Excluding this additional expense, net income for the first quarter

ended March 31, 2013 was $18.7 million or $0.35 per basic

share.

Bryan A. Shinn, president and chief executive officer of the

company commented, “The first quarter of 2013 was very strong for

our company as we posted record revenue, driven by our strong

performance in oil and gas. We believe that drilling and efficiency

improvements in hydraulic fracturing will drive increased demand in

oil and gas and we expect to grow market share in a growing

market.” Shinn added that, “We are also seeing success in our ISP

business. We anticipate this segment will continue to be a positive

contributor to this year’s earnings growth, due to the continuing

rebounds in housing, chemical and automotive end markets and our

focus on developing and marketing higher value offerings.”

First Quarter 2013 Highlights

Total Company

- Revenue totaled $122.3 million compared

with $102.6 million for the same period in 2012, an improvement of

19.2%. The increase was driven primarily by strength in the Oil and

Gas Proppants segment.

- Overall sales volumes increased to 1.9

million tons, an increase of 8.2% over the first quarter of

2012.

- Contribution margin for the quarter of

$49.4 million compared with $47.4 million for the same period last

year.

- Adjusted EBITDA was $38.8 million or

31.7% of revenue compared with $37.0 million or 36.1% of revenue

for the same period last year.

Oil and Gas

- Revenue for the quarter totaled $73.6

million compared with $53.8 million in the same period in

2012.

- Segment contribution margin was $36.2

million versus $35.1 million in the first quarter of 2012.

- Tons sold totaled 920,569 versus

678,982 sold in the first quarter of 2012.

Industrial and Specialty

Products

- Revenue for the quarter totaled $48.7

million compared with $48.8 million for the same period in

2012.

- Segment contribution margin was $13.2

million versus $12.4 million in the first quarter of 2012.

- Tons sold totaled 964,956 compared with

1,063,900 sold in the first quarter of 2012.

Capital Update

As of March 31, 2013, the Company had $42.9 million in cash and

cash equivalents and $29.0 million available under its credit

facilities. Total outstanding debt at March 31, 2013 totaled $265.4

million. Capital expenditures in the first quarter totaled $22.7

million and were associated primarily with our raw sand plant in

Sparta, Wisconsin, the acquisition of an existing silica sand

processing facility near our Ottawa operations, and the

construction of three new transloads in Texas, West Virginia and

Ohio.

Quarterly Cash Dividend

The Company’s Board of Directors has declared a regular

quarterly cash dividend of $0.125 per share to common shareholders

of record at the close of business on June 19, 2013, payable on

July 3, 2013. Future declarations of dividends are subject to

approval of the Board. Commenting on the Board’s decision,

President and CEO Bryan Shinn said “the initiation of this dividend

reflects the confidence that we have in our future business

prospects and ability to generate cash beyond the needs for growth

investment.”

Outlook and Guidance

The company expects revenues of approximately $132 million to

$140 million and adjusted EBITDA of between $39 million and $42

million in the second quarter of 2013. For the full year, 2013, the

Company is reaffirming its guidance for adjusted EBITDA in the

range of $165 million to $175 million and capital expenditures of

between $50 and $60 million.

Conference Call

U.S. Silica will host a conference call for investors today,

April 30, 2013 at 10:00 a.m. Eastern Time to discuss these results.

Hosting the call will be Bryan A. Shinn, President and Chief

Executive Officer and Don Merril, Vice President and Chief

Financial Officer. Investors are invited to listen to a live

webcast of the conference call by visiting the “Investor Resources”

section of the Company’s website at www.ussilica.com. The webcast

will be archived for one year. The call can also be accessed live

over the telephone by dialing (877) 705-6003 or for international

callers, (201) 493-6725. A replay will be available shortly after

the call and can be accessed by dialing (877) 870-5176, or for

international callers, (858) 384-5517. The Passcode for the replay

is 412223. The replay of the call will be available through May 31,

2013.

About U.S. Silica

U.S. Silica Holdings, Inc., a Delaware corporation, is the

second largest domestic producer of commercial silica, a

specialized mineral that is a critical input into the oil and gas

proppants end market. The company also processes ground and

unground silica sand for a variety of industrial and specialty

products end markets such as glass, fiberglass, foundry molds,

municipal filtration and recreational uses. During its 100-plus

year history, U.S. Silica Holdings, Inc. has developed core

competencies in mining, processing, logistics and materials science

that enable it to produce and cost-effectively deliver over 250

products to customers across these end markets. U.S. Silica

Holdings, Inc. is headquartered in Frederick, MD.

Forward-looking Statements

Certain statements in this press release are “forward-looking

statements” made pursuant to the safe harbor provisions of the

Private Securities Litigation Reform Act of 1995 and speak only as

of this date. Forward-looking statements made include any statement

that does not directly relate to any historical or current fact and

may include, but are not limited to, statements regarding U.S.

Silica’s growth opportunities, strategy, future financial results,

forecasts, projections, plans and capital expenditures, and the

commercial silica industry. Forward-looking statements are based on

our current expectations and assumptions, which may not prove to be

accurate. These statements are not guarantees and are subject to

risks, uncertainties and changes in circumstances that are

difficult to predict. Many factors could cause actual results to

differ materially and adversely from these forward-looking

statements. Among these factors are: (1) fluctuations in demand for

commercial silica; (2) the cyclical nature of our customers’

businesses; (3) operating risks that are beyond our control; (4)

federal, state and local legislative and regulatory initiatives

relating to hydraulic fracturing; (5) our ability to implement our

capacity expansion plans within our current timetable and budget;

(6) loss of, or reduction in, business from our largest customers;

(7) increasing costs or a lack of dependability or availability of

transportation services or infrastructure; (8) our substantial

indebtedness and pension obligations; (9) our ability to attract

and retain key personnel; (10) silica-related health issues and

corresponding litigation; (11) seasonal and severe weather

conditions; and (12) extensive and evolving environmental, mining,

health and safety, licensing, reclamation and other regulation (and

changes in their enforcement or interpretation). Additional

information concerning these and other factors can be found in U.S.

Silica’s filings with the Securities and Exchange Commission. We

undertake no obligation to publicly update or revise any

forward-looking statement as a result of new information, future

events or otherwise, except as otherwise required by law.

U.S. SILICA HOLDINGS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS

Three Months Ended March 31, 2013

2012 (in thousands, except per share amounts)

Sales $ 122,311 $ 102,591 Cost of goods sold (excluding

depreciation, depletion and amortization) 74,412 56,921 Operating

expenses Selling, general and administrative 12,404 9,904

Depreciation, depletion and amortization 8,278 5,978

20,682 15,882 Operating income 27,217 29,788 Other

(expense) income Interest expense (3,576) (3,797) Other income,

net, including interest income 122 154 (3,454)

(3,643) Income before income taxes 23,763 26,145

Income tax expense

(6,486) (7,032) Net income $ 17,277 $ 19,113

Earnings per share: Basic $ 0.33 $ 0.37 Diluted $ 0.32 $ 0.37

U.S. SILICA HOLDINGS, INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

March 31, December 31, 2013 2012

(in thousands) ASSETS Current Assets: Cash and

cash equivalents $ 42,919 $ 61,022 Accounts receivable, net 65,249

59,564 Inventories, net 42,776 39,835 Prepaid expenses and other

current assets 7,686 6,738 Deferred income tax, net 10,122

10,108 Total current assets 168,752 177,267

Property, plant and mine development, net 429,611 414,218 Debt

issuance costs, net 1,980 2,111 Goodwill 68,403 68,403 Trade names

10,436 10,436 Customer relationships, net 6,428 6,531 Other assets

8,451 7,844 Total assets $ 694,061 $ 686,810

LIABILITIES AND STOCKHOLDERS’ EQUITY Current

Liabilities: Book overdraft $ 4,376 $ 5,390 Accounts payable

30,307 37,333 Accrued liabilities 10,080 9,481 Accrued interest 154

2 Current portion of capital lease 489 - Current portion of

long-term debt 2,434 2,433 Short-term debt 10,551 - Income tax

payable 6,149 20,596 Current portion of deferred revenue

2,938 4,855 Total current liabilities 67,478

80,090 Long-term debt 252,383 252,992 Liability for pension and

other post-retirement benefits 52,768 52,747 Deferred income tax,

net 60,154 59,111 Other long-term obligations 10,323

10,176 Total liabilities 443,106 455,116 Commitments and

contingencies

Stockholders’ Equity: Common stock 529

529 Preferred stock - - Additional paid-in capital 164,535 163,579

Retained earnings 100,008 82,731 Treasury stock, at cost (364)

(970) Accumulated other comprehensive loss (13,753)

(14,175) Total stockholders’ equity 250,955 231,694

Total liabilities and stockholders’ equity $ 694,061 $ 686,810

Non-GAAP Financial Measures

Adjusted EBITDA

Adjusted EBITDA is not a measure of our financial performance or

liquidity under GAAP and should not be considered as an alternative

to net income as a measure of operating performance, cash flows

from operating activities as a measure of liquidity or any other

performance measure derived in accordance with GAAP. Additionally,

Adjusted EBITDA is not intended to be a measure of free cash flow

for management’s discretionary use, as it does not consider certain

cash requirements such as interest payments, tax payments and debt

service requirements. Adjusted EBITDA contains certain other

limitations, including the failure to reflect our cash

expenditures, cash requirements for working capital needs and cash

costs to replace assets being depreciated and amortized, and

excludes certain non-recurring charges that may recur in the

future. Management compensates for these limitations by relying

primarily on our GAAP results and by using Adjusted EBITDA only

supplementally. Our measure of Adjusted EBITDA is not necessarily

comparable to other similarly titled captions of other companies

due to potential inconsistencies in the methods of calculation.

Three Months Ended March 31, 2013

2012 (in thousands) Net income $ 17,277 $ 19,113

Total interest expense, net of interest income 3,552 3,763

Provision for taxes

6,486 7,032 Total depreciation, depletion and amortization expenses

8,278 5,978 EBITDA 35,593 35,886

Non-recurring expense (income)(1)

- (439) Transaction expenses(2) - 156 Non-cash incentive

compensation(3) 678 654 Post-employment expenses (excluding service

costs)(4) 586 605 Other adjustments allowable under our existing

credit agreements(5) 1,930 125 Adjusted EBITDA $

38,787 $ 36,987 (1) Includes the gain on sale of assets for

the three months ended March 31, 2013, and 2012, respectively. (2)

Includes fees and expenses related to the January 27, 2012

amendment of our Term Loan and Revolver. (3) Includes vesting of

incentive equity compensation issued to our employees. (4) Includes

net pension cost and net post-retirement cost relating to pension

and other post-retirement benefit obligations during the applicable

period, but in each case excluding the service cost relating to

benefits earned during such period. See Note Q to our Consolidated

Financial Statements in Part I, Item 1 of this Quarterly Report on

Form 10-Q. (5) Reflects miscellaneous adjustments permitted under

our existing credit agreements, including such items as expenses

related to a secondary offering by Golden Gate Capital and

reviewing growth initiatives and potential acquisitions.

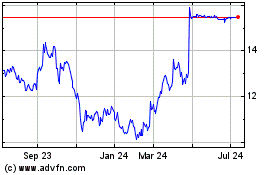

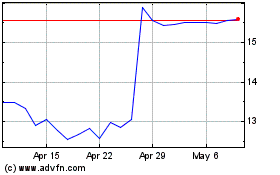

Silica (NYSE:SLCA)

Historical Stock Chart

From Jun 2024 to Jul 2024

Silica (NYSE:SLCA)

Historical Stock Chart

From Jul 2023 to Jul 2024