Statement of Changes in Beneficial Ownership (4)

January 12 2022 - 5:18PM

Edgar (US Regulatory)

FORM 4

[ ]

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue. See Instruction 1(b).

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

Warner Nicholas |

2. Issuer Name and Ticker or Trading Symbol

SentinelOne, Inc.

[

S

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

_____ Director _____ 10% Owner

__X__ Officer (give title below) _____ Other (specify below)

Chief Operating Officer |

|

(Last)

(First)

(Middle)

C/O SENTINELONE, INC., 444 CASTRO STREET, SUITE 400 |

3. Date of Earliest Transaction

(MM/DD/YYYY)

1/10/2022 |

|

(Street)

MOUNTAIN VIEW, CA 94041

(City)

(State)

(Zip)

|

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

_X

_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

| Class A Common Stock | 1/10/2022 | | C | | 62166 (1) | A | $0.6467 | 63342 (2) | D | |

| Class A Common Stock | 1/10/2022 | | S(3) | | 19185 | D | $41.0386 (4) | 44157 (2) | D | |

| Class A Common Stock | 1/10/2022 | | S(3) | | 10140 | D | $42.3958 (5) | 34017 (2) | D | |

| Class A Common Stock | 1/10/2022 | | S(3) | | 5357 | D | $43.1023 (6) | 286610 (2) | D | |

| Class A Common Stock | 1/10/2022 | | S(3) | | 3400 | D | $44.3066 (7) | 25260 (2) | D | |

| Class A Common Stock | 1/10/2022 | | S(3) | | 20459 | D | $45.2124 (8) | 4801 (2) | D | |

| Class A Common Stock | 1/10/2022 | | S(3) | | 3625 | D | $45.9381 (9) | 1176 (2) | D | |

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3) | 2. Conversion or Exercise Price of Derivative Security | 3. Trans. Date | 3A. Deemed Execution Date, if any | 4. Trans. Code

(Instr. 8) | 5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5) | 6. Date Exercisable and Expiration Date | 7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4) | 8. Price of Derivative Security

(Instr. 5) | 9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4) | 10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4) | 11. Nature of Indirect Beneficial Ownership (Instr. 4) |

| Code | V | (A) | (D) | Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| Stock Option (Right to Buy) | $0.6467 | 1/10/2022 | | M | | | 62166 | (10) | 8/1/2027 | Class B Common Stock | 62166 | $0.00 | 797211 | D | |

| Class B Common Stock | (11)(12) | 1/10/2022 | | M | | 62166 | | (11)(12) | (11)(12) | Class A Common Stock | 62166 | $0.00 | 62166 | D | |

| Class B Common Stock | (11)(12) | 1/10/2022 | | C | | | 62166 | (11)(12) | (11)(12) | Class A Common Stock | 62166 | $0.00 | 0 | D | |

| Explanation of Responses: |

| (1) | Represents the number of shares that were acquired upon conversion of Class B common stock to Class A common stock. |

| (2) | Includes 1,176 shares acquired under the Employee Stock Purchase Plan on January 5, 2022. |

| (3) | The transactions reported on this Form 4 were effected pursuant to a Rule 10b5-1 trading plan adopted by the reporting person on July 14, 2021. |

| (4) | The price reported in Column 4 is a weighted average price. These shares were sold in multiple transactions at prices ranging from $40.74 to $41.72, inclusive. The reporting person undertakes to provide to the Issuer, any security holder of the Issuer, or the staff of the Securities and Exchange Commission, upon request, full information regarding the number of shares sold at each separate price within the ranges set forth herein. |

| (5) | The price reported in Column 4 is a weighted average price. These shares were sold in multiple transactions at prices ranging from $41.76 to $42.75, inclusive. The reporting person undertakes to provide to the Issuer, any security holder of the Issuer, or the staff of the Securities and Exchange Commission, upon request, full information regarding the number of shares sold at each separate price within the ranges set forth herein. |

| (6) | The price reported in Column 4 is a weighted average price. These shares were sold in multiple transactions at prices ranging from $42.76 to $43.75, inclusive. The reporting person undertakes to provide to the Issuer, any security holder of the Issuer, or the staff of the Securities and Exchange Commission, upon request, full information regarding the number of shares sold at each separate price within the ranges set forth herein. |

| (7) | The price reported in Column 4 is a weighted average price. These shares were sold in multiple transactions at prices ranging from $43.76 to $44.74, inclusive. The reporting person undertakes to provide to the Issuer, any security holder of the Issuer, or the staff of the Securities and Exchange Commission, upon request, full information regarding the number of shares sold at each separate price within the ranges set forth herein. |

| (8) | The price reported in Column 4 is a weighted average price. These shares were sold in multiple transactions at prices ranging from $44.79 to $45.78, inclusive. The reporting person undertakes to provide to the Issuer, any security holder of the Issuer, or the staff of the Securities and Exchange Commission, upon request, full information regarding the number of shares sold at each separate price within the ranges set forth herein. |

| (9) | The price reported in Column 4 is a weighted average price. These shares were sold in multiple transactions at prices ranging from $45.79 to $46.00, inclusive. The reporting person undertakes to provide to the Issuer, any security holder of the Issuer, or the staff of the Securities and Exchange Commission, upon request, full information regarding the number of shares sold at each separate price within the ranges set forth herein. |

| (10) | The stock option is fully vested. |

| (11) | Each share of Class B common stock is convertible into one share of Class A common stock at any time and will convert automatically upon certain transfers and upon the earlier of (i) the date specified by a vote of the holders of 66 2/3% of the then outstanding shares of Class B common stock, (ii) seven years from the effective date of the Issuer's initial public offering ("IPO"), (iii) the first date following the IPO on which the number of shares of outstanding Class B common stock (including shares of Class B common stock subject to outstanding stock options) held by Tomer Weingarten, including certain entities that Mr. Weingarten controls, is less than 25% of the number of shares of Class B common stock (including shares of Class B common stock subject to outstanding stock options) that Mr. Weingarten originally held as of the date of the IPO, |

| (12) | (continued from footnote 11) (iv) the date fixed by the Issuer's board of directors (the "Board"), following the first date following the completion of this offering when Mr. Weingarten is no longer providing services to the Issuer as an officer, employee, consultant or member of the Board, (v) the date fixed by the Board following the date, if applicable, on which Mr. Weingarten is terminated for cause, as defined in the Issuer's restated certificate of incorporation, and (vi) the date that is 12 months after the death or disability, as defined in the Issuer's restated certificate of incorporation, of Mr. Weingarten. |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

Warner Nicholas

C/O SENTINELONE, INC.

444 CASTRO STREET, SUITE 400

MOUNTAIN VIEW, CA 94041 |

|

| Chief Operating Officer |

|

Signatures

|

| /s/ David Bernhardt, Attorney-in-Fact | | 1/12/2022 |

| **Signature of Reporting Person | Date |

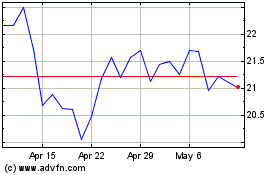

SentinelOne (NYSE:S)

Historical Stock Chart

From Aug 2024 to Sep 2024

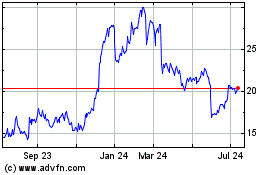

SentinelOne (NYSE:S)

Historical Stock Chart

From Sep 2023 to Sep 2024