Ryman Hospitality Properties, Inc. Announces Upsizing and Pricing of $1.0 Billion of Senior Notes Due 2032

March 21 2024 - 6:27PM

Ryman Hospitality Properties, Inc. (NYSE: RHP) (the “Company”)

announced today that its subsidiaries, RHP Hotel Properties, LP

(the “Operating Partnership”) and RHP Finance Corporation

(together, with the Operating Partnership, the “Issuers”),

successfully upsized and priced the private placement of

$1.0

billion aggregate principal amount of

6.500% senior notes due 2032 (the “Notes”). The aggregate principal

amount of the Notes to be issued in the offering was increased to

$1.0 billion from the previously announced $800.0 million. The

Notes will be senior unsecured obligations of the Issuers and

guaranteed by the Company and its subsidiaries that guarantee its

existing credit facility, 4.750% senior unsecured notes due 2027,

7.250% senior unsecured notes due 2028 and 4.500% senior unsecured

notes due 2029. Subject to customary closing conditions, the

Issuers expect the private placement of the Notes to close on March

28, 2024. The aggregate net proceeds from the sale of the notes are

expected to be approximately $983 million, after deducting the

initial purchasers’ discounts and commissions and estimated

offering expenses.

The Operating Partnership intends to contribute

a portion of the net proceeds of this offering to its subsidiaries

that own the Gaylord Rockies Resort & Convention Center, and

such subsidiaries intend to use such net proceeds to prepay the

indebtedness outstanding under the Second Amended and Restated Loan

Agreement, dated as of July 2, 2019, with Wells Fargo Bank,

National Association, as administrative agent, as amended from time

to time, and to pay related fees and expenses. The Operating

Partnership intends to use the remaining net proceeds, together

with cash on hand, to repay, as soon as practicable, approximately

$200 million of indebtedness outstanding under the Operating

Partnership’s term loan B pursuant to its existing credit facility.

There can be no assurance that the offering of the notes will be

consummated.

The Notes will be offered only to persons

reasonably believed to be qualified institutional buyers in

compliance with Rule 144A under the Securities Act of 1933, as

amended (the “Securities Act”), and to certain non-U.S. persons

outside the United States in reliance on Regulation S under the

Securities Act. The Notes have not been registered under the

Securities Act and will not be offered or sold in the United States

absent registration or an applicable exemption from the

registration requirements of the Securities Act.

This press release is neither an offer to sell

nor a solicitation of an offer to buy any securities, nor shall

there be any offer, solicitation or sale in any jurisdiction in

which such offer, solicitation or sale would be unlawful.

About Ryman Hospitality Properties, Inc.

Ryman Hospitality Properties, Inc. (NYSE: RHP)

is a leading lodging and hospitality real estate investment trust

that specializes in upscale convention center resorts and

entertainment experiences. RHP’s holdings include Gaylord Opryland

Resort & Convention Center; Gaylord Palms Resort &

Convention Center; Gaylord Texan Resort & Convention Center;

Gaylord National Resort & Convention Center; and Gaylord

Rockies Resort & Convention Center, five of the top ten largest

non-gaming convention center hotels in the United States based on

total indoor meeting space. The Company also owns the JW Marriott

San Antonio Hill Country Resort & Spa and two ancillary hotels

adjacent to our Gaylord Hotels properties. The Company’s hotel

portfolio is managed by Marriott International and includes a

combined total of 11,414 rooms as well as more than 3 million

square feet of total indoor and outdoor meeting space in top

convention and leisure destinations across the country. RHP also

owns a 70% controlling ownership interest in Opry Entertainment

Group (OEG), which is composed of entities owning a growing

collection of iconic and emerging country music brands, including

the Grand Ole Opry, Ryman Auditorium, WSM 650 AM, Ole Red,

Nashville-area attractions, and Block 21, a mixed-use

entertainment, lodging, office and retail complex, including the W

Austin Hotel and the ACL Live at the Moody Theater, located in

downtown Austin, Texas. RHP operates OEG as its Entertainment

segment in a taxable REIT subsidiary, and its results are

consolidated in the Company’s financial results.

Cautionary Note Regarding

Forward-Looking Statements

This press release contains statements as to the

Company’s beliefs and expectations of the outcome of future events

that are forward-looking statements as defined in the Private

Securities Litigation Reform Act of 1995. You can identify these

statements by the fact that they do not relate strictly to

historical or current facts. Examples of these statements include,

but are not limited to, statements regarding the intended use of

the net proceeds from the offering of the Notes. These

forward-looking statements are subject to risks and uncertainties

that could cause actual results to differ materially from the

statements made. These include the risks and uncertainties

associated with the offering of the Notes including, but not

limited to, the occurrence of any event, change or other

circumstance that could delay the offering of the Notes, or result

in the termination of the offering of the Notes; and adverse

effects on the Company because of the failure to complete the

offering of the Notes. Other factors that could cause results to

differ are described in the filings made from time to time by the

Company with the SEC and include the risk factors and other risks

and uncertainties described in the Company’s Annual Report on Form

10-K for the fiscal year ended December 31, 2023 and subsequent

filings. Except as required by law, the Company does not undertake

any obligation to release publicly any revisions to forward-looking

statements made by it to reflect events or circumstances occurring

after the date hereof or the occurrence of unanticipated

events.

|

Investor Relations Contacts: |

Media Contacts: |

|

Mark Fioravanti, President and Chief Executive Officer |

Shannon Sullivan, Vice President Corporate and Brand

Communications |

|

Ryman Hospitality Properties, Inc. |

Ryman Hospitality Properties, Inc. |

|

(615) 316-6588 |

(615) 316-6725 |

|

mfioravanti@rymanhp.com |

ssullivan@rymanhp.com |

|

~or~ |

~or~ |

|

Jennifer Hutcheson, Chief Financial Officer |

Robert Winters |

|

Ryman Hospitality Properties, Inc. |

Alpha IR Group |

|

(615) 316-6320 |

(929) 266-6315 |

|

jhutcheson@rymanhp.com |

robert.winters@alpha-ir.com |

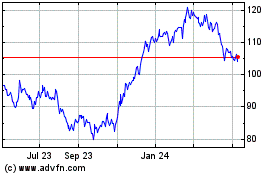

Ryman Hospitality Proper... (NYSE:RHP)

Historical Stock Chart

From Oct 2024 to Nov 2024

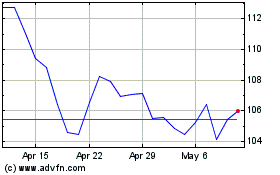

Ryman Hospitality Proper... (NYSE:RHP)

Historical Stock Chart

From Nov 2023 to Nov 2024