false

N-2/A

0001501072

false

true

true

false

false

true

false

false

false

true

false

false

true

No

false

false

0001501072

2024-02-23

2024-02-23

0001501072

dei:BusinessContactMember

2024-02-23

2024-02-23

0001501072

riv:CommonSharesMember

2024-02-23

2024-02-23

0001501072

2022-08-01

2023-07-31

0001501072

riv:SeriesAPreferredStockMember

2022-08-01

2023-07-31

0001501072

riv:SeriesAPreferredStockMember

2021-08-01

2022-07-31

0001501072

2020-08-01

2021-07-31

0001501072

riv:CreditFacilityMember

2019-08-01

2020-07-31

0001501072

2018-08-01

2019-07-31

0001501072

riv:PreferredSharesMember

2018-08-01

2019-07-31

0001501072

2017-08-01

2018-07-31

0001501072

riv:PreferredSharesMember

2017-08-01

2018-07-31

0001501072

2016-11-01

2017-10-31

0001501072

riv:PreferredSharesMember

2016-11-01

2017-10-31

0001501072

2015-11-01

2016-10-31

0001501072

riv:PreferredSharesMember

2015-11-01

2016-10-31

0001501072

riv:CommonSharesMember

2023-12-26

2023-12-26

0001501072

riv:SeriesAPreferredStockMember

2023-12-26

2023-12-26

0001501072

riv:CommonSharesMember

2023-11-01

2024-01-31

0001501072

riv:CommonSharesMember

2023-08-01

2023-10-31

0001501072

riv:CommonSharesMember

2023-05-01

2023-07-31

0001501072

riv:CommonSharesMember

2023-02-01

2023-04-30

0001501072

riv:CommonSharesMember

2022-11-01

2023-01-31

0001501072

riv:CommonSharesMember

2022-08-01

2022-10-31

0001501072

riv:CommonSharesMember

2022-05-01

2022-07-31

0001501072

riv:CommonSharesMember

2022-02-01

2022-04-30

0001501072

riv:CommonSharesMember

2021-11-01

2022-01-31

0001501072

riv:CommonSharesMember

2021-08-01

2021-10-31

0001501072

riv:CommonSharesMember

2021-05-01

2021-07-31

0001501072

riv:CommonSharesMember

2021-02-01

2021-04-30

0001501072

riv:CommonSharesMember

2020-11-01

2021-01-31

0001501072

riv:CommonSharesMember

2020-08-01

2020-10-31

0001501072

riv:CommonSharesMember

2020-05-01

2020-07-31

0001501072

riv:CommonSharesMember

2020-02-01

2020-04-30

0001501072

riv:CommonSharesMember

2019-11-01

2020-01-31

0001501072

riv:CommonSharesMember

2024-01-31

2024-01-31

0001501072

riv:SeriesAPreferredStockMember

2024-02-23

2024-02-23

0001501072

riv:PreferredSharesMember

2024-02-23

2024-02-23

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

As filed with the Securities and Exchange Commission

on February 23, 2024

Securities Act File No. 333-274473

Investment Company Act File No. 811-22472

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

N-2

(check

appropriate box or boxes)

| REGISTRATION

STATEMENT UNDER THE SECURITIES ACT OF 1933 |

[X] |

| Pre-Effective

Amendment No. 2 |

[X] |

| Post-Effective

Amendment No. |

[ ] |

| and/or |

|

| REGISTRATION

STATEMENT UNDER THE INVESTMENT COMPANY ACT OF 1940 |

[X] |

| Amendment

No. 33 |

[X] |

RIVERNORTH

OPPORTUNITIES FUND, INC.

(Exact

name of registrant as specified in charter)

360

South Rosemary Avenue, Suite 1420

West

Palm Beach, FL 33401

(Address

of principal executive offices)

(303)

623-2577

(Registrant’s

Telephone Number)

Marcus

L. Collins, Esq.

RiverNorth

Capital Management, LLC

360

South Rosemary Avenue, Suite 1420

West

Palm Beach, FL 33401

(Names

and addresses of agents for service)

Copies

to:

Joshua

B. Deringer

Faegre

Drinker Biddle & Reath LLP

One

Logan Square, Ste. 2000

Philadelphia,

PA 19103-6996

(215)

988-2700

Approximate

Date of Proposed Public Offering: As soon as practicable after the effective date of the Registration Statement.

If

appropriate, check the following box:

| [ ] |

The

only securities being registered on the form are being offered pursuant to a dividend or interest reinvestment plan. |

| [X] |

Any

securities being registered on this form will be offered on a delayed or continuous basis in reliance on Rule 415 under the

Securities Act of 1933, other than securities offered in connection with a dividend reinvestment plan. |

| [X] |

This

form is a registration statement pursuant to General Instruction A.2 or a post-effective amendment thereto. |

| [ ] |

This

form is a registration statement or a post-effective amendment thereto that will become effective upon filing with the Commission

pursuant to Rule 462(e) under the Securities Act. |

| [ ] |

This

form is a post-effective amendment to a registration statement filed to register additional securities or additional classes

of securities pursuant to Rule 413(b) under the Securities Act. |

It

is proposed that this filing will become effective (check appropriate box)

| [X] |

when

declared effective pursuant to Section 8(c) of the Securities Act |

If

appropriate, check the following box:

| [ ] |

This

[post-effective] amendment designates a new effective date for a previously filed [post-effective amendment] [registration

statement]. |

| [ ] |

This

form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act and the Securities

Act registration statement number of the earlier effective registration statement for the same offering is ______. |

| [ ] |

This

form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, and the Securities Act registration

statement number of the earlier effective registration statement for the same offering is ______. |

| |

|

[ ] |

This

Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, and the Securities Act registration

statement number of the earlier effective registration statement for the same offering is: |

Check

each box that appropriately characterizes the Registrant:

| [X] |

Registered

Closed-End Fund (closed-end company that is registered under the Investment Company Act). |

| [ ] |

Business

Development Company (closed-end company that intends or has elected to be regulated as a business development company under

the Investment Company Act). |

| [

] |

Interval

Fund (Registered Closed-End Fund or a Business Development Company that makes periodic repurchase offers under Rule 23c-3

under the Investment Company Act). |

| [

] |

Well-Known

Seasoned Issuer (as defined by Rule 405 under the Securities Act). |

| [

] |

Emerging

Growth Company (as defined by Rule 12b-2 under the Securities Exchange Act of 1934 (“Exchange Act”). |

| [

] |

New

Registrant (registered or regulated under the Investment Company Act for less than 12 calendar months preceding this filing). |

The

Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until

the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become

effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall

become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

PROSPECTUS

DATED [ ]

Subject to completion, dated February 23, 2024

The

information in this Prospectus is not complete and may be changed. We may not sell these securities until the registration statement

filed with the Securities and Exchange Commission is effective. This Prospectus is not an offer to sell these securities and it

is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

RiverNorth

Opportunities Fund, Inc.

$600,000,000

Shares

of Common Stock

Shares

of Preferred Stock

Subscription

Rights for Shares of Common Stock

Subscription

Rights for Shares of Preferred Stock

Subscription

Rights for Common and Preferred Stock

Follow-on

Offerings

RiverNorth

Opportunities Fund, Inc. (the “Fund”) is a diversified, closed-end management investment company registered under

the Investment Company Act of 1940, as amended (the “1940 Act”). The Fund’s investment objective is total return

consisting of capital appreciation and current income. The Fund seeks to achieve its investment objective by pursuing a tactical

asset allocation strategy and opportunistically investing under normal circumstances in closed-end funds, exchange-traded funds

(“ETFs”), business development companies (“BDCs” and collectively, “Underlying Funds”) and

special purpose acquisition companies (“SPACs”). Under normal market conditions, the Fund will invest at least 80%

of its Managed Assets in Underlying Funds and SPACs. “Managed Assets” means the total assets of the Fund, including

assets attributable to leverage, minus liabilities (other than debt representing leverage and any preferred stock that may be

outstanding). The Underlying Funds in which the Fund invests will not include those that are advised or subadvised by RiverNorth

Capital Management, LLC (the “Adviser”) or its affiliates.

RiverNorth Capital Management, LLC serves as the

Fund’s investment adviser. As of September 30, 2023, RiverNorth had approximately $4.8 billion of assets under management. The Adviser’s

address is 360 South Rosemary Avenue, Suite 1420, West Palm Beach, FL 33401 and its telephone number is (561) 484-7185. The Fund’s

address is RiverNorth Opportunities Fund, Inc., 360 South Rosemary Avenue, Suite 1420, West Palm Beach, FL 33401 and its telephone number

is (844) 569-4750.

The

Fund may offer, from time to time, up to $600,000,000 aggregate initial offering price of (i) shares of common stock, $0.0001

par value per share (“Common Shares”), (ii) shares of preferred stock (“Preferred Shares”), (iii) subscription

rights to purchase Common Shares, Preferred Shares or both (“Rights”) and/or (iv) any follow-on offering (“Follow-on

Offering” and together with the Common Shares, Preferred Shares, and Rights, “Securities”) in one or more offerings

in amounts, at prices and on terms set forth in one or more supplements to this Prospectus (each a “Prospectus Supplement”).

Follow-on Offerings may include offerings of Common Shares, offerings of Preferred Shares, offerings of Rights, and offerings

made in transactions that are deemed to be “at the market” as defined in Rule 415 under the Securities Act of 1933,

as amended (the “Securities Act”), including sales made directly on the New York Stock Exchange or sales made to or

through a market maker other than on an exchange. You should read this Prospectus and any related Prospectus Supplement carefully

before you decide to invest in the Securities.

The

Fund may offer Securities (1) directly to one or more purchasers, (2) through agents that the Fund may designate from time to

time or (3) to or through underwriters or dealers. The Prospectus Supplement relating to a particular offering of Securities will

identify any agents or underwriters involved in the sale of Securities, and will set forth any applicable purchase price, fee,

commission or discount arrangement between the Fund and agents or underwriters or among underwriters or the basis upon which such

amount may be calculated. The Fund may not sell Securities through agents, underwriters or dealers without delivery of this Prospectus

and a Prospectus Supplement. See “Plan of Distribution.”

An

investment in the Fund is not appropriate for all investors. No assurances can be given that the Fund will achieve its investment

objective.

This

Prospectus sets forth concisely the information about the Fund and the Securities that a prospective investor ought to know before investing

in the Fund and participating in an offer. You should read this Prospectus, which contains important information about the Fund, before

deciding whether to invest in the Fund’s common stock, and retain it for future reference. A Statement of Additional Information

dated [ ] (the “SAI”), containing additional information about the Fund, has been filed with the Securities and Exchange

Commission (“SEC”) and is incorporated by reference in its entirety into this Prospectus, which means that it is part of

this Prospectus for legal purposes. You may request a free copy of the SAI, the Fund’s Annual and Semi-Annual Reports, request

other information about the Fund and make shareholder inquiries by calling 1-844-569-4750 (toll-free) or by writing to the Fund at RiverNorth

Opportunities Fund, Inc., 360 South Rosemary Avenue, Suite 1420, West Palm Beach, FL 33401, or obtain a copy of such documents (and other

information regarding the Fund) by visiting the Fund’s website at rivernorth.com/riv (information included on the website

does not form a part of this Prospectus), or from the SEC’s website (sec.gov).

Investing

in Fund’s common stock involves certain risks. See “Risks” beginning on page 35 of this Prospectus.

Principal

Investment Strategies. The Fund seeks to achieve its investment objective by pursuing a tactical asset allocation strategy

and opportunistically investing under normal circumstances in Underlying Funds and SPACs. Under normal market conditions, the

Fund will invest at least 80% of its Managed Assets in Underlying Funds and SPACs. “Managed Assets” means the total

assets of the Fund, including assets attributable to leverage, minus liabilities (other than debt representing leverage and any

preferred stock that may be outstanding). The Underlying Funds and SPACs in which the Fund invests will not include those that

are advised or subadvised by the Adviser or its affiliates.

The currently outstanding shares of the Fund’s

common stock are, and the shares of the Fund’s common stock offered in this Prospectus will be, subject to notice of issuance,

listed on the New York Stock Exchange (“NYSE”) under the trading or “ticker” symbol “RIV,” and the

Fund’s Series A Cumulative Perpetual Preferred Stock are listed on the NYSE under the symbol “RIVPRA.” As of January

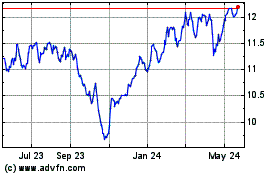

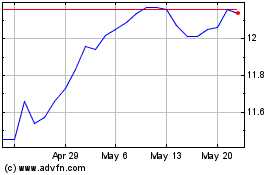

31, 2024, the last reported sale price for the Fund’s Common Shares on the NYSE was $11.47

per Common Share, and the NAV of the Fund's Common Shares was $12.51 per Common Share, representing a discount to NAV of -8.31%.

Leverage.

The Fund may borrow money and/or issue preferred stock, notes or debt securities for investment purposes. These practices

are known as leveraging. Since the holders of common stock pay all expenses related to the issuance of debt or use of leverage,

any use of leverage would create a greater risk of loss for the shares of common stock than if leverage is not used.

The

Fund currently anticipates that if employed, leverage will primarily be obtained through the use of bank borrowings or other similar

term loans. The provisions of the 1940 Act further provide that the Fund may borrow or issue notes or debt securities in an amount

up to 33 1/3% of its total assets or may issue preferred shares in an amount up to 50% of the Fund’s total assets (including

the proceeds from leverage). In addition, the Fund may enter into certain derivatives or other transactions (e.g., total return

swaps) that may provide leverage (other than through borrowings or the issuance of preferred stock). The Fund’s obligations

under such transactions will not be considered indebtedness for purposes of the 1940 Act and will not be included in calculating

the aggregate amount of the Fund’s financial leverage, but the Fund’s use of such transactions may be limited by the

applicable requirements of the SEC.

The

amount of distributions that the Fund may pay is not guaranteed. The Fund may pay distributions in a significant part from sources

that may not be available in the future and that are unrelated to the Fund’s performance such as a return of capital (which

is a non-taxable distribution).

This

Prospectus is part of a registration statement on Form N-2 that the Fund filed with the SEC using a “shelf” registration

process. Under this process, the Fund may offer, from time to time, up to $600,000,000 aggregate initial offering price of Securities

in one or more offerings in amounts, at prices and on terms set forth in one or more Prospectus Supplements. The Prospectus Supplement

may also add, update or change information contained in this Prospectus. You should carefully read this Prospectus and any accompanying

Prospectus Supplement, together with the additional information described under the heading “Where You Can Find More Information.”

You

should rely only on the information contained or incorporated by reference in this Prospectus and any accompanying Prospectus

Supplement. The Fund has not authorized any other person to provide you with different information. If anyone provides you with

different or inconsistent information, you should not rely on it. The Fund is not making an offer to sell these securities in

any jurisdiction where the offer or sale is not permitted. You should assume that the information contained or the representations

made herein are accurate only as of the date on the cover page of this Prospectus. The Fund’s business, financial condition

and prospects may have changed since that date. The Fund will amend this Prospectus and any accompanying Prospectus Supplement

if, during the period that this Prospectus and any accompanying Prospectus Supplement is required to be delivered, there are any

subsequent material changes.

WHERE

YOU CAN FIND MORE INFORMATION

The Fund is subject to the informational requirements

of the Securities Exchange Act of 1934 (the “Exchange Act”) and the Investment Company Act of 1940 (“1940 Act”)

and in accordance therewith files, or will file, reports and other information with the SEC. The SEC maintains a web site at sec.gov

containing reports, proxy and information statements and other information regarding registrants, including the Fund, that file electronically

with the SEC.

This Prospectus constitutes part of a Registration

Statement filed by the Fund with the SEC under the Securities Act of 1933 (“Securities Act”) and the 1940 Act. This Prospectus

omits certain of the information contained in the Registration Statement, and reference is hereby made to the Registration Statement

and related exhibits for further information with respect to the Fund and the Common Shares offered hereby. Any statements contained

herein concerning the provisions of any document are not necessarily complete, and, in each instance, reference is made to the copy of

such document filed as an exhibit to the Registration Statement or otherwise filed with the SEC. Each such statement is qualified in

its entirety by such reference. The complete Registration Statement may be obtained from the SEC upon payment of the fee prescribed by

its rules and regulations or free of charge through the SEC’s website (sec.gov).

The Fund will provide without charge to each person,

including any beneficial owner, to whom this Prospectus is delivered, upon written or oral request, a copy of any and all of the information

that has been incorporated by reference in this Prospectus or any accompanying Prospectus Supplement. You may request such information

by calling toll-free 1-844-569-4750 or you may obtain a copy (and other information regarding the Fund) from the SEC’s website

(sec.gov). Free copies of the Fund’s Prospectus, Statement of Additional Information and any incorporated information will also

be available from the Fund’s website at rivernorth.com/riv. Information contained on the Fund’s website is not incorporated

by reference into this Prospectus or any Prospectus Supplement and should not be considered to be part of this Prospectus or any Prospectus

Supplement.

INCORPORATION

BY REFERENCE

This

Prospectus is part of a registration statement that the Fund has filed with the SEC. The Fund is permitted to “incorporate

by reference” the information that it files with the SEC, which means that the Fund can disclose important information to

you by referring you to those documents. The information incorporated by reference is an important part of this Prospectus, and

later information that the Fund files with the SEC will automatically update and supersede this information.

The

documents listed below, and any reports and other documents subsequently filed with the SEC pursuant to Rule 30(b)(2) under the

1940 Act and Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act, prior to the termination of the offering, are incorporated

by reference into this Prospectus and deemed to be part of this Prospectus from the date of the filing of such reports and documents:

| ● | the

Fund’s Statement of Additional Information, dated [ ], filed with this

Prospectus (“SAI”); |

| |

● |

the Fund’s Annual Report on Form

N-CSR for the fiscal year ended July 31, 2023, filed with the SEC on October 6, 2023 (“Annual

Report”); |

| |

● |

the Fund’s Semi-Annual Report on Form N-CSRS for the period ended January 31, 2023, filed with the SEC on April 6, 2023; |

| |

● |

the Fund’s definitive proxy statement on Schedule 14A for our 2023 annual meeting of shareholders, filed with the SEC on August 23, 2023 (“Proxy Statement”); and |

| |

● |

the Fund’s description of common shares contained in our Registration Statement on Form 8-A (File No. 333-169317) filed with the SEC on December 17, 2015. |

To

obtain copies of these filings, see “Where You Can Find More Information.”

The

Fund’s securities do not represent a deposit or obligation of, and are not guaranteed or endorsed by, any bank or other

insured depository institution and are not federally insured by the Federal Deposit Insurance Corporation, the Federal Reserve

Board or any other government agency.

The

Securities and Exchange Commission has not approved or disapproved these securities or passed upon the adequacy of this prospectus.

Any representation to the contrary is a criminal offense.

TABLE

OF CONTENTS

| |

Page |

| Prospectus

Summary |

6 |

| Summary

of Fund Expenses |

27 |

| Financial

Highlights |

28 |

| Information

Regarding Senior Securities |

29 |

| The

Fund |

29 |

| Market and Net Asset Value Information |

30 |

| The

Offering |

31 |

| Use

of Proceeds |

32 |

| Investment

Objective, Strategies and Policies |

32 |

| Use

of Leverage |

35 |

| Risks |

35 |

| Management

of the Fund |

36 |

| Net

Asset Value |

38 |

| Dividends

and Distributions |

38 |

| Plan

of Distribution |

40 |

| Dividend

Reinvestment Plan |

42 |

| Description

of the Fund’s Securities |

43 |

| Certain

Provisions of the Fund’s Charter and Bylaws and of Maryland Law |

47 |

| Repurchase

of Shares |

54 |

| Conversion

to Open-End Fund |

54 |

| U.S.

Federal Income Tax Matters |

55 |

| Custodian

and Transfer Agent |

58 |

| Legal

Matters |

58 |

| Control

Persons |

58 |

| Additional

Information |

58 |

| Incorporation

By Reference |

59 |

| The

Fund’s Privacy Policy |

60 |

You

should rely only on the information contained or incorporated by reference in this Prospectus. The Fund has not authorized any

other person to provide you with different information. If anyone provides you with different or inconsistent information, you

should not rely on it. The Fund is not making an offer to sell these securities in any jurisdiction where the offer or sale is

not permitted. You should not assume that the information provided by this Prospectus and any related Prospectus Supplement is

accurate as of any date other than the date on the front of this Prospectus and any related Prospectus Supplement. The Fund’s

business, financial condition and results of operations may have changed since that date.

PROSPECTUS

SUMMARY

The

following summary is qualified in its entirety by reference to the more detailed information appearing elsewhere in this Prospectus.

This summary does not contain all of the information that you should consider before investing in the Fund’s shares of common

stock (the “Common Shares”). You should review the more detailed information contained in this Prospectus and in the

Statement of Additional Information, especially the information set forth under the heading “Risks.”

| The

Fund |

RiverNorth

Opportunities Fund, Inc. (the “Fund”) is a Maryland corporation registered as

a diversified, closed-end management investment company under the Investment Company Act

of 1940, as amended (the “1940 Act”). An investment in the Fund may not be appropriate

for all investors. There can be no assurance that the Fund will achieve its investment objective.

As

of January 31, 2024, the Fund had 21,453,174 shares of its common stock outstanding and net assets applicable to such shares

of $268,288,109. As of the same date, the Fund had 3,910,000 shares of 6.00% Series A Cumulative Perpetual Preferred Stock, liquidation

preference $25 per share, outstanding (“Series A Preferred Stock”). The shares of the Fund’s common stock offered

by this Prospectus are called “Common Shares” and the holders of Common Shares are called “Common Stockholders.”

As used hereinafter in this Prospectus, unless the context requires otherwise, “common shares” refers to the shares

of the Fund’s common stock currently outstanding as well as those Common Shares offered by this Prospectus. As used hereinafter

in this Prospectus, unless the context otherwise requires, “preferred shares” or “Preferred Shares” refers

to the shares of the Fund’s Series A Preferred Stock outstanding or any future issuance of Preferred Shares, and the holders

of preferred shares are called “preferred shareholders.” An investment in the Fund may not be appropriate for all

investors. |

| The Offering |

The

Fund may offer, from time to time, up to $600,000,000 aggregate initial offering price of (i) Common Shares, (ii) Preferred

Shares, (iii) subscription rights to purchase Common Shares, Preferred Shares or both (“Rights”) and/or (iv)

any follow-on offering (“Follow-on Offering” and together with the Common Shares, Preferred Shares and Rights,

“Securities”) in one or more offerings in amounts, at prices and on terms set forth in one or more supplements

to this Prospectus (each a “Prospectus Supplement”). Follow-on Offerings may include offerings of Common Shares,

offerings of Preferred Shares, offerings of Rights, and offerings made in transactions that are deemed to be “at

the market” as defined in Rule 415 under the Securities Act, including sales made directly on the NYSE or sales

made to or through a market maker other than on an exchange. You should read this Prospectus and any related Prospectus

Supplement carefully before you decide to invest in the Securities.

The

Fund may offer Securities (1) directly to one or more purchasers, (2) through agents that the Fund may designate from

time to time or (3) to or through underwriters or dealers. The Prospectus Supplement relating to a particular offering

of Securities will identify any agents or underwriters involved in the sale of Securities, and will set forth any applicable

purchase price, fee, commission or discount arrangement between the Fund and agents or underwriters or among underwriters

or the basis upon which such amount may be calculated. The Fund may not sell Securities through agents, underwriters or

dealers without delivery of this Prospectus and a Prospectus Supplement. See “Plan of Distribution.”

|

| Use of Proceeds |

Unless

otherwise specified in a Prospectus Supplement, RiverNorth Capital Management, LLC (the “Adviser” or “RiverNorth”),

the Fund’s investment adviser, anticipates that investment of the proceeds will be made in accordance with the Fund’s

investment objective and policies as appropriate investment opportunities are identified. It is currently anticipated that

the Fund will be able to invest substantially all of the net proceeds of an offering of Securities in accordance with its

investment objective and policies within three months after the completion of such offering. Pending such investment, the

proceeds will be held in high quality short-term debt securities and instruments. A delay in the anticipated use of proceeds

could lower returns and reduce the Fund’s distribution to Common Stockholders. |

| |

|

| Investment Objective |

The Fund’s

investment objective is total return consisting of capital appreciation and current income. There is no assurance that the

Fund will achieve its investment objective. |

| Principal Investment

Strategies |

The

Fund seeks to achieve its investment objective by pursuing a tactical asset allocation strategy and opportunistically

investing under normal circumstances in closed-end funds, exchange traded funds (“ETFs”), business development

companies (“BDCs” and collectively, “Underlying Funds”) and special purpose acquisition companies

(“SPACs”). The Adviser has the flexibility to change the Fund’s asset allocation based on its ongoing

analysis of the equity, fixed income and alternative asset markets. The Adviser considers various quantitative and qualitative

factors relating to the domestic and foreign securities markets and economies when making asset allocation and security

selection decisions. While the Adviser continuously evaluates these factors, material shifts in the Fund’s asset

class exposures will typically take place over longer periods of time.

Under

normal market conditions, the Fund will invest at least 80% of its Managed Assets in Underlying Funds and SPACs. “Managed

Assets” means the total assets of the Fund, including assets attributable to leverage, minus liabilities (other than debt

representing leverage and any preferred stock that may be outstanding). The Underlying Funds and SPACs in which the Fund invests

will not include those that are advised or subadvised by the Adviser or its affiliates. The Fund directly, and therefore Common

Stockholders indirectly, will bear the expenses of the Underlying Funds and SPACs. |

Under

normal market conditions: (i) no more than 80% of the Fund’s Managed Assets will be invested in “equity” Underlying

Funds and SPACs; (ii) no more than 60% of the Fund’s Managed Assets will be invested in “fixed income” Underlying

Funds and SPACs; (iii) no more than 30% of the Fund’s Managed Assets will be invested in “global equity” Underlying

Funds and SPACs; (iv) no more than 15% of the Fund’s Managed Assets will be invested in “emerging market equity”

Underlying Funds and SPACs; (v) no more than 30% of the Fund’s Managed Assets will be invested in “high yield”

(also known as “junk bond”) and “senior loan” Underlying Funds and SPACs; (vi) no more than 15% of the

Fund’s Managed Assets will be invested in “emerging market income” Underlying Funds and SPACs; (vii) no more

than 10% of the Fund’s Managed Assets will be invested in “real estate” Underlying Funds and SPACs; and (viii)

no more than 15% of the Fund’s Managed Assets will be invested in “energy master limited partnership” (“MLP”)

Underlying Funds and SPACs. Underlying Funds and SPACs included in the 30% limitation applicable to investments in “global

equity” Underlying Funds and SPACs may include Underlying Funds and SPACs that invest a portion of their assets in emerging

markets securities. The Fund will also limit its investments in closed-end funds (including BDCs) that have been in operation

for less than one year to no more than 10% of the Fund’s Managed Assets. The Fund will not invest in inverse ETFs and leveraged

ETFs. The types of Underlying Funds and SPACs referenced in this paragraph will be categorized in accordance with the fund categories

established and maintained by Morningstar, Inc. The investment parameters stated above (and elsewhere in this Prospectus) apply

only at the time of purchase.

In

selecting closed-end funds, the Adviser opportunistically utilizes a combination of short-term and longer-term trading strategies

to seek to derive value from the discount and premium spreads associated with closed-end funds. The Adviser employs both a quantitative

and qualitative approach in its selection of closed-end funds and has developed proprietary screening models and algorithms to

trade closed-end funds. The Adviser employs the following trading strategies, among others:

Statistical

Analysis (Mean Reversion)

● Using proprietary quantitative models, the Adviser seeks to identify closed-end funds that are trading at compelling absolute

and / or relative discounts (i.e., trading at a market price lower than its net asset value).

● The Fund will attempt to capitalize on the perceived mispricing if the Adviser believes that the discount widening is irrational

and expects the discount to narrow to longer-term mean valuations (i.e., the current discount will approach the price of the longer-term

valuation).

Corporate

Actions

● The Adviser will pursue investments in closed-end funds that have announced, or the Adviser believes are likely to announce, certain

corporate actions that may drive value for their shareholders.

● The Adviser has developed trading strategies that focus on closed-end fund tender offers, rights offerings, shareholder distributions,

open-endings (i.e., conversion of a closed-end fund to an open-end mutual fund) and liquidations (the disposition of a Fund’s

assets).

The

Fund will invest in other Underlying Funds and SPACs (that are not closed-end funds) to gain exposure to specific asset classes

when the Adviser believes closed-end fund discount or premium spreads are not attractive or to manage overall closed-end fund

exposure in the Fund.

Under

normal circumstances, the Fund intends to maintain long positions in Underlying Funds and SPACs, but may engage in short sales

for investment purposes. When the Fund engages in a short sale, it sells a security it does not own and, to complete the sale,

borrows the same security from a broker or other institution. The Fund may benefit from a short position when the shorted security

decreases in value. The Fund may also at times establish hedging positions. Hedging positions may include short sales and derivatives,

such as options and swaps (“Hedging Positions”). Under normal market conditions, no more than 30% of the Fund’s

Managed Assets will be in Hedging Positions. The Adviser intends to use Hedging Positions to lower the Fund’s volatility

but they may also be used to seek to enhance the Fund’s return. The Fund’s investments in derivatives will be included

under the 80% policy noted above so long as the underlying asset of such derivatives is a closed-end fund or Underlying Fund,

respectively.

The

Adviser performs both a quantitative and qualitative analysis, including fundamental and technical analysis to assess the relative

risk and reward potential, for each SPAC investment. Among other things, the Adviser will evaluate the management team’s

strategy, experience, deal flow, and demonstrated track record in building enterprise value. The Adviser will also evaluate the

terms of each SPAC offering, including the aggregate amount of the offering, the offering price of the securities, the equity

yield to termination, the option value of warrants, the sponsor’s interest in the SPAC, and the expected liquidity of the

SPAC’s securities. The Fund will purchase securities of SPACs in their initial public offerings and in the secondary market.

The

Fund also may invest up to 20% of its Managed Assets in exchange-traded notes (“ETNs”), certain derivatives, such

as options and swaps, cash and cash equivalents. Such investments will not be counted towards the Fund’s 80% policy.

There

are no limits on the Fund’s portfolio turnover, and the Fund may buy and sell securities to take advantage of potential

short-term trading opportunities without regard to length of time and when the Adviser believes investment considerations warrant

such action.

The

Fund may attempt to enhance the return on the cash portion of its portfolio (and not for hedging purposes) by investing in a total

return swap agreement. A total return swap agreement provides the Fund with a return based on the performance of an underlying

asset, in exchange for fee payments to a counterparty based on a specific rate. The difference in the value of these income streams

is recorded daily by the Fund, and is typically settled in cash at least monthly. If the underlying asset declines in value over

the term of the swap, the Fund would be required to pay the dollar value of that decline plus any applicable fees to the counterparty.

The Fund may use its own NAV or any other reference asset that the Adviser chooses as the underlying asset in a total return swap.

The Fund will limit the notional amount of all total return swaps in the aggregate to 15% of the Fund’s Managed Assets.

See “Investment Objective, Strategies and Policies—Principal Investment Strategies.”

| Use

of Leverage |

The

Fund may borrow money and/or issue Preferred Shares, notes or debt securities for investment purposes. These practices

are known as leveraging. The Adviser will assess whether or not to engage in leverage based on its assessment of conditions

in the debt and credit markets. Leverage, if used, may take the form of a borrowing or the issuance of Preferred Shares,

although the Fund currently anticipates that leverage will primarily be obtained through the use of bank borrowings or

other similar term loans.

As

of July 31, 2023, the Fund had outstanding 3,910,000 shares of 6.00% Series A Preferred Stock. As of the same date, the average

liquidation preference since the issuance of such Series A Preferred Stock was approximately $25.00. As of July 31, 2023, the

Fund's leverage from its issuance of Series A Preferred Stock was approximately 27% of its Managed Assets. See “Summary

of Fund Expenses” and “Use of Leverage.”

The

provisions of the 1940 Act provide that the Fund may borrow or issue notes or debt securities in an amount up to 33 1/3%

of its total assets or may issue Preferred Shares in an amount up to 50% of the Fund’s total assets (including the

proceeds from leverage).

If

the net rate of return on the Fund’s investments purchased with the leverage proceeds exceeds the interest or dividend

rate payable on the leverage, such excess earnings will be available to pay higher dividends to Common Stockholders. If

the net rate of return on the Fund’s investments purchased with leverage proceeds does not exceed the costs of leverage,

the return to Common Stockholders will be less than if leverage had not been used. The use of leverage magnifies gains

and losses to Common Stockholders. Since the holders of Common Shares pay all expenses related to the issuance of debt

or use of leverage, any use of leverage would create a greater risk of loss for the Common Shares than if leverage is

not used. There can be no assurance that a leveraging strategy will be successful during any period in which it is employed.

See “Use of Leverage” and “Risks—Leverage Risks.”

Rule

18f-4 under the 1940 Act (“Rule 18f-4”) permits the Fund to enter into Derivatives Transactions (as defined

below) and certain other transactions notwithstanding the restrictions on the issuance of senior securities under Section

18 of the 1940 Act. Among other things, Section 18 of the 1940 Act prohibits closed-end funds, including the Fund, from

issuing or selling any senior security representing indebtedness (unless the fund maintains 300% asset coverage) or any

senior security representing stock (unless the fund maintains 200% asset coverage).

Under

Rule 18f-4, “Derivatives Transactions” include (i) any swap, security-based swap, futures contract, forward

contract, option, any combination of the foregoing, or any similar instrument, under which a fund is or may be required

to make any payment or delivery of cash or other assets during the life of the instrument or at maturity or early termination,

whether as margin or settlement payment or otherwise; (ii) any short sale borrowing; and (iii) reverse repurchase agreements

and similar financing transactions if the fund has elected to treat all such transactions as derivatives transactions

under the rule.

|

| Adviser |

Effective

October 1, 2022, RiverNorth Capital Management, LLC serves as the adviser to the Fund pursuant

to the Fund’s investment management agreement with the Adviser dated October 1, 2022.

As of September 30, 2023, RiverNorth had approximately $4.8 billion of assets under management.

The Adviser’s address is 360 South Rosemary Avenue, Suite 1420, West Palm Beach, FL

33401 and its telephone number is (561) 484-7185.

Effective

October 1, 2022, the Fund pays the Adviser a management fee payable on a monthly basis at the annual rate of 1.30% of

the Fund’s average daily Managed Assets for the services it provides. This management fee paid by the Fund to the

Adviser is essentially an all-in fee structure (the “unified management fee”) and, as part of the unified

management fee, the Adviser provides or causes to be furnished all supervisory and administrative and other services reasonably

necessary for the operation of the Fund, except (unless otherwise described in this Prospectus or otherwise agreed to

in writing), the Fund pays, in addition to the unified management fee, taxes and governmental fees (if any) levied against

the Fund; brokerage fees and commissions and other portfolio transaction expenses incurred by or for the Fund; costs of

borrowing money including interest expenses or engaging in other types of leverage financing; dividend and/or interest

expenses and other costs associated with the Fund’s issuance, offering, redemption and maintenance of preferred

shares or other instruments for the purpose of incurring leverage; fees and expenses of any underlying funds in which

the Fund invests; dividend and interest expenses on short positions taken by the Fund; fees and expenses, including travel

expenses and fees and expenses of legal counsel retained for the benefit of the Fund or directors of the Fund who are

not officers, employees, partners, stockholders or members of the Adviser or its affiliates; fees and expenses associated

with and incident to stockholder meetings and proxy solicitations involving contested elections of directors, stockholder

proposals or other non-routine matters that are not initiated or proposed by the Adviser; legal, marketing, printing,

accounting and other expenses associated with any future share offerings, such as rights offerings and shelf offerings,

following the Fund’s initial offering; expenses associated with tender offers and other share repurchases and redemptions;

and other extraordinary expenses, including extraordinary legal expenses, as may arise, including, without limit, expenses

incurred in connection with litigation, proceedings, other claims and the legal obligations of the Fund to indemnify its

directors, officers, employees, stockholders, distributors and agents with respect thereto. Prior to October 1, 2022,

the Adviser served as investment subadviser to the Fund.

Because

the Fund pays the Adviser a management fee based on Managed Assets, the Adviser is paid more if the Fund uses leverage

directly, which creates a potential conflict of interest for the Adviser. The Adviser will seek to manage that potential

conflict by utilizing leverage only when it determines such action is in the best interests of the Fund.

Prior

to October 1, 2022, ALPS Advisors, Inc. (“ALPS Advisors”) served as the Fund’s investment adviser, and the Fund

paid ALPS Advisors a management fee payable on a monthly basis at the annual rate of 1.00% of the Fund’s average daily Managed

Assets for the services and facilities it provided. The management fee paid by the Fund to ALPS Advisors was essentially a variable

fee structure where the Fund paid an advisory fee under the prior investment advisory agreement with ALPS Advisors and also paid

“variable fees” to cover other Fund expenses (including administrative expenses). |

| |

For

more information on the Adviser, as well as the fees and expenses, see “Summary of Fund Expenses” and “Management

of the Fund.” |

| |

|

| Administrator |

ALPS

Fund Services, Inc. (“AFS”) is the Fund’s administrator. Under an Administration, Bookkeeping and Pricing

Services Agreement (the “Administration Agreement”), AFS is responsible for calculating NAVs, providing additional

fund accounting and tax services, and providing fund administration and compliance-related services. See “Management

of the Fund.” |

| |

|

| Dividends

and Distributions |

The

Board of Directors of the Fund (the “Board”) approved an amended distribution policy, under which the Fund intends

to make regular monthly distributions to stockholders at a constant and fixed (but not guaranteed) rate that is reset annually

to a rate equal to a percentage of the average of the Fund’s NAV per share (the “Distribution Amount”),

as reported for the final five trading days of the preceding calendar year (the “Distribution Rate Calculation”).

The Distribution Amount is set by the Board and may be adjusted from time to time. The Fund’s intention is that monthly

distributions paid to stockholders throughout a calendar year will be at least equal to the Distribution Amount (plus any

additional amounts that may be required to be included in a distribution for federal or excise tax purposes) and that, on

the close of the calendar year, the Distribution Amount applicable to the following calendar year will be reset based upon

the new results of the Distribution Rate Calculation. At times, to maintain a stable level of distributions, the Fund may

pay out less than all of its net investment income or pay out accumulated undistributed income, or return capital, in addition

to current net investment income. Any distribution that is treated as a return of capital generally will reduce a stockholder’s

basis in his or her shares, which may increase the capital gain or reduce the capital loss realized upon the sale of such

shares. Any amounts received in excess of a shareholder’s basis are generally treated as capital gain, assuming the

shares are held as capital assets. See “Dividends and Distributions.” |

| |

|

| Dividend

Reinvestment Plan |

The

Fund has a dividend reinvestment plan (the “Plan”) commonly referred to as an “opt-out” plan. Each

Common Stockholder who participates in the Plan will have all distributions of dividends and capital gains automatically reinvested

in additional Common Shares. Shareholders who elect not to participate in the Plan will receive all distributions in cash.

Stockholders whose Common Shares are held in the name of a broker or nominee should contact the broker or nominee to determine

whether and how they may participate in the Plan. See “Dividend Reinvestment Plan” and “U.S. Federal Income

Tax Matters.” |

| |

|

| Exchange

Listing |

The

Fund’s currently outstanding Common Shares are, and the Common Shares offered in this Prospectus and any applicable

prospectus supplement will be, subject to notice of issuance, listed on the NYSE under the symbol “RIV.” The

Fund’s Series A Preferred Stock is listed on the NYSE under the symbol “RIVPRA.”

As

of January 31, 2024, the last reported sale price for the Fund's Common Shares on the NYSE was $11.47 per Common Share, and the

NAV of the Fund's Common Shares was $12.51 per Common Share, representing a discount to NAV of -8.31%. In connection with any

offering of Rights, the Fund will provide information in the Prospectus Supplement of the expected trading market, if any, for

Rights. |

| Risk

Considerations |

Risk

is inherent in all investing. Investing in any investment company security involves risk, including the risk that

you may receive little or no return on your investment or even that you may lose part or all of your investment. Therefore,

before investing in the Securities, you should consider the following risks and the risks set forth in the Fund’s

most recent annual report on Form N-CSR (as well as the other information in this Prospectus, including under the section

entitled “Risks” below, the applicable prospectus supplement and the SAI).

Structural

Risks:

Not

a Complete Investment Program. The Fund is intended for investors seeking total return consisting of capital appreciation

and current income over the long-term and is not intended to be a short-term trading vehicle. An investment in the Securities

should not be considered a complete investment program. Each investor should take into account the Fund’s investment

objective and other characteristics, as well as the investor’s other investments, when considering an investment

in the Securities. An investment in the Fund may not be appropriate for all investors.

Risks

Associated with Additional Offerings. There are risks associated with offerings of additional Common Shares or

Preferred Shares of the Fund. The voting power of current shareholders will be diluted to the extent that current shareholders

do not purchase shares in any future offerings of shares or do not purchase sufficient shares to maintain their percentage

interest. In addition, the sale of shares in an offering may have an adverse effect on prices in the secondary market

for the Fund’s shares by increasing the number of shares available, which may put downward pressure on the market

price for the Fund’s Shares. These sales also might make it more difficult for the Fund to sell additional equity

securities in the future at a time and price the Fund seems appropriate.

In

the event any additional series of fixed rate preferred shares are issued and such shares are intended to be listed on

an exchange, prior application will have been made to list such shares. During an initial period, which is not expected

to exceed 30 days after the date of its initial issuance, such shares may not be listed on any securities exchange. During

such period, the underwriters may make a market in such shares, although they will have no obligation to do so. Consequently,

an investment in such shares may be illiquid during such period. Fixed rate preferred shares may trade at a premium to

or discount from liquidation value.

|

There

are risks associated with an offering of Rights (in addition to the risks discussed herein related to the offering of Common Shares

and Preferred Shares). Shareholders who do not exercise their rights may, at the completion of such an offering, own a smaller

proportional interest in the Fund than if they exercised their rights. As a result of such an offering, a shareholder may experience

dilution in net asset value per share if the subscription price per share is below the net asset value per share on the expiration

date. In addition to the economic dilution described above, if a shareholder does not exercise all of its Rights, the shareholder

will incur voting dilution as a result of the Rights offering. This voting dilution will occur because the shareholder will own

a smaller proportionate interest in the Fund after the rights offering than prior to the Rights offering.

There

is a risk that changes in market conditions may result in the underlying Common Shares or Preferred Shares purchasable upon exercise

of Rights being less attractive to investors at the conclusion of the subscription period. This may reduce or eliminate the value

of the Rights. If investors exercise only a portion of the rights, the number of shares issued may be reduced, and the shares

may trade at less favorable prices than larger offerings for similar securities. Rights issued by the Fund may be transferable

or non-transferable rights.

Leverage

Risks. The Fund may borrow money, or issue debt or preferred stock. Since Common Stockholders pay all expenses related

to the issuance of debt or use of leverage, the use of leverage through borrowing of money, issuance of debt securities or the

issuance of preferred stock for investment purposes creates risks for the holders of Common Shares. Leverage is a speculative

technique that exposes the Fund to greater risk and increased costs than if it were not implemented. Increases and decreases in

the value of the Fund’s portfolio will be magnified when the Fund uses leverage. As a result, leverage may cause greater

changes in the Fund’s NAV. The Fund will also have to pay interest on its borrowings or dividends on preferred stock, if

any, which may reduce the Fund’s return. The leverage costs may be greater than the Fund’s return on the underlying

investment. The Fund’s leveraging strategy may not be successful. Leverage risk would also apply to the Fund’s investments

in Underlying Funds and SPACs to the extent an Underlying Fund or SPAC uses leverage. See “Use of Leverage.”

Market

Discount. Common stock of closed-end funds frequently trades at a discount from its NAV. This risk may be greater for

investors selling their shares in a relatively short period of time after completion of the initial offering. The Common Shares

may trade at a price that is less than the Fund’s NAV. This risk would also apply to the Fund’s investments in closed-end

funds.

Anti-Takeover

Provisions. Maryland law and the Fund’s Charter and Bylaws include provisions that could limit the ability of other

entities or persons to acquire control of the Fund or convert the Fund to open-end status. These provisions could deprive the

holders of Common Shares of opportunities to sell their Common Shares at a premium over the then current market price of the Common

Shares or at NAV. See “Certain Provisions of the Fund’s Charter and Bylaws and of Maryland Law.” This risk would

also apply to many of the Fund’s investments in closed-end funds.

Investment-Related

Risks:

The

risks listed below are in alphabetical order. With the exception of Underlying Fund risk (and except as otherwise noted below),

the following risks apply to the direct investments the Fund may make, and generally apply to the Fund’s investments in

Underlying Funds and SPACs. That said, each risk described below may not apply to each Underlying Fund or SPAC investment. Similarly,

an Underlying Fund may be subject to additional or different risks than those described below.

Asset

Allocation Risks. To the extent that the Adviser’s asset allocation strategy may fail to produce the intended result,

the Fund’s return may suffer. Additionally, the active asset allocation style of the Fund leads to changing allocations

over time and represents a risk to investors who target fixed asset allocations.

Convertible

Securities Risks. The Underlying Funds may invest in convertible securities. The market value of convertible securities

tends to fall when prevailing interest rates rise. The value of convertible securities also tends to change whenever the market

value of the underlying common or preferred stock fluctuates. Convertible securities tend to be of lower credit quality.

Defensive

Measures. The Fund may invest up to 100% of its assets in cash, cash equivalents and short-term investments as a defensive

measure in response to adverse market conditions or opportunistically at the discretion of the Adviser. During these periods,

the Fund may not be pursuing its investment objective.

Derivatives

Risks. The Fund and the Underlying Funds may enter into derivatives transactions. Derivative transactions involve investment

techniques and risks different from those associated with investments in Underlying Funds. Generally, a derivative is a financial

contract the value of which depends upon, or is derived from, the value of an underlying asset, reference rate, or index, and

may relate to individual debt or equity instruments, interest rates, currencies or currency exchange rates, commodities, related

indexes, and other assets. Derivatives can be volatile and involve various types and degrees of risk, depending upon the characteristics

of a particular derivative. Derivatives may entail investment exposures that are greater than their cost would suggest, meaning

that a small investment in a derivative could have a large potential impact on the performance of the Fund or an Underlying Fund.

The Fund or an Underlying Fund could experience a loss if derivatives do not perform as anticipated, if they are not correlated

with the performance of other investments which they are used to hedge or if the fund is unable to liquidate a position because

of an illiquid secondary market. When used for speculative purposes, derivatives will produce enhanced investment exposure, which

will magnify gains and losses. The Fund and the Underlying Funds also will be subject to credit risk with respect to the counterparties

to the derivatives contracts purchased by such fund. If a counterparty becomes bankrupt or otherwise fails to perform its obligations

under a derivative contract due to financial difficulties, the Fund or an Underlying Fund may experience significant delays in

obtaining any recovery under the derivative contract in a bankruptcy or other reorganization proceeding. The Fund or an Underlying

Fund may obtain only a limited recovery or may obtain no recovery in such circumstances.

On

October 28, 2020, the SEC adopted Rule 18f-4 under the 1940 Act providing for the regulation of the use of derivatives and certain

related instruments by registered investment companies. Rule 18f-4 prescribes specific value-at-risk leverage limits for certain

derivatives users. In addition, Rule 18f-4 requires certain derivatives users to adopt and implement a derivatives risk management

program (including the appointment of a derivatives risk manager, and the implementation of certain testing requirements), and

prescribes reporting requirements in respect of derivatives. Subject to certain conditions, if a fund qualified as a “limited

derivatives user,” as defined in Rule 18f-4, it is not subject to the full requirements of Rule 18f-4. In connection with

the adoption of Rule 18f-4, the SEC rescinded certain of its prior guidance regarding asset segregation and coverage requirements

in respect of derivatives transactions and related instruments. With respect to reverse repurchase agreements or other similar

financing transactions in particular, Rule 18f-4 permits a fund to enter into such transactions if the fund either (i) complies

with the asset coverage requirements of Section 18 of the 1940 Act, and combines the aggregate amount of indebtedness associated

with all tender option bonds or similar financing with the aggregate amount of any other senior securities representing indebtedness

when calculating the relevant asset coverage ratio, or (ii) treats all tender option bonds or similar financing transactions as

derivatives transactions for all purposes under Rule 18f-4. The Fund was required to comply with Rule 18f-4 on August 19, 2022

and has adopted procedures for investing in derivatives and other transactions in compliance with Rule 18f-4.

Defaulted

and Distressed Securities Risks. The Underlying Funds may invest directly in defaulted and distressed securities. Legal

difficulties and negotiations with creditors and other claimants are common when dealing with defaulted or distressed companies.

Defaulted or distressed companies may be insolvent or in bankruptcy. In the event of a default, an Underlying Fund may incur additional

expenses to seek recovery. The repayment of defaulted bonds is subject to significant uncertainties, and in some cases, there

may be no recovery of repayment. Defaulted bonds might be repaid only after lengthy workout or bankruptcy proceedings, during

which the issuer might not make any interest or other payments. With distressed investing, often there is a time lag between when

a fund makes an investment and when an Underlying Fund realizes the value of the investment. In addition, an Underlying Fund may

incur legal and other monitoring costs in protecting the value of the Underlying Fund’s claims.

Equity

Securities Risks. The Underlying Funds may invest in equity securities. While equity securities have historically generated

higher average returns than fixed income securities, equity securities have also experienced significantly more volatility in

those returns. An adverse event, such as an unfavorable earnings report, may depress the value of an issuer’s equity securities

held by an Underlying Fund. Equity security prices fluctuate for several reasons, including changes in investors’ perceptions

of the financial condition of an issuer or the general condition of the relevant stock market, or when political or economic events

affecting the issuers occur. The value of an Underlying Fund’s shares will go up and down due to movement in the collective

returns of the individual securities held by the Underlying Fund. Common stocks are subordinate to preferred stocks and debt in

a company’s capital structure, and if a company is liquidated, the claims of secured and unsecured creditors and owners

of preferred stocks take precedence over the claims of those who own Common Shares. In addition, equity security prices may be

particularly sensitive to rising interest rates, as the cost of capital rises and borrowing costs increase.

Exchange-Traded

Note Risks. The Fund and the Underlying Funds may invest in ETNs, which are notes representing unsecured debt issued by

an underwriting bank. ETNs are typically linked to the performance of an index plus a specified rate of interest that could be

earned on cash collateral. The value of an ETN may be influenced by time to maturity, level of supply and demand for the ETN,

volatility and lack of liquidity in underlying markets, changes in the applicable interest rates, changes in the issuer’s

credit rating and economic, legal, political or geographic events that affect the referenced index. ETNs typically mature 30 years

from the date of issue. There may be restrictions on a fund’s right to liquidate its investment in an ETN prior to maturity

(for example, a fund may only be able to offer its ETN for repurchase by the issuer on a weekly basis), and there may be limited

availability of a secondary market.

Fixed

Income Risks. The Underlying Funds may invest in fixed income securities. Fixed income securities increase or decrease

in value based on changes in interest rates. If rates increase, the value of a fund’s fixed income securities generally

declines. On the other hand, if rates fall, the value of the fixed income securities generally increases. This risk is increased

in the case of issuers of high yield securities, also known as “junk bonds.” High yield securities are predominantly

speculative with respect to the issuer’s capacity to pay interest and repay principal in accordance with the terms of the

obligation. In typical interest rate environments, the prices of longer-term fixed income securities generally fluctuate more

than the prices of shorter-term fixed income securities as interest rates change. These risks may be greater in the current market

environment because certain interest rates are near historically low levels. The issuer of a fixed income security may not be

able to make interest and principal payments when due. In general, lower rated fixed income securities carry a greater degree

of credit risk.

Foreign

Investing Risks. The Fund and the Underlying Funds may invest in foreign securities. Investments in foreign securities

may be affected by currency controls and exchange rates; different accounting, auditing, financial reporting, and legal standards

and practices; expropriation; changes in tax policy; social, political and economic instability; greater market volatility; differing

securities market structures; higher transaction costs; and various administrative difficulties, such as delays in clearing and

settling portfolio transactions or in receiving payment of dividends. In addition, changes in government administrations or economic

or monetary policies in the United States or abroad could result in appreciation or depreciation of the Fund’s or Underlying

Fund’s securities. These risks may be heightened in connection with investments in emerging or developing countries. To

the extent that a Fund or Underlying Fund invests in depositary receipts, the Fund or Underlying Fund will be subject to many

of the same risks as when investing directly in foreign securities. The effect of recent, worldwide economic instability on specific

foreign markets or issuers may be difficult to predict or evaluate, and some national economies continue to show profound instability,

which may in turn affect their international trading partners.

Illiquid

Securities Risks. The Underlying Funds may invest in illiquid securities. It may not be possible to sell or otherwise

dispose of illiquid securities both at the price and within the time period deemed desirable by the Fund. Illiquid securities

also may be difficult to value.

Initial

Public Offerings Risks. The Fund and the Underlying Funds may purchase securities in initial public offerings (“IPOs”).

Investing in IPOs has added risks because the shares are frequently volatile in price. As a result, their performance can be more

volatile and they face greater risk of business failure, which could increase the volatility of an Underlying Fund’s portfolio.

Investment

and Market Risks. An investment in Common Shares is subject to investment risk, including the possible loss of the entire

principal amount invested. An investment in Common Shares represents an indirect investment in the Underlying Funds owned by the

Fund. The value of the Underlying Funds, like other market investments, may move up or down, sometimes rapidly and unpredictably.

Overall stock market risks may also affect the value of the Fund or the Underlying Funds. Factors such as domestic and foreign

economic growth and market conditions, interest rate levels and political events affect the securities markets. The Common Shares

at any point in time may be worth less than the original investment, even after taking into account any reinvestment of dividends

and distributions.

Legislation,

Policy and Regulatory Risks. At any time after the date of this Prospectus, legislation or additional regulations may

be enacted that could negatively affect the assets of the Fund or the issuers of such assets. Recent changes in the U.S. political

landscape and changing approaches to regulation may have a negative impact on the entities and/or securities in which the Fund

or an Underlying Fund invests. Legislation or regulation may also change the way in which the Fund or an Underlying Fund is regulated.

New or amended regulations may be imposed by the Commodity Futures Trading Commission (“CFTC”), the SEC, the Board

of Governors of the Federal Reserve System (the “Federal Reserve”) or other financial regulators, other governmental

regulatory authorities or self-regulatory organizations that supervise the financial markets that could adversely affect the Fund

or the Underlying Funds. In particular, these agencies are empowered to promulgate a variety of new rules pursuant to financial

reform legislation in the United States. There can be no assurance that future legislation, regulation or deregulation will not

have a material adverse effect on the Fund or will not impair the ability of the Fund to achieve its investment objective. The

Fund and the Underlying Funds also may be adversely affected by changes in the enforcement or interpretation of existing statutes

and rules by these governmental agencies.

Management

Risks. The Adviser’s judgments about the attractiveness, value and potential appreciation of a particular asset

class or individual security in which the Fund invests may prove to be incorrect and there is no guarantee that the Adviser’s

judgment will produce the desired results. Similarly, the Fund’s investments in Underlying Funds are subject to the judgment

of the Underlying Funds’ managers which may prove to be incorrect. In addition, the Adviser will have limited information

as to the portfolio holdings of the Underlying Funds at any given time. This may result in the Adviser having less ability to

respond to changing market conditions. The Fund may allocate its assets so as to under-emphasize or over-emphasize ETFs or other

investments under the wrong market conditions, in which case the Fund’s NAV may be adversely affected.

Market

Disruption, Geopolitical and Climate Change Risks. The value of your investment in the Fund is based on the values of the Fund’s

investments, which may change due to economic and other events that affect markets generally, as well as those that affect particular

regions, countries, industries, companies or governments. These movements, sometimes called volatility, may be greater or less depending

on the types of securities the Fund owns and the markets in which the securities trade. The increasing interconnectivity between global

economies and financial markets increases the likelihood that events or conditions in one region or financial market may adversely impact

issuers in a different country, region or financial market. Securities in the Fund’s portfolio may underperform due to inflation

(or expectations for inflation), interest rates, global demand for particular products or resources, natural disasters, pandemics, epidemics,

terrorism, regulatory events and governmental or quasi-governmental actions. The occurrence of global events similar to those in recent

years, such as terrorist attacks around the world, natural disasters, social and political discord or debt crises and downgrades, among

others, may result in market volatility and may have long term effects on both the U.S. and global financial markets. The occurrence

of such events may be sudden and unexpected, and it is difficult to predict when similar events affecting the U.S. or global financial

markets may occur, the effects that such events may have and the duration of those effects. Any such event(s) could have a significant

adverse impact on the value, liquidity and risk profile of the Fund’s portfolio, as well as its ability to sell securities to meet

redemptions. There is a risk that you may lose money by investing in the Fund.

Social,

political, economic and other conditions and events, such as natural disasters, health emergencies (e.g., epidemics and pandemics),

terrorism, conflicts and social unrest, may occur and could significantly impact issuers, industries, governments and other systems,

including the financial markets. As global systems, economies and financial markets are increasingly interconnected, events that

once had only local impact are now more likely to have regional or even global effects. Events that occur in one country, region

or financial market will, more frequently, adversely impact issuers in other countries, regions or markets. These impacts can

be exacerbated by failures of governments and societies to adequately respond to an emerging event or threat. These types of events

quickly and significantly impact markets in the U.S. and across the globe leading to extreme market volatility and disruption.

The extent and nature of the impact on supply chains or economies and markets from these events is unknown, particularly if a

health emergency or other similar event, such as the COVID-19 (the “Coronavirus”) outbreak, persists for an extended

period of time. Social, political, economic and other conditions and events, such as natural disasters, health emergencies (e.g.,

epidemics and pandemics), terrorism, conflicts and social unrest, could reduce consumer demand or economic output, result in market

closures, travel restrictions or quarantines, and generally have a significant impact on the economies and financial markets and

the Adviser’s investment advisory activities and services of other service providers, which in turn could adversely affect

the Fund’s investments and other operations. The value of the Fund’s investment may decrease as a result of such events,

particularly if these events adversely impact the operations and effectiveness of the Adviser or key service providers or if these

events disrupt systems and processes necessary or beneficial to the investment advisory or other activities on behalf the Fund.

Climate change poses long-term threats to physical and biological systems. Potential hazards and risks related to climate change for a

State or municipality include, among other things, wildfires, rising sea levels, more severe coastal flooding and erosion hazards, and

more intense storms. Storms in recent years have demonstrated vulnerabilities in a State's or municipality's infrastructure to extreme

weather events. Climate change risks, if they materialize, can adversely impact a State's or municipality's financial plan in current

or future years. In addition, economists and others have expressed increasing concern about the potential effects of global climate change

on property and security values. A rise in sea levels, an increase in powerful windstorms and/or a climate-driven increase in sea levels

or flooding could cause coastal properties to lose value or become unmarketable altogether. Economists warn that, unlike previous declines

in the real estate market, properties in affected coastal zones may not ever recover their value. Large wildfires driven by high winds

and prolonged drought may devastate businesses and entire communities and may be very costly to any business found to be responsible for

the fire. Regulatory changes and divestment movements tied to concerns about climate change could adversely affect the value of certain

land and the viability of industries whose activities or products are seen as accelerating climate change.

Master

Limited Partnerships Risks. The Underlying Funds may invest in MLPs. Investments in publicly traded MLPs, which are limited

partnerships or limited liability companies taxable as partnerships, involve some risks that differ from an investment in the