Regis Corporation Adopts Tax Benefits Preservation Plan

January 30 2024 - 6:30AM

Business Wire

Regis Corporation (NasdaqGM:RGS) (“Regis” or the “Company”),

today announced that its Board of Directors adopted a tax benefits

preservation plan (the “Plan”) designed to preserve the

availability of its net operating loss carryforwards (“NOLs”) and

certain other tax attributes under the Internal Revenue Code (the

“Code”).

As of September 30, 2023, Regis had approximately $646 million

of U.S. federal NOLs. These NOLs, the majority of which are not

subject to any expiration date, represent a valuable asset to the

company and are available to offset the Company’s current or future

taxable income.

Regis’ ability to use these NOLs (as well as certain other tax

attributes) would be substantially limited if Regis were to

experience an “ownership change” within the meaning of Section 382

of the Code. Generally, an “ownership change” occurs if the

percentage of the Regis’ common shares owned by one or more of its

“5-percent stockholders” (determined under Section 382 of the Code)

increases by more than 50% over a rolling three-year period. The

Plan is designed to protect shareholder value by mitigating the

likelihood of an “ownership change” that would result in

significant limitations on Regis’ ability to use its NOLs or

certain other tax attributes to offset current or future taxable

income.

The Plan is similar to those adopted by other public companies

with significant NOLs and other tax attributes that may be limited

by the application of Section 382 of the Code. The Plan is not

designed to prevent any action that the Board determines to be in

the best interests of Regis and its shareholders, and will help to

ensure that the Board remains in the best position to discharge its

fiduciary duties and protect these valuable assets.

The Plan provides, subject to certain exceptions, that if any

person or group acquires 4.95% or more of Regis’ outstanding common

shares, there would be a triggering event potentially resulting in

significant dilution in the voting power and economic ownership of

that person or group. As part of the Plan, the Board declared a

dividend of one preferred stock purchase right, which are referred

to as “rights,” for each outstanding common share. The dividend

will be payable to holders of record as of the close of business on

February 9, 2024. Any common shares issued after the record date

will be issued together with the rights. The rights will initially

trade with Regis’ common shares and will generally become

exercisable if a person or group, without the approval of the

Board, acquires 4.95% or more of Regis’s outstanding common shares.

Under the Plan, any person or group which currently owns 4.95% or

more of Regis’s outstanding common shares may continue to own its

common shares but may not acquire any additional shares without

triggering the Plan (except as otherwise specified in the Plan,

including the right to acquire up to 1% of additional common

shares). If the rights become exercisable, all holders of rights

(other than the triggering person or group) will be entitled to

purchase common shares at a 50% discount or Regis may exchange each

right held by such holders for one common share. Rights held by the

triggering person or group will become null and void and will not

be exercisable.

The Plan will continue in effect until January 29, 2025, unless

earlier terminated or the rights are earlier exchanged or redeemed

by the Board of Directors.

Additional information with respect to the Plan will be

contained in the Current Report on Form 8-K that the Company is

filing with the Securities and Exchange Commission (the

“SEC”). A copy of the Form 8-K can be

obtained at the SEC’s Internet website at www.sec.gov.

About Regis Corporation.

Regis Corporation (NasdaqGM: RGS) is a leader in the haircare

industry. As of September 30, 2023, the Company franchised or owned

4,811 locations. Regis’ franchised and corporate locations operate

under concepts such as Supercuts®, SmartStyle®, Cost Cutters®,

Roosters® and First Choice Haircutters®. For additional information

about the Company, including a reconciliation of certain non-GAAP

financial information and certain supplemental financial

information, please visit the Investor Relations section of the

corporate website at www.regiscorp.com.

Forward-Looking

Statements

This release contains or may contain “forward-looking

statements” within the meaning of the federal securities laws,

including statements concerning anticipated future events and

expectations that are not historical facts, including statements

with respect to the Company’s net operating losses, tax attributes

and impact of the Plan. These forward-looking statements are made

pursuant to the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995. The forward-looking statements in

this document reflect management’s best judgment at the time they

are made, but all such statements are subject to numerous risks and

uncertainties, which could cause actual results to differ

materially from those expressed in or implied by the statements

herein. Such forward-looking statements are often identified herein

by use of words including, but not limited to, “will,” “may,”

“believe,” “project,” “forecast,” “expect,” “estimate,”

“anticipate,” “intend,” “looks forward to” and “plan.” In addition,

the following factors could affect the Company’s actual results and

cause such results to differ materially from those expressed in

forward-looking statements. These factors include our ability to

comply with applicable national stock exchange listing

requirements, potential timing and outcomes of suspension and

delisting procedures and future trading or quotation of our common

stock, and other potential factors that could affect future

financial and operating results as set forth under Item 1A of our

Form 10-K. We undertake no obligation to publicly update or revise

any forward-looking statements, whether as a result of new

information, future events or otherwise. However, your attention is

directed to any further disclosures made in our subsequent annual

and periodic reports filed or furnished with the Securities and

Exchange Commission on Forms 10-K, 10-Q and 8-K and Proxy

Statements on Schedule 14A.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240129776962/en/

REGIS CORPORATION Kersten Zupfer

investorrelations@regiscorp.com

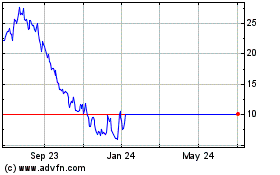

Regis (NYSE:RGS)

Historical Stock Chart

From Dec 2024 to Jan 2025

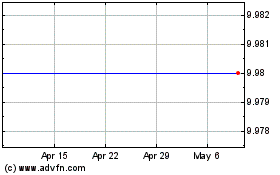

Regis (NYSE:RGS)

Historical Stock Chart

From Jan 2024 to Jan 2025