false

0000726728

0000726728

2024-01-08

2024-01-08

0000726728

us-gaap:CommonStockMember

2024-01-08

2024-01-08

0000726728

o:Notes1.125PercentDue2027Member

2024-01-08

2024-01-08

0000726728

o:Notes1.875PercentDue2027Member

2024-01-08

2024-01-08

0000726728

o:Notes1.625PercentDue2030Member

2024-01-08

2024-01-08

0000726728

o:Notes4.875PercentDue2030Member

2024-01-08

2024-01-08

0000726728

o:Notes5.750PercentDue2031Member

2024-01-08

2024-01-08

0000726728

o:Notes1.750PercentDue2033Member

2024-01-08

2024-01-08

0000726728

o:Notes5.125PercentDue2034Member

2024-01-08

2024-01-08

0000726728

o:Notes6.000PercentDue2039Member

2024-01-08

2024-01-08

0000726728

o:Notes2.500PercentDue2042Member

2024-01-08

2024-01-08

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

United States

Securities

and Exchange Commission

Washington, D.C. 20549

Form 8-K

Current

Report

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report: January 8, 2024

(Date of Earliest Event Reported)

REALTY

INCOME CORPORATION

(Exact name of registrant as specified in

its charter)

| Maryland |

|

1-13374 |

|

33-0580106 |

(State or Other Jurisdiction of

Incorporation or Organization) |

|

(Commission File Number) |

|

(IRS

Employer Identification No.) |

11995 El Camino Real, San Diego, California 92130

(Address of principal executive offices)

(858) 284-5000

(Registrant’s telephone number, including area code)

N/A

(former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of

the Act:

| Title

of each class |

|

Trading

symbol |

|

Name

of Each Exchange On Which

Registered |

| Common

Stock, $0.01 Par Value |

|

O |

|

New York Stock Exchange |

| 1.125% Notes due 2027 |

|

O27A |

|

New York Stock Exchange |

| 1.875% Notes due 2027 |

|

O27B |

|

New York Stock Exchange |

| 1.625% Notes due 2030 |

|

O30 |

|

New York Stock Exchange |

| 4.875% Notes due 2030 |

|

O30A |

|

New York Stock Exchange |

| 5.750% Notes due 2031 |

|

O31A |

|

New York Stock Exchange |

| 1.750% Notes due 2033 |

|

O33A |

|

New York Stock Exchange |

| 5.125% Notes due 2034 |

|

O34 |

|

New York Stock Exchange |

| 6.000% Notes due 2039 |

|

O39 |

|

New York Stock Exchange |

| 2.500% Notes due 2042 |

|

O42 |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 8.01 Other Events

On January 8, 2024, Realty Income Corporation (the

“Company,” “Realty Income,” “our,” “us” or “we,” which terms include, unless

otherwise expressly stated or the context otherwise requires, its consolidated subsidiaries) provided certain updates with respect to

its recent investments, capital raising, liquidity and litigation matters, as set forth below.

Unless as otherwise indicated or the context otherwise

requires, for purposes of the following disclosures, (a) references to our “revolving credit facility” and similar references

mean our $4.25 billion unsecured revolving credit facility (excluding a $1.0 billion expansion option, which is subject to obtaining lender

commitments and other customary conditions) and references to our “commercial paper programs” and similar references mean,

collectively, our $1.5 billion U.S. Dollar-denominated unsecured commercial paper program and our $1.5 billion Euro-denominated unsecured

commercial paper program; (b) references to our “clients” mean our tenants, (c) references to “GBP,” “Sterling”

and “£” are to the lawful currency of the United Kingdom; and (d) references to “Euro” and “€”

are to the lawful currency of the European Union. For purposes of determining the aggregate amount of borrowings outstanding under our

revolving credit facility as of any specified date, borrowings denominated in GBP and Euros are translated into U.S. dollars using the

applicable exchange rates as in effect from time to time.

Acquisitions Update

During the three and twelve months ended December

31, 2023, we invested approximately $2.7 billion and $9.5 billion, respectively, in properties and properties under development, unconsolidated

joint ventures, a preferred equity investment and loans at an initial weighted average cash yield of approximately 7.6% and 7.1%, respectively.

The initial weighted average cash yield for acquisitions

of properties and properties under development is computed as contractual cash net operating income for the first twelve months following

the acquisition date, divided by the total cost of the property (including all expenses borne by us). Initial weighted average cash yield

for unconsolidated entities is computed as our pro-rata contractual cash income on the investment for the first twelve months following

the acquisition date, after deducting our pro-rata share of debt and preferred interest payments as applicable, divided by the total cost

of our common equity investment. Initial weighted average cash yield for loans receivable and preferred equity investment is computed

as contractual cash income on the loan receivable and preferred equity investment for the first twelve months following the acquisition

date, or in the case of floating rate loans, the cash yield at the time of inception. Since it is possible that a client could default

on the payment, total cost or cash yield could differ from our expectations or estimates and we cannot provide assurance that the actual

initial weighted average cash yields on the applicable investments will not be lower than those described above. These estimates are preliminary

and are based on the most current information available to management.

Liquidity and Capital Markets

ATM Equity Capital Raising

As of December 31, 2023, there were 6.2 million

shares of common stock subject to forward sale agreements through our at-the-market (“ATM”) program, representing approximately

$337.8 million in estimated net proceeds (assuming full physical settlement of all outstanding shares of common stock subject to such

forward sale agreements and certain assumptions made with respect to settlement dates), which have been executed but not settled. In addition,

year to date through December 31, 2023, we settled approximately 91.7 million shares of common stock previously sold pursuant to forward

sale agreements through our prior and current ATM programs for approximately $5.4 billion of net proceeds. Under our current ATM program,

we may offer and sell from time to time up to 120.0 million shares of common stock (1) by us to, or through, a consortium of banks acting

as our sales agents or (2) by a consortium of banks acting as forward sellers on behalf of any forward purchasers contemplated thereunder,

in each case by means of ordinary brokers’ transactions on the NYSE at prevailing market prices, at prices related to prevailing

market prices or at negotiated prices or by any other methods permitted by applicable law. As of December 31, 2023, we had 81.3 million

shares remaining available for future issuance under our current ATM program.

Liquidity

As of December 31, 2023, we had a cash and cash

equivalents balance of approximately $220.3 million, including £46.0 million denominated in Sterling and €60.9 million denominated

in Euro, unsettled ATM forward equity of $337.8 million, and approximately $3.5 billion of availability under our $4.25 billion unsecured

revolving credit facility, after deducting $764.4 million in borrowings under our commercial paper programs.

Merger Litigation Update

As previously disclosed, on October 29, 2023, we

entered into an Agreement and Plan of Merger (as amended from time to time, the “Merger Agreement”) with Spirit Realty Capital,

Inc., a Maryland corporation (“Spirit”), and Saints MD Subsidiary, Inc., a Maryland corporation and our wholly owned subsidiary

(“Merger Sub”). Pursuant to the terms and conditions of the Merger Agreement, upon the closing, Spirit will be merged with

and into Merger Sub, with Merger Sub continuing as the surviving corporation (the “Merger”).

Following the announcement of the Merger Agreement,

and as of the date of this Current Report on Form 8-K, purported stockholders of Spirit have filed three lawsuits challenging disclosures

related to the Merger (the “Spirit Complaints”). The Spirit Complaints are Thompson v. Spirit Realty Capital, Inc., et. al.,

Case No. 2:23cv13219 (E.D. Mich Dec 18, 2023) (the “Thompson Complaint”); Kent v. Spirit Realty Capital, Inc., et. al., Case

No. 2:23-cv-13232 (E.D. Mich Dec 19, 2023) (the “Kent Complaint”); and Snow v. Kevin Charlton, et. al., Case No. 72567/2023

(Sup. Ct. Westchester Cnty. 2023) (the “Snow Complaint”).

The Thompson and Kent Complaints name Spirit and

the members of the Spirit board of directors as defendants. The Snow Complaint names Spirit, the members of the Spirit board of directors

and Realty Income as defendants.

The Thompson and Kent Complaints allege that Spirit

and the members of the Spirit board of directors violated Section 14(a) of the Securities Exchange Act of 1934 (the “Exchange Act”)

and Rule 14a-9 promulgated thereunder by preparing and disseminating a registration statement that misstates or omits certain allegedly

material information. They also allege that the members of the Spirit board of directors violated Section 20(a) of the Exchange Act by

causing Spirit to disseminate a misleading registration statement.

The Snow Complaint alleges violations of Maryland

state law based on alleged breaches of fiduciary duty, allegedly misleading statements and omissions in the proxy statement/prospectus

related to the Merger (the “proxy statement/prospectus”), and alleged aiding and abetting of such violations. It also alleges

a claim under New York law for negligent misrepresentation and concealment.

Each of the Spirit Complaints seeks, among other

things, injunctive relief enjoining Spirit from holding the stockholder vote to approve the Merger and/or the consummation of the Merger,

rescission or rescissory damages in the event the Merger is consummated, and an award of the plaintiff’s costs, including attorneys’

and experts’ fees.

In addition to the Spirit Complaints, beginning

on December 19, 2023, purported stockholders of Spirit sent demand letters (the “Demands,” and together with the Spirit Complaints,

the “Matters”) alleging similar deficiencies regarding the disclosures made in the proxy statement/prospectus.

All of the defendants believe that the Matters

are without merit. However, litigation is inherently uncertain and there can be no assurance regarding the likelihood that the defendants’

defense of the actions will be successful. Additional lawsuits arising out of the Merger may also be filed in the future. While Spirit

and Realty Income believe that the disclosures set forth in the proxy statement/prospectus comply fully with applicable law, to moot plaintiffs’

disclosure claims and to avoid nuisance, potential expense and delay, Spirit and Realty Income intend to voluntarily supplement the proxy

statement/prospectus with supplemental disclosures.

Forward-Looking Statements

This Current Report on Form 8-K contains forward-looking

statements within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Exchange Act of 1934, as amended. When used herein, the words “estimated,” “anticipated,”

“expect,” “believe,” “intend,” “continue,” “should,” “may,” “likely,”

“plans,” and similar expressions are intended to identify forward-looking statements. Forward-looking statements include discussions

of our business and portfolio (including our growth strategies and our intention to acquire or dispose of properties including the timing

and terms), re-leases, re-development and speculative development of properties and expenditures related thereto; future operations and

results; the announcement of operating results, strategy, plans, and the intentions of management; trends in our business, including trends

in the market for long-term leases of freestanding, single-client properties; and statements regarding the anticipated or projected impact

of our proposed Merger, if consummated, on our business, results of operations, financial condition or prospects). Forward-looking statements

regarding the anticipated or projected impact of the proposed Merger may include, without limitation, statements regarding potential impacts

on our adjusted funds from operations, general and administrative and other corporate expenses, leverage ratios and other credit metrics

if the Merger is consummated; potential changes in our interest expense from refinancing or repaying outstanding Spirit indebtedness or

preferred equity subsequent to the Merger, if consummated, and potential interest rates at which such indebtedness and preferred equity

could be refinanced; statements regarding the potential impact of the Merger, if consummated, on our cash flow and dividend coverage durability;

and pro forma information regarding the combined company assuming the Merger is consummated. Likewise, all such pro forma financial statements

and other pro forma information has been prepared on the basis of certain assumptions and estimates and is subject to other uncertainties

and does not purport to reflect what our actual results of operations or financial condition or this other pro forma information would

have been had the Merger been consummated on the dates assumed for purposes of such pro forma financial statements and information or

to be indicative of our financial condition, results of operations or metrics as of or for any future date or period. In that regard,

there can be no assurance that the proposed Merger will be consummated on the terms or timeline currently contemplated, or at all.

Forward-looking statements are subject to risks,

uncertainties, and assumptions about us, which may cause our actual future results to differ materially from expected results. Some of

the factors that could cause actual results to differ materially are, among others, our continued qualification as a real estate investment

trust; general domestic and foreign business, economic, or financial conditions; competition; fluctuating interest and currency rates;

inflation and its impact on our clients and us; access to debt and equity capital markets and other sources of funding; continued volatility

and uncertainty in the credit markets and broader financial markets; other risks inherent in the real estate business including our clients’

defaults under leases, increased client bankruptcies, potential liability relating to environmental matters, illiquidity of real estate

investments, and potential damages from natural disasters; impairments in the value of our real estate assets; changes in domestic and

foreign income tax laws and rates; our clients’ solvency; property ownership through joint ventures and partnerships which may limit

control of the underlying investments; current or future epidemics or pandemics, measures taken to limit their spread, the impacts on

us, our business, our clients (including those in the theater and fitness industries), and the economy generally; the loss of key personnel;

the outcome of any legal proceedings to which we are a party or which may occur in the future; acts of terrorism and war; the structure,

timing and completion of the announced Merger between our subsidiary and Spirit and any effects of the announcement, pendency or completion

of the announced Merger, including the anticipated benefits therefrom; and those additional risks and factors discussed in our reports

filed with the U.S. Securities and Exchange Commission. Readers are cautioned not to place undue reliance on forward-looking statements.

Those forward-looking statements are not guarantees of future plans and performance and speak only as of the date of this report. Actual

plans and operating results may differ materially from what is expressed or forecasted herein. We do not undertake any obligation to update

forward-looking statements or publicly release the results of any revisions to these forward-looking statements that may be made to reflect

events or circumstances after the date these statements were made.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Dated: January 8, 2024 |

REALTY INCOME CORPORATION |

| |

|

|

| |

By: |

/s/ Bianca Martinez |

| |

|

Bianca Martinez |

| |

|

Senior Vice President, Associate General Counsel and Assistant Secretary |

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=o_Notes1.125PercentDue2027Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=o_Notes1.875PercentDue2027Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=o_Notes1.625PercentDue2030Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=o_Notes4.875PercentDue2030Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=o_Notes5.750PercentDue2031Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=o_Notes1.750PercentDue2033Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=o_Notes5.125PercentDue2034Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=o_Notes6.000PercentDue2039Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=o_Notes2.500PercentDue2042Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

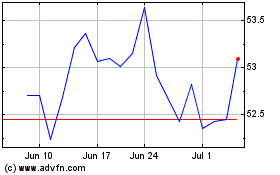

Realty Income (NYSE:O)

Historical Stock Chart

From Apr 2024 to May 2024

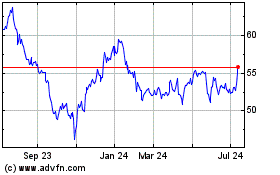

Realty Income (NYSE:O)

Historical Stock Chart

From May 2023 to May 2024