0000080424FalseFalseFalseFalseFalse00000804242024-01-232024-01-230000080424us-gaap:CommonStockMember2024-01-232024-01-230000080424exch:XNYS2024-01-232024-01-230000080424pg:A0.500due2024Domain2024-01-232024-01-230000080424pg:A0.625due2024Domain2024-01-232024-01-230000080424pg:A1.375due2025Domain2024-01-232024-01-230000080424pg:A0110Due2026Domain2024-01-232024-01-230000080424pg:A3250EURNotesDue2026Domain2024-01-232024-01-230000080424pg:A4.875EURdueMay2027Domain2024-01-232024-01-230000080424pg:A1.200due2028Domain2024-01-232024-01-230000080424pg:A1.250due2029Domain2024-01-232024-01-230000080424pg:A1.800due2029Domain2024-01-232024-01-230000080424pg:A6.250GBPdueJanuary2030Domain2024-01-232024-01-230000080424pg:A0350Due2030Domain2024-01-232024-01-230000080424pg:A0230Due2031Domain2024-01-232024-01-230000080424pg:A3250EURNotesDue2031Domain2024-01-232024-01-230000080424pg:A5.250GBPdueJanuary2033Domain2024-01-232024-01-230000080424pg:A1.875due2038Domain2024-01-232024-01-230000080424pg:A0900Due2041Domain2024-01-232024-01-23

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act Of 1934 | | | | | |

| Date of Report (Date of earliest event reported) | January 23, 2024 |

THE PROCTER & GAMBLE COMPANY

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Ohio | OH | 1-434 | | 31-0411980 |

| (State of Incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification Number) |

| One Procter & Gamble Plaza | , | Cincinnati | OH | |

| One Procter & Gamble Plaza, Cincinnati, Ohio | 45202 |

| (Address of principal executive offices) | (Zip Code) |

(513) 983-1100

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below): | | | | | | | | |

| ¨ | False | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | False | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | False | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | False | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common Stock, without Par Value | PG | NYSE |

| 0.500% Notes due 2024 | PG24A | NYSE |

| 0.625% Notes due 2024 | PG24B | NYSE |

| 1.375% Notes due 2025 | PG25 | NYSE |

| 0.110% Notes due 2026 | PG26D | NYSE |

| 3.250% EUR Notes due 2026 | PG26E | NYSE |

| 4.875% EUR notes due May 2027 | PG27A | NYSE |

| 1.200% Notes due 2028 | PG28 | NYSE |

| 1.250% Notes due 2029 | PG29B | NYSE |

| 1.800% Notes due 2029 | PG29A | NYSE |

| 6.250% GBP notes due January 2030 | PG30 | NYSE |

| 0.350% Notes due 2030 | PG30C | NYSE |

| 0.230% Notes due 2031 | PG31A | NYSE |

| 3.250% EUR Notes due 2031 | PG31B | NYSE |

| 5.250% GBP notes due January 2033 | PG33 | NYSE |

| 1.875% Notes due 2038 | PG38 | NYSE |

| 0.900% Notes due 2041 | PG41 | NYSE |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨ False

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| | | | | |

| ITEM 2.02 | RESULTS OF OPERATIONS AND FINANCIAL CONDITION |

On January 23, 2024, The Procter & Gamble Company (the "Company") issued a news release with respect to earnings for the quarter ended December 31, 2023. The Company is furnishing this 8-K pursuant to Item 2.02, "Results of Operations and Financial Condition." |

| | | | | |

| ITEM 9.01 | FINANCIAL STATEMENTS AND EXHIBITS |

| Exhibit Number | Description |

| 99.1 | News Release by The Procter & Gamble Company dated January 23, 2024. |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| THE PROCTER & GAMBLE COMPANY |

| By | /s/ SANDRA T. LANE |

| Sandra T. Lane, Assistant Secretary |

| 1/23/2024 |

EXHIBIT(S)

| | | | | |

| News Release | The Procter & Gamble Company |

| One P&G Plaza |

| Cincinnati, OH 45202 |

| | |

P&G ANNOUNCES FISCAL YEAR 2024 SECOND QUARTER RESULTS |

| Net Sales +3% and Organic Sales +4% |

| Diluted EPS $1.40, -12% and Core EPS $1.84, +16% |

| MAINTAINS FISCAL YEAR SALES AND CASH RETURN GUIDANCE |

| UPDATES GAAP EPS OUTLOOK, RAISES CORE EPS GROWTH GUIDANCE |

CINCINNATI, January 23, 2024 - The Procter & Gamble Company (NYSE:PG) reported second quarter fiscal year 2024 net sales of $21.4 billion, an increase of three percent versus the prior year. Organic sales, which excludes the impacts of foreign exchange and acquisitions and divestitures, increased four percent. Diluted net earnings per share were $1.40, a decrease of 12% versus prior year primarily due to a non-cash impairment of the carrying value of the Gillette intangible asset. Core net earnings per share were $1.84, an increase of 16% versus prior year.

Operating cash flow was $5.1 billion, and net earnings were $3.5 billion for the quarter. Adjusted free cash flow productivity was 95%, which is calculated as operating cash flow excluding capital spending, as a percentage of net earnings excluding the Gillette impairment charge. The Company returned $3.3 billion of cash to shareowners via approximately $2.3 billion of dividend payments and $1 billion of share repurchases.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Second Quarter ($ billions, except EPS) |

GAAP | 2024 | 2023 | % Change | | Non-GAAP* | 2024 | 2023 | % Change |

Net Sales | 21.4 | 20.8 | 3% | | Organic Sales | n/a | n/a | 4% |

Diluted EPS | 1.40 | 1.59 | (12)% | | Core EPS | 1.84 | 1.59 | 16% |

*Please refer to Exhibit 1 - Non-GAAP Measures for the definition and reconciliation of these measures to the related GAAP measures.

“We delivered strong results in the second quarter, enabling us to raise our core EPS growth guidance and maintain our top-line outlook for the fiscal year,” said Jon Moeller, Chairman of the Board, President and Chief Executive Officer. “We remain committed to our integrated strategy of a focused product portfolio of daily use categories where performance drives brand choice, superiority — across product performance, packaging, brand communication, retail execution and consumer and customer value — productivity, constructive disruption and an agile and accountable organization. The P&G team’s execution of this strategy has enabled us to build and sustain strong momentum. We have confidence this remains the right strategy to deliver balanced growth and value creation.”

October - December Quarter Discussion

Net sales in the second quarter of fiscal year 2024 were $21.4 billion, a three percent increase versus the prior year. Organic sales, which exclude the impacts of foreign exchange and acquisitions and divestitures, increased four percent. The organic sales increase was driven by a four percent increase from higher pricing, partially offset by a one percent decrease in organic shipment volumes. Mix had a neutral impact on sales for the quarter.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| October - December 2023 | Volume | Foreign Exchange | Price | Mix | Other (2) | Net Sales | Organic Volume | Organic Sales |

Net Sales Drivers (1) |

| Beauty | —% | (1)% | 4% | (3)% | 1% | 1% | (1)% | 1% |

| Grooming | 1% | (3)% | 7% | 1% | —% | 6% | 1% | 9% |

| Health Care | (3)% | 2% | 5% | 1% | (1)% | 4% | (4)% | 2% |

| Fabric & Home Care | —% | —% | 4% | 1% | —% | 5% | 1% | 6% |

| Baby, Feminine & Family Care | (2)% | (1)% | 4% | 1% | —% | 2% | (2)% | 3% |

| Total P&G | —% | (1)% | 4% | —% | —% | 3% | (1)% | 4% |

(1)Net sales percentage changes are approximations based on quantitative formulas that are consistently applied.

(2)Other includes the sales mix impact from acquisitions and divestitures and rounding impacts necessary to reconcile volume to net sales.

•Beauty segment organic sales increased one percent versus year ago. Skin and Personal Care organic sales declined mid-single digits as volume declines and unfavorable mix due to lower sales of SK-II were partially offset by higher pricing. Hair Care organic sales increased high single digits driven by increased pricing, premium product mix and volume growth, primarily in North America.

•Grooming segment organic sales increased nine percent versus year ago driven by higher pricing, premium product mix and volume growth.

•Health Care segment organic sales increased two percent versus year ago. Oral Care organic sales increased mid-single digits due to increased pricing and premium product mix, partially offset by volume declines mainly in Latin America and Asia. Personal Health Care organic sales declined low single digits as volume declines and unfavorable mix due to market decline of respiratory products, were partially offset by increased pricing.

•Fabric and Home Care segment organic sales increased six percent versus year ago. Fabric Care organic sales increased mid-single digits due to increased pricing and mix due to growth of premium forms and fabric enhancers. Home Care organic sales increased high single digits due to increased pricing, favorable premium products mix and volume growth from innovation.

•Baby, Feminine and Family Care segment organic sales increased three percent versus year ago. Baby Care organic sales were unchanged as increased pricing and favorable product mix were offset by volume declines. Feminine Care organic sales increased mid-single digits driven by increased pricing and favorable product mix, partially offset by pricing-related volume declines in international markets. Family Care organic sales increased mid-single digits due primarily to volume growth.

Diluted net earnings per share decreased by 12% to $1.40, primarily due to the non-cash charge to impair the carrying value of the Gillette trade name intangible asset and higher non-core restructuring charges. Core net earnings per share increased by 16% to $1.84, driven by an increase in net sales and an increase in core operating margin. Currency-neutral core EPS were up 18% versus the prior year EPS.

Gross margin for the quarter increased 520 basis points versus the prior year, 590 basis points on a currency-neutral basis. The increase was driven by benefits of 240 basis points from gross productivity savings, 200 basis points of favorable commodity costs and 190 basis points from increased pricing. These were partially offset by 40 basis points of product reinvestments and other impacts.

Reported selling, general and administrative expense (SG&A) as a percentage of sales increased 130 basis points versus the prior year. Core selling, general and administrative expense (SG&A) as a percentage of sales increased 120 basis points versus year ago and 110 basis points on a currency-neutral basis. The increase was driven by 290 basis points of reinvestments, partially offset by 100 basis points of productivity savings and 80 basis points of net sales growth leverage and other impacts.

Reported operating margin for the quarter decreased 230 basis points due primarily to the current period charge for the impairment of the Gillette intangible asset. Excluding this impairment and 10 basis points of non-core restructuring charges, core operating margin for the quarter increased 400 basis points versus the prior year, 470 basis points on a currency-neutral basis. Core operating margin included gross productivity savings of 340 basis points.

Limited Market Portfolio Restructuring

In December 2023, the Company announced a limited market portfolio restructuring of its business operations, primarily in certain Enterprise Markets, including Argentina and Nigeria, to address challenging macroeconomic and fiscal conditions. In connection with this announcement, the Company said that it expects to record incremental restructuring charges of $1.0 to 1.5 billion after tax, including foreign currency translation losses to be recognized upon the substantial liquidation of operations in the affected markets. The Company estimates that the large majority of these charges to be non-cash and anticipates that these restructuring charges will be recognized in the fiscal years ending June 30, 2024 and 2025.

Intangible Asset Impairment

During the October-December 2023 quarter, the Company recorded a $1.3 billion before tax ($1.0 billion after tax) non-cash impairment charge, on intangible assets acquired as part of the Company’s 2005 acquisition of The Gillette Company.

The impairment charge arose from a reduction in the estimated fair value of the Gillette indefinite-lived intangible asset due to a higher discount rate, weakening of several currencies relative to the U.S.

dollar and the impact of the non-core restructuring program described above. This impairment charge adjusted the carrying value of the Gillette indefinite-lived intangible asset to fair value.

Fiscal Year 2024 Guidance

P&G maintained its guidance range for fiscal 2024 all-in sales growth to be in the range of two to four percent versus the prior year. Foreign exchange is expected to be a headwind of approximately one to two percentage points to all-in sales growth. The Company also maintained its outlook for organic sales growth in the range of four to five percent.

P&G adjusted its fiscal 2024 diluted net earnings per share growth from a range of six to nine percent to a range of -1% to in-line versus fiscal 2023 EPS of $5.90. This change is due to the impairment of the Gillette intangible asset value discussed above and the two-year restructuring program announced by the Company last month. P&G raised its fiscal 2024 core net earnings per share growth from a range of six to nine percent to a range of eight to nine percent versus fiscal 2023 EPS. This outlook equates to a range of $6.37 to $6.43 per share.

P&G continues to expect unfavorable foreign exchange rates will be a headwind of approximately $1 billion after tax. The Company now expects the net impact of interest expense and interest income to be a headwind of approximately $100 million after tax. The Company continues to expect tailwinds of approximately $800 million after tax due to favorable commodity costs for fiscal year 2024.

The Company is unable to reconcile its forward-looking non-GAAP cash flow and tax rate measures without unreasonable efforts given the unpredictability of the timing and amounts of discrete items, such as acquisitions, divestitures, or impairments, which could significantly impact GAAP results.

P&G expects a core effective tax rate of approximately 21% in fiscal 2024.

Capital spending is estimated to be approximately 4% of fiscal 2024 net sales.

P&G continues to expect adjusted free cash flow productivity of 90% and expects to pay more than $9 billion in dividends and to repurchase $5 to $6 billion of common shares in fiscal 2024.

Forward-Looking Statements

Certain statements in this release, other than purely historical information, including estimates, projections, statements relating to our business plans, objectives and expected operating results, and the assumptions upon which those statements are based, are "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements generally are identified by the words "believe," "project," "expect," "anticipate," "estimate," "intend," "strategy," "future," "opportunity," "plan," "may," "should," "will," "would," "will be," "will continue," "will likely result" and similar expressions. Forward-looking statements are based on current expectations and assumptions, which are subject to risks and uncertainties that may cause results to differ materially from those expressed or implied in the forward-looking statements. We undertake no obligation to update or revise publicly any forward-looking statements, whether because of new information, future events or otherwise, except to the extent required by law.

Risks and uncertainties to which our forward-looking statements are subject include, without limitation: (1) the ability to successfully manage global financial risks, including foreign currency fluctuations, currency exchange or pricing controls and localized volatility; (2) the ability to successfully manage local, regional or global economic volatility, including reduced market growth rates, and to generate sufficient income and cash flow to allow the Company to effect the expected share repurchases and dividend payments; (3) the ability to manage disruptions in credit markets or to our banking partners or changes to our credit rating; (4) the ability to maintain key manufacturing and supply arrangements (including execution of supply chain optimizations and sole supplier and sole manufacturing plant arrangements) and to manage disruption of business due to various factors, including ones outside of our control, such as natural disasters, acts of war (including the Russia-Ukraine War) or terrorism or disease outbreaks; (5) the ability to successfully manage cost fluctuations and pressures, including prices of commodities and raw materials and costs of labor, transportation, energy, pension and healthcare; (6) the ability to stay on the leading edge of innovation, obtain necessary intellectual property protections and successfully respond to changing consumer habits, evolving digital marketing and selling platform requirements and technological advances attained by, and patents granted to, competitors; (7) the ability to compete with our local and global competitors in new and existing sales channels, including by successfully responding to competitive factors such as prices, promotional incentives and trade terms for products; (8) the ability to manage and maintain key customer relationships; (9) the ability to protect our reputation and brand equity by successfully managing real or perceived issues, including concerns about safety, quality, ingredients, efficacy, packaging content, supply chain practices or similar matters that may arise; (10) the ability to successfully manage the financial, legal, reputational and operational risk associated with third-party relationships, such as our suppliers, contract manufacturers, distributors,

contractors and external business partners; (11) the ability to rely on and maintain key company and third-party information and operational technology systems, networks and services and maintain the security and functionality of such systems, networks and services and the data contained therein; (12) the ability to successfully manage uncertainties related to changing political and geopolitical conditions and potential implications such as exchange rate fluctuations and market contraction; (13) the ability to successfully manage current and expanding regulatory and legal requirements and matters (including, without limitation, those laws and regulations involving product liability, product and packaging composition, intellectual property, labor and employment, antitrust, privacy and data protection, tax, the environment, due diligence, risk oversight, accounting and financial reporting) and to resolve new and pending matters within current estimates; (14) the ability to manage changes in applicable tax laws and regulations; (15) the ability to successfully manage our ongoing acquisition, divestiture and joint venture activities, in each case to achieve the Company's overall business strategy and financial objectives, without impacting the delivery of base business objectives; (16) the ability to successfully achieve productivity improvements and cost savings and manage ongoing organizational changes while successfully identifying, developing and retaining key employees, including in key growth markets where the availability of skilled or experienced employees may be limited; (17) the ability to successfully manage the demand, supply and operational challenges, as well as governmental responses or mandates, associated with a disease outbreak, including epidemics, pandemics or similar widespread public health concerns; (18) the ability to manage the uncertainties, sanctions and economic effects from the war between Russia and Ukraine; and (19) the ability to successfully achieve our ambition of reducing our greenhouse gas emissions and delivering progress towards our environmental sustainability priorities. For additional information concerning factors that could cause actual results and events to differ materially from those projected herein, please refer to our most recent 10-K, 10-Q and 8-K reports.

About Procter & Gamble

P&G serves consumers around the world with one of the strongest portfolios of trusted, quality, leadership brands, including Always®, Ambi Pur®, Ariel®, Bounty®, Charmin®, Crest®, Dawn®, Downy®, Fairy®, Febreze®, Gain®, Gillette®, Head & Shoulders®, Lenor®, Olay®, Oral-B®, Pampers®, Pantene®, SK-II®, Tide®, Vicks®, and Whisper®. The P&G community includes operations in approximately 70 countries worldwide. Please visit https://www.pg.com for the latest news and information about P&G and its brands. For other P&G news, visit us at https://www.pg.com/news.

# # #

P&G Media Contacts:

Wendy Kennedy, 513.780.7212

Jennifer Corso, 513.983.2570

P&G Investor Relations Contact:

John Chevalier, 513.983.9974

Category: PG-IR

| | | | | | | | | | | | | | | | | |

| THE PROCTER & GAMBLE COMPANY AND SUBSIDIARIES |

| Consolidated Earnings Information |

| Three Months Ended December 31 |

| Amounts in millions except per share amounts | 2023 | | 2022 | | % Chg |

| NET SALES | $ | 21,441 | | | $ | 20,773 | | | 3 | % |

| Cost of products sold | 10,144 | | | 10,897 | | | (7) | % |

| GROSS PROFIT | 11,297 | | | 9,876 | | | 14 | % |

| Selling, general and administrative expense | 5,522 | | | 5,091 | | | 8 | % |

| Indefinite-lived intangible asset impairment charge | 1,341 | | | — | | | |

| OPERATING INCOME | 4,433 | | | 4,785 | | | (7) | % |

| Interest expense | (248) | | | (171) | | | 45 | % |

| Interest income | 133 | | | 66 | | | 102 | % |

| Other non-operating income, net | 177 | | | 155 | | | 14 | % |

| EARNINGS BEFORE INCOME TAXES | 4,496 | | | 4,835 | | | (7) | % |

| Income taxes | 1,003 | | | 876 | | | 14 | % |

| NET EARNINGS | 3,493 | | | 3,959 | | | (12) | % |

| Less: Net earnings attributable to noncontrolling interests | 25 | | | 26 | | | (4) | % |

| NET EARNINGS ATTRIBUTABLE TO PROCTER & GAMBLE | $ | 3,468 | | | $ | 3,933 | | | (12) | % |

| | | | | |

| EFFECTIVE TAX RATE | 22.3 | % | | 18.1 | % | | |

| | | | | |

NET EARNINGS PER COMMON SHARE (1) | | | | | |

| Basic | $ | 1.44 | | | $ | 1.63 | | | (12) | % |

| Diluted | $ | 1.40 | | | $ | 1.59 | | | (12) | % |

| | | | | |

| DIVIDENDS PER COMMON SHARE | $ | 0.9407 | | | $ | 0.9133 | | | |

| DILUTED WEIGHTED AVERAGE COMMON SHARES OUTSTANDING | 2,468.4 | | | 2,481.2 | | | |

| | | | | |

| COMPARISONS AS A % OF NET SALES | | | | | Basis Pt Chg |

| Gross profit | 52.7 | % | | 47.5 | % | | 520 | |

| Selling, general and administrative expense | 25.8 | % | | 24.5 | % | | 130 | |

| Operating income | 20.7 | % | | 23.0 | % | | (230) | |

| Earnings before income taxes | 21.0 | % | | 23.3 | % | | (230) | |

| Net earnings | 16.3 | % | | 19.1 | % | | (280) | |

| Net earnings attributable to Procter & Gamble | 16.2 | % | | 18.9 | % | | (270) | |

(1)Basic net earnings per common share and Diluted net earnings per common share are calculated on Net earnings attributable to Procter & Gamble.

Certain columns and rows may not add due to rounding.

| | | | | | | | | | | | | | | | | | | | |

| THE PROCTER & GAMBLE COMPANY AND SUBSIDIARIES |

| Consolidated Earnings Information |

| Three Months Ended December 31, 2023 |

| Amounts in millions | Net Sales | % Change Versus Year Ago | Earnings/(Loss) Before Income Taxes | % Change Versus Year Ago | Net Earnings/(Loss) | % Change Versus Year Ago |

| Beauty | $ | 3,849 | | 1 | % | $ | 1,112 | | (3) | % | $ | 868 | | (5) | % |

| Grooming | 1,734 | | 6 | % | 538 | | 8 | % | 440 | | 9 | % |

| Health Care | 3,172 | | 4 | % | 932 | | 5 | % | 719 | | 5 | % |

| Fabric & Home Care | 7,415 | | 5 | % | 2,018 | | 31 | % | 1,577 | | 35 | % |

| Baby, Feminine & Family Care | 5,146 | | 2 | % | 1,437 | | 29 | % | 1,102 | | 30 | % |

| Corporate | 126 | | N/A | (1,541) | | N/A | (1,214) | | N/A |

| Total Company | $ | 21,441 | | 3 | % | $ | 4,496 | | (7) | % | $ | 3,493 | | (12) | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, 2023 |

Net Sales Drivers (1) | Volume | | Organic Volume | | Foreign Exchange | | Price | | Mix | | Other (2) | | Net Sales |

| Beauty | — | % | | (1) | % | | (1) | % | | 4 | % | | (3) | % | | 1 | % | | 1 | % |

| Grooming | 1 | % | | 1 | % | | (3) | % | | 7 | % | | 1 | % | | — | % | | 6 | % |

| Health Care | (3) | % | | (4) | % | | 2 | % | | 5 | % | | 1 | % | | (1) | % | | 4 | % |

| Fabric & Home Care | — | % | | 1 | % | | — | % | | 4 | % | | 1 | % | | — | % | | 5 | % |

| Baby, Feminine & Family Care | (2) | % | | (2) | % | | (1) | % | | 4 | % | | 1 | % | | — | % | | 2 | % |

| Total Company | — | % | | (1) | % | | (1) | % | | 4 | % | | — | % | | — | % | | 3 | % |

(1)Net sales percentage changes are approximations based on quantitative formulas that are consistently applied.

(2)Other includes the sales mix impact from acquisitions and divestitures and rounding impacts necessary to reconcile volume to net sales.

Certain columns and rows may not add due to rounding.

| | | | | | | | | | | |

| THE PROCTER & GAMBLE COMPANY AND SUBSIDIARIES |

| Consolidated Statements of Cash Flows |

| Six Months Ended December 31 |

| Amounts in millions | 2023 | | 2022 |

| CASH, CASH EQUIVALENTS AND RESTRICTED CASH, BEGINNING OF PERIOD | $ | 8,246 | | | $ | 7,214 | |

| OPERATING ACTIVITIES | | | |

| Net earnings | 8,049 | | | 7,922 | |

| Depreciation and amortization | 1,423 | | | 1,316 | |

| Share-based compensation expense | 275 | | | 250 | |

| Deferred income taxes | (154) | | | (398) | |

| Gain on sale of assets | (3) | | | (3) | |

| Indefinite-lived intangible asset impairment charge | 1,341 | | | — | |

| Changes in: | | | |

| Accounts receivable | (839) | | | (654) | |

| Inventories | (32) | | | (655) | |

| Accounts payable and accrued and other liabilities | 302 | | | 177 | |

| Other operating assets and liabilities | (704) | | | (535) | |

| Other | 346 | | | 224 | |

| TOTAL OPERATING ACTIVITIES | 10,004 | | | 7,644 | |

| INVESTING ACTIVITIES | | | |

| Capital expenditures | (1,742) | | | (1,598) | |

| Proceeds from asset sales | 8 | | | 8 | |

| Acquisitions, net of cash acquired | — | | | (76) | |

| Other investing activity | (489) | | | 344 | |

| TOTAL INVESTING ACTIVITIES | (2,224) | | | (1,322) | |

| FINANCING ACTIVITIES | | | |

| Dividends to shareholders | (4,578) | | | (4,486) | |

| Additions to short-term debt with original maturities of more than three months | 2,798 | | | 10,447 | |

| Reductions in short-term debt with original maturities of more than three months | (5,862) | | | (3,260) | |

| Net additions/(reductions) to other short-term debt | 3,740 | | | (1,759) | |

| Additions to long-term debt | 254 | | | — | |

| Reductions in long-term debt | (2,335) | | | (1,877) | |

| Treasury stock purchases | (2,503) | | | (6,002) | |

| Impact of stock options and other | 397 | | | 437 | |

| TOTAL FINANCING ACTIVITIES | (8,087) | | | (6,500) | |

| EFFECT OF EXCHANGE RATE CHANGES ON CASH, CASH EQUIVALENTS AND RESTRICTED CASH | (49) | | | (182) | |

| CHANGE IN CASH, CASH EQUIVALENTS AND RESTRICTED CASH | (356) | | | (360) | |

| CASH, CASH EQUIVALENTS AND RESTRICTED CASH, END OF PERIOD | $ | 7,890 | | | $ | 6,854 | |

Certain columns and rows may not add due to rounding.

| | | | | | | | | | | |

| THE PROCTER & GAMBLE COMPANY AND SUBSIDIARIES |

| Condensed Consolidated Balance Sheets |

| Amounts in millions | December 31, 2023 | | June 30, 2023 |

| Cash and cash equivalents | $ | 7,890 | | | $ | 8,246 | |

| Accounts receivable | 6,334 | | | 5,471 | |

| Inventories | 7,151 | | | 7,073 | |

| Prepaid expenses and other current assets | 1,736 | | | 1,858 | |

| TOTAL CURRENT ASSETS | 23,111 | | | 22,648 | |

| Property, plant and equipment, net | 22,132 | | | 21,909 | |

| Goodwill | 40,916 | | | 40,659 | |

| Trademarks and other intangible assets, net | 22,302 | | | 23,783 | |

| Other noncurrent assets | 12,248 | | | 11,830 | |

| TOTAL ASSETS | $ | 120,709 | | | $ | 120,829 | |

| | | |

| Accounts payable | $ | 14,234 | | | $ | 14,598 | |

| Accrued and other liabilities | 11,100 | | | 10,929 | |

| Debt due within one year | 10,616 | | | 10,229 | |

| TOTAL CURRENT LIABILITIES | 35,950 | | | 35,756 | |

| Long-term debt | 23,096 | | | 24,378 | |

| Deferred income taxes | 6,219 | | | 6,478 | |

| Other noncurrent liabilities | 6,614 | | | 7,152 | |

| TOTAL LIABILITIES | 71,880 | | | 73,764 | |

| TOTAL SHAREHOLDERS' EQUITY | 48,829 | | | 47,065 | |

| TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY | $ | 120,709 | | | $ | 120,829 | |

Certain columns and rows may not add due to rounding.

The Procter & Gamble Company

Exhibit 1: Non-GAAP Measures

The following provides definitions of the non-GAAP measures used in Procter & Gamble's January 23, 2024 earnings release and the reconciliation to the most closely related GAAP measures. We believe that these measures provide useful perspective on underlying business trends (i.e., trends excluding non-recurring or unusual items) and results and provide a supplemental measure of period-to-period results. The non-GAAP measures described below are used by management in making operating decisions, allocating financial resources and for business strategy purposes. These measures may be useful to investors, as they provide supplemental information about business performance and provide investors a view of our business results through the eyes of management. These measures are also used to evaluate senior management and are a factor in determining their at-risk compensation. These non-GAAP measures are not intended to be considered by the user in place of the related GAAP measures but rather as supplemental information to our business results. These non-GAAP measures may not be the same as similar measures used by other companies due to possible differences in method and in the items or events being adjusted. The Company is not able to reconcile its forward-looking non-GAAP cash flow and tax rate measures because the Company cannot predict the timing and amounts of discrete items such as acquisition and divestitures, which could significantly impact GAAP results.

The Core earnings measures included in the following reconciliation tables refer to the equivalent GAAP measures adjusted as applicable for the following items:

•Incremental restructuring: The Company has historically had an ongoing level of restructuring activities of approximately $250 - $500 million before tax. On December 5, 2023, the Company announced a limited market portfolio restructuring of its business operations, primarily in certain Enterprise Markets, including Argentina and Nigeria. The adjustment to Core earnings includes the restructuring charges that exceed the normal, recurring level of restructuring charges.

•Intangible asset impairment: The Company recognized in the three months ended December 31, 2023, a non-cash, after-tax impairment charge of $1.0 billion ($1.3 billion before tax) to adjust the carrying value of the Gillette intangible asset acquired as part of the Company's 2005 acquisition of The Gillette Company.

We do not view the above items to be part of our sustainable results, and their exclusion from core earnings measures provides a more comparable measure of year-on-year results. These items are also excluded when evaluating senior management in determining their at-risk compensation.

Organic sales growth: Organic sales growth is a non-GAAP measure of sales growth excluding the impacts of acquisitions and divestitures and foreign exchange from year-over-year comparisons. We believe this measure provides investors with a supplemental understanding of underlying sales trends by

providing sales growth on a consistent basis. This measure is used in assessing the achievement of management goals for at-risk compensation.

Core EPS and Currency-neutral EPS: Core earnings per share, or Core EPS, is a measure of diluted net earnings per common share (diluted EPS) adjusted for items as indicated. Currency-neutral EPS is a measure of the Company's Core EPS excluding the incremental current year impact of foreign exchange. Management views these non-GAAP measures as useful supplemental measures of Company performance over time.

Core gross margin and Currency-neutral Core gross margin: Core gross margin is a measure of the Company's gross margin adjusted for items as indicated. Currency-neutral Core gross margin is a measure of the Company's Core gross margin excluding the incremental current year impact of foreign exchange. Management believes these non-GAAP measures provide a supplemental perspective to the Company’s operating efficiency over time.

Core selling, general and administrative (SG&A) expense as a percentage of sales and Currency-neutral Core SG&A expense as a percentage of sales: Core SG&A expense as a percentage of sales is a measure of the Company's selling, general and administrative expense as a percentage of net sales adjusted for items as indicated. Currency-neutral Core SG&A expense as a percentage of sales is a measure of the Company's Core selling, general and administrative expense as a percentage of net sales excluding the incremental current year impact of foreign exchange. Management believes these non-GAAP measures provides a supplemental perspective to the Company's operating efficiency over time.

Core operating margin and Currency-neutral Core operating margin: Core operating margin is a measure of the Company's operating margin adjusted for items as indicated. Currency-neutral Core operating margin is a measure of the Company's Core operating margin excluding the incremental current year impact of foreign exchange. Management believes these non-GAAP measures provide a supplemental perspective to the Company’s operating efficiency over time.

Adjusted free cash flow: Adjusted free cash flow is defined as operating cash flow less capital expenditures. Adjusted free cash flow represents the cash that the Company is able to generate after taking into account planned maintenance and asset expansion. We view adjusted free cash flow as an important measure because it is one factor used in determining the amount of cash available for dividends, share repurchases, acquisitions and other discretionary investments.

Adjusted free cash flow productivity: Adjusted free cash flow productivity is defined as the ratio of adjusted free cash flow to net earnings excluding the Gillette intangible asset impairment charge. We view adjusted free cash flow productivity as a useful measure to help investors understand P&G’s ability to generate cash. Adjusted free cash flow productivity is used by management in making operating decisions,

in allocating financial resources and for budget planning purposes. This measure is also used in assessing the achievement of management goals for at-risk compensation.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

THE PROCTER & GAMBLE COMPANY AND SUBSIDIARIES

Reconciliation of Non-GAAP Measures |

| Three Months Ended December 31, 2023 | | Three Months Ended December 31, 2022 |

| Amounts in millions except per share amounts | As Reported (GAAP) | | Incremental Restructuring | | Intangible Impairment | | Core

(Non-GAAP) | | As Reported (GAAP) (1) |

| Cost of products sold | $ | 10,144 | | | $ | (12) | | | $ | — | | | $ | 10,132 | | | $ | 10,897 | |

| Gross profit | 11,297 | | | 12 | | | — | | | 11,308 | | | 9,876 | |

| Gross margin | 52.7 | % | | 0.1 | % | | — | % | | 52.7 | % | | 47.5 | % |

| Currency impact to Core gross margin | | | | | | | 0.6 | % | | |

| Currency-neutral Core gross margin | | | | | | | 53.4 | % | | |

| Selling, general and administrative expense | 5,522 | | | (8) | | | — | | | 5,515 | | | 5,091 | |

| Selling, general and administrative expense as a % of net sales | 25.8 | % | | — | % | | — | % | | 25.7 | % | | 24.5 | % |

| Currency impact to Core selling, general and administrative expense as a % of net sales | | | | | | | (0.1) | % | | |

| Currency-neutral Core selling, general and administrative expense as a % of net sales | | | | | | | 25.6 | % | | |

| Operating income | 4,433 | | | 19 | | | 1,341 | | | 5,793 | | | 4,785 | |

| Operating margin | 20.7 | % | | 0.1 | % | | 6.3 | % | | 27.0 | % | | 23.0 | % |

| Currency impact to Core operating margin | | | | | | | 0.7 | % | | |

| Currency-neutral Core operating margin | | | | | | | 27.7 | % | | |

| Income taxes | 1,003 | | | (20) | | | 315 | | | 1,299 | | | 876 | |

| Net earnings attributable to P&G | 3,468 | | | 39 | | | 1,026 | | | 4,533 | | | 3,933 | |

| | | | | | | Core EPS | | |

Diluted net earnings per common share (2) | $ | 1.40 | | | $ | 0.02 | | | $ | 0.42 | | | $ | 1.84 | | | $ | 1.59 | |

| Currency impact to Core EPS | | $ | 0.03 | | | |

| Currency-neutral Core EPS | | $ | 1.87 | | | |

| Diluted weighted average common shares outstanding | 2,468.4 | | | | | | | | | 2,481.2 | |

Common shares outstanding - December 31, 2023 | 2,353.0 | | | | | | | | | |

(1)For the period ending December 31, 2022, there were no adjustments to or reconciling items for Core EPS. (2)Diluted net earnings per common share are calculated on Net earnings attributable to Procter & Gamble. | | |

| | | | | | | | | |

| CHANGE VERSUS YEAR AGO | | | | |

| Gross margin | | 520 | | | BPS |

| Core gross margin | | 520 | | | BPS |

| Currency-neutral Core gross margin | | 590 | | | BPS |

| Selling, general and administrative expense as a % of net sales | | 130 | | | BPS |

| Core selling, general and administrative expense as a % of net sales | | 120 | | | BPS |

| Currency-neutral Core selling, general and administrative as a % of net sales | | 110 | | | BPS |

| Operating margin | | (230) | | | BPS |

| Core operating margin | | 400 | | | BPS |

| Currency-neutral Core operating margin | | 470 | | | BPS |

| Diluted EPS | | (12) | % | | |

| Core EPS | | 16 | % | | |

| Currency-neutral Core EPS | | 18 | % | | |

Certain columns and rows may not add due to rounding.

Organic sales growth: | | | | | | | | | | | | | | | | | | | | | | | |

| October - December 2023 | Net Sales Growth | | Foreign Exchange Impact | | Acquisition & Divestiture Impact/Other (1) | | Organic Sales Growth |

| Beauty | 1% | | 1% | | (1)% | | 1% |

| Grooming | 6% | | 3% | | —% | | 9% |

| Health Care | 4% | | (2)% | | —% | | 2% |

| Fabric & Home Care | 5% | | —% | | 1% | | 6% |

| Baby, Feminine & Family Care | 2% | | 1% | | —% | | 3% |

| Total Company | 3% | | 1% | | —% | | 4% |

(1)Acquisition & Divestiture Impact/Other includes the volume and mix impact of acquisitions and divestitures and rounding impacts necessary to reconcile net sales to organic sales.

| | | | | | | | | | | | | | | | | | | | |

| Total Company | | Net Sales Growth | | Combined Foreign Exchange & Acquisition/Divestiture Impact/Other (1) | | Organic Sales Growth |

| FY 2024 (Estimate) | | +2% to +4% | | +1% to +2% | | +4% to +5% |

(1)Combined Foreign Exchange & Acquisition/Divestiture Impact/Other includes foreign exchange impacts, the volume and mix impact of acquisitions and divestitures and rounding impacts necessary to reconcile net sales to organic sales.

Core EPS growth:

| | | | | | | | | | | | | | | | | | | | |

| Total Company | | Diluted EPS Growth | | Impact of Incremental Non-Core Items (1) | | Core EPS Growth |

| FY 2024 (Estimate) | | (1)% to in-line | | +9% | | +8% to +9% |

(1)Includes the Gillette intangible asset impairment charge and incremental non-core restructuring charges announced in December 2023.

Adjusted free cash flow (dollar amounts in millions): | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, 2023 |

| Operating Cash Flow | | Capital Spending | | | Adjusted Free Cash Flow |

| $5,101 | | $(817) | | | $4,283 |

Adjusted free cash flow productivity (dollar amounts in millions): | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, 2023 |

| Adjusted Free Cash Flow | | Net Earnings | | Adjustments to Net Earnings (1) | | Net Earnings

as Adjusted | | Adjusted Free Cash Flow Productivity |

| $4,283 | | $3,493 | | $1,026 | | $4,519 | | 95% |

(1)Adjustments to Net Earnings relate to the Gillette intangible asset impairment charge recognized in the three months ended December 31, 2023. |

Certain columns and rows may not add due to rounding.

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=pg_A0.500due2024Domain |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=pg_A0.625due2024Domain |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=pg_A1.375due2025Domain |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=pg_A0110Due2026Domain |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=pg_A3250EURNotesDue2026Domain |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=pg_A4.875EURdueMay2027Domain |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=pg_A1.200due2028Domain |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=pg_A1.250due2029Domain |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=pg_A1.800due2029Domain |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=pg_A6.250GBPdueJanuary2030Domain |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=pg_A0350Due2030Domain |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=pg_A0230Due2031Domain |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=pg_A3250EURNotesDue2031Domain |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=pg_A5.250GBPdueJanuary2033Domain |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=pg_A1.875due2038Domain |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=pg_A0900Due2041Domain |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

dei_EntityListingsExchangeAxis=exch_XNYS |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

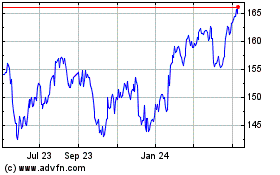

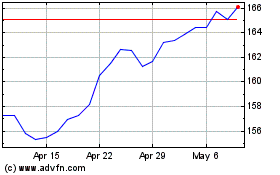

Procter and Gamble (NYSE:PG)

Historical Stock Chart

From Oct 2024 to Nov 2024

Procter and Gamble (NYSE:PG)

Historical Stock Chart

From Nov 2023 to Nov 2024