All financial figures are approximate and in Canadian dollars

unless otherwise noted. This news release refers to certain

financial measures that are not specified, defined or determined in

accordance with Generally Accepted Accounting Principles ("GAAP"),

including adjusted earnings before interest, taxes, depreciation

and amortization ("adjusted EBITDA"). For more information see

"Non-GAAP and Other Financial Measures" herein.

Pembina Pipeline Corporation ("Pembina" or the "Company") (TSX:

PPL; NYSE: PBA) announced today its 2025 financial guidance and

provided a business update.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20241212048876/en/

Highlights

- 2025 adjusted EBITDA guidance of $4.2 billion to $4.5 billion,

which relative to Pembina’s guidance for 2024 is driven by the

positive impacts of continued volume growth across the Western

Canadian Sedimentary Basin ("WCSB"), new assets acquired or placed

into service, and the full year impact of the consolidation of the

Alliance and Aux Sable assets, partially offset primarily by the

impacts of the recontracting of the Cochin Pipeline, and moderation

of commodity margins in the marketing business.

- 2025 capital investment program of $1.1 billion reflects

ongoing construction of previously sanctioned projects, development

spending on potential future projects in response to growing

volumes across the Canadian energy industry, and sustaining

capital.

- Pembina continues to execute its strategy within a fully funded

model and consistent with its financial guardrails. Within the 2025

adjusted EBITDA guidance range, Pembina expects to generate

positive free cash flow, with all 2025 capital investment program

scenarios being fully funded by cash flow from operating

activities, net of dividends. Further, the Company is forecasting a

year-end proportionately consolidated debt-to-adjusted EBITDA ratio

of 3.4 to 3.7 times.

- Mr. Alister Cowan has been appointed to the board of directors

effective December 3, 2024.

Business Update

Pembina anticipates a record setting financial year in 2024

reflecting the positive impact of recent acquisitions, growing

volumes in the WCSB, and a strong contribution from the marketing

business. As expected, volumes in the conventional pipelines

business have strengthened in the fourth quarter relative to the

first three quarters of the year.

In 2024, the Company meaningfully advanced its strategy through

the full consolidation of Alliance Pipeline and Aux Sable (the

"Alliance/Aux Sable Transaction"), and by reaching a positive final

investment decision on the Cedar LNG Project. These two

accomplishments highlight Pembina’s focus on strengthening the

existing franchise, increasing exposure to resilient end-use

markets, and accessing global market pricing for Canadian energy

products. In addition, Pembina Gas Infrastructure ("PGI") announced

transactions with Veren Inc. and Whitecap Resources Inc., creating

opportunities with attractive economics that are expected to

enhance asset utilization, capture future volumes, and benefit

Pembina’s full value chain. Through these two transactions, we are

realizing the vision set forth with the creation of PGI in

2022.

Other accomplishments over the past year include the completion

of the $430 million Phase VIII Peace Pipeline Expansion and the $90

million NEBC MPS Expansion, on time and under budget; sanctioning

$210 million (net to Pembina) of new projects, including the Wapiti

Expansion and K3 Cogeneration Facility; and entering into long-term

agreements with Dow Chemical Canada to supply up to 50,000 barrels

per day ("bpd") of ethane for their Path2Zero Project (the "Dow

Supply Agreement").

Through its extensive asset base and integrated value chain,

Pembina can provide a full suite of transportation and midstream

services across multiple hydrocarbons – natural gas, crude oil,

condensate, and NGL. This uniquely positions the Company to benefit

from a robust, multi-year growth outlook for the WCSB driven by

transformational developments that include the recent completion of

the Trans Mountain Pipeline expansion, new West Coast liquefied

natural gas ("LNG") and NGL export capacity, and the development of

new petrochemical facilities creating significant demand for ethane

and propane. Growing production and demand for services in the WCSB

continues to provide opportunities to increase utilization on

existing assets and pursue expansion opportunities.

As attention turns to 2025, Pembina is focused on several key

priorities including:

- Safe, reliable, and cost-effective operations.

- Stewardship of inflight construction projects, including the

RFS IV Expansion, Wapiti Expansion, and the K3 Cogeneration

Facility, to ensure safe, on-time and on-budget execution.

- Progressing the Cedar LNG Project, including completion of

detailed engineering followed by the start of construction of the

floating LNG vessel in mid-2025. Further, Pembina will continue the

process underway to assign its capacity in the project to a third

party. This represents the only capacity currently available for

contracting from a sanctioned west coast LNG project, and as such,

there is broad interest in the capacity from multiple

counterparties.

- Completing the evaluation of the options available to meet

Pembina’s commitment under the Dow Supply Agreement. Pembina is

seeking to fulfill its commitment in the most capital efficient

manner possible and is evaluating a portfolio of opportunities,

including the addition of a de-ethanizer tower at RFS III within

the Redwater Complex.

- Development of additional expansions to support growing demand

for services on Pembina’s conventional pipelines. In particular,

Pembina continues to advance expansions to support volume growth in

northeastern British Columbia ("NEBC"), including the Taylor to

Gordondale Project (an expansion of the Pouce Coupe system), which

is in the assessment phase of the Canada Energy Regulator’s (the

"CER") regulatory process. In addition, Pembina is undertaking

development work on an additional expansion of the Peace Pipeline

system. The current total capacity of the Peace Pipeline and

Northern Pipeline systems is approximately 1.1 million bpd and

Pembina has the ability to add approximately 200,000 bpd of

additional capacity to its market delivery pipelines from Fox Creek

to Namao through the relatively low-cost addition of pump stations

on these mainlines (the "Fox Creek-to-Namao Peace Pipeline

Expansion"), bringing the total capacity of these systems to 1.3

million bpd.

- Fully contracting the remaining available capacity on the

Nipisi Pipeline to serve growing volumes from the Clearwater

area.

Alliance Pipeline CER Toll

Review

The CER initiated a review of Alliance Pipeline’s tolls, which

were previously approved by the CER. As such, the CER has ordered

Alliance Pipeline to submit for approval a detailed toll

application justifying why the current tolling methodology remains

compliant with the Canadian Energy Regulator Act, or a new tolling

methodology application. Likewise, the CER has ordered that the

current tolls shall be deemed interim tolls until resolution of the

above.

Alliance Pipeline's tolls for the Canadian segment of the

pipeline are approved by the CER, while its tolls for the United

States segment are approved by the Federal Energy Regulatory

Commission. Alliance Pipeline's Canadian long-term firm service

tolls have remained level since they were approved by the CER in

2015, while its full path tolls to Chicago have declined by

approximately 15 percent. In comparison, tolls on alternative

systems have increased by approximately 30 percent. Likewise,

Alliance Pipeline has operated at an industry leading reliability

rate. Furthermore, Alliance Pipeline remains an ‘at-risk’

commercial model where returns and cost recovery are squarely

driven by the customer demand for its service and Alliance

Pipeline's ability to efficiently provide such service. By

contrast, the competitive alternatives and the majority of CER

regulated Group 1 natural gas pipelines' returns are not materially

exposed to volume or cost recovery risk.

Alliance Pipeline is working collaboratively with its

stakeholders through the CER review process and will remain focused

on delivering the highest standards of service that customers have

come to expect. Pembina will work expeditiously throughout 2025

with shippers towards a negotiated solution, in accordance with all

CER direction.

Approximately 60 percent of the adjusted EBITDA contribution

from Alliance Pipeline is generated from the Canadian portion of

the pipeline. Pembina’s 2025 adjusted EBITDA guidance, discussed

below, assumes the existing toll is in effect for the full

year.

Board of Directors Appointment

Pembina is pleased to announce that Mr. Alister Cowan has been

appointed to the board of directors effective December 3, 2024.

Mr. Cowan has over 20 years of experience in the energy industry

and has significant financial executive level experience at various

public companies. In 2023, he was Executive Advisor of Suncor

Energy Inc. ("Suncor") and was previously Chief Financial Officer

of Suncor from 2014 to 2023 where he oversaw financial operations,

accounting, investor relations, treasury, tax, internal audit, and

enterprise risk management. Prior to joining Suncor, Alister was

Chief Financial Officer of Husky Energy Inc. from 2008 to 2014.

Before that, he was Executive Vice President and Chief Financial

Officer and Chief Compliance Officer of British Columbia Hydro and

Power Authority. Mr. Cowan is a non-executive director of The

Chemours Company and of Smiths Group PLC. He has a Bachelor of Arts

in Accounting and Finance from Heriot-Watt University and is a

member of the Institute of Chartered Accountants of Scotland.

Mr. Cowan has also been appointed to the audit committee.

"The board of directors is excited to welcome Alister, and we

look forward to working with him. Alister is a seasoned financial

executive with extensive experience in Canadian energy. We are sure

to benefit from his contribution as we work together to ensure

Pembina's continued success during a transformational period of

growth in the Canadian oil and gas industry," said Henry Sykes,

Chair of the Board.

2025 Guidance

Pembina is anticipating 2025 adjusted EBITDA of $4.2 billion to

$4.5 billion. Relative to the midpoint of Pembina’s adjusted EBITDA

guidance range for 2024, the major factors driving the outlook for

2025 adjusted EBITDA include:

- Higher contracted and interruptible volumes and higher tolls on

Pembina's conventional pipelines (approximately $80 million),

reflecting increased producer activity across the WCSB and fewer

Pembina and third-party outages compared to the prior year.

Forecasted physical volume growth on Pembina’s conventional systems

is aligned with mid-single digit volume growth expected in the

WCSB, with revenue volume growth reflecting certain customers

growing into their contractual take-or-pay commitments.

- The full year impact of higher ownership of Alliance Pipeline

following the Alliance/Aux Sable Transaction in 2024 (approximately

$70 million).

- A higher contribution from gas processing assets (approximately

$50 million), primarily at PGI due to higher volumes and the

impacts of previously announced transactions with Veren Inc. and

Whitecap Resources Inc.

- A lower contribution from the Cochin Pipeline (approximately

$40 million) due to the full year impact of lower contracted tolls

that became effective in the third quarter of 2024, partially

offset by higher interruptible volumes and lower integrity

spending.

- A lower contribution from various oil sands assets

(approximately $10 million) due primarily to the sale of the

Edmonton South Rail Terminal, which occurred in 2024, lower

contracted rates at another terminal asset, and one-time items

which occurred in 2024, partially offset by a higher contribution

from Nipisi Pipeline.

- A lower contribution from the marketing business (approximately

$125 million) due to lower NGL prices and higher natural gas

prices, narrower margins and reduced blending opportunities in

crude oil marketing, and lower realized gains on commodity-related

derivatives, partially offset by a higher ownership of Aux Sable

following the Alliance/Aux Sable Transaction in 2024 and the

synergies associated with consolidating ownership of Aux

Sable.

Pembina has hedged approximately 32 percent of its 2025 frac

spread exposure. For 2025, the weighted average price of Pembina's

frac spread hedges, excluding transportation and processing costs,

is approximately C$36 per barrel, which compares to the prevailing

2025 forward price at the end of November 2024 of approximately

C$37 per barrel.

The mid-point of the 2025 adjusted EBITDA guidance range

includes a forecasted contribution from the Marketing & New

Ventures segment of $550 million.

Excluding the contribution from the Marketing & New Ventures

segment, the midpoint of the 2025 guidance range reflects an

approximately 5.5 percent increase in fee-based adjusted EBITDA,

relative to the forecast for 2024. Further, Pembina remains

on-track to achieve four to six percent compound annual growth of

fee-based adjusted EBITDA per share from 2023-2026.

The lower and upper ends of the guidance range are framed

primarily as a function of (1) commodity prices and the resulting

contribution from the marketing business; (2) interruptible volumes

on key systems; and (3) the U.S./Canadian dollar exchange rate.

Current income tax expense in 2025 is anticipated to be $415

million to $470 million as Pembina will continue to benefit from

the availability of tax pools from assets recently placed into

service.

Pembina's 2025 adjusted EBITDA may be directly impacted by

market-based prices as follows:

Key Variable

2025 Guidance Midpoint

Assumption

Sensitivity

Impact on Adjusted EBITDA

($millions) (1)

AECO / Station 2 Natural Gas (CAD/GJ)

(2)

$1.94

± $0.50

± 20

Chicago Natural Gas (USD/MMbtu)

$2.90

± $0.50

± 49

Mont Belvieu Propane (USD/usg)

$0.80

± $0.10

± 70

Foreign Exchange Rate (USD/CAD)

$1.39

± $0.05

± 50

(1)

Includes the impact of Pembina's hedging

program.

(2)

In addition, Pembina has asymmetric

exposure to AECO natural gas prices through a commercial contract

with a customer, where Pembina benefits as AECO price rises above

$3.00/GJ but does not have downside risk.

2025 Capital Investment

Pembina's 2025 capital program is expected to be allocated as

follows:

($ millions)

2025 Budget (1)

Pipelines Division

$330

Facilities Division

$345

Marketing & New Ventures Division

$15

Corporate

$55

Capital Expenditures

$745

Contributions to Equity Accounted

Investees

$355

Capital Expenditures and Contributions

to Equity Accounted Investees

$1,100

(1) Capital budget shown in Canadian dollars based on a forecasted

average USD/CAD exchange rate of 1.39.

Pipelines Division capital expenditures primarily relate to

sustaining capital, a terminal expansion within the conventional

pipeline system, development spending on potential future projects,

including the Fox Creek-to-Namao Peace Pipeline Expansion, and

investments in smaller growth projects, including various laterals

and terminals.

Capital expenditures in the Facilities Division primarily relate

to construction of the RFS IV Expansion, smaller growth projects,

and sustaining capital spending.

Capital expenditures within the Marketing and New Ventures

Division and the Corporate segment are primarily targeted at

information technology enhancements to further the Company's

continuous improvement aspirations.

Contributions to Equity Accounted Investees includes

approximately $200 million of contributions to Cedar LNG to fund

the construction of the Cedar LNG Project, and contributions to PGI

to fund development of the Wapiti Expansion, K3 Cogeneration

Facility, as well as development activities related to the

previously announced agreements with Veren Inc. and Whitecap

Resources Inc.

The Company's 2025 capital program includes:

- $200 million of non-recoverable sustaining capital to support

safe and reliable operations.

- $85 million related to digitization, technology, and systems

investments, which aim to enhance operational efficiency.

In addition to the 2025 capital investment program detailed

above, Pembina is in development of potential additional projects

that, if sanctioned, would increase the 2025 capital program by up

to $200 million. These projects primarily include pipeline and

terminal upgrades in support of volume growth in NEBC, the Fox

Creek-to-Namao Peace Pipeline Expansion, investments related to the

Dow Supply Agreement, including the addition of a de-ethanizer

tower at RFS III within the Redwater Complex, and optimization of

the Prince Rupert Terminal to allow for the use of larger vessels,

which would reduce per unit costs.

Capital Allocation

Pembina continues to execute its strategy within a fully funded

model and consistent with its financial guardrails. Within the 2025

adjusted EBITDA guidance range, Pembina expects to generate

positive free cash flow with all 2025 capital investment program

scenarios being fully funded by cash flow from operating

activities, net of dividends. Under prevailing market and economic

conditions, Pembina expects to prioritize the use of excess free

cash flow to debt repayment in 2025. As has been our approach since

2021, Pembina will continue to evaluate the merits of debt

repayment relative to share repurchases while considering expected

future funding requirements along with prevailing market conditions

and the risk-adjusted returns of the associated alternatives.

Pembina expects to exit 2025 with a proportionately consolidated

debt-to-adjusted EBITDA ratio of 3.4 to 3.7 times. Excluding the

debt related to the construction of the Cedar LNG project this

ratio would be 3.2 to 3.5 times.

About Pembina

Pembina Pipeline Corporation is a leading energy transportation

and midstream service provider that has served North America's

energy industry for 70 years. Pembina owns an integrated network of

hydrocarbon liquids and natural gas pipelines, gas gathering and

processing facilities, oil and natural gas liquids infrastructure

and logistics services, and an export terminals business. Through

our integrated value chain, we seek to provide safe and reliable

energy solutions that connect producers and consumers across the

world, support a more sustainable future and benefit our customers,

investors, employees and communities. For more information, please

visit www.pembina.com.

Purpose of Pembina: We deliver extraordinary energy solutions so

the world can thrive.

Pembina is structured into three Divisions: Pipelines Division,

Facilities Division and Marketing & New Ventures Division.

Pembina's common shares trade on the Toronto and New York stock

exchanges under PPL and PBA, respectively. For more information,

visit www.pembina.com.

Forward-Looking Information and Statements

This news release contains certain forward-looking information

and statements (collectively, "forward-looking statements"),

including forward-looking statements within the meaning of the

"safe harbor" provisions of applicable securities legislation, that

are based on Pembina's current expectations, estimates, projections

and assumptions in light of its experience and its perception of

historical trends. In some cases, forward-looking statements can be

identified by terminology such as "continue", "anticipate",

"schedule", "will", "expects", "estimate", "potential", "planned",

"future", "outlook", "strategy", "project", "trend", "commit",

"maintain", "focus", "ongoing", "believe" and similar expressions

suggesting future events or future performance.

In particular, this news release contains forward-looking

statements, including certain financial outlooks, pertaining to,

without limitation, the following: Pembina's anticipated 2025

adjusted EBITDA, 2025 capital investment program costs, 2025

year-end proportionately consolidated debt-to-adjusted EBITDA ratio

and current income tax expenses in 2025; Pembina's capital

allocation plans, including with respect to debt repayment and

share repurchases; expected cash flow from operating activities in

2025 and the uses thereof; 2024 year-end financial results,

including the expectation that 2024 will be a record setting

financial year; expectations with respect to the impacts of the Dow

Supply Agreement and the transactions with Veren Inc. and Whitecap

Resources Inc., as well as future actions taken in relation

thereto; future pipeline, processing, fractionation and storage

facility and system operations and throughput levels; Pembina's

corporate strategy and the development and expected timing of new

business initiatives and growth opportunities, including the

anticipated timing and impacts thereof; expectations about industry

activities and development opportunities, as well as the

anticipated benefits and timing thereof; expectations about the

demand for services, including expectations in respect of increased

utilization across Pembina's assets, future tolls and volumes;

planning, construction, capital expenditure and cost estimates,

schedules, locations, regulatory and environmental applications and

approvals, expected capacity, incremental volumes, power output,

project completion and in-service dates, rights, activities and

operations with respect to planned construction of, or expansions

on, pipelines systems, gas services facilities, processing and

fractionation facilities, terminalling, storage and hub facilities

and other facilities or infrastructure; the development and

anticipated benefits of Pembina's new projects and developments,

including the K3 Cogeneration Facility, the Cedar LNG Project, the

Wapiti Expansion, the Taylor to Gordondale Project, Fox

Creek-to-Namao Peace Pipeline Expansion and the RFS IV Expansion,

including the completion and timing thereof; expectations regarding

CER's review of Alliance Pipeline's tolls, including the timing and

outcome thereof and steps taken in connection therewith; the impact

of current and future market conditions on Pembina; Pembina's

hedging strategy and expected results therefrom; Pembina's capital

structure, including future actions that may be taken with respect

thereto and expectations regarding future uses of cash flows and

uses thereof, repayments of existing debt, new borrowings and

securities issuances; and Pembina's commitment to, and ability to

maintain, its financial guardrails.

The forward-looking statements are based on certain assumptions

that Pembina has made in respect thereof as at the date of this

news release regarding, among other things: oil and gas industry

exploration and development activity levels and the geographic

region of such activity; that favourable market conditions exist,

and that Pembina has available capital for share repurchases,

repayment of debt and funding its capital expenditures; the success

of Pembina's operations; prevailing commodity prices, interest

rates, carbon prices, tax rates and exchange rates; the ability of

Pembina to maintain current credit ratings; the availability of

capital to fund future capital requirements relating to existing

assets and projects; future operating costs; geotechnical and

integrity costs; that all required regulatory and environmental

approvals can be obtained on the necessary terms in a timely

manner; prevailing regulatory, tax and environmental laws and

regulations; maintenance of operating margins; and certain other

assumptions in respect of Pembina's forward-looking statements

detailed in Pembina's Annual Information Form for the year ended

December 31, 2023 (the "AIF") and Management's Discussion and

Analysis for the year ended December 31, 2023 (the "Annual

MD&A"), which were each filed on SEDAR+ on February 22, 2024,

as well as in Pembina's Management's Discussion and Analysis dated

November 5, 2024 for the three and nine months ended September 30,

2024 (the "Interim MD&A") and from time to time in Pembina's

public disclosure documents available at www.sedarplus.ca,

www.sec.gov and through Pembina's website at www.pembina.com.

Although Pembina believes the expectations and material factors

and assumptions reflected in these forward-looking statements are

reasonable as of the date hereof, there can be no assurance that

these expectations, factors and assumptions will prove to be

correct. These forward-looking statements are not guarantees of

future performance and are subject to a number of known and unknown

risks and uncertainties that could cause actual events or results

to differ materially, including, but not limited to: the regulatory

environment and decisions and Indigenous and landowner consultation

requirements; the impact of competitive entities and pricing;

reliance on third parties to successfully operate and maintain

certain assets; the strength and operations of the oil and natural

gas production industry and related commodity prices;

non-performance or default by counterparties to agreements with

Pembina or one or more of its affiliates; actions taken by

governmental or regulatory authorities and changes in legislation

(including uncertainty with respect to the interpretation of the

recently enacted Bill C-59 and related amendments to the

Competition Act (Canada)); the ability of Pembina to acquire or

develop the necessary infrastructure in respect of future

development projects; fluctuations in operating results; adverse

general economic and market conditions in Canada, North America and

worldwide; the ability to access various sources of debt and equity

capital on acceptable terms; changes in credit ratings;

counterparty credit risk; and certain other risks and uncertainties

detailed in the AIF, Annual MD&A, Interim MD&A and from

time to time in Pembina's public disclosure documents available at

www.sedarplus.ca, www.sec.gov and through Pembina's website at

www.pembina.com.

This list of risk factors should not be construed as exhaustive.

Readers are cautioned that events or circumstances could cause

actual results to differ materially from those predicted,

forecasted or projected by forward-looking statements contained

herein. The forward-looking statements contained in this news

release speak only as of the date hereof. Pembina does not

undertake any obligation to publicly update or revise any

forward-looking statements or information contained herein, except

as required by applicable laws. Management approved the 2025

adjusted EBITDA, 2025 capital investment program costs, 2025

proportionately consolidated debt-to-adjusted EBITDA and 2025

income tax expense guidance contained herein as of the date of this

news release. The purpose of these financial outlooks is to assist

readers in understanding Pembina's expected and targeted financial

results, and this information may not be appropriate for other

purposes. The forward-looking statements contained in this news

release are expressly qualified by this cautionary statement.

Non-GAAP and Other Financial Measures

Throughout this news release, Pembina has disclosed certain

financial measures and ratios that are not specified, defined or

determined in accordance with GAAP and which are not disclosed in

Pembina's financial statements. Non-GAAP financial measures either

exclude an amount that is included in, or include an amount that is

excluded from, the composition of the most directly comparable

financial measure specified, defined and determined in accordance

with GAAP. Non-GAAP ratios are financial measures that are in the

form of a ratio, fraction, percentage or similar representation

that has a non-GAAP financial measure as one or more of its

components. These non-GAAP financial measures and ratios, together

with financial measures and ratios specified, defined and

determined in accordance with GAAP, are used by management to

evaluate the performance and cash flows of Pembina and its

businesses and to provide additional useful information respecting

Pembina's financial performance and cash flows to investors and

analysts.

In this news release, Pembina has disclosed adjusted EBITDA, a

non-GAAP financial measure, and proportionately consolidated

debt-to-adjusted EBITDA, a non-GAAP ratio, which that do not have

any standardized meaning under International Financial Reporting

Standards ("IFRS") and may not be comparable to similar financial

measures or ratios disclosed by other issuers. Such financial

measures and ratios should not, therefore, be considered in

isolation or as a substitute for, or superior to, measures and

ratios of Pembina's financial performance or cash flows specified,

defined or determined in accordance with IFRS, including revenue or

earnings.

Except as otherwise described herein, these non-GAAP financial

measures and non-GAAP ratios are calculated on a consistent basis

from period to period. Specific reconciling items may only be

relevant in certain periods.

Below is a description of each non-GAAP financial measure and

non-GAAP ratio disclosed in this news release, together with, as

applicable, disclosure of the most directly comparable financial

measure that is determined in accordance with GAAP to which each

non-GAAP financial measure relates and a quantitative

reconciliation of each non-GAAP financial measure to such directly

comparable GAAP financial measure. Additional information relating

to such non-GAAP financial measures and non-GAAP ratios, including

disclosure of the composition of each non-GAAP financial measure

and non-GAAP ratio, an explanation of how each non-GAAP financial

measure and non-GAAP ratio provides useful information to investors

and the additional purposes, if any, for which management uses each

non-GAAP financial measure; an explanation of the reason for any

change in the label or composition of each non-GAAP financial

measure and non-GAAP ratio from what was previously disclosed; and

a description of any significant difference between forward-looking

non-GAAP financial measures and the equivalent historical non-GAAP

financial measures, is contained in the "Non-GAAP & Other

Financial Measures" section of the Annual MD&A, which

information is incorporated by reference in this news release. The

Annual MD&A is available on SEDAR+ at www.sedarplus.ca, EDGAR

at www.sec.gov and Pembina's website at www.pembina.com.

Adjusted Earnings Before Interest, Taxes,

Depreciation and Amortization

Adjusted EBITDA is a non-GAAP financial measure and is

calculated as earnings before net finance costs, income taxes,

depreciation and amortization (included in operations and general

and administrative expense) and unrealized gains or losses on

commodity-related derivative financial instruments. The exclusion

of unrealized gains or losses on commodity-related derivative

financial instruments eliminates the non-cash impact of such gains

or losses.

Adjusted EBITDA also includes adjustments to earnings for losses

(gains) on disposal of assets, transaction costs incurred in

respect of acquisitions, dispositions and restructuring, impairment

charges or reversals in respect of goodwill, intangible assets,

investments in equity accounted investees and property, plant and

equipment, certain non-cash provisions and other amounts not

reflective of ongoing operations. In addition, Pembina's

proportionate share of results from investments in equity accounted

investees with a preferred interest is presented in adjusted EBITDA

as a 50 percent common interest. These additional

adjustments are made to exclude various non-cash and other items

that are not reflective of ongoing operations.

The equivalent historical non-GAAP financial measure to 2025

adjusted EBITDA guidance is adjusted EBITDA for the year ended

December 31, 2023.

12 Months Ended December 31,

2023

Pipelines

Facilities

Marketing &

New Ventures

Corporate &

Inter-segment

Eliminations

Total

($ millions, except per share amounts)

Earnings (loss)

1,840

610

435

(696)

1,776

Income tax expense

—

—

—

—

413

Adjustments to share of profit from equity

accounted investees and other

172

438

84

—

694

Net finance costs

28

9

4

425

466

Depreciation and amortization

414

159

46

44

663

Unrealized loss from derivative

instruments

—

—

32

—

32

Impairment reversal

(231)

—

—

—

(231)

Transaction costs incurred in respect of

acquisitions, gain on disposal of assets and non-cash

provisions

11

(3)

(4)

7

11

Adjusted EBITDA

2,234

1,213

597

(220)

3,824

Adjusted EBITDA from Equity Accounted

Investees

In accordance with IFRS, Pembina's jointly controlled

investments are accounted for using equity accounting. Under equity

accounting, the assets and liabilities of the investment are

presented net in a single line item in the Consolidated Statement

of Financial Position, "Investments in Equity Accounted Investees".

Net earnings from investments in equity accounted investees are

recognized in a single line item in the Consolidated Statement of

Earnings and Comprehensive Income "Share of Profit from Equity

Accounted Investees". The adjustments made to earnings, in adjusted

EBITDA above, are also made to share of profit from investments in

equity accounted investees. Cash contributions and distributions

from investments in equity accounted investees represent Pembina's

share paid and received in the period to and from the investments

in equity accounted investees.

To assist in understanding and evaluating the performance of

these investments, Pembina is supplementing the IFRS disclosure

with non-GAAP proportionate consolidation of Pembina's interest in

the investments in equity accounted investees. Pembina's

proportionate interest in equity accounted investees has been

included in adjusted EBITDA.

12 Months Ended December 31,

2023

Pipelines

Facilities

Marketing &

New Ventures

Total

($ millions)

Share of profit (loss) from equity

accounted investees - operations

109

233

(26)

316

Adjustments to share of profit from equity

accounted investees:

Net finance costs

22

160

1

183

Income tax expense

—

41

—

41

Depreciation and amortization

150

207

25

386

Unrealized loss on commodity-related

derivative financial instruments

—

16

—

16

Transaction costs incurred in respect of

acquisitions

—

14

58

72

Total adjustments to share of profit from

equity accounted investees

172

438

84

694

Adjusted EBITDA from equity accounted

investees

281

671

58

1,010

Proportionately Consolidated

Debt-to-Adjusted EBITDA

Proportionately Consolidated Debt-to-Adjusted EBITDA is a

non-GAAP ratio that management believes is useful to investors and

other users of Pembina’s financial information in the evaluation of

the Company’s debt levels and creditworthiness.

12 Months Ended

($ millions, except as noted)

September 30, 2024

December 31, 2023

Loans and borrowings (current)

946

650

Loans and borrowings (non-current)

11,182

9,253

Loans and borrowings of equity accounted

investees

2,770

2,805

Proportionately consolidated debt

14,898

12,708

Adjusted EBITDA

4,187

3,824

Proportionately consolidated

debt-to-adjusted EBITDA (times)

3.6

3.3

($ millions)

12 Months Ended September 30,

2024

9 Months Ended September 30,

2024

12 Months Ended December 31,

2023

9 Months Ended September 30,

2023

Earnings before income tax

1,791

976

2,189

1,374

Adjustments to share of profit from equity

accounted investees and other

640

454

694

508

Net finance costs

514

398

466

350

Depreciation and amortization

805

627

663

485

Unrealized loss on derivative

instruments

83

129

32

78

Non-controlling interest(1)

(12)

(12)

—

—

Loss on Alliance/Aux Sable Acquisition

616

616

—

—

Derecognition of insurance contract

provision

(34)

(34)

—

—

Transaction and integration costs in

respect of acquisitions

20

18

2

—

Gain on disposal of assets, other non-cash

provisions, and other

(5)

(18)

9

(4)

Impairment reversal

(231)

—

(231)

—

Adjusted EBITDA

4,187

3,154

3,824

2,791

=A+B-C

A

B

C

(1) Presented net of adjusting items.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241212048876/en/

For further information:

Pembina Investor Relations (403) 231-3156 1-855-880-7404

investor-relations@pembina.com www.pembina.com

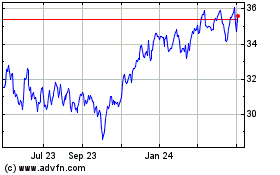

Pembina Pipeline (NYSE:PBA)

Historical Stock Chart

From Nov 2024 to Dec 2024

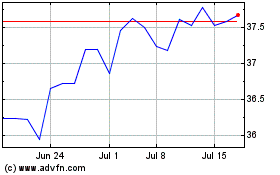

Pembina Pipeline (NYSE:PBA)

Historical Stock Chart

From Dec 2023 to Dec 2024