New York Mortgage Trust 2007 First Quarter Conference Call Rescheduled for Tuesday, May 15, 2007

May 08 2007 - 5:36PM

PR Newswire (US)

NEW YORK, May 8 /PRNewswire-FirstCall/ -- New York Mortgage Trust,

Inc. (NYSE:NTR) today announced that its first quarter conference

call has been rescheduled to 9:00 a.m. ET on Tuesday, May 15, 2007.

The call was previously scheduled for Wednesday, May 9, 2007. As of

the date of this press release, the Company is in the process of

completing the preparation and review of its financial statements

for the quarterly period ended March 31, 2007. The sale of

substantially all of the operating assets of the retail mortgage

origination business to IndyMac Bank, F.S.B. on March 31, 2007 and

the subsequent transition period for the Company's exit from the

mortgage origination business has delayed the completion and review

of the Company's Quarterly Report on Form 10-Q. As a result of the

foregoing, the Company intends to file a Notification of Late

Filing with the Securities and Exchange Commission for the purpose

of receiving a filing extension for its Quarterly Report on Form

10-Q. The Company now expects to report financial results for the

first quarter ended March 31, 2007 after the close of market on

Monday, May 14, 2007 and file its Quarterly Report on Form 10-Q on

Tuesday, March 15, 2007. On Tuesday, May 15, 2007 at 9:00 a.m. ET,

New York Mortgage Trust's executive management will host a

conference call and audio webcast highlighting the Company's

quarterly financial results. The conference call dial-in number is

303-205-0033. A live audio webcast of the conference call can be

accessed via the Internet, on a listen-only basis, at

http://www.earnings.com/ or at the Investor Relations section of

the Company's website at http://www.nymtrust.com/. Please allow

extra time, prior to the call, to visit the site and download the

necessary software to listen to the Internet broadcast. The online

archive of the webcast will be available for approximately 90 days.

About New York Mortgage Trust New York Mortgage Trust, Inc., a real

estate investment trust (REIT), is engaged in the investment in and

management of high credit quality residential adjustable rate

mortgage (ARM) loans and mortgage-backed securities (MBS). As of

March 31, 2007, the Company has exited the mortgage lending

business. The Company's portfolio is comprised of securitized, high

credit quality, adjustable and hybrid ARM loans, and purchased MBS.

Historically at least 98% of the portfolio has been rated "AA" or

"AAA". As a REIT, the Company is not subject to federal income tax

provided that it distributes at least 90% of its REIT income to

stockholders. Safe Harbor Regarding Forward-Looking Statements

Certain statements contained in this press release may be deemed to

be forward-looking statements that predict or describe future

events or trends. The matters described in these forward-looking

statements are subject to known and unknown risks, uncertainties

and other unpredictable factors, many of which are beyond the

Company's control. The Company faces many risks that could cause

its actual performance to differ materially from the results

predicted by its forward-looking statements, including, without

limitation, that a rise in interest rates may cause a decline in

the market value of the Company's assets, prepayment rates that may

change, borrowings to finance the purchase of assets may not be

available on favorable terms, the Company may not be able to

maintain its qualification as a REIT for federal tax purposes, the

Company may experience the risks associated with investing in

mortgage loans, including changes in loan delinquencies, and the

Company's hedging strategies may not be effective. The reports that

the Company files with the Securities and Exchange Commission

contain a fuller description of these and many other risks to which

the Company is subject. Because of those risks, the Company's

actual results, performance or achievements may differ materially

from the results, performance or achievements contemplated by its

forward- looking statements. The information set forth in this news

release represents management's current expectations and

intentions. The Company assumes no responsibility to issue updates

to the forward-looking matters discussed in this press release.

DATASOURCE: New York Mortgage Trust, Inc. CONTACT: Steven R. Mumma,

New York Mortgage Trust President, Co-Chief Executive Officer and

Chief Financial Officer, +1-212-792-0107, or ; or General, Joe

Calabrese +1-212-827-3772, or Analysts, Julie Tu, +1-212-827-3776,

both of Financial Relations Board

Copyright

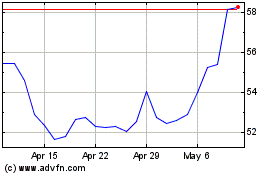

Nutrien (NYSE:NTR)

Historical Stock Chart

From May 2024 to Jun 2024

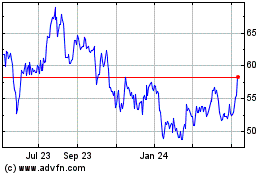

Nutrien (NYSE:NTR)

Historical Stock Chart

From Jun 2023 to Jun 2024