- Consolidated net loss of $0.79 per share for year ended December

31, 2006 versus a $0.30 net loss for the same period in 2005.

Losses attributable solely to the mortgage lending segment which is

being discontinued; NEW YORK, March 15 /PRNewswire-FirstCall/ --

New York Mortgage Trust, Inc. (NYSE:NTR), a self-advised

residential mortgage finance company organized as a real estate

investment trust ("REIT"), today reported results for the three and

twelve months ended December 31, 2006. Comparison of the Years

Ended December 31, 2006 and 2005: -- Total loan origination volume

of $2.5 billion in 2006 versus volume of $3.4 billion in 2005; --

2006 consolidated net loss for the Company totaled $14.2 million,

or $0.79 per share, representing an increased net loss of $8.9

million from a $5.3 million, or $0.30 per share, net loss for 2005.

The Company fully reserved for its fourth quarter tax benefit; and

-- The net interest margin on the Company's mortgage portfolio for

2006 averaged 49 basis points, down from 85 basis points in 2005,

primarily due to rising short-term interest rates, an inverted

yield curve and a reduction in average earning portfolio assets.

Quarterly Comparisons: -- Fourth quarter 2006 total loan

origination volume of $585.6 million as compared to $822.9 million

for the same period in 2005, representing a decrease of 29%; --

Fourth quarter total loan origination volume declined 3% as

compared to the third quarter of 2006; -- Consolidated net loss for

the Company totaled $8.8 million, or $0.49 per share, for the

fourth quarter 2006, as compared to a net loss of $8.7 million, or

$0.49 per share, for the same period in 2005; and -- Net interest

margin on the Company's mortgage portfolio for the fourth quarter

of 2006 averaged 9 basis points down from 16 basis points in the

third quarter of 2006 and down from 62 basis points during the

fourth quarter of 2005. This decrease is primarily due to a

continued increase in our borrowing costs and a decrease in average

size of portfolio assets ($1.1 billion in the forth quarter of 2006

versus $1.5 billion in the same period of 2005). Note Regarding

Presentation of Financial Results Solely as a result of the sale of

the Company's wholesale origination platform assets on February 22,

2007 to Tribeca Lending Corp. and the pending sale of its retail

mortgage origination platform assets to Indymac Bank, F.S.B., the

Company is required to account for the operating results related to

these business segments as discontinued operations. As of the date

hereof, the Company is in the process of finalizing allocations for

the discontinued operations. Because these allocations are not yet

finalized, financial results will only be disclosed in this press

release on a consolidated basis. Also as a result of the foregoing,

the Company intends to file a Notification of Late Filing with the

Securities and Exchange Commission for the purpose of receiving a

filing extension for its Annual Report on Form 10-K. The Company

expects that it will be able to file its Annual Report on Form 10-K

within the 15 day extension period provided under Rule 12b-25 of

the Securities Exchange Act of 1934, as amended. Comments from

Management Steven B. Schnall, Chairman, President and Co-Chief

Executive Officer, commented, "Our 2006 operating results are

reflective of a continued deterioration in the mortgage lending

environment. Despite the fact that we have virtually no sub-prime

credit exposure, we have experienced a marked increase in the

number of early payment defaults of the Alt-A loans originated in

our mortgage lending segment. This has resulted in an unprecedented

high level of loan repurchases and credit losses totaling $7.4

million over the second half of 2006. This pressure, compounded by

our lack of sufficient scale to achieve profitability in this very

challenging market, further validates our decision to exit the

mortgage lending business. "Furthermore, our exit from the mortgage

lending business will enable the Company to stem its associated

losses, stabilize its book value and focus exclusively on the

management of its high credit quality mortgage portfolio. Going

forward, I am highly confident that Steve Mumma and Dave Akre will

be able, with our newfound earnings and book value stability, to

take steps to successfully enhance shareholder value." Company

Statistics: MORTGAGE LOAN ORIGINATION SUMMARY A breakdown of the

mortgage lending segment loan originations for the year ended

December 31, 2006 follows: (Dollar amounts in thousands) Number of

Loans Dollar Value % of Total Payment Stream Fixed Rate FHA/VA 477

$78,899 3.1% Conventional Conforming 5,942 1,044,537 41.1%

Conventional Jumbo 505 318,346 12.5% Total Fixed Rate 6,924

$1,441,782 56.7% ARMs FHA/VA 12 $3,423 0.1% Conventional 3,386

1,098,798 43.2% Total ARMs 3,398 1,102,221 43.3% Annual Total

10,322 $2,544,003 100.0% Loan Purpose Conventional 9,833 $2,461,681

96.8% FHA/VA 489 82,322 3.2% Total 10,322 $2,544,003 100.0%

Documentation Type Full Documentation 5,317 $1,265,453 49.7% Stated

Income 2,167 610,235 24.0% Stated Income/Stated Assets 1,259

293,454 11.5% No Documentation 925 231,244 9.1% No Ratio 445

101,868 4.0% Stated Assets 15 2,329 0.1% Other 194 39,420 1.6%

Total 10,322 $2,544,003 100.0% A breakdown of the mortgage lending

segment loan originations for the 2006 fourth quarter follows:

Aggregate Principal Weighted Balance Percentage Average Average

Weighted Number ($ in Of Total Interest Principal Average of Loans

millions) Principal Rate Balance LTV FICO ARM 647 $218.2 37.3%

7.10% $337,270 73.5 699 Fixed- rate 1,609 353.7 60.4% 7.14% 219,835

75.8 712 Sub- total- non- FHA 2,256 $571.9 97.7% 7.13% $253,514

74.9 707 FHA-ARM - $- - - $- - - FHA- fixed- rate 83 13.7 2.3%

6.42% 164,723 94.6 650 Sub- total- FHA 83 $13.7 2.3% 6.42% $164,723

94.6 650 Total ARM 647 $218.2 37.3% 7.10% $337,270 73.5 699 Total

fixed- rate 1,692 367.4 62.7% 7.11% 217,132 76.5 709 Total Origin-

ations 2,339 $585.6 100.0% 7.11% $250,364 75.4 706 Purchase mort-

gages 1,350 $306.0 52.3% 7.22% $226,633 80.2 720 Refinanc- ings 906

265.9 45.4% 7.02% 293,570 68.8 693 Sub- total- non- FHA 2,256

$571.9 97.7% 7.13% $253,514 74.9 707 FHA- purchase 71 $11.3 1.9%

6.35% $159,550 96.9 661 FHA-re- financings 12 2.4 0.4% 6.74%

195,333 83.4 597 Sub- total- FHA 83 $13.7 2.3% 6.42% $164,723 94.6

650 Total pur- chase 1,421 $317.3 54.2% 7.19% $223,281 80.8 717

Total re- fin- ancings 918 $268.3 45.8% 7.02% $292,286 69.0 692

Total Origin- ations 2,339 $585.6 100.0% 7.11% $250,364 75.4 706 *

FHA originations are Streamlined Refinance mortgages with low

average balances. All FHA loans are and will continue to be sold or

brokered to third party investors. Mortgage Portfolio Activity As

of December 31, 2006, the Company's portfolio of high credit

quality investment securities totaled $489.0 million and had a

weighted average purchase price of $100.30. Approximately 19% of

the securities purchased are backed by 3/1 hybrid adjustable rate

mortgages, 41% are backed by 5/1 hybrid adjustable rate mortgages

and the remaining 39% are comprised of short reset floating rate

securities. In addition, loans held in securitization trusts

totaled $588.2 million and had an average purchase price of $100.65

and total delinquencies of 1.16%. Approximately 33% of investment

securities and loans held in securitized trusts have interest rate

resets of less than 6 months. The investment securities and the

loans held in securitization trusts are financed in part with debt

aggregating approximately $1.0 billion as of December 31, 2006.

Following the expected completion of the disposition of its retail

mortgage origination platform in the early part of the second

quarter, the Company will be able to redeploy the net proceeds from

this transaction back into the portfolio. Additionally, the Company

expects to benefit from improving reinvestment opportunities as 33%

of the investment portfolio resets over the next 6 months. Dividend

Declaration On Monday, March 12, 2007, the Company's Board of

Directors declared a cash dividend of $0.05 per share on shares of

its common stock for the quarter ending March 31, 2007. The

dividend is payable on April 26, 2007 to stockholders of record as

of April 9, 2007. The Company reevaluates the dividend policy each

quarter and makes adjustments as necessary. Investors are advised

that the Company's earnings projections are based on a number of

operational, financial and market assumptions, and if such

assumptions do not materialize, the Company may not be able to

maintain its dividend policy. In addition to such assumptions, the

Company's dividend policy is subject to its Board of Directors

approval and ongoing review which includes, but is not limited to,

considerations such as the Company's financial condition, earnings

projections and business prospects. The dividend policy does not

constitute an obligation to pay dividends, which only occurs when

the Board of Directors declares a dividend. Conference Call On

Friday, March 16, 2007 at 10:00 a.m. Eastern time, New York

Mortgage Trust's executive management will host a conference call

and audio webcast highlighting the Company's fourth quarter

financial results. The conference call dial-in number is

303-262-2140. A live audio webcast of the conference call can be

accessed via the Internet, on a listen-only basis, at

http://www.earnings.com/ or at the Investor Relations section of

the Company's website at http://www.nymtrust.com/. Please allow

extra time, prior to the call, to visit the site and download the

necessary software to listen to the Internet broadcast. The online

archive of the webcast will be available for approximately 90 days.

About New York Mortgage Trust New York Mortgage Trust, Inc., a real

estate investment trust (REIT), is currently engaged in the

origination of and investment in residential mortgage loans

throughout the United States. The Company, through its wholly owned

taxable REIT subsidiary, The New York Mortgage Company, LLC

("NYMC"), originates a broad spectrum of residential loan products

with a focus on high credit quality, or prime, loans. In addition

to prime loans, NYMC also originates jumbo loans, alternative-A

loans, sub-prime loans and home equity or second mortgage loans

through its retail origination branch network. The Company's REIT

portfolio is comprised of securitized, high credit quality,

adjustable and hybrid ARM loans. As a REIT, the Company is not

subject to federal income tax provided that it distributes at least

90% of its REIT taxable income to its stockholders. This news

release contains forward-looking statements that predict or

describe future events or trends. The matters described in these

forward- looking statements are subject to known and unknown risks,

uncertainties and other unpredictable factors, many of which are

beyond the Company's control. The Company faces many risks that

could cause its actual performance to differ materially from the

results predicted by its forward-looking statements, including,

without limitation, that the Company may ail to satisfy all of the

closing conditions required for consummation of the sale of its

retail mortgage origination platform to Indymac Bank, the

possibilities that a rise in interest rates may cause a decline in

the market value of the Company's assets, a decrease in the demand

for mortgage loans may have a negative effect on the Company's

volume of closed loan originations, prepayment rates may change,

borrowings to finance the purchase of assets may not be available

on favorable terms, the Company may not be able to maintain its

qualification as a REIT for federal tax purposes, the Company may

experience the risks associated with investing in real estate,

including changes in business conditions and the general economy,

and the Company's hedging strategies may not be effective. The

reports that the Company files with the Securities and Exchange

Commission contain a fuller description of these and many other

risks to which the Company is subject. Because of those risks, the

Company's actual results, performance or achievements may differ

materially from the results, performance or achievements

contemplated by its forward-looking statements. The information set

forth in this news release represents management's current

expectations and intentions. The Company assumes no responsibility

to issue updates to the forward-looking matters discussed in this

news release. DATASOURCE: New York Mortgage Trust, Inc. CONTACT:

Steven R. Mumma, Chief Financial Officer, of New York Mortgage

Trust, Inc., +1-212-634-2411, ; or General, Joe Calabrese,

+1-212-827-3772, or Analysts, Julie Tu, +1-212-827-3776, both of

Financial Relations Board for New York Mortgage Trust, Inc. Web

site: http://www.nymtrust.com/

Copyright

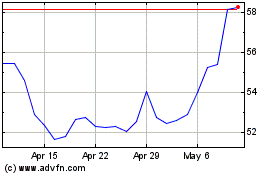

Nutrien (NYSE:NTR)

Historical Stock Chart

From May 2024 to Jun 2024

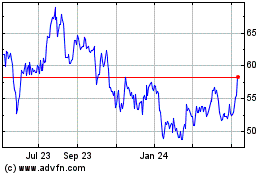

Nutrien (NYSE:NTR)

Historical Stock Chart

From Jun 2023 to Jun 2024