Current Report Filing (8-k)

November 04 2021 - 5:34PM

Edgar (US Regulatory)

0001078207false10/29/202117750 S.E. 6th WayVancouverWashington98683(360)859-290000010782072021-10-292021-10-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report: October 29, 2021

(Date of earliest event reported)

_________________________________________

NAUTILUS, INC.

(Exact name of registrant as specified in its charter)

__________________________________________

|

|

|

|

|

|

|

|

|

|

|

Washington

|

001-31321

|

94-3002667

|

(State or other jurisdiction of

incorporation)

|

(Commission File Number)

|

(I.R.S. Employer

Identification No.)

|

17750 S.E. 6th Way

Vancouver, Washington 98683

(Address of principal executive offices, including zip code)

(360) 859-2900

(Registrant's telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

|

|

|

|

|

|

|

|

|

☐

|

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

|

☐

|

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

|

☐

|

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

|

☐

|

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

|

|

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, no par value

|

NLS

|

New York Stock Exchange

|

|

|

|

|

|

|

|

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

|

|

|

Emerging growth company

|

☐

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

|

☐

|

NAUTILUS, INC.

FORM 8-K

|

|

|

|

|

|

|

|

Item 1.01

|

Entry into a Material Definitive Agreement

|

On October 29, 2021, Nautilus, Inc., a Washington corporation (the “Company”), entered into an Amendment (the “Amendment”) to the Credit Agreement (the “Credit Agreement”) by and among the Company, Wells Fargo Bank, National Association, as Agent (“Wells Fargo”), and the institutions named as Lenders. Capitalized terms used but not defined in this report have the meanings ascribed to such terms in the Credit Agreement.

The Amendment modifies the Senior Secured Credit Facility (the “Credit Facility”) under the Credit Agreement, which previously consisted of a $55,000,000 Asset Based Revolver (“Revolver”) and a $15,000,000 Term Loan (“Term Loan). Under the terms of the Amendment, the commitment under the Revolver was increased to $100,000,000 due to organic growth in Nautilus’s business. The Amendment also extended the maturity date of the Credit Facility to October 29, 2026 from January 31, 2025. The unamortized balance on the Term Loan was $11,500,000, as of the effective date of the Amendment, and will amortize on a new 60-month straight line basis to coincide with the extended maturity date.

Other structural improvements to the Credit Agreement include amending the definition of Springing Trigger Event to mean the greater of (i) 10.0% of the lesser of (a) the Revolver Commitment and (b) the Borrowing Base as of such date of determination and (ii) $7,500,000. The Springing Trigger Event pertains to the period in which a Fixed Charge Coverage Ratio test will apply and be tested. Consistent with the Credit Agreement before the Amendment, there continues to be no additional financial maintenance covenants. Additionally, the borrowing base definitions were favorably amended to change the eligible in-transit inventory sublimit from $10,000,000 to $22,500,000 and the total inventory sublimit from $35,000,000 to $65,000,000.

Other than as specifically provided in the Amendment, the Amendment had no effect on any schedules, exhibits or attachments to the Credit Agreement and the Guaranty and Security Agreement remain in effect.

The foregoing description of the Amendment is a summary only and qualified in its entirety by reference to the text of the Amendment, which is attached as Exhibit 99.1 to this Current Report on Form 8-K and incorporated by reference herein.

|

|

|

|

|

|

|

|

Item 2.03

|

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

|

The information in Item 1.01 is incorporated herein by reference.

|

|

|

|

|

|

|

|

|

|

|

Item 9.01

|

|

Financial Statements and Exhibits

|

(d) Exhibits

The following exhibit is furnished herewith and this list is intended to constitute the exhibit index:

|

|

|

|

|

|

|

|

|

Amendment to Loan Documents, dated October 29, 2021, by and among Nautilus, Inc., Wells Fargo Bank, National Association, as Agent, and the requisite lenders named therein. (Portions of the exhibit have been omitted)

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NAUTILUS, INC.

|

|

|

|

(Registrant)

|

|

|

|

|

|

|

November 04, 2021

|

|

By:

|

/s/ Alan L. Chan

|

|

Date

|

|

|

Alan L. Chan

|

|

|

|

|

Chief Legal Officer

|

|

|

|

|

|

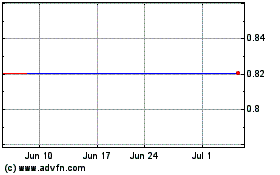

Nautilus (NYSE:NLS)

Historical Stock Chart

From Aug 2024 to Sep 2024

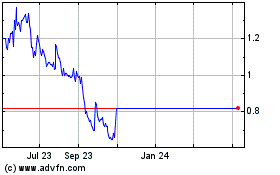

Nautilus (NYSE:NLS)

Historical Stock Chart

From Sep 2023 to Sep 2024