MRC Global Inc. (NYSE: MRC), the leading global distributor of

pipe, valves, fittings and infrastructure products and

services to diversified energy, industrial and gas

utilities end-markets, today announced first quarter

2024 results.

Net income attributable to common

stockholders for the first quarter of 2024 was

$13 million, or $0.15 per diluted share, as compared to

the first quarter of 2023 net income attributable to

common stockholders of $28 million, or $0.33 per diluted

share. Adjusted net income attributable to common stockholders

for the first quarter of 2024 was $17 million, or

$0.20 per diluted share, as compared to the first quarter

of 2023 adjusted net income attributable to common

stockholders of $27 million, or $0.32 per diluted

share.

MRC Global’s

first quarter 2024 gross profit was

$163 million, or 20.2% of sales, as compared to the

first quarter 2023 gross profit of

$179 million, or 20.2% of sales. Gross profit for the

first quarter of

2024 and 2023 includes $1 million of

expense and $1 million of income, respectively, in cost of

sales relating to the use of the last-in, first-out (LIFO) method

of inventory cost accounting. Adjusted Gross Profit, which excludes

(among other items) the impact of LIFO, was $174 million, or

21.6% of sales, for the first quarter of 2024 and

was $188 million, or 21.2% of sales, for the

first quarter of 2023.

First Quarter 2024 Financial

Highlights:

- Cash flow provided by operations of

$38 million

- Sales of $806 million, a

5% improvement compared to the fourth quarter of 2023

- Adjusted Gross Profit, as a

percentage of sales, of 21.6%, and eight consecutive

quarters above 21%

- Adjusted EBITDA of $57 million, or

7.1% of sales

- Net Debt leverage ratio of 0.6

times, the lowest in MRC Global history

Rob Saltiel, MRC Global’s President and CEO

stated, “Our commitment to improving capital returns, maintaining

cost discipline and generating cash across the market cycle is

reflected in our excellent results this quarter. We exceeded our

expectations with sequential revenue growth of 5% and adjusted

EBITDA margins of 7.1%. We believe that our business has

turned the corner after the lower activity levels of the fourth

quarter of 2023.

“In addition, we generated $38 million of

operating cash flow in the first quarter and are on-track to meet

or exceed our cash flow guidance of $200 million this

year. Our strengthening balance sheet and strong cash flow

generation will allow us to repay our Term Loan B in the second

quarter and exit 2024 with minimal net debt. We expect to

generate significant cash over the next few years, which would

provide us flexibility to consider various capital allocation

alternatives,” Mr. Saltiel added.

Selling, general and administrative (SG&A)

expenses were $125 million, or 15.5% of sales, for the

first quarter of 2024 compared to $122 million,

or 13.8% of sales, for the same period in 2023. Adjusted

SG&A for the first quarter of 2024 was $122 million,

or 15.1% of sales, excluding $3 million of activism

response expenses.

Adjusted EBITDA was $57 million in

the first quarter of 2024 compared

to $69 million for the same period in 2023.

Adjusted EBITDA, Adjusted EBITDA margin,

Adjusted Gross Profit, Adjusted Net Income, Adjusted SG&A, Net

Debt and Leverage Ratio are all non-GAAP measures. Please refer to

the reconciliation of each of these measures to the nearest GAAP

measure in this release.

An income tax

expense of $8 million was incurred in the

first quarter of 2024, with an effective tax rate

of 30%, as compared to an income tax

expense of $13 million, with an effective tax

rate of 28%, for the first quarter of 2023. Our

rates differ from the U.S. federal statutory rate of 21% as a

result of state income taxes, non-deductible expenses, and

differing foreign income tax rates. In addition, the effective tax

rate for the three months ended March 31, 2024, was higher

than the U.S. federal statutory rate due to foreign losses

with no tax benefit.

Sales

The company’s sales were $806 million for

the first quarter of 2024, which

was 5% higher than the fourth quarter of

2023 and 9% lower than the first quarter

of 2023. Sequentially, all sectors were up, led by the Downstream,

Industrial and Energy Transition (DIET) and Gas Utilities

sectors. As compared to the first quarter of 2023, all sectors

declined, led by the Gas Utilities and Production and Transmission

Infrastructure (PTI) sectors.

Sales by Segment

U.S. sales in the first quarter of

2024 were $667 million, down $73 million, or

10%, from the same quarter in 2023. The Gas Utilities sector

revenue decreased $41 million, or 13%, as

customers reduce their product inventory levels.

PTI sector sales decreased by $24 million, or 11%,

primarily due to lower line pipe sales. DIET sector sales

declined $8 million primarily due to non-recurring

projects.

Sequentially, as compared to the fourth quarter

of 2023, U.S. sales increased $34 million,

or 5%, driven by the U.S. Gas

Utilities sector, which increased $13 million, or 5%, as

a result of deliveries for upcoming projects

and increased customer spending due to normalizing

buying patterns. The

DIET sector increased $11 million, or 6%,

due to increased turnarounds and project activity for mining,

refining and chemicals customers. The PTI sector

increased $10 million, or 5%, primarily due to the

timing of customer projects benefiting valve sales and production

infrastructure.

Canada sales in the first quarter of

2024 were $29 million, down $13 million, or

31%, from the same quarter in 2023, as decreases in the

PTI sector offset an increase in the DIET

sector.

Sequentially, Canada sales were

up $1 million from the prior quarter.

International sales in the first quarter of

2024 were $110 million, up $7 million, or 7%,

from the same period in 2023. The increase was driven by the PTI

sector primarily in Europe and Middle East, followed

by the DIET sector in Europe and the Middle East for renewable

and LNG projects.

Sequentially, as compared to the previous

quarter, International sales were up $3 million,

or 3%. The increase was driven by the DIET

sector for project activity in the Middle East and

Europe.

Sales by Sector

Gas Utilities sector sales, which

are primarily U.S. based, were $266 million in

the first quarter of 2024, or 33% of total sales, a

decrease of $41 million, or 13%, from the

first quarter of 2023.

Sequentially, as compared to the fourth

quarter of 2023, the Gas Utilities sector sales

increased $13 million, or 5%.

DIET sector sales in the first quarter of

2024 were $276 million, or 34% of total sales,

a decrease of $2 million, or 1%, from the

first quarter of 2023. The decrease in DIET

sector sales was driven by the U.S. segment.

Sequentially, as compared to the previous

quarter, sales in the DIET sector were up $18 million,

or 7%, led by the U.S. segment followed by the

International segment.

PTI sector sales in the first quarter of

2024 were $264 million, or 33% of total sales, a

decline of $36 million, or 12%, from the

first quarter of 2023. The decrease in PTI sales was due

to declines in the U.S. and Canada segments.

Sequentially, as compared to the prior quarter,

PTI sector sales increased $7 million, or 3%,

driven by the U.S. segment followed by

the International segment.

Backlog

As of March 31, 2024, the company's backlog

was $704 million, a 1% increase compared to the

previous quarter.

Balance Sheet and Cash Flow

As of March 31, 2024, the cash

balance was $146 million, long-term debt (including

current portion) was $295 million, and Net Debt was

$149 million. Cash provided by operations was $38

million in the first quarter of 2024. Availability under

the company’s asset-based lending facility was $645 million,

and available liquidity was $791 million as of March 31, 2024.

The company intends to repay its Term Loan B in its

entirety during the second quarter using a combination of its

asset-based lending facility and cash. Please refer to the

reconciliation of non-GAAP measures (Net Debt) to GAAP measures

(Long-term Debt) in this release.

Conference Call

The company will hold a conference call to

discuss its first quarter 2024 results at 10:00 a.m.

Eastern Time (9:00 a.m. Central Time) on May 9, 2024. To

participate in the call, please dial 201-689-8261 and ask for

the MRC Global conference call at least 10 minutes prior to

the start time. To access the conference call, live over the

Internet, please log onto the web at www.mrcglobal.com and go to

the “Investors” page of the company’s website at least fifteen

minutes early to register, download and install any necessary audio

software. For those who cannot listen to the live call, a replay

will be available through May 23, 2024, and can be accessed by

dialing 201-612-7415 and using pass code 13745025#. Also,

an archive of the webcast will be available shortly after the call

at www.mrcglobal.com for 90 days.

About MRC Global Inc.

Headquartered in Houston, Texas, MRC Global

(NYSE: MRC) is the leading global distributor of pipe,

valves, fittings (PVF) and other infrastructure products

and services to diversified end-markets including the gas

utilities, downstream, industrial and energy transition, and

production and transmission sectors. With over 100 years of

experience, MRC Global has provided customers with innovative

supply chain solutions, technical product expertise and a robust

digital platform from a worldwide network of 214 locations

including valve and engineering centers. The company’s unmatched

quality assurance program offers over 300,000 SKUs from over 8,500

suppliers, simplifying the supply chain for

approximately 10,000 customers. Find out more at

www.mrcglobal.com.

This news release contains forward-looking

statements within the meaning of Section 27A of the Securities

Act and Section 21E of the Exchange Act. Words such as “will,”

“expect,” “expected,” “anticipating,” “intend,” “believes,”

"on-track," “well positioned,” “strong position,” “looking

forward,” “guidance,” “plans,” “can,” "target," "targeted" and

similar expressions are intended to identify forward-looking

statements.

Statements about the company’s business,

including its strategy, its industry, the company’s future

profitability, the company’s guidance on its sales, adjusted

EBITDA, adjusted EBITDA margin, tax rate,

capital expenditures, achieving cost savings and cash flow,

debt reduction, liquidity, growth in the company’s various markets

and the company’s expectations, beliefs, plans, strategies,

objectives, prospects and assumptions are not guarantees of future

performance. These statements are based on management’s

expectations that involve a number of business risks and

uncertainties, any of which could cause actual results to differ

materially from those expressed in or implied by the

forward-looking statements. These statements involve known and

unknown risks, uncertainties and other factors, most of which are

difficult to predict and many of which are beyond MRC Global’s

control, including the factors described in the company’s SEC

filings that may cause the company’s actual results and performance

to be materially different from any future results or performance

expressed or implied by these forward-looking statements.

These risks and uncertainties include (among

others) decreases in capital and other expenditure levels in

the industries that the company serves; U.S. and international

general economic conditions; geopolitical events; decreases in oil

and natural gas prices; unexpected supply shortages; loss of

third-party transportation providers; cost increases by the

company’s suppliers and transportation providers; increases in

steel prices, which the company may be unable to pass along to its

customers which could significantly lower the company’s profit; the

company’s lack of long-term contracts with most of its suppliers;

suppliers’ price reductions of products that the company sells,

which could cause the value of its inventory to decline; decreases

in steel prices, which could significantly lower the company’s

profit; a decline in demand for certain of the products the company

distributes if tariffs and duties on these products are imposed or

lifted; holding more inventory than can be sold in a commercial

time frame; significant substitution of renewables and low-carbon

fuels for oil and gas, impacting demand for the company’s

products; risks related to adverse weather events or natural

disasters; environmental, health and safety laws and regulations

and the interpretation or implementation thereof; changes in the

company’s customer and product mix; the risk that manufacturers of

the products that the company distributes will sell a substantial

amount of goods directly to end users in the industry sectors that

the company serves; failure to operate the company’s business in an

efficient or optimized manner; the company’s ability to compete

successfully with other companies; the company’s lack of

long-term contracts with many of its customers and the company’s

lack of contracts with customers that require minimum purchase

volumes; inability to attract and retain employees or the potential

loss of key personnel; adverse health events, such as a pandemic;

interruption in the proper functioning of the company’s information

systems; the occurrence of cybersecurity incidents; risks related

to the company’s customers’ creditworthiness; the success of

acquisition strategies; the potential adverse effects associated

with integrating acquisitions and whether these acquisitions will

yield their intended benefits; impairment of the company’s goodwill

or other intangible assets; adverse changes in political or

economic conditions in the countries in which the company operates;

the company’s significant indebtedness; the dependence on the

company’s subsidiaries for cash to meet parent company obligations;

changes in the company’s credit profile; potential inability to

obtain necessary capital; the sufficiency of the company’s

insurance policies to cover losses, including liabilities arising

from litigation; product liability claims against the company;

pending or future asbestos-related claims against the company;

exposure to U.S. and international laws and regulations, regulating

corruption, limiting imports or exports or imposing economic

sanctions; risks relating to ongoing evaluations of internal

controls required by Section 404 of the Sarbanes-Oxley Act; risks

related to changing laws and regulations including trade policies

and tariffs; and the potential share price volatility and costs

incurred in response to any shareholder activism campaigns.

For a discussion of key risk factors, please see

the risk factors disclosed in the company’s SEC filings, which are

available on the SEC’s website at www.sec.gov and on the company’s

website, www.mrcglobal.com. MRC Global’s filings and other

important information are also available on the Investors page

of the company’s website at www.mrcglobal.com.

Undue reliance should not be placed on the

company’s forward-looking statements. Although forward-looking

statements reflect the company’s good faith beliefs, reliance

should not be placed on forward-looking statements because they

involve known and unknown risks, uncertainties and other factors,

which may cause the company’s actual results, performance or

achievements or future events to differ materially from anticipated

future results, performance or achievements or future events

expressed or implied by such forward-looking statements. The

company undertakes no obligation to publicly update or revise any

forward-looking statement, whether as a result of new information,

future events, changed circumstances or otherwise, except to the

extent required by law.

Contact:

| |

|

Monica BroughtonVP, Investor Relations & Treasury |

|

MRC Global Inc. |

|

Monica.Broughton@mrcglobal.com |

|

832-308-2847 |

| |

|

MRC Global Inc.Condensed Consolidated

Balance Sheets (Unaudited)(in millions, except

shares) |

| |

| |

|

March 31, |

|

|

December 31, |

|

| |

|

2024 |

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

| Assets |

|

|

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

|

|

Cash |

|

$ |

146 |

|

|

$ |

131 |

|

|

Accounts receivable, net |

|

|

478 |

|

|

|

430 |

|

|

Inventories, net |

|

|

546 |

|

|

|

560 |

|

|

Other current assets |

|

|

34 |

|

|

|

34 |

|

| Total current assets |

|

|

1,204 |

|

|

|

1,155 |

|

| |

|

|

|

|

|

|

|

|

| Long-term assets: |

|

|

|

|

|

|

|

|

|

Operating lease assets |

|

|

196 |

|

|

|

205 |

|

|

Property, plant and equipment, net |

|

|

78 |

|

|

|

78 |

|

|

Other assets |

|

|

20 |

|

|

|

21 |

|

| |

|

|

|

|

|

|

|

|

| Intangible assets: |

|

|

|

|

|

|

|

|

|

Goodwill, net |

|

|

264 |

|

|

|

264 |

|

|

Other intangible assets, net |

|

|

158 |

|

|

|

163 |

|

| |

|

$ |

1,920 |

|

|

$ |

1,886 |

|

| |

|

|

|

|

|

|

|

|

| Liabilities and

stockholders' equity |

|

|

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

|

|

Trade accounts payable |

|

$ |

402 |

|

|

$ |

355 |

|

|

Accrued expenses and other current liabilities |

|

|

95 |

|

|

|

102 |

|

|

Operating lease liabilities |

|

|

25 |

|

|

|

34 |

|

|

Current portion of debt obligations |

|

|

292 |

|

|

|

292 |

|

| Total current liabilities |

|

|

814 |

|

|

|

783 |

|

| |

|

|

|

|

|

|

|

|

| Long-term liabilities: |

|

|

|

|

|

|

|

|

|

Long-term debt |

|

|

3 |

|

|

|

9 |

|

|

Operating lease liabilities |

|

|

186 |

|

|

|

186 |

|

|

Deferred income taxes |

|

|

47 |

|

|

|

45 |

|

|

Other liabilities |

|

|

20 |

|

|

|

20 |

|

| |

|

|

|

|

|

|

|

|

| Commitments and

contingencies |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| 6.5% Series A Convertible

Perpetual Preferred Stock, $0.01 par value; authorized 363,000

shares; 363,000 shares issued and outstanding |

|

|

355 |

|

|

|

355 |

|

| |

|

|

|

|

|

|

|

|

| Stockholders' equity: |

|

|

|

|

|

|

|

|

|

Common stock, $0.01 par value per share: 500 million shares

authorized, 109,287,979 and 108,531,564 issued, respectively |

|

|

1 |

|

|

|

1 |

|

|

Additional paid-in capital |

|

|

1,767 |

|

|

|

1,768 |

|

|

Retained deficit |

|

|

(665 |

) |

|

|

(678 |

) |

|

Less: Treasury stock at cost: 24,216,330 shares |

|

|

(375 |

) |

|

|

(375 |

) |

|

Accumulated other comprehensive loss |

|

|

(233 |

) |

|

|

(228 |

) |

| |

|

|

495 |

|

|

|

488 |

|

| |

|

$ |

1,920 |

|

|

$ |

1,886 |

|

| |

|

MRC Global Inc.Condensed Consolidated

Statements of Operations (Unaudited)(in millions, except

per share amounts) |

| |

| |

|

Three Months Ended |

|

| |

|

March 31, |

|

|

March 31, |

|

| |

|

2024 |

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

| Sales |

|

$ |

806 |

|

|

$ |

885 |

|

| Cost of sales |

|

|

643 |

|

|

|

706 |

|

| Gross profit |

|

|

163 |

|

|

|

179 |

|

| Selling, general and

administrative expenses |

|

|

125 |

|

|

|

122 |

|

| Operating income |

|

|

38 |

|

|

|

57 |

|

| Other expense: |

|

|

|

|

|

|

|

|

|

Interest expense |

|

|

(8 |

) |

|

|

(7 |

) |

|

Other, net |

|

|

(3 |

) |

|

|

(3 |

) |

| |

|

|

|

|

|

|

|

|

| Income before income

taxes |

|

|

27 |

|

|

|

47 |

|

| Income tax expense |

|

|

8 |

|

|

|

13 |

|

| Net income |

|

|

19 |

|

|

|

34 |

|

| Series A preferred stock

dividends |

|

|

6 |

|

|

|

6 |

|

| Net income attributable to

common stockholders |

|

$ |

13 |

|

|

$ |

28 |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Basic earnings per common

share |

|

$ |

0.15 |

|

|

$ |

0.33 |

|

| Diluted earnings per common

share |

|

$ |

0.15 |

|

|

$ |

0.33 |

|

| Weighted-average common

shares, basic |

|

|

84.7 |

|

|

|

84.0 |

|

| Weighted-average common

shares, diluted |

|

|

86.1 |

|

|

|

85.4 |

|

| |

|

MRC Global Inc.Condensed Consolidated

Statements of Cash Flows (Unaudited)(in millions) |

| |

| |

|

Three Months Ended |

|

| |

|

March 31, |

|

|

March 31, |

|

| |

|

2024 |

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

| Operating

activities |

|

|

|

|

|

|

|

|

| Net income |

|

$ |

19 |

|

|

$ |

34 |

|

| Adjustments to reconcile net

income to net cash provided by (used in) operations: |

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

5 |

|

|

|

5 |

|

|

Amortization of intangibles |

|

|

5 |

|

|

|

5 |

|

|

Equity-based compensation expense |

|

|

4 |

|

|

|

3 |

|

|

Deferred income tax expense |

|

|

2 |

|

|

|

5 |

|

|

Other non-cash items |

|

|

3 |

|

|

|

4 |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

|

Accounts receivable |

|

|

(51 |

) |

|

|

(28 |

) |

|

Inventories |

|

|

8 |

|

|

|

(96 |

) |

|

Other current assets |

|

|

1 |

|

|

|

(1 |

) |

|

Accounts payable |

|

|

49 |

|

|

|

54 |

|

|

Accrued expenses and other current liabilities |

|

|

(7 |

) |

|

|

(15 |

) |

| Net cash provided by (used in)

operations |

|

|

38 |

|

|

|

(30 |

) |

| |

|

|

|

|

|

|

|

|

| Investing

activities |

|

|

|

|

|

|

|

|

| Purchases of property, plant

and equipment |

|

|

(6 |

) |

|

|

(3 |

) |

| Other investing

activities |

|

|

1 |

|

|

|

- |

|

| Net cash used in investing

activities |

|

|

(5 |

) |

|

|

(3 |

) |

| |

|

|

|

|

|

|

|

|

| Financing

activities |

|

|

|

|

|

|

|

|

| Payments on revolving credit

facilities |

|

|

(14 |

) |

|

|

(211 |

) |

| Proceeds from revolving credit

facilities |

|

|

9 |

|

|

|

262 |

|

| Payments on debt

obligations |

|

|

(1 |

) |

|

|

(1 |

) |

| Dividends paid on preferred

stock |

|

|

(6 |

) |

|

|

(6 |

) |

| Repurchases of shares to

satisfy tax withholdings |

|

|

(5 |

) |

|

|

(4 |

) |

| Net cash (used in) provided by

financing activities |

|

|

(17 |

) |

|

|

40 |

|

| |

|

|

|

|

|

|

|

|

| Increase in cash |

|

|

16 |

|

|

|

7 |

|

| Effect of foreign exchange

rate on cash |

|

|

(1 |

) |

|

|

- |

|

| Cash -- beginning of

period |

|

|

131 |

|

|

|

32 |

|

| Cash -- end of period |

|

$ |

146 |

|

|

$ |

39 |

|

| |

|

MRC Global Inc.Supplemental Sales

Information (Unaudited)(in millions) |

|

|

|

Disaggregated Sales by Segment and Sector |

|

|

|

Three Months EndedMarch 31, |

| |

|

U.S. |

|

|

Canada |

|

|

International |

|

|

Total |

|

|

2024 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gas Utilities |

|

$ |

265 |

|

|

$ |

1 |

|

|

$ |

- |

|

|

$ |

266 |

|

| DIET |

|

|

202 |

|

|

|

9 |

|

|

|

65 |

|

|

|

276 |

|

| PTI |

|

|

200 |

|

|

|

19 |

|

|

|

45 |

|

|

|

264 |

|

| |

|

$ |

667 |

|

|

$ |

29 |

|

|

$ |

110 |

|

|

$ |

806 |

|

| 2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gas Utilities |

|

$ |

306 |

|

|

$ |

1 |

|

|

$ |

- |

|

|

$ |

307 |

|

| DIET |

|

|

210 |

|

|

|

5 |

|

|

|

63 |

|

|

|

278 |

|

| PTI |

|

|

224 |

|

|

|

36 |

|

|

|

40 |

|

|

|

300 |

|

| |

|

$ |

740 |

|

|

$ |

42 |

|

|

$ |

103 |

|

|

$ |

885 |

|

| |

|

MRC Global Inc.Supplemental Sales

Information (Unaudited)(in millions) |

|

|

|

Sales by Product Line |

|

|

| |

| |

|

Three Months Ended |

|

| |

|

March 31, |

|

|

March 31, |

|

|

Type |

|

2024 |

|

|

2023 |

|

|

Line Pipe |

|

$ |

117 |

|

|

$ |

141 |

|

| Carbon Fittings and

Flanges |

|

|

100 |

|

|

|

117 |

|

| Total Carbon Pipe, Fittings

and Flanges |

|

|

217 |

|

|

|

258 |

|

| Valves, Automation,

Measurement and Instrumentation |

|

|

291 |

|

|

|

315 |

|

| Gas Products |

|

|

187 |

|

|

|

207 |

|

| Stainless Steel and Alloy Pipe

and Fittings |

|

|

41 |

|

|

|

32 |

|

| General Products |

|

|

70 |

|

|

|

73 |

|

| |

|

$ |

806 |

|

|

$ |

885 |

|

| |

|

MRC Global Inc.Supplemental Information

(Unaudited)Reconciliation of Gross Profit to

Adjusted Gross Profit (a non-GAAP measure)(in

millions) |

| |

| |

|

Three Months Ended |

|

| |

|

March 31, |

|

|

Percentage |

|

|

March 31, |

|

|

Percentage |

|

| |

|

2024 |

|

|

of Revenue* |

|

|

2023 |

|

|

of Revenue* |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross profit, as reported |

|

$ |

163 |

|

|

|

20.2 |

% |

|

$ |

179 |

|

|

|

20.2 |

% |

| Depreciation and

amortization |

|

|

5 |

|

|

|

0.6 |

% |

|

|

5 |

|

|

|

0.6 |

% |

| Amortization of

intangibles |

|

|

5 |

|

|

|

0.6 |

% |

|

|

5 |

|

|

|

0.6 |

% |

| Increase (decrease) in LIFO

reserve |

|

|

1 |

|

|

|

0.1 |

% |

|

|

(1 |

) |

|

|

(0.1 |

)% |

| Adjusted Gross Profit |

|

$ |

174 |

|

|

|

21.6 |

% |

|

$ |

188 |

|

|

|

21.2 |

% |

Notes to above:* Does not foot due to

rounding

The company defines Adjusted Gross Profit as

sales, less cost of sales, plus depreciation and amortization, plus

amortization of intangibles, plus inventory-related charges

incremental to normal operations and plus or minus the impact of

its LIFO inventory costing methodology. The company presents

Adjusted Gross Profit because the company believes it is a useful

indicator of the company’s operating performance without regard to

items, such as amortization of intangibles, that can vary

substantially from company to company depending upon the nature and

extent of acquisitions of which they have been involved. Similarly,

the impact of the LIFO inventory costing method can cause results

to vary substantially from company to company depending upon

whether they elect to utilize LIFO and depending upon which method

they may elect. The company uses Adjusted Gross Profit as a key

performance indicator in managing its business. The company

believes that gross profit is the financial measure calculated and

presented in accordance with U.S. generally accepted accounting

principles that is most directly comparable to Adjusted Gross

Profit.

| |

|

MRC Global Inc.Supplemental Information

(Unaudited)Reconciliation of Selling, General and

Administrative Expenses (SG&A) to Adjusted SG&A (a non-GAAP

measure)(in millions) |

| |

| |

|

Three Months Ended |

|

| |

|

March 31, |

|

|

March 31, |

|

| |

|

2024 |

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

| Selling, general and

administrative expenses |

|

$ |

125 |

|

|

$ |

122 |

|

| Activism response legal and

consulting costs |

|

|

(3 |

) |

|

|

- |

|

| Adjusted Selling, general and

administrative expenses |

|

$ |

122 |

|

|

$ |

122 |

|

Notes to above:

The company defines adjusted selling, general and administrative

(SG&A) expenses as SG&A, less severance and

restructuring expenses and other unusual items. The company

presents adjusted SG&A because the company believes it is a

useful indicator of the company’s operating performance. Among

other things, adjusted SG&A measures the company’s

operating performance without regard to certain non-recurring,

non-cash or transaction-related expenses. The company uses

adjusted SG&A as a key performance indicator in managing

its business. The company believes that SG&A is the financial

measure calculated and presented in accordance with U.S. Generally

Accepted Accounting Principles that is most directly comparable to

adjusted SG&A.

| |

|

MRC Global Inc.Supplemental Information

(Unaudited)Reconciliation of Net Income to

Adjusted EBITDA (a non-GAAP measure)(in millions) |

| |

| |

|

Three Months Ended |

|

| |

|

March 31, |

|

|

March 31, |

|

| |

|

2024 |

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

| Net income |

|

$ |

19 |

|

|

$ |

34 |

|

| Income tax expense |

|

|

8 |

|

|

|

13 |

|

| Interest expense |

|

|

8 |

|

|

|

7 |

|

| Depreciation and

amortization |

|

|

5 |

|

|

|

5 |

|

| Amortization of

intangibles |

|

|

5 |

|

|

|

5 |

|

| Increase (decrease) in LIFO

reserve |

|

|

1 |

|

|

|

(1 |

) |

| Equity-based compensation

expense (1) |

|

|

4 |

|

|

|

3 |

|

| Activism response legal and

consulting costs (1) |

|

|

3 |

|

|

|

- |

|

| Write off of debt issuance

costs |

|

|

1 |

|

|

|

- |

|

| Asset disposal (2) |

|

|

1 |

|

|

|

- |

|

| Foreign currency losses |

|

|

2 |

|

|

|

3 |

|

| Adjusted EBITDA |

|

$ |

57 |

|

|

$ |

69 |

|

Notes to above:(1) Charges (pre-tax)

recorded in SG&A. (2) Charge (pre-tax) for an asset

disposal in our International segment.

The company defines adjusted EBITDA as net

income plus interest, income taxes, depreciation and amortization,

amortization of intangibles, and certain other expenses, including

non-cash expenses, (such as equity-based compensation, severance

and restructuring, changes in the fair value of derivative

instruments, asset impairments, including inventory, long-lived

asset impairments (including goodwill and intangible assets),

inventory-related charges incremental to normal

operations, and plus or minus the impact of its LIFO inventory

costing methodology. The company presents adjusted EBITDA

because the company believes adjusted EBITDA is a useful indicator

of the company’s operating performance. Among other things,

adjusted EBITDA measures the company’s operating performance

without regard to certain non-recurring, non-cash or

transaction-related expenses. adjusted EBITDA, however, does not

represent and should not be considered as an alternative to net

income, cash flow from operations or any other measure of financial

performance calculated and presented in accordance with GAAP.

Because adjusted EBITDA does not account for certain expenses, its

utility as a measure of the company’s operating performance has

material limitations. Because of these limitations, the company

does not view adjusted EBITDA in isolation or as a primary

performance measure and also uses other measures, such as net

income and sales, to measure operating performance. See the

company's Annual Report filed on Form 10-K for a more thorough

discussion of the use of adjusted EBITDA.

| |

|

MRC Global Inc.Supplemental Information

(Unaudited)Reconciliation of Net Income

Attributable to Common Stockholders to Adjusted

Net Income Attributable to Common Stockholders (a non-GAAP

measure)(in millions, except per share amounts) |

| |

| |

|

Three Months Ended |

|

| |

|

March 31, 2024 |

|

| |

|

Amount |

|

|

Per Share |

|

|

|

|

|

|

|

|

|

|

|

| Net income attributable to

common stockholders |

|

$ |

13 |

|

|

$ |

0.15 |

|

| Asset disposal, net of tax

(1) |

|

|

1 |

|

|

|

0.01 |

|

| Activism response legal and

consulting costs, net of tax |

|

|

2 |

|

|

|

0.03 |

|

| Increase in LIFO reserve, net

of tax |

|

|

1 |

|

|

|

0.01 |

|

| Adjusted net income

attributable to common stockholders |

|

$ |

17 |

|

|

$ |

0.20 |

|

Notes to above:(1) An after-tax charge for

an asset disposal in our International segment.

| |

|

Three Months Ended |

|

| |

|

March 31, 2023 |

|

| |

|

Amount |

|

|

Per Share |

|

|

|

|

|

|

|

|

|

|

|

| Net income attributable to

common stockholders |

|

$ |

28 |

|

|

$ |

0.33 |

|

| Decrease in LIFO reserve, net

of tax |

|

|

(1 |

) |

|

|

(0.01 |

) |

| Adjusted net income

attributable to common stockholders |

|

$ |

27 |

|

|

$ |

0.32 |

|

Notes to above:

The company defines adjusted net income

attributable to common stockholders (a non-GAAP measure) as net

income attributable to common stockholders plus or minus the

after-tax impact of items deemed non-standard and plus or

minus the after-tax impact of its LIFO inventory costing

methodology. After-tax impacts were determined using the company's

U.S. blended statutory rate. The company presents

adjusted net income attributable to common stockholders and related

per share amounts because the company believes it provides

useful comparisons of the company’s operating results to other

companies, including those companies with whom we compete in the

distribution of pipe, valves and fittings to the energy industry,

without regard to the irregular variations from certain

restructuring events not indicative of the on-going business. Those

items include goodwill and intangible asset impairments,

inventory-related charges, facility closures, severance and

restructuring as well as the LIFO inventory costing methodology.

The impact of the LIFO inventory costing methodology can cause

results to vary substantially from company to company depending

upon whether they elect to utilize LIFO and depending upon which

method they may elect. The company believes that net income

attributable to common stockholders is the financial measure

calculated and presented in accordance with U.S. generally accepted

accounting principles that is most directly compared to adjusted

net income attributable to common stockholders.

| |

|

MRC Global Inc.Supplemental Information

(Unaudited)Reconciliation of Long-term Debt to Net

Debt (a non-GAAP measure) and the Leverage Ratio

Calculation(in millions) |

| |

| |

|

March 31, |

|

| |

|

2024 |

|

|

|

|

|

|

|

| Long-term debt |

|

$ |

3 |

|

| Plus: current portion of debt

obligations |

|

|

292 |

|

| Total debt |

|

|

295 |

|

| Less: cash |

|

|

146 |

|

| Net Debt |

|

$ |

149 |

|

| |

|

|

|

|

| Net Debt |

|

$ |

149 |

|

| Trailing twelve months

adjusted EBITDA |

|

|

238 |

|

| Leverage ratio |

|

|

0.6 |

|

Notes to above:

Net Debt and related leverage metrics may be

considered non-GAAP measures. The company defines Net Debt as

total long-term debt, including current portion, minus cash. The

company defines its leverage ratio as Net Debt divided by

trailing twelve months Adjusted EBITDA. The company believes

Net Debt is an indicator of the extent to which the company’s

outstanding debt obligations could be satisfied by cash on hand and

a useful metric for investors to evaluate the company’s leverage

position. The company believes the leverage ratio is a commonly

used metric that management and investors use to assess the

borrowing capacity of the company. The company believes total

long-term debt (including the current portion) is the financial

measure calculated and presented in accordance with U.S. generally

accepted accounting principles that is most directly comparable to

Net Debt.

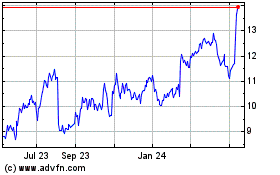

MRC Global (NYSE:MRC)

Historical Stock Chart

From Dec 2024 to Jan 2025

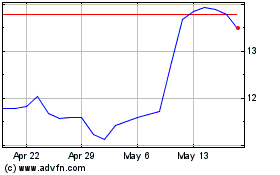

MRC Global (NYSE:MRC)

Historical Stock Chart

From Jan 2024 to Jan 2025