MRC Global Inc. (NYSE: MRC), the leading global distributor of

pipe, valves, fittings and infrastructure products and services to

diversified energy, industrial and gas utilities end-markets (“MRC

Global” or the “Company”), today issued the following statement in

response to the recent statement and nomination notice the Company

has received from Engine Capital LP (“Engine”):

For the full-year

2023, MRC Global set several new records for profit margins,

balance sheet strength and working capital efficiency. Notably, we

generated significant operating cash for the year of $181 million,

well above what we previously expected. We also set a company

record for adjusted gross margins.

The fundamentals of

our three business sectors and their long-term outlook remain

strong, especially given the high demand for our products and

services. We have seen a meaningful improvement in our backlog and

our new orders over the early part of 2024, and we expect to return

to growth in the coming quarters.

With the recent

improvements in our cost structure and our working capital

efficiencies, we expect to generate significant earnings and cash

flow across the business cycle. We are targeting to generate

approximately $200 million in operating cash flow in 2024. This,

combined with the strength of our balance sheet – MRC Global has

record low net debt as a public company – will provide us with a

lot of flexibility to pursue a capital allocation strategy that is

focused on the highest return opportunities, including investing in

our growth drivers and distributing capital to our

shareholders.

MRC Global’s Board of

Directors is composed of diverse and highly qualified directors,

bringing together unique and complementary skillsets to

successfully oversee the Company’s strategic plan. Members of the

Board bring decades of expertise at publicly traded companies,

including across the industrial distribution and energy sectors, as

well as corporate governance, finance and capital allocation,

supply chain and international experience.

The Board has an

active refreshment program and has appointed five new directors

since 2021. On March 11, 2024, MRC Global appointed David Hager to

the Board. Mr. Hager, previously Executive Chairman of Devon Energy

Corporation where he led the execution of a strategy that drove

impressive shareholder returns, brings a wealth of relevant

industry experience and a sharp business acumen to the Company. Mr.

Hager joined the Board to replace Barbara Duganier who is

retiring at the end of her term at the next Annual Meeting.

Engagement

with Engine Capital

As noted in our

preliminary proxy statement, our Board and leadership team have

held discussions with Engine Capital over the past several months.

In addition to several meetings with Arnaud Ajdler to better

understand his perspectives, members of our Board interviewed

Engine Capital’s candidates to assess their qualifications for

potential addition to the MRC Global Board. Following these

interviews, the Board determined that these candidates do not bring

any additional skills to the Board that it does not already

possess.

Our Board and

management team regularly and proactively review MRC Global’s

business against our strategic priorities and other opportunities

available to the Company. The MRC Global Board and management team

are committed to serving in the best interests of all our

shareholders and we will continue to take actions that are in the

best interests of driving long-term value creation.

Shareholders are not required to take any action

at this time. The Board will present its recommendations with

respect to the election of directors in the Company's definitive

proxy statement, which will be filed with the Securities and

Exchange Commission and mailed to all shareholders eligible to vote

at the Annual Meeting. The 2024 Annual Meeting has not yet been

announced.

J.P. Morgan Securities LLC is serving as

financial advisor and Akin Gump Strauss Hauer & Feld LLP is

serving as legal advisor to MRC Global.

About MRC Global Inc.

Headquartered in Houston, Texas, MRC Global

(NYSE: MRC) is the leading global distributor of pipe, valves,

fittings (PVF) and other infrastructure products and services to

diversified end-markets including the gas utilities, downstream,

industrial and energy transition, and production and transmission

infrastructure sectors. With over 100 years of experience, MRC

Global has provided customers with innovative supply chain

solutions, technical product expertise and a robust digital

platform from a worldwide network of 214 locations including valve

and engineering centers. The Company’s unmatched quality assurance

program offers over 300,000 SKUs from over 8,500 suppliers,

simplifying the supply chain for approximately 10,000 customers.

Find out more at https://www.mrcglobal.com/.

Forward-Looking Statements

This news release contains forward-looking

statements within the meaning of Section 27A of the Securities Act

and Section 21E of the Exchange Act. Words such as “will,”

“expect,” "target" and similar expressions are intended to identify

forward-looking statements.

Statements about the Company’s business,

including its strategy, its industry, the Company’s future

profitability, achieving cost savings and cash flow, debt

reduction, liquidity, growth in the Company’s various markets and

the Company’s expectations, beliefs, plans, strategies, objectives,

prospects and assumptions are not guarantees of future performance.

These statements are based on management’s expectations that

involve a number of business risks and uncertainties, any of which

could cause actual results to differ materially from those

expressed in or implied by the forward-looking statements. These

statements involve known and unknown risks, uncertainties and other

factors, most of which are difficult to predict and many of which

are beyond MRC Global’s control, including the factors described in

the Company’s SEC filings that may cause the Company’s actual

results and performance to be materially different from any future

results or performance expressed or implied by these

forward-looking statements.

These risks and uncertainties include (among

others) decreases in capital and other expenditure levels in the

industries that the Company serves; U.S. and international general

economic conditions; geopolitical events; decreases in oil and

natural gas prices; unexpected supply shortages; loss of

third-party transportation providers; cost increases by the

Company’s suppliers and transportation providers; increases in

steel prices, which the Company may be unable to pass along to its

customers which could significantly lower the Company’s profit; the

Company’s lack of long-term contracts with most of its suppliers;

suppliers’ price reductions of products that the Company sells,

which could cause the value of its inventory to decline; decreases

in steel prices, which could significantly lower the Company’s

profit; a decline in demand for certain of the products the Company

distributes if tariffs and duties on these products are imposed or

lifted; holding more inventory than can be sold in a commercial

time frame; significant substitution of renewables and low-carbon

fuels for oil and gas, impacting demand for the Company’s products;

risks related to adverse weather events or natural disasters;

environmental, health and safety laws and regulations and the

interpretation or implementation thereof; changes in the Company’s

customer and product mix; the risk that manufacturers of the

products that the Company distributes will sell a substantial

amount of goods directly to end users in the industry sectors that

the Company serves; failure to operate the Company’s business in an

efficient or optimized manner; the Company’s ability to compete

successfully with other companies; the Company’s lack of long-term

contracts with many of its customers and the Company’s lack of

contracts with customers that require minimum purchase volumes;

inability to attract and retain employees or the potential loss of

key personnel; adverse health events, such as a pandemic;

interruption in the proper functioning of the Company’s information

systems; the occurrence of cybersecurity incidents; risks related

to the Company’s customers’ creditworthiness; the success of

acquisition strategies; the potential adverse effects associated

with integrating acquisitions and whether these acquisitions will

yield their intended benefits; impairment of the Company’s goodwill

or other intangible assets; adverse changes in political or

economic conditions in the countries in which the Company operates;

the Company’s significant indebtedness; the dependence on the

Company’s subsidiaries for cash to meet parent Company obligations;

changes in the Company’s credit profile; potential inability to

obtain necessary capital; the sufficiency of the Company’s

insurance policies to cover losses, including liabilities arising

from litigation; product liability claims against the Company;

pending or future asbestos-related claims against the Company;

exposure to U.S. and international laws and regulations, regulating

corruption, limiting imports or exports or imposing economic

sanctions; risks relating to ongoing evaluations of internal

controls required by Section 404 of the Sarbanes-Oxley Act; risks

related to changing laws and regulations including trade policies

and tariffs; and the potential share price volatility and costs

incurred in response to any shareholder activism campaigns.

For a discussion of key risk factors, please see

the risk factors disclosed in the Company’s SEC filings, which are

available on the SEC’s website at www.sec.gov and on the Company’s

website, https://www.mrcglobal.com/. MRC Global’s filings and other

important information are also available on the Investors page of

the Company’s website at https://www.mrcglobal.com/.

Undue reliance should not be placed on the

Company’s forward-looking statements. Although forward-looking

statements reflect the Company’s good faith beliefs, reliance

should not be placed on forward-looking statements because they

involve known and unknown risks, uncertainties and other factors,

which may cause the Company’s actual results, performance or

achievements or future events to differ materially from anticipated

future results, performance or achievements or future events

expressed or implied by such forward-looking statements. The

Company undertakes no obligation to publicly update or revise any

forward-looking statement, whether as a result of new information,

future events, changed circumstances or otherwise, except to the

extent required by law.

Additional Information and Where to Find

It

MRC Global has filed a preliminary proxy

statement on Schedule 14A with the Securities and Exchange

Commission (the “SEC”), containing a form of WHITE proxy card, with

respect to its solicitation of proxies for MRC Global’s 2024 Annual

Meeting of Shareholders. The proxy statement is in preliminary form

and MRC Global intends to file and mail a definitive proxy

statement to shareholders of MRC Global. INVESTORS AND SECURITY

HOLDERS ARE URGED TO READ THE PROXY STATEMENT (INCLUDING ANY

AMENDMENTS OR SUPPLEMENTS THERETO) FILED BY MRC GLOBAL AND ANY

OTHER RELEVANT DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR

ENTIRETY BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION

ABOUT ANY SOLICITATION. Investors and security holders may obtain

copies of these documents and other documents filed with the SEC by

MRC Global free of charge through the website maintained by the SEC

at www.sec.gov. Copies of the documents filed by MRC Global are

also available free of charge by accessing MRC Global’s website at

https://www.mrcglobal.com/.

Participants

MRC Global, its directors and executive officers

and other members of management and employees will be participants

in the solicitation of proxies with respect to a solicitation by

MRC Global. Information about MRC Global’s executive officers and

directors and a description of their direct and indirect interests,

by security holdings or otherwise, are included in the preliminary

proxy statement and will be included in the definitive proxy

statement and other relevant materials that may be filed with the

SEC by MRC Global. Information regarding MRC Global’s directors and

executive officers is available at “Security Ownership—Directors

and Executive Officers,” “Proposal I: Election of Directors,”

“Compensation Discussion and Analysis” and “Proposal II: Advisory

Approval of Named Executive Officer Compensation” in its

preliminary proxy statement for the 2024 Annual Meeting of

Stockholders, which was filed with the SEC on March 15, 2024. To

the extent holdings by our directors and executive officers of MRC

Global securities reported in the preliminary proxy statement for

the 2024 Annual Meeting or in such Form 8-Ks have changed, such

changes have been or will be reflected on Statements of Change in

Ownership on Forms 3, 4 or 5 filed with the SEC. These documents

are or will be available free of charge at the SEC’s website at

www.sec.gov.

Contact:

Investors:

Monica BroughtonVP, Investor Relations &

TreasuryMRC Global

Inc.Monica.Broughton@mrcglobal.com832-308-2847

Media:

Jim Golden / Dan Moore Collected

StrategiesMRC-CS@collectedstrategies.com

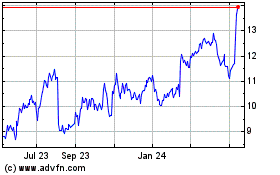

MRC Global (NYSE:MRC)

Historical Stock Chart

From Dec 2024 to Jan 2025

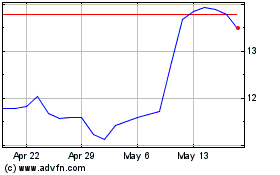

MRC Global (NYSE:MRC)

Historical Stock Chart

From Jan 2024 to Jan 2025