Believes it is Critical to Add Directors

with an Investor Mindset, and Capital Allocation and Financial

Markets Experience

Underscores Engine’s Repeated Attempts to

Avoid an Election Contest, Including by its Willingness to Settle

for Reduced Board Representation

Engine Capital, L.P. (together with its affiliates, "Engine"), a

significant shareholder of MRC Global Inc. (NYSE: MRC) ("MRC" or

the "Company") and the owner of nearly 4.3% of the Company’s

outstanding common stock, today announced it has filed a

preliminary proxy statement with the U.S. Securities and Exchange

Commission in connection with its nomination of two highly

qualified candidates for election to the Company’s Board of

Directors (the “Board”) at the 2024 Annual Meeting of Stockholders

(the “Annual Meeting”): Brad Favreau and Daniel Silvers.

Arnaud Ajdler, Engine’s Founder and Managing Member,

commented:

“Engine has spent months engaging with MRC on its current

strategy, capital allocation approach and Board composition. In

particular, we have highlighted to the Board the risks of its

stated M&A strategy1 and the importance of adding at least one

director with an investor mindset and significant capital

allocation experience. While we have formally nominated two

directors to the Board, we want to emphasize that Engine made its

candidates available for interviews and was willing to agree to a

framework that contemplated a single board seat to facilitate a

resolution to benefit all stakeholders. Considering the size of our

ownership position and our significant concerns, it is

disappointing the Company has resisted working with us. In our

view, a Board that owns de minimis stock should not be willing to

spend stockholder capital to keep an investor-designee from serving

on a nine-member Board.

We look forward to engaging with our fellow shareholders on the

case for adding stockholder-designees to MRC’s boardroom. In the

meantime, we would like to highlight the following:

- MRC has struggled as a public company. The stock is down 42.4%

since its initial public offering almost 12 years ago and has

underperformed its competitor DNOW Inc. over the last one-, three-

and five-year periods.2

- The Board has been unable to resolve its ongoing dispute with

its Preferred Stockholder, Cornell Capital. This is preventing MRC

from fully optimizing its capital structure and harming financial

flexibility.

- Management’s plan to pursue an M&A strategy is concerning.

We believe the strategy is risky in the best of times, but

especially today given the current state of MRC’s capital

structure, depressed multiple and undervaluation, and the high

likelihood that the Board will have to pay higher multiples for

acquisition targets.

- Chief Executive Officer Rob Saltiel does not have a successful

track record of creating value through business acquisitions or

integrations.

For these reasons (among others), we expected the Board to be

open to input from one of its largest stockholders to help ensure

investor interests are prioritized. While this has not been the

case so far and forced us to make our concerns public today, it is

still our hope to work constructively with the Board to resolve

this matter.”

DIRECTOR CANDIDATE BIOS

Brad Favreau

Mr. Favreau is a representative of the nominating stockholder

and a seasoned investor with additive experience in finance,

capital allocation, corporate governance and M&A.

- Current Partner at Engine Capital Management, a top MRC

stockholder and value-oriented special situations fund with a track

record of helping companies implement value-enhancing initiatives,

including M&A transactions, operational and cost improvements,

and optimization of capital allocation policies.

- Currently serves on the boards of directors of American Outdoor

Brands, Inc. (NASDAQ: AOUT), an outdoor products company, and MYR

Group Inc. (NASDAQ: MYRG), a specialty electrical construction

service providers holding company where he serves on the

compensation committee and the nominating, environmental, social

and corporate governance committee.

- Previously worked as an investment professional at Apax

Partners, an international private equity investment group, and as

a member of the Mergers and Acquisitions group at UBS.

- Previously served on the board of directors and audit committee

of RDM Corporation (TSE:RC) a provider of remote deposit capture

software and various solutions, until its sale to the Deluxe

Corporation.

Daniel Silvers

Mr. Silvers is an experienced investment manager, former

banker and public company director with significant capital

allocation and M&A expertise from his time serving in senior

positions at leading global asset managers.

- Former Vice President at Fortress Investment Group LLC

(formerly NYSE: FIG), a leading global alternative asset manager,

and former senior member of the real estate, gaming and lodging

investment banking group at Bear, Stearns & Co. Inc. (formerly

NYSE: BSC), a global financial services firm.

- Former Chief Executive Officer and a director of Leisure

Acquisition Corp. (NASDAQ: LACQ), a special purpose acquisition

company, former Executive Vice President and Chief Strategy Officer

at Inspired Entertainment, Inc. (NASDAQ: INSE), a gaming technology

company, and current Executive Chairman of Winventory, Inc., a

tech-enabled event ticketing management partner.

- Current Managing Member of Matthews Lane Capital Partners LLC,

an investment firm.

- Previously served on the boards of directors of several public

companies, including Avid Technology, Inc. (NASDAQ: AVID), a global

media technology provider where he served on the finance committee,

compensation committee and as Chair of the audit committee, PICO

Holdings, Inc. (NASDAQ: PICO), a diversified holding company where

he served on the compensation committee and corporate governance

and nominating committee, and Universal Health Services, Inc.

(NYSE: UHS), a hospital management and health services

company.

ABOUT ENGINE CAPITAL

Engine Capital is a value-oriented special situations fund that

invests both actively and passively in companies undergoing

change.

***

CERTAIN INFORMATION CONCERNING THE

PARTICIPANTS

Engine Capital, L.P. (“Engine Capital”), together with the other

participants named herein (collectively, “Engine”), has filed a

preliminary proxy statement and an accompanying BLUE universal

proxy card with the Securities and Exchange Commission (“SEC”) to

be used to solicit votes for the election of its slate of director

nominees at the 2024 annual meeting of stockholders of MRC Global

Inc., a Delaware corporation (the “Company”).

ENGINE STRONGLY ADVISES ALL STOCKHOLDERS OF THE COMPANY TO READ

THE PROXY STATEMENT AND OTHER PROXY MATERIALS AS THEY BECOME

AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. SUCH

PROXY MATERIALS WILL BE AVAILABLE AT NO CHARGE ON THE SEC’S WEBSITE

AT HTTP://WWW.SEC.GOV. IN ADDITION, THE PARTICIPANTS IN THIS PROXY

SOLICITATION WILL PROVIDE COPIES OF THE PROXY STATEMENT WITHOUT

CHARGE, WHEN AVAILABLE, UPON REQUEST. REQUESTS FOR COPIES SHOULD BE

DIRECTED TO THE PARTICIPANTS’ PROXY SOLICITOR.

The participants in the proxy solicitation are expected to be

Engine Capital, Engine Jet Capital, L.P. (“Engine Jet”), Engine

Lift Capital, LP (“Engine Lift”), Engine Capital Management, LP

(“Engine Management”), Engine Capital Management GP, LLC (“Engine

GP”), Engine Investments, LLC (“Engine Investments”), Engine

Investments II, LLC (“Engine Investments II”), Arnaud Ajdler,

Bradley T. Favreau and Daniel B. Silvers (collectively, the

“Participants”).

As of the date hereof, Engine Capital directly beneficially owns

3,013,102 shares of Common Stock, $0.01 par value per share (the

“Common Stock”), of the Company. As of the date hereof, Engine Jet

directly beneficially owns 324,920 shares of Common Stock. As of

the date hereof, Engine Lift directly beneficially owns 325,386

shares of Common Stock. Engine Management, as the investment

manager of each of Engine Capital, Engine Jet and Engine Lift, may

be deemed the beneficial owner of the 3,663,408 shares of Common

Stock owned directly by Engine Capital, Engine Jet and Engine Lift.

Engine GP, as the general partner of Engine Management, may be

deemed the beneficial owner of the 3,663,408 shares of Common Stock

owned directly by Engine Capital, Engine Jet and Engine Lift.

Engine Investments, as the general partner of each of Engine

Capital and Engine Jet, may be deemed the beneficial owner of the

3,338,022 shares of Common Stock owned directly by Engine Capital

and Engine Jet. Engine Investments II, as the general partner of

Engine Lift, may be deemed the beneficial owner of the 325,386

shares of Common Stock owned directly by Engine Lift. Mr. Ajdler,

as the Managing Partner of Engine Management, and the Managing

Member of each of Engine GP, Engine Investments and Engine

Investments II, may be deemed the beneficial owner of the 3,663,408

shares of Common Stock directly owned by Engine Capital, Engine Jet

and Engine Lift. As of the date hereof, neither Messrs. Favreau nor

Silvers beneficially owned any shares of Common Stock.

________________________________ 1 “We would

really like to get back to M&A to grow this Company … this

Company will now have more financial flexibility going into '24

than we will have had probably in our entire existence as a public

company. And we will continue to scan the market for attractive

M&A for ways to profitably grow our business.” Chief Executive

Officer Robert J. Saltiel, Jr., MRC 3Q 2023 earnings call, November

8, 2023. 2 Source: CapitalIQ. Total shareholder returns as of

market close on March 11, 2024.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240319434276/en/

Engine Capital, L.P. (212) 321-0048 info@enginecap.com

Longacre Square Partners Charlotte Kiaie / Bela Kirpalani,

646-386-0091 enginecapital@longacresquare.com

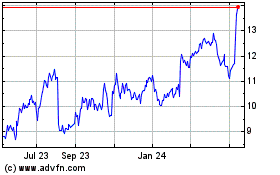

MRC Global (NYSE:MRC)

Historical Stock Chart

From Dec 2024 to Jan 2025

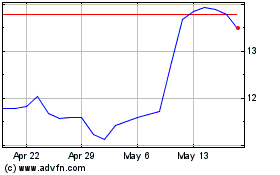

MRC Global (NYSE:MRC)

Historical Stock Chart

From Jan 2024 to Jan 2025