Meritage Homes Corporation (NYSE: MTH, “Meritage” or the

“Company”), the fifth-largest homebuilder in the U.S., today

announced that it has commenced an offering of $500 million

aggregate principal amount of its Convertible Senior Notes due 2028

(the “notes”), subject to market and other conditions. The Company

also expects to grant the initial purchasers of the notes a 13-day

option to purchase up to $75 million of aggregate principal amount

of additional notes.

The notes will be senior, unsecured obligations of

the Company and will be guaranteed fully, unconditionally, and

jointly and severally initially by each of the Company’s direct and

indirect owned subsidiaries from time to time guaranteeing the

Company’s existing senior notes, that is a guarantor or obligor

under the Company’s existing revolving credit agreement or that is

a guarantor or obligor with respect to certain refinancing

indebtedness with respect to the Company’s existing senior notes.

Interest related to the notes is expected to be payable

semi-annually in arrears on May 15 and November 15 of each year,

beginning on November 15, 2024. The Company will satisfy any

conversion elections by paying cash up to the aggregate principal

amount of the notes to be converted and paying or delivering, as

the case may be, cash, shares of the Company’s common stock or a

combination of cash and shares of the Company’s common stock, at

the Company’s election, in respect of the remainder, if any, of the

Company’s conversion obligation in excess of the aggregate

principal amount of the notes being converted. The interest rate,

the initial conversion rate, and certain other terms of the

offering will be determined at the time of pricing. The offering is

subject to market conditions, and there can be no assurance as to

whether or when the offering will be completed, or as to the actual

size or terms of the offering.

The Company intends to use the net proceeds

received from the offering to pay the cost of entering into capped

call transactions, as described below, to redeem all of its

outstanding 6.00% Senior Notes due 2025 and the remainder for

general corporate purposes. If the initial purchasers exercise

their option to purchase additional notes, the Company expects to

use a portion of the net proceeds from the sale of such additional

notes to enter into additional capped call transactions, as

described below, and to use the remainder of such net proceeds for

general corporate purposes.

Contemporaneous with the pricing of the notes, the

Company expects to enter into privately negotiated capped call

transactions in respect of the notes with one or more of the

initial purchasers or their respective affiliates and/or certain

other financial institutions (the “counterparties”). The capped

call transactions are expected to cover, subject to anti-dilution

adjustments, the number of shares of the Company’s common stock

initially underlying the notes. The capped call transactions are

expected generally to reduce potential dilution to the Company’s

common stock upon conversion of any notes and to offset any cash

payments made by the Company in excess of the principal amount of

converted notes, as the case may be, with such reduction and/or

offset subject to a cap. If the initial purchasers exercise their

option to purchase additional notes, the Company expects to enter

into additional capped call transactions with the counterparties in

respect of the additional notes.

To hedge their positions in the capped call

transactions, the Company expects the counterparties or their

respective affiliates to purchase shares of the Company’s common

stock and/or enter into various derivative transactions with

respect to the Company’s common stock concurrently with, or shortly

after, the pricing of the notes. These activities could also

increase (or reduce the size of any decrease in) the market price

per share of the Company’s common stock or the notes at that

time.

In addition, the counterparties or their

respective affiliates may modify their hedge positions by entering

into or unwinding various derivatives with respect to the Company’s

common stock and/or by purchasing or selling shares of the

Company’s common stock or other securities of the Company in

secondary market transactions following the pricing of the notes

and from time to time prior to the maturity of the notes (and are

likely to do so during any observation period for the notes or

following any termination of any portion of the capped call

transactions in connection with any repurchase or early conversion

of the notes). These activities could also increase (or reduce the

size of any decrease in) the market price per share of the

Company’s common stock or the notes, which could affect the ability

of holders of notes to convert the notes, and, to the extent the

activity occurs following conversion or during any observation

period related to a conversion of notes, it could affect the amount

and/or value of the consideration that holders of notes will

receive upon conversion of such notes.

The offering is being made to persons reasonably

believed to be qualified institutional buyers pursuant to Rule 144A

under the Securities Act of 1933, as amended (the “Securities

Act”). The offer and sale of the notes, the related guarantees and

any shares of Meritage’s common stock issuable upon conversion of

the notes have not been and are not expected to be registered under

the Securities Act, or under any state securities laws, and, unless

so registered, the notes, the related guarantees and such shares

may not be offered or sold in the United States except pursuant to

an exemption from, or on a transaction not subject to, the

registration requirements of the Securities Act and applicable

state securities laws.

This release does not constitute an offer to sell

or the solicitation of an offer to buy any of these securities, nor

shall there be any sale of these securities in any state in which

such offer, solicitation or sale would be unlawful prior to

registration or qualification under the securities laws of any such

state.

Forward-Looking Statements

The information included in this press release

contains forward-looking statements within the meaning of the

Private Securities Litigation Reform Act of 1995. Such statements

are based on the current beliefs and expectations of Company

management and current market conditions, which are subject to

significant uncertainties and fluctuations. Actual results may

differ from those set forth in the forward-looking statements. The

Company makes no commitment, and disclaims any duty, except as

required by law, to update or revise any forward-looking statements

to reflect future events or changes in these expectations.

Meritage’s business is subject to a number of risks and

uncertainties. As a result of those risks and uncertainties, the

Company’s stock and note prices may fluctuate dramatically. These

risks and uncertainties include, but are not limited to, the

following: increases in interest rates or decreases in mortgage

availability, and the cost and use of rate locks and buy-downs;

inflation in the cost of materials used to develop communities and

construct homes; cancellation rates; supply chain and labor

constraints; the ability of our potential buyers to sell their

existing homes; our ability to acquire and develop lots may be

negatively impacted if we are unable to obtain performance and

surety bonds; the adverse effect of slow absorption rates;

legislation related to tariffs; impairments of our real estate

inventory; competition; home warranty and construction defect

claims; failures in health and safety performance; fluctuations in

quarterly operating results; our level of indebtedness; our ability

to obtain financing if our credit ratings are downgraded; our

exposure to and impacts from natural disasters or severe weather

conditions; the availability and cost of finished lots and

undeveloped land; the success of our strategy to offer and market

entry-level and first move-up homes; a change to the feasibility of

projects under option or contract that could result in the

write-down or write-off of earnest money or option deposits; our

limited geographic diversification; shortages in the availability

and cost of subcontract labor; the replication of our

energy-efficient technologies by our competitors; our exposure to

information technology failures and security breaches and the

impact thereof; the loss of key personnel; changes in tax laws that

adversely impact us or our homebuyers; our inability to prevail on

contested tax positions; failure of our employees and

representatives to comply with laws and regulations; our compliance

with government regulations; liabilities or restrictions resulting

from regulations applicable to our financial services operations;

negative publicity that affects our reputation; potential

disruptions to our business by an epidemic or pandemic, and

measures that federal, state and local governments and/or health

authorities implement to address it; and other factors identified

in documents filed by the Company with the Securities and Exchange

Commission, including those set forth in our Form 10-K for the year

ended December 31, 2023 and our Form 10-Q for the quarter ended

March 31, 2024 under the caption “Risk Factors.”

About Meritage Homes

Corporation

Meritage is the fifth-largest public homebuilder

in the United States, based on homes closed in 2023. The Company

offers energy-efficient and affordable entry-level and first

move-up homes. Operations span across Arizona, California,

Colorado, Utah, Texas, Florida, Georgia, North Carolina, South

Carolina and Tennessee.

Meritage has delivered over 180,000 homes in its

38-year history, and has a reputation for its distinctive style,

quality construction, and award-winning customer experience. The

Company is an industry leader in energy-efficient homebuilding, an

eleven-time recipient of the U.S. Environmental Protection Agency’s

(“EPA”) ENERGY STAR® Partner of the Year for Sustained Excellence

Award, a ten-time recipient of the EPA’s ENERGY STAR® Residential

New Construction Market Leader Award, and a three-time recipient of

the EPA’s Indoor airPLUS Leader Award.

|

Contacts: |

Emily Tadano, VP Investor Relations and ESG (480) 515-8979 (office)

investors@meritagehomes.com |

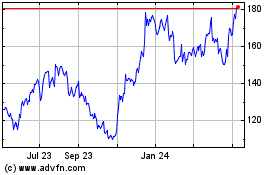

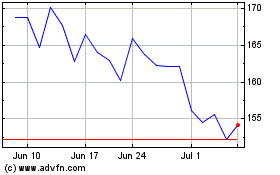

Meritage Homes (NYSE:MTH)

Historical Stock Chart

From Feb 2025 to Mar 2025

Meritage Homes (NYSE:MTH)

Historical Stock Chart

From Mar 2024 to Mar 2025