Mastercard SpendingPulse: US Black Friday Retail Sales Up +3.4% vs. Last Year

November 30 2024 - 1:37PM

Business Wire

- Consumers valued deals and promotions on Black Friday,

e-commerce sales grew +14.6% compared to 2023

According to preliminary insights from Mastercard

SpendingPulse™, U.S. retail sales excluding automotive were up

+3.4% on Black Friday, November 29 compared to Black Friday

2023. Mastercard SpendingPulse measures in-store and online retail

sales, representing all payment types, and is not adjusted for

inflation.

Over the last several years, Black Friday has become more than

just one day, but instead a window of time for shoppers to find

value. While consumers were enticed by early deals in the days

leading up to the Thanksgiving holiday, Black Friday continued to

reign as one of the biggest days of the season. Focusing on Black

Friday, we observed:

- Online Retail sales increased +14.6%, while In-store sales were

up a more modest +0.7%, compared to Black Friday last year.

- Jewelry, Electronics and Apparel remain the top gift sectors

for the holidays, with particular strength in e-commerce for

Apparel on Black Friday.

“Black Friday was a good indicator of how the holiday season is

positively shaping up,” said Michelle Meyer, chief economist,

Mastercard Economics Institute. “Our real-time insights show that

consumers are comfortably in the gift-giving spirit as price

reductions and deals occur across sectors, supporting budgets for

holiday shopping.”

“Shoppers are making the most of seasonal deals and enjoying a

balance of experiences spending and gifts for all loved ones,” said

Steve Sadove, senior advisor for Mastercard and former CEO and

Chairman of Saks Incorporated. “They're more strategic in their

shopping though, prioritizing promotions that they believe hold the

greatest value — opening their wallets, but with more intentional

distribution.”

Zooming out to the two-week period ending in Black Friday, a few

themes stood out:

- Value is in vogue: While retailers and consumers sought

an early start to the season, deals and promotions rolled out on

Black Friday appealed to shoppers looking to save on items they

value most.

- New ‘fits & kicks: Apparel spending started off the

season with relatively stronger activity in-store, but consumers

spent impressively online for Black Friday. After an unusually warm

Fall, the cool and clear weather was welcomed for the Apparel

sector. To complete the outfit, spending on Footwear is tracking

stronger than last year at this time.

- Festive feasts & dining delights: Grocery spending

saw growth during the holidays as consumers feasted at home in the

two weeks leading up to Black Friday while Restaurant spending on

Black Friday showed particular strength.

- Regions: We saw spending outperform in pockets of the

country including Massachusetts, Washington D.C, and Colorado.

About Mastercard SpendingPulse

Mastercard SpendingPulse measures national retail sales based on

aggregated and anonymized Mastercard insights, representing all

payment types in select markets around the world.

Mastercard SpendingPulse defines “U.S. retail sales” as sales at

retailers and food services merchants of all sizes. Sales activity

within the services sector (for example, travel services such as

airlines and lodging) are not included in the total retail sales

figure. SpendingPulse insights are not indicative of Mastercard

company performance; insights and forecast are subject to

change.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241130514905/en/

Raul Lopez | raul.lopez@mastercard.com | 914-841-7049 Alyssa

O’Brien | alyssa.o'brien@mastercard.com | 914-336-1981

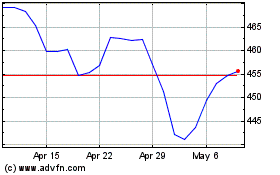

MasterCard (NYSE:MA)

Historical Stock Chart

From Dec 2024 to Jan 2025

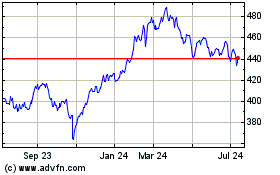

MasterCard (NYSE:MA)

Historical Stock Chart

From Jan 2024 to Jan 2025