Marriott Vacations Worldwide Completes $445 Million Term Securitization

September 30 2024 - 11:10AM

Business Wire

Marriott Vacations Worldwide Corporation (NYSE: VAC) (“MVW” or

the “Company”) announced today the completion of a $445 million

securitization of vacation ownership loans, offered to qualified

institutional buyers in the United States pursuant to Rule 144A and

outside the United States in accordance with Regulation S under the

Securities Act of 1933, as amended. The notes were issued by MVW

2024-2 LLC (the “Issuer”). The notes have a blended interest rate

of 4.52% and a gross advance rate of 98%.

“We are very pleased with the strong investor demand for this

offering. That and the current interest rate environment resulted

in a blended interest rate nearly 200 basis points lower than our

November 2023 transaction,” said Jason Marino, executive vice

president and chief financial officer.

The transaction was backed by a pool of approximately $454

million of vacation ownership loans from a variety of the Company’s

timeshare brands. Three classes of notes were issued by the Issuer,

comprising approximately $307 million of Class A Notes,

approximately $86 million of Class B Notes, and approximately $52

million of Class C Notes. The Class A Notes have an interest rate

of 4.43%, the Class B Notes have an interest rate of 4.58%, and the

Class C Notes have an interest rate of 4.92%.

The Company intends to use the proceeds of the 2024-2

securitization, net of fees, to pay down outstanding credit

facility obligations and for other general corporate purposes.

Important Notice

This press release does not constitute an offer to sell or the

solicitation of an offer to buy any securities nor shall there be

any sale of these securities in any jurisdiction in which such

offer, solicitation or sale would be unlawful prior to registration

or qualification under the securities laws of such jurisdiction.

The notes have not been registered under the Securities Act of

1933, as amended, or any state securities law. Unless so

registered, the notes may not be offered or sold in the United

States, except pursuant to an exemption from the registration

requirements of the Securities Act and applicable state securities

laws.

About Marriott Vacations Worldwide Corporation

Marriott Vacations Worldwide Corporation is a leading global

vacation company that offers vacation ownership, exchange, rental

and resort and property management, along with related businesses,

products, and services. The Company has approximately 120 vacation

ownership resorts and approximately 700,000 owner families in a

diverse portfolio that includes some of the most iconic vacation

ownership brands. The Company also operates an exchange network and

membership programs comprised of more than 3,200 affiliated resorts

in over 90 countries and territories, and provides management

services to other resorts and lodging properties. As a leader and

innovator in the vacation industry, the Company upholds the highest

standards of excellence in serving its customers, investors and

associates while maintaining exclusive, long-term relationships

with Marriott International, Inc. and an affiliate of Hyatt Hotels

Corporation for the development, sales and marketing of vacation

ownership products and services. For more information, please visit

www.marriottvacationsworldwide.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240930484801/en/

Neal Goldner Investor Relations 407-206-6149

neal.goldner@mvwc.com Cameron Klaus Global Communications

407-513-6606 cameron.klaus@mvwc.com

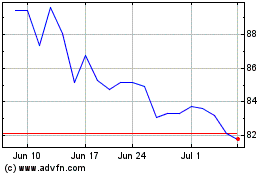

Marriott Vacations World... (NYSE:VAC)

Historical Stock Chart

From Nov 2024 to Dec 2024

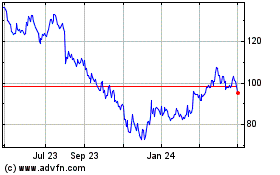

Marriott Vacations World... (NYSE:VAC)

Historical Stock Chart

From Dec 2023 to Dec 2024