(down just 1.7% against demanding comparison in

2023).

Confirmation of 2023/2024 outlook2:

Adjusted EBITDA3 of at least €170 million (or €160 million

excluding the impact of non-recurring income4), up sharply relative

to the previous year (€137 million)

Regulatory News:

- The Pierre & Vacances Center Parcs Group (Paris:VAC)

recorded Q3 2023/2024 revenue from the tourism businesses down just

1.7% relative to the third quarter of the previous year, in a

difficult external environment for the tourism industry, especially

in France (disadvantageous calendar effects, poor weather

conditions, pre-Olympic Games effects, a deteriorated political,

social and economic backdrop, market normalisation after 2023

boosted by the post-Covid rebound…). After an increase of almost 9%

during the first-half period, the Group therefore reported

revenue across all brands up by almost 5% over the

first nine months of the year.

- In view of this performance, the level of reservations to date

and the ongoing savings plan, the Group confirms its outlook for

growth in operating profitability over the full-year 2023/2024,

with adjusted EBITDA set to reach at least €170 million (or

€160 million excluding the impact of non-recurring income).

Franck Gervais, CEO of Pierre & Vacances-Center Parcs,

stated:

“Despite weak sector momentum and the combination of

disadvantageous economic factors, our revenue was only down

slightly in the third quarter, testifying to the Group’s resilience

and the relevance of its positioning in positive-impact local

tourism. Reservations for the summer season show healthy momentum

in last-minute bookings which already represent more than 80% of

the target. Combined with the smooth execution of our strategic

plan, this is reassuring for our full-year EBITDA target indicating

a sharp increase on the figure recorded in 2023.”

1] Revenue

Under IFRS accounting, Q3 2023/2024 revenue totalled €421

million (with nine-month revenue at €1,199.6 million),

compared with €429.8 million in Q3 2022/2023 (and €1,171.6

million over nine months of the previous year).

The Group comments on its revenue and the associated financial

indicators in compliance with its operational reporting, which is

more representative of its business, i.e. (i) with the presentation

of joint undertakings in proportional consolidation, and (ii)

excluding the impact of IFRS16 application. A reconciliation table

presenting revenue stemming from operational reporting and revenue

under IFRS accounting is presented at the end of the press

release.

Revenue is also presented according to the following operational

sectors defined in compliance with the IFRS 8 standard5, i.e.:

- Center Parcs covering both operation

of the Domains marketed under the Center Parcs, Sunparks and

Villages Nature brands, and the building/renovation activities for

tourism assets and property marketing. - Pierre &

Vacances covering the tourism businesses operated in France and

Spain under the Pierre & Vacances brand, the property

development business in Spain and the Asset Management business

line (responsible notably for relations with individual and

institutional lessors). - Maeva.com (included in the Pierre

& Vacances6 business line until 30 September 2023), a

distribution and services platform, operating the maeva.com,

Campings maeva, maeva Home and La France du Nord au Sud brands on

the French market and the Vacansoleil brand on European markets. -

Adagio, covering operation of the city residences leased by

the Pierre & Vacances-Center Parcs Group and entrusted to the

Adagio SAS joint venture under management mandates, as well as

operation of the sites directly leased by the joint venture. - an

operational sector covering the Major Projects business line

responsible for construction and development of new assets on

behalf of the Group in France, and Senioriales, the

subsidiary specialised in property development and operation of

non-medicalised residences for independent elderly people. - the

Corporate operational segment housing primarily the holding

company activities.

Q3

9 months

€m

23/24

22/23

Chg.

23/24

22/23

Chg.

Center Parcs

283.2

297.7

-4.9%

778.1

792.6

-1.8%

of which: Revenue from tourism

businesses

273.1

279.6

-2.3%

752.1

716.2

+5.0%

o/w accommodation revenue

209.5

221.4

-5.4%

581.7

562.0

+3.5%

P&V

78.1

74.2*

+5.2%

236.9

222.2*

+6.6%

of which: Revenue from tourism

businesses

78.1

73.8

+5.8%

236.9

221.9

+6.7%

o/w accommodation revenue

60.0

58.2

+3.1%

190.4

178.1

+6.9%

Adagio

59.1

66.0

-10.4%

164.9

165.3

-0.2%

of which: Revenue from tourism

businesses

59.1

66.0

-10.4%

164.9

165.3

-0.2%

o/w accommodation revenue

53.2

60.0

-11.4%

147.9

149.6

-1.2%

maeva.com:

10.9

9.3

+17.3%

34.8

30.0

+15.9%

of which: Revenue from tourism

businesses

10.9

9.3

+17.3%

34.8

30.0

+15.9%

Major Projects & Senioriales

15.4

17.8

-13.7%

53.6

62.7

-14.6%

Corporate

0.0

0.1

-100.0%

0.6

1.1

-51.9%

Total

446.6

465.2

-4.0%

1,268.9

1,274.0

-0.4%

Revenue from tourism businesses

421.2

428.7

-1.7%

1,188.7

1,133.4

+4.9%

Accommodation revenue

322.6

339.6

-5.0%

920.0

889.7

+3.4%

Supplementary income

98.5

89.1

+10.6%

268.7

243.7

+10.3%

Other revenue

25.4

36.5

-30.4%

80.1

140.6

-43.0%

*Restated for the externalisation of the maeva.com operating

segment

Revenue from the tourism

businesses

The Group recorded Q3 2023/2024 revenue in its tourism

businesses down a slight 1.7% in a complex external backdrop,

especially in France with a combination of dismal weather, a less

advantageous year for bank holidays and long weekends, a strained

political, economic and social environment and a slowdown in

reservations ahead of the Paris 2024 Olympic Games.

Over the first nine months of the year, revenue from the Group’s

brands was up almost 5% to €1,188.7 million.

Accommodation revenue

Accommodation revenue totalled €920 million over the first

nine months of 2023/2024, up 3.4%, driven by both the increase

in average letting rates (+2%) and the number of nights sold

(+1.3%).

The occupancy rate was up by 0.2 point to 71.1% over the period

and RevPar7 increased by 2.6%.

Revenue slowed during Q3 (-5%) due to several disadvantageous

economic factors, taking a particular toll on the Center Parcs and

Adagio brands:

- Center Parcs: -5.4%

Revenue at the French Domains suffered from the partial

unavailability of cottages at Domaine des Hauts de Bruyères and

Domaine des Bois Francs in April, in line with the renovation

programme, and from shifts in holiday dates (less beneficial

positioning of bank holidays and reversal of holiday zones). In

contrast, accommodation revenue was higher for the Domains located

in BNG8.

- Adagio: -11.4%

The decline in revenue was primarily due to the aparthotels

located in Ile de France, which represented more than 50% of the

brand’s revenue in Q3. The downturn was due to both the shift in

the timing of Easter weekend, renovation works underway at certain

sites, and the tendency to avoid Paris in the run-up to the Paris

2024 Olympic Games (company travel bans, cancelled or postponed

exhibitions and events, tourist arbitrage moves in favour of other

capital cities).

In contrast, the Pierre & Vacances brand posted an

increase in accommodation revenue of 3.1%.

- Revenue from the residences in

France was down slightly (-0.9%) in view of a reduction9 in

the stock operated by lease (-2.1% of nights offered relative to Q3

of the previous year). On a constant stock basis, revenue was up

(RevPar up +1.2%). - Revenue from the residences in Spain

was up sharply (+13.5%), driven by a surge in the occupancy rate

(+8.3 points).

Supplementary income10:

Supplementary income totalled €268.7 million over the first

nine months of the year, up 10.3%.

Q3 supplementary income rose by 10.6%, driven by:

- the increase in on-site sales (+4.1% with

growth of more than 11% in catering and events), - growth in the

maeva.com businesses (+17.3%), with:

o a 20% increase in the distribution

activity, driven by the camping product, which benefited from the

relaunch of the European websites under the Vacansoleil banner, o a

9% increase in the services division, driven by the development of

activities in the maeva Home seasonal rentals agency network.

Other revenue:

Over the first nine months of the year, other revenue totalled

€80.1 million, with €25.4m in Q3 2023/2024 (compared with €36.5

million in Q3 2022/2023, although the decline had no significant

impact on EBITDA).

Other revenue in Q3 was primarily made up of:

- renovation operations at Center Parcs

Domains on behalf of owner-lessors, for €10.1 million (compared

with €18.2 million in Q3 2022/2023). - Les Senioriales for €7.1

million (vs. €13.8 million in Q3 2022/2023). Note that on 1 January

2024, the Group sold off part of the Seniorales scope (residence

lease businesses) to the ACAPACE Group. - the Major Projects

business line: €8.3 million, mainly related to the extension of

Villages Nature Paris (vs. €4 million in Q3 2022/2023).

2] Change in operational KPIs

RevPar

Average letting rates

(by night, for accommodation)

Number of nights sold

Occupancy rate

€ (excl. tax)

Chg. % N-1

€ (excl. tax)

Chg. % N-1

Units

Chg. % N-1

%

Chg. Pts N-1

Center Parcs

133.8

-5.9%

174.6

-5.2%

1,200 088

-0.2%

76.6%

-0.6 pt

Pierre & Vacances

55.8

+4.2%

89.7

+0.7%

668,510

+2.4%

68.8%

+1.8 pts

Adagio

82.6

-11.5%

116.9

-4.1%

454,687

-7.6%

71.3%

-6.0 pts

Total Q3 2023/2024 revenue

98.2

-4.9%

138.9

-4.0%

2,323 285

-1.0%

73.0%

-0.8 pt

Center Parcs

123.1

+1.5%

168.6

+2.5%

3,449 069

+1.0%

73.0%

-0.7 pt

Pierre & Vacances

70.5

+8.9%

116.4

+0.6%

1,635 421

+6.3%

68.0%

+4.5 pts

Adagio

75.9

-2.9%

107.8

+2.1%

1,371 950

-3.2%

71.0%

-3.8 pts

Total 9M 2023/2024 revenue

98.1

+2.6%

142.5

+2.0%

6,456 440

+1.3%

71.1%

+0.2 pt

3] Main events during Q3 2023/2024

As announced in the press release of 29 May 2024, the Group

obtained approval from its lending institutions to refinance its

corporate debt.

The refinancing operations were finalised on 23 July with:

(i) redemption of reinstalled debt for a principal amount of

€303 million, and the state-guaranteed loan for a principal amount

of €25 million, using the Group’s available cash, (ii)

Implementation of a revolving credit facility (RCF) for €205

million, maturing in 2029.

4] Outlook

In view of the level of reservations to date for the summer

season representing more than 80% of the target (similar to the

year-earlier level), and momentum in last-minute bookings, the

Group is forecasting accommodation revenue over the summer in line

with the year-earlier amount, which provided a demanding comparison

basis.

Strengthened by past performances and the outlook for revenue

demonstrating the Group’s resilience in a difficult context, as

well as the relevance of its brands’ local offering, the Group

confirms its full-year 2023/2024 EBITDA guidance for at least €170

million (€160 million excluding the impact of non-recurring

income), a sharp increase on the year-earlier period (€137

million).

5] Reconciliation table between revenue

stemming from operational reporting and revenue under IFRS

accounting.

Under IFRS accounting, revenue for the first nine months of

2023/2024 totalled €1,199.6 million, compared with €1,171.6m in

2022/2023, representing growth of +2.4% driven by the tourism

businesses. Growth in revenue was driven by both the rise in

average letting rates and the number of nights sold.

€ millions

2023/2024

according to operational

reporting

Restatement IFRS11

Impact IFRS16

2023/2024 IFRS

Center Parcs

778.1

-

-9.8

768.4

Pierre & Vacances

236.8

+0.1

-

236.9

Adagio

164.9

-41.1

-

123.8

maeva.com:

34.8

-

-

34.8

Major Projects & Seniorales

53.6

-9.9

-8.5

35.2

Corporate

0.6

-

-

0.6

Total 9M 2023/2024 revenue

1,268.9

-51.0

-18.2

1,199.6

€ millions

2022/2023

according to operational

reporting

Restatement IFRS11

Impact IFRS16

2022/2023 IFRS

Center Parcs

792.6

-6.4

-34.7

751.6

Pierre & Vacances

222.2

-

-

222.2

Adagio

165.3

-39.7

-

125.6

maeva.com:

30.0

-

-

30.0

Major Projects & Seniorales

62.7

-17.0

-4.8

40.9

Corporate

1.1

-

-

1.1

Total 9M 2022/2023 revenue

1,274.0

-63.0

-39.5

1,171.6

IFRS11 adjustments: for its operating reporting, the

Group continues to integrate joint operations under the

proportional integration method, considering that this presentation

is a better reflection of its performance. In contrast, joint

ventures are consolidated under equity associates in the

consolidated IFRS accounts.

Impact of IFRS16: The application of IFRS16 as of 1

October 2019 leads to the cancellation, in the financial

statements, of a share of revenue and the capital gain for

disposals undertaken under the framework of property operations

with third-parties (given the Group’s leasing contracts). See above

for the impact on nine-month revenue.

__________________________________________ 1 according to

operational reporting 2 Guidance announced in the Press Release of

29 May 2024. 3 Adjusted EBITDA = current operating profit stemming

from operational reporting (consolidated operating income before

other non-current operating income and expense, excluding the

impact of IFRS 11 and IFRS 16 accounting rules) adjusted for

provisions and depreciation and amortisation of fixed operating

assets. Adjusted EBITDA therefore includes the benefit of rental

savings generated by the Villages Nature project following the

agreements signed in December 2022 for an amount of €10.9 million

for 2023, €14.5 million for 2024, €12.4 million for 2025 and €4.0

million for 2026). 4 Recognition in the first half of the 2023/2024

financial year of additional German government aid of €10.9 million

for the Covid-19 pandemic. 5 See page 186 of the Universal

Registration Document, filed with the AMF on 21 December 2023 and

available on the Group’s website: www.groupepvcp.com 6 The Group

has externalised the maeva.com operating segment in order to

improve the readability of the performance of this business line

and has consequently restated the historical comparative

information presented in this press release. 7 RevPar

=accommodation revenue divided by the number of nights offered 8

Belgium, the Netherlands, Germany 9 Decrease in inventory due to

non-renewal of leases 10 Revenue from on-site activities (catering,

events, stores, services etc.), co-ownership and multi-owner fees

and management mandates, marketing margins and revenue generated by

the maeva.com business line.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240723012591/en/

For further information:

Investor Relations and Strategic Operations Emeline

Lauté: +33 1 58 21 88 76 info.fin@groupepvcp.com

Press Relations Valérie Lauthier: +33 1 58 21 54 61

valerie.lauthier@groupepvcp.com

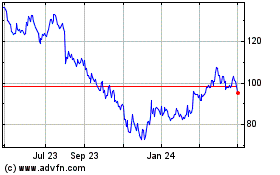

Marriott Vacations World... (NYSE:VAC)

Historical Stock Chart

From Nov 2024 to Dec 2024

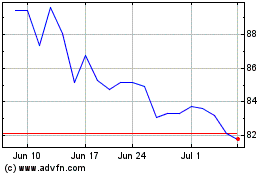

Marriott Vacations World... (NYSE:VAC)

Historical Stock Chart

From Dec 2023 to Dec 2024