false

0001980088

0001980088

2024-08-26

2024-08-26

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d)

OF

THE SECURITIES EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported): August 26, 2024

Mach Natural Resources LP

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-41849 |

|

93-1757616 |

(State

or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer

Identification No.) |

| 14201 Wireless Way, Suite 300, Oklahoma City, Oklahoma |

|

73134 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

(405)

252-8100

Registrant’s

telephone number, including area code

Not

applicable.

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common units representing limited partner interests |

|

MNR |

|

New York Stock Exchange |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Acts.

Item

1.01. Entry into a Material Definitive Agreement.

On

August 26, 2024, Mach Natural Resources LP (the “Company”) entered into (i) the first amendment (the “First Term Loan

Amendment”) to the senior secured term loan credit agreement, dated as of December 28, 2023 (the “Term Loan Credit Agreement”),

among the Company, the guarantors party thereto, the lenders party thereto, Texas Capital Bank, as the administrative agent, and Chambers

Energy Management, LP, as the loan commitment arranger, and (ii) the first amendment (the “First RCA Amendment”) to the senior

secured revolving credit agreement, dated as of December 28, 2023 (the “Revolving Credit Agreement”), among the Company,

the guarantors party thereto, the lenders party thereto and MidFirst Bank, as the administrative agent.

The

First Term Loan Amendment amends the Term Loan Credit Agreement to, among other things, provide for commitments from the lenders party

to the First Term Loan Amendment to make up to an aggregate amount of $75 million in Additional Loans (as defined in the First Term Loan

Amendment).

The

First RCA Amendment amends the Revolving Credit Agreement to, among other things, permit the Company to incur the Additional Loans and

modify certain definitions relating to the Company’s hedging arrangements. The First RCA Amendment also reaffirms the Company’s

borrowing base at $75 million.

The

foregoing descriptions of the First Term Loan Amendment and the First RCA Amendment are summaries only, do not purport to be complete,

and are qualified in their entirety by reference to the full text of each agreement, which are filed herewith as Exhibit 10.1 and Exhibit

10.2 to this Current Report on Form 8-K (this “Report”) and incorporated herein by reference.

Item

2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The

information set forth in Item 1.01 of this Report is incorporated by reference into this Item 2.03.

Item

9.01. Financial Statements and Exhibits.

(d)

Exhibits.

| Exhibit

No. |

|

Description |

| 10.1† |

|

First Amendment to Term Loan Credit Agreement, dated August 26, 2024, among Mach Natural Resources LP, the guarantors party thereto, the lenders party thereto, Texas Capital Bank, as the administrative agent, and Chambers Energy Management, LP, as the loan commitment arranger. |

| 10.2 |

|

First Amendment to Revolving Credit Agreement, dated August 26, 2024, among Mach Natural Resources LP, the guarantors party thereto, the lenders party thereto and MidFirst Bank, as the administrative agent. |

| 104 |

|

Cover

Page Interactive Data File (formatted as Inline XBRL). |

†

Certain of the schedules and exhibits to the agreement have been omitted pursuant to Item 601(a)(5) of Regulation S-K. A copy of any

omitted schedule or exhibit will be furnished to the SEC upon request.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

Mach Natural Resources LP |

| |

|

| |

By: |

Mach Natural Resources GP LLC, |

| |

|

its general partner |

| |

|

| Dated: August 30, 2024 |

By: |

/s/

Tom L. Ward |

| |

|

Name: |

Tom

L. Ward |

| |

|

Title: |

Chief Executive Officer |

2

Exhibit

10.1

FIRST

Amendment TO

CREDIT AGREEMENT

This

FIRST AMENDMENT TO CREDIT AGREEMENT (this “Amendment”), dated as of August 26, 2024, is by and among MACH NATURAL

RESOURCES LP, a Delaware limited partnership (“Borrower”), the Guarantors party hereto, the several banks and

other financial institutions or entities party to this Agreement (the “Lenders”), and TEXAS CAPITAL BANK, as

the administrative and collateral agent (in such capacity, the “Agent”) and CHAMBERS ENERGY MANAGEMENT, LP

as loan commitment arranger (in such capacity, the “Arranger”).

WHEREAS,

Borrower, the Lenders party thereto and the Agent are parties to that certain Credit Agreement, dated as of December 28, 2023 (as may

be further amended, restated or otherwise modified from time to time, the “Credit Agreement”);

WHEREAS,

Borrower has requested, and certain of the Lenders party hereto (such Lenders, the “First Amendment Lenders”)

have agreed, subject to the terms and on the conditions hereof, to severally provide commitments up to an aggregate amount of $75,000,000

in Additional Loans (as defined below) under the Credit Agreement to partially fund the Chief Acquisition (as defined below);

WHEREAS,

the Lenders party hereto, constituting the “Required Lenders” under the Credit Agreement, hereby consent and agree in accordance

with Section 9.1 of the Credit Agreement to the amendments to the Credit Agreement described below;

NOW,

THEREFORE, in consideration of the foregoing recitals, the mutual covenants and agreements set forth herein and other good and valuable

consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto hereby agree as follows:

1. Defined

Terms. Capitalized terms used but not defined in this Amendment shall have the meanings ascribed to such terms in the Credit Agreement.

The principles of interpretation set forth in Section 1.2 of the Credit Agreement shall apply to the provisions of this Amendment.

2. Additional

Loans.

(a) Subject

to the terms and conditions set forth herein, each of the First Amendment Lenders severally agrees to make additional loans (“Additional

Loans”) under the Credit Agreement in an aggregate principal amount equal to that amount set forth opposite such Lender’s

name in Schedule 1.1(a) attached hereto (the “First Amendment Commitments”);

(b) The

First Amendment Commitments shall be effective on and from the First Amendment Effective Date (as defined below) to the earliest of (i)

the occurrence of any Event of Default, (ii) the funding of such Additional Loans, (iii) close of business on September 30, 2024 and

(iv) the termination of the Chief Acquisition Agreement (as defined below);

(c) The

Additional Loans shall be funded in full, and not in part, in a single draw on the First Amendment Funding Date (as defined below);

(d) Each

Additional Loan shall be funded to Borrower net of an amount equal to 1.50% of the aggregate principal amount of the First Amendment

Commitments on the First Amendment Funding Date, which amount may be taken in the form of original issue discount or upfront fees in

such proportion as each First Amendment Lender may elect in writing;

(e) Additional

Loans, once funded, shall constitute, and be treated as the same tranche and class, and with the same voting rights, as the Existing

Loans (as defined below). Prior to the First Amendment Funding Date, the Lenders advanced $825,000,000 in an aggregate principal amount

of loans to Borrower pursuant to the Credit Agreement. As of the date immediately prior to the First Amendment Funding Date, the aggregate

principal amount of Loans outstanding is $804,375,000 (the “Existing Loans”; and together with the Additional

Loans, “Loans”);

(f) The

Additional Loans shall bear interest at the Interest Rate using the same Term SOFR for purposes of calculation as the then prevailing

Interest Rate for the Existing Loans, regardless of the date on which they are funded; and

(g) The

proceeds of the Additional Loans shall be used (a) to partially fund the Chief Acquisition, (b) to pay fees and expenses associated with

this Amendment and (c) for general corporate purposes of the Loan Parties (but excluding any distribution on Capital Stock of Borrower).

3. Amendments

to Credit Agreement. In reliance on the representations and warranties set forth in Section 4 below and subject to the

satisfaction of the conditions set forth in Section 5 below, each of the Borrower, the Agent and the undersigned Lenders,

constituting “Required Lenders” for purposes of the Credit Agreement, agree to the following amendments, each to be

effective as of the First Amendment Effective Date:

(a) Schedule

1.1(a) to the Credit Agreement is hereby amended to include Schedule 1.1(a) attached hereto;

(b) Section

1.1 of the Credit Agreement is hereby amended and restated by amending and restating the defined term “Loans” in its entirety

as follows:

“Aggregate

Exposure” means with respect to any Lender at any time after the Closing Date, the sum of such Lender’s Commitment

at such time and the aggregate then unpaid principal amount of such Lender’s Loans.

“Loans”

means the Loans outstanding under the Credit Agreement immediately prior to the effectiveness of the First Amendment together with the

Additional Loans advanced, if any, pursuant to the First Amendment.

(c) Section

1.1 of the Credit Agreement is hereby amended by adding the following defined terms in appropriate alphabetical order as follows:

“Additional

Loans” shall have the meaning ascribed to it in the First Amendment.

“First

Amendment” means that certain First Amendment to Credit Agreement dated as of August 26, 2024 by and among Borrower, the

Guarantors the Lenders party thereto, and the Agent.

(d) Section

2.1(a) of the Credit Agreement is hereby amended as applicable to provide for the actions described in Section 2 above; and

(e) Section

2.7(a) of the Credit Agreement is hereby amended and restated in its entirety as follows:

(a) Beginning

with the Interest Period ending June 30, 2024, on each March 31, June 30, September 30 and December 31 of each year (or if any such date

is not a Business Day, such payment date shall be the preceding Business Day), Borrower shall repay (at par and without premium, including

the Applicable Premium, or penalty) the Loans in quarterly installments each equal to 2.50% of the sum of (i) the aggregate original

principal amount of the Loans advanced as of the Closing Date (without giving effect to any reduction of the amount funded in respect

of the OID Amount), and (ii) the aggregate principal amount of the Additional Loans funded pursuant to the First Amendment (without giving

effect to any reduction of the amount funded in respect of Section 2(d) of the First Amendment). The quarterly installment payments associated

with Additional Loans shall be made beginning December 31, 2024. For clarity, no mandatory prepayment pursuant to this Section 2.7 or

otherwise shall offset or reduce the amount payable under this Section 2.7(a).

4. Representations

and Warranties of Borrower. Borrower represents and warrants as of the date hereof and on the First Amendment Funding Date to the

Agent and each Lender that:

(a) Each

of the Loan Parties (i) has the corporate, company or partnership power and authority, as applicable, and the legal right, to make, deliver

and perform this Amendment and (ii) has taken all necessary corporate or other action to authorize the execution, delivery and performance

of this Amendment;

(b) No

consent or authorization of, filing with, notice to or other act by or in respect of, any Governmental Authority or any other Person

is required to be obtained by Borrower in connection with the execution, delivery, performance, validity or enforceability of this Amendment;

(c) This

Amendment (i) has been duly executed and delivered on behalf of Borrower and (ii) constitutes a legal, valid and binding obligation of

Borrower, enforceable against Borrower in accordance with its terms, except as enforceability may be limited by applicable bankruptcy,

insolvency, reorganization, moratorium or similar laws affecting the enforcement of creditors’ rights generally and by general

equitable principles (whether enforcement is sought by proceedings in equity or at law);

(d) The

execution, delivery and performance of this Amendment, the borrowings under the Credit Agreement in connection herewith, and the use

of the proceeds thereof shall not result in a violation by Borrower of any Requirement of Law or any Contractual Obligation of Borrower

and shall not result in, or require, the creation or imposition of any Lien on any of its Properties or revenues pursuant to any Requirement

of Law or any such Contractual Obligation (other than the Liens created by the Security Documents);

(e) After

giving effect to the amendments set forth herein, the representations and warranties of Borrower contained in the Loan Documents are

true and accurate in all material respects as of the date hereof with the same force and effect as if such had been made on and as of

the date hereof, except for such representations and warranties (i) made as of an earlier date, in which case such representations and

warranties are true and correct in all material respects as of such earlier date or (ii) qualified by materiality, in which case such

representations and warranties are true in all respects;

(f) Each

of the Loan Parties are in compliance in all material respects with all terms and provisions set forth in the Loan Documents to which

it is a party; and

(g) No

Default or Event of Default has occurred and is continuing.

5. Conditions

Precedent to Effectiveness. The effectiveness of this Amendment is subject to the satisfaction of the following conditions precedent

the date on which all such conditions have been satisfied or waived, the “First

Amendment Effective Date”):

(a) The

Agent and the Arranger shall have received this Amendment duly executed and delivered by a Responsible Officer of each of the Loan Parties;

(b) The

Agent and the Arranger shall have received the First Amendment Fee Letter duly executed by a Responsible Officer of the Borrower;

(c) The

Agent shall have received the following:

(i) a

copy of each amendment to the operating agreement, partnership agreement, bylaws, company agreement or other governing agreement of each

Loan Party, if any, executed after the date of the Credit Agreement, certified (as of a date reasonably near the date of the extension

of credit) as being a true and correct copy thereof by a Responsible Officer of such Loan Party (or certifying as to no amendments since

last delivered to the Agent and the Arranger on the Closing Date);

(ii) a

copy, certified by the Secretary of State or other applicable Governmental Authority of the jurisdiction in which such Loan Party is

organized of each amendment to any charter of such Loan Party filed, if any, after the date of the Credit Agreement, and certifying that

such amendments are the only amendments to such Loan Party’s charter on file in such office;

(iii)

an electronic confirmation from the Secretary of State or other applicable Governmental Authority of each jurisdiction in which each

such Loan Party is organized certifying that such Loan Party has paid all franchise taxes to the date of such certification and is duly

organized and in good standing under the laws of such jurisdiction on the date hereof, prepared by, or on behalf of, a filing service

acceptable to Arranger;

(iv)

a copy of a certificate of the Secretary of State or other applicable Governmental Authority of the States of Oklahoma, Texas and Kansas,

dated reasonably near the date of the extension of credit, stating that each Loan Party is duly qualified and in good standing as a foreign

corporation or entity in each such jurisdiction and has filed all annual reports required to be filed to the date of such certificate;

and electronic confirmation, from the Secretary of State or other applicable Governmental Authority of each such jurisdiction on the

date hereof as to the due qualification and continued good standing of each such Person as a foreign corporation or entity in each such

jurisdiction on or about such date, prepared by, or on behalf of, a filing service acceptable to Arranger;

(v) true,

correct and complete copies of the resolutions duly adopted by the Board of Directors of each Loan Party authorizing each Loan Party

to enter into the Amendment and the other Loan Documents and to execute, deliver and perform such Loan Party’s obligations thereunder

together with a certification that such resolutions have not been amended, modified, or revoked and are in full force and effect as of

the First Amendment Effective Date; and

(vi) certification

as to the incumbency and specimen signature of each officer or director executing any Loan Document or any other document delivered in

connection herewith on behalf of such Person by a Responsible Officer of such Loan Party (or certifying as to no change since last delivered

to the Agent and the Arranger on the Closing Date).

(d) Since

the Closing Date, no Material Adverse Effect shall have occurred and be continuing;

(e) After

giving effect to the amendments set forth herein, the representations and warranties of Borrower contained in the Loan Documents are

true and accurate in all material respects as of the date hereof with the same force and effect as if such had been made on and as of

the date hereof;

(f) After

giving effect to the amendments set forth herein, no Default or Event of Default shall have occurred and be continuing on the date hereof

or shall occur as a result hereof;

(g) Agent

shall have received the executed legal opinion of Kirkland & Ellis LLP, counsel to the Loan Parties, with respect to such matters

as may be reasonably requested by Arranger, and in form and substance reasonably satisfactory to Arranger;

(h) Borrower

shall have paid, or caused to be paid, the outstanding fees and expenses of Latham & Watkins LLP, counsel for the Arranger; and

(i) The

Agent shall have received copies of each of:

(x)

a draft Purchase and Sale Agreement (the “Crescent PSA”) to be executed

by Crescent Gladiator LLC (“Crescent”), as purchaser, and the seller party thereto, in connection with the

Chief Acquisition, which draft the parties hereto acknowledge and agree was delivered to counsel to the Arranger on August 25, 2024 (the

“Approved Draft PSA”); and

(y)

that certain Acquisition and Cooperation Agreement, dated August 23, 2024, between Mach Natural

Resources LP (“Mach”) and Crescent (such agreement, together with the Crescent PSA, the “Chief

Acquisition Agreements”).

6.

Conditions Precedent to Funding. The satisfaction of each of the following shall constitute conditions precedent to the funding

of the Additional Loans:

(a) The

occurrence of the First Amendment Effective Date;

(b) The

Agent and First Amendment Lenders shall have received a Borrowing Notice at least five Business Days (or such shorter time as agreed

by the Arranger) prior to the anticipated borrowing date (the “First Amendment Funding Date”);

(c) The

Agent shall have received a certificate of a Responsible Party of each Loan Party, dated of even date herewith, in substantially the

form of Exhibit A hereto;

(d) The

Agent shall have received a Solvency Certificate certifying the solvency of Borrower and its Subsidiaries after giving effect to the

transactions contemplated hereby and the consummation of the Chief Acquisition;

(e) Each

of the parties thereto shall have executed the Crescent PSA, in form and substance substantially the same as the Approved Draft PSA,

for purchase by Crescent of the Assets (as defined in the Crescent PSA) (the acquisitions contemplated in the Chief Acquisition Agreements,

together the “Chief Acquisition”)

(f) The

Agent shall have received (as contemplated by Exhibit A hereto) true, correct and complete executed copies of each of the Chief

Acquisition Agreements together with all schedules, exhibits, annexes and amendments thereto and all side letters and agreements affecting

the terms thereof or entered into in connection therewith, executed, made or delivered by any Person in connection with the Chief Acquisition

(together, the “Chief Acquisition Documents”);

(g) The

Chief Acquisition shall have closed prior to or substantially concurrently with the funding of the Additional Loans in accordance with

the terms of the Chief Acquisition Documents;

(h) The

Agent shall have received evidence satisfactory to Arranger that concurrently with the advancement of the Additional Loans hereunder

arrangements satisfactory to Arranger shall have been made for the termination of any Liens and security interests (other than Permitted

Liens) encumbering the Assets (as defined in the Chief Acquisition Agreements);

(i) The

Lenders and the Agent shall have received all fees required to be paid under any Loan Document or other written agreement (including,

for the avoidance of doubt, the First Amendment Fee Letter); and

(j) No

Default or Event of Default has occurred and is continuing.

7. Loan

Documents.

(a) This

Amendment shall constitute a Loan Document, as such term is defined in the Credit Agreement, and the Credit Agreement shall constitute

such agreement as amended by this Amendment;

(b) This

Amendment is not intended to nor shall it be construed to create a novation or accord and satisfaction with respect to any of the Obligations;

and

(c) Each

Loan Party hereby reaffirms its respective obligations under each of the Loan Documents, as the same are amended hereby, and agrees and

acknowledges that each such Loan Document, and all of such obligations thereunder, remains in full force and effect after giving effect

to this Amendment.

8.

Counterparts. This Amendment may be executed by

one or more parties to this Agreement on any number of separate counterparts, and all of said counterparts taken together shall be

deemed to constitute one and the same instrument. Delivery of an executed signature page of this Amendment by electronic

transmission (including via e-mail in portable document format (.pdf) or facsimile transmission) shall be effective as delivery of a

manually executed counterpart hereof. A set of the copies of this Amendment signed by all the parties shall be lodged with Borrower

and the Agent.

9. Severability.

Any provision of this Amendment that is prohibited or unenforceable in any jurisdiction shall, as to such jurisdiction, be

ineffective to the extent of such prohibition or unenforceability without invalidating the remaining provisions hereof, and any such

prohibition or unenforceability in any jurisdiction shall not invalidate or render unenforceable such provision in any other

jurisdiction.

10.

Integration. This Amendment and the other Loan Documents

represent the entire agreement of the Loan Parties, the Agent, the Arranger and the Lenders with respect to the subject matter hereof

and thereof, and there are no promises, undertakings, representations or warranties by the Arranger, any Agent or any Lender relative

to subject matter hereof not expressly set forth or referred to herein or in the other Loan Documents.

11. GOVERNING

LAW. THIS AMENDMENT AND THE RIGHTS AND OBLIGATIONS OF THE PARTIES UNDER THIS AMENDMENT SHALL BE GOVERNED BY, AND

CONSTRUED AND INTERPRETED IN ACCORDANCE WITH, THE LAW OF THE STATE OF NEW YORK.

12.

Survival. The representations and warranties contained in Section 4 of this Amendment shall survive the execution and delivery

of this Amendment and the First Amendment Funding Date.

13.

Ratification; No Other Amendments; No Waiver.

(a) Except

as expressly modified hereby, the Credit Agreement and each other Loan Document are each hereby ratified and confirmed by the parties

hereto and remain in full force and effect in accordance with the respective terms thereof. Other than as otherwise expressly provided

herein, this Amendment shall not be deemed to operate as an amendment or waiver of, or to prejudice, any right, power, privilege or remedy

of any Lender, any Agent or any other Indemnitee under the Agreement or any of the other Loan Documents, nor shall the entering into

of this Amendment preclude any such Person from refusing to enter into any further amendments with respect to the Agreement or any of

the other Loan Documents. Other than as to otherwise expressly provided herein, this Amendment shall not constitute a waiver of compliance

with any covenant or other provision in the Agreement or any other Loan Document or of the occurrence or continuance of any present or

future Default or Event of Default.

(b) To

induce the Lenders and the Agent to enter into this Amendment, each Loan Party hereby acknowledges and reaffirms its obligations under

each Loan Document to which it is a party, including, without limitation, any grant, pledge or collateral assignment of a lien or security

interest, as applicable, contained therein and any guarantee provided by it therein, in each case as amended, restated, amended and restated,

supplemented or otherwise modified prior to or as of the date hereof (including as amended pursuant to this Amendment), and without limiting

the foregoing, acknowledges and agrees that each of the Loan Documents to which it is a party or otherwise bound shall continue in full

force and effect and that all of its obligations thereunder shall not be impaired or limited by the execution or effectiveness of this

Amendment

14.

Costs; Expenses. Subject to and in accordance with Section 9.5 of the Credit Agreement, regardless of whether the transactions

contemplated by this Amendment are consummated, Borrower agrees to pay on demand all reasonable out-of-pocket costs and expenses of the

Agent and the Arranger incurred in connection with the development, preparation, execution and delivery of this Amendment, including

the reasonable fees and disbursements and other charges of counsel and consultants to the Agent and the Arranger.

15.

Headings. The section headings contained in this Amendment are inserted for convenience only and shall not affect in any way the

meaning or interpretation of this Amendment.

16.

Amendments. This Amendment may not be amended or modified except in the manner specified for an amendment of or modification to

the Credit Agreement in Section 9.1 of the Credit Agreement.

[Signature

Page to Follow]

IN

WITNESS WHEREOF, the parties hereto have caused this Amendment to be duly executed under seal and delivered by their respective duly

authorized officers on the date first written above.

| |

BORROWER: |

| |

|

| |

MACH NATURAL RESOURCES LP, |

| |

|

| |

By: |

Mach Natural Resources GP, LLC, |

| |

|

its general partner |

| |

|

|

|

| |

By: |

/s/ Kevin White |

| |

|

Name: |

Kevin White |

| |

|

Title: |

Chief Financial Officer |

| |

|

|

|

| |

LOAN PARTIES: |

| |

|

|

|

| |

MACH NATURAL RESOURCES LP, |

| |

as a Loan Party |

| |

|

|

|

| |

By: |

/s/ Kevin White |

| |

|

Name: |

Kevin White |

| |

|

Title: |

Chief Financial Officer |

| |

|

|

|

| |

MACH NATURAL RESOURCES INTERMEDIATE LLC, |

| |

as a Loan Party |

| |

|

|

|

| |

By: |

/s/ Kevin White |

| |

|

Name: |

Kevin White |

| |

|

Title: |

Chief Financial Officer |

| |

|

|

|

| |

MACH NATURAL RESOURCES HOLDCO LLC, |

| |

as a Loan Party |

| |

|

|

|

| |

By: |

/s/ Kevin White |

| |

|

Name: |

Kevin White |

| |

|

Title: |

Chief Financial Officer |

[Signature Page to First Amendment to Credit Agreement]

| |

BCE-MACH LLC, as a Loan Party |

| |

|

|

|

| |

By: |

/s/ Kevin White |

| |

|

Name: |

Kevin White |

| |

|

Title: |

Chief Financial Officer |

| |

|

|

|

| |

BCE-MACH II LLC, as a Loan Party |

| |

|

|

|

| |

By: |

/s/ Kevin White |

| |

|

Name: |

Kevin White |

| |

|

Title: |

Chief Financial Officer |

| |

|

|

|

| |

BCE-MACH III LLC, as a Loan Party |

| |

|

|

|

| |

By: |

/s/ Kevin White |

| |

|

Name: |

Kevin White |

| |

|

Title: |

Chief Financial Officer |

| |

|

|

|

| |

BCE-MACH III MIDSTREAM HOLDINGS LLC, as a Loan Party |

| |

|

|

|

| |

By: |

/s/ Kevin White |

| |

|

Name: |

Kevin White |

| |

|

Title: |

Chief Financial Officer |

| |

|

|

|

| |

MACH NATURAL RESOURCES GP LLC, as a Loan Party |

| |

|

|

|

| |

By: |

/s/ Kevin White |

| |

|

Name: |

Kevin White |

| |

|

Title: |

Chief Financial Officer |

[Signature Page to First Amendment to Credit Agreement]

| |

CHAMBERS ENERGY MANAGEMENT, LP.,

as Arranger |

| |

|

|

| |

By: |

/s/ J. Robert Chambers |

| |

|

J. Robert Chambers |

| |

|

President and Chief Executive Officer |

[Signature Page to First Amendment to Credit Agreement]

| |

TEXAS CAPITAL BANK, |

| |

as Administrative Agent |

| |

|

|

|

| |

By: |

/s/ Jared R. Mills |

| |

|

Name: |

Jared R. Mills |

| |

|

Title: |

Managing Director |

[Signature Page to First Amendment to Credit Agreement]

| |

Chambers Energy Capital IV, LP, |

| |

as a First Amendment Lender |

| |

|

|

|

| |

By: |

CEC Fund IV GP, LLC, its general partner |

| |

|

|

|

| |

By: |

/s/ J. Robert Chambers |

| |

|

Name: |

J. Robert Chambers |

| |

|

Title: |

Partner |

| |

|

|

|

| |

Chambers Energy Capital V, LP, |

| |

as a First Amendment Lender |

| |

|

|

|

| |

By: |

CEC Fund V GP, LLC, its general partner |

| |

|

|

|

| |

By: |

/s/ J. Robert Chambers |

| |

|

Name: |

J. Robert Chambers |

| |

|

Title: |

Partner |

[Signature Page to First Amendment to Credit Agreement]

| |

Sixth Street

Lending Partners, |

| |

as a Lender |

| |

|

|

|

| |

By: |

/s/

Joshua Easterly |

| |

|

Name: |

Joshua Easterly |

| |

|

Title: |

Chief Executive Officer |

| |

|

|

|

| |

Sixth Street

Specialty Lending, Inc., |

| |

as a Lender |

| |

|

|

|

| |

By: |

/s/

Joshua Easterly |

| |

|

Name : |

Joshua Easterly |

| |

|

Title: |

Chief Executive Officer |

[Signature Page to First Amendment to Credit Agreement]

|

BTC HOLDINGS

FUND III-B LLC |

| |

|

|

By: |

Blue Torch Credit Opportunities Fund III

LP, its Sole Member |

|

By: |

Blue Torch Credit Opportunities GP III

LLC, its General Partner |

|

By: |

KPG BTC Management LLC, its sole member |

| |

|

|

|

| |

By: |

/s/ Kevin Genda |

| |

|

Name: |

Kevin Genda |

| |

|

Title: |

Managing Member |

| |

|

|

|

|

BTC HOLDINGS

FUND III LLC |

| |

|

|

By: |

Blue Torch Credit

Opportunities Fund III LP, its Sole Member |

|

By: |

Blue Torch Credit

Opportunities GP III LLC, its General Partner |

|

By: |

KPG BTC Management

LLC, its sole member |

| |

|

|

|

| |

By: |

/s/ Kevin Genda |

| |

|

Name: |

Kevin Genda |

| |

|

Title: |

Managing Member |

| |

|

|

|

|

BTC HOLDINGS

KRS FUND LLC |

| |

|

|

By: |

Blue Torch Credit Opportunities KRS Fund

LP, its Sole Member |

|

By: |

Blue Torch Credit Opportunities KRS GP

LLC, its General Partner |

|

By: |

KPG BTC Management LLC, its sole member |

| |

|

|

|

| |

By: |

/s/ Kevin Genda |

| |

|

Name: |

Kevin Genda |

| |

|

Title: |

Managing Member |

| |

|

|

|

|

BTC Offshore

HOLDINGS FUND III LLC |

| |

|

|

By: |

Blue Torch Offshore Credit Opportunities

Master Fund III LP, its Sole Member |

|

By: |

Blue Torch Offshore Credit Opportunities

GP III LLC, its General Partner |

|

By: |

KPG BTC Management LLC, its managing member |

| |

|

|

|

| |

By: |

/s/ Kevin Genda |

| |

|

Name: |

Kevin Genda |

| |

|

Title: |

Managing Member |

[Signature Page to First Amendment to Credit Agreement]

| |

BTC Offshore

HOLDINGS FUND III-B LLC |

| |

|

| |

By: |

Blue Torch Offshore Credit Opportunities

Master Fund III LP, its Sole Member |

| |

By: |

Blue Torch Offshore Credit Opportunities

GP III LLC, its General Partner |

| |

By: |

KPG BTC Management LLC, its managing member |

| |

|

|

|

| |

By: |

/s/ Kevin Genda |

| |

|

Name: |

Kevin Genda |

| |

|

Title: |

Managing Member |

| |

|

|

|

| |

BTC Offshore

HOLDINGS FUND III-D LLC |

| |

|

| |

By: |

Blue Torch Offshore Credit Opportunities

Master Fund III LP, its Sole Member |

| |

By: |

Blue Torch Offshore Credit Opportunities

GP III LLC, its General Partner |

| |

By: |

KPG BTC Management LLC, its managing member |

| |

|

|

|

| |

By: |

/s/ Kevin Genda |

| |

|

Name: |

Kevin Genda |

| |

|

Title: |

Managing Member |

| |

|

|

|

| |

BTC Holdings

SBAF Fund-B LLC |

| |

|

| |

By: |

Blue Torch Credit Opportunities SBAF Fund

LP, its Sole Member |

| |

By: |

Blue Torch Credit Opportunities SBAF GP

LLC, its General Partner |

| |

By: |

KPG BTC Management LLC, its sole member |

| |

|

|

|

| |

By: |

/s/ Kevin Genda |

| |

|

Name: |

Kevin Genda |

| |

|

Title: |

Managing Member |

| |

|

|

|

| |

BTC Holdings

SBAF Fund LLC |

| |

|

| |

By: |

Blue Torch Credit Opportunities SBAF Fund

LP, its Sole Member |

| |

By: |

Blue Torch Credit Opportunities SBAF GP

LLC, its General Partner |

| |

By: |

KPG BTC Management LLC, its sole member |

| |

|

|

|

| |

By: |

/s/ Kevin Genda |

| |

|

Name: |

Kevin Genda |

| |

|

Title: |

Managing Member |

[Signature Page to First Amendment to Credit Agreement]

| |

BTC Holdings

SC Fund LLC |

| |

|

| |

By: |

Blue Torch Credit Opportunities SC Master

Fund LP, its Sole Member |

| |

By: |

Blue Torch Credit Opportunities SC GP LLC,

its General Partner |

| |

By: |

KPG BTC Management LLC, its sole member |

| |

|

|

|

| |

By: |

/s/ Kevin Genda |

| |

|

Name: |

Kevin Genda |

| |

|

Title: |

Managing Member |

| |

|

|

|

| |

Blue torch

Credit Opportunities unlevered fund III LP |

| |

|

| |

By: |

Blue Torch Credit Opportunities GP III

LLC, its General Partner |

| |

By: |

KPG BTC Management LLC, its managing member |

| |

|

|

|

| |

By: |

/s/ Kevin Genda |

| |

|

Name: |

Kevin Genda |

| |

|

Title: |

Managing Member |

[Signature Page to First Amendment to Credit Agreement]

| |

Perilla S.A.R.L, |

| |

as a First Amendment Lender |

| |

|

|

|

| |

By: |

/s/ Jean-François Bouchoms |

| |

|

Name: |

Jean-François Bouchoms |

| |

|

Title: |

Manager & attorney-in-fact of the board of managers |

[Signature Page to First Amendment to Credit Agreement]

| |

Mercuria

Investments US, Inc., |

| |

as a First Amendment Lender |

| |

|

|

|

| |

By: |

/s/ Brian Falik |

| |

|

Name: |

Brian Falik |

| |

|

Title: |

President |

[Signature Page to First Amendment to Credit Agreement]

| |

Macquarie

Bank Limited, |

| |

as a First Amendment Lender |

| |

|

|

|

| |

By: |

/s/ Robert Trevena |

| |

|

Name: |

Robert Trevena |

| |

|

Title: |

Division Director |

| |

|

|

|

| |

By: |

/s/ Alexandra Schnuir |

| |

|

Name: |

Alexandra Schnuir |

| |

|

Title: |

Associate Director |

[Signature Page to First Amendment to Credit Agreement]

| |

Highvista

Opportunistic Private Credit Fund II LP, |

| |

as a First Amendment Lender |

| |

|

|

|

| |

By: |

HighVista GP VI LP, its general partner |

| |

By: |

HighVista GP LLC, its general partner |

| |

|

|

|

| |

By: |

/s/ Raphael Schorr |

| |

|

Name: |

Raphael Schorr |

| |

|

Title: |

Manager |

[Signature Page to First Amendment to Credit Agreement]

| |

EOC Partners

Fund - G LP, |

| |

as a Lender |

| |

|

|

|

| |

By: |

/s/ Nicholas Fersen |

| |

|

Name: |

Nicholas Fersen |

| |

|

Title: |

Managing Partner |

| |

|

|

|

| |

EOC Partners

Fund - C LP, |

| |

as a Lender |

| |

|

|

|

| |

By: |

/s/ Nicholas Fersen |

| |

|

Name: |

Nicholas Fersen |

| |

|

Title: |

Managing Partner |

| |

|

|

|

| |

EOC Partners

Co-Invest Fund, d LP, |

| |

as a Lender |

| |

|

|

|

| |

By: |

/s/ Nicholas Fersen |

| |

|

Name: |

Nicholas Fersen |

| |

|

Title: |

Managing Partner |

[Signature Page to First Amendment to Credit Agreement]

Exhibit 10.2

FIRST AMENDMENT TO CREDIT AGREEMENT

THIS FIRST AMENDMENT TO CREDIT

AGREEMENT (this “Amendment”), is made effective as of August 26, 2024 (the “Effective Date”),

among MACH NATURAL RESOURCES LP, a Delaware limited partnership (“Borrower”), the Loan Parties party

hereto, the several banks and other financial institutions or entities party hereto as lenders (the “Lenders”),

MIDFIRST BANK, a federally chartered savings association, as administrative agent for the Lenders (in such capacities, the “Agent”)

and L/C Issuer, and amends the Credit Agreement dated as of December 28, 2023 among the Borrower, the Lenders, and the Agent (as amended,

restated or otherwise modified from time to time, the “Credit Agreement”).

The parties to this Amendment

agree as follows:

1. Defined

Terms. Capitalized terms used but not defined in this Amendment have the meanings provided in the Credit Agreement.

2. Amendments

to Credit Agreement. The Credit Agreement is amended as follows:

(a) The

definitions of “Qualified Counterparty” and “Qualified Hedging Agreement”, respectively,

are amended and restated in their entirety as follows:

“Qualified Counterparty”

means with respect to any Hedging Agreement, each Person party to the Collateral Agency Agreement that is either (a) on the date that

such Person enters into the related Hedging Agreement, the agent or any lender under this Agreement or any of their respective Affiliates,

(b) each of Macquarie Bank Limited, Mercuria Energy America, LLC and each of their respective Affiliates, (c) an Existing Hedge Party,

but solely with respect to the Hedging Agreements in effect on the Closing Date, or (d) any other Person approved from time to time by

the Agent.

“Qualified Hedging Agreement”

means a Hedging Agreement entered into by Borrower or any Guarantor and any Qualified Counterparty.

(b) The

references to the dollar amount “$825,000,000” in Section 6.2(b) and Section 9.1(a)(vii) of the Credit Agreement

are each amended to refer to “$880,000,000.”

3. Redetermination

of Borrowing Base. As of the Effective Date, the amount of the Borrowing Base is reaffirmed at $75,000,000.00, which Borrowing Base

will remain in effect until otherwise redetermined in accordance with the Credit Agreement.

4. Effect

of this Amendment. This Amendment is not, and should not be deemed to be, a waiver of, amendment to, consent to or modification of

any other term or provision of the Loan Documents, or of any event, condition, or transaction on the part of any Loan Party or any other

Person, in each case except as specifically set forth in this Amendment.

5. Conditions.

This Amendment (other than Section 10 below, which is effective immediately upon execution and delivery) will be effective as of

the Effective Date, but only upon satisfaction of the following conditions precedent:

(a) The

Agent’s receipt of original or facsimile or portable document format (PDF) copies (followed promptly by originals) of each of the

following, each properly executed, each dated as of the Effective Date (or, in the case of certificates of governmental officials, a recent

date before the date of the Amendment) and each in form and substance satisfactory to Agent and its legal counsel:

(i) this

Amendment;

(ii) certificates

of resolutions or other action, incumbency certificates and/or other certificate(s) signed by an officer of any Loan Party that is other

than a natural person, as required by the Agent, to evidence the identity, authority and capacity of the signatory(ies) to this Amendment

and the other Loan Documents; and

(b) If

required by Agent, the payment by Borrower of all amounts described in Section 9. The Agent’s declination to require Borrower

to pay all or a portion of these amounts as a condition to the effectiveness of this Amendment will not excuse Borrower’s obligation

to do so immediately upon the Agent’s demand.

6. Acknowledgment

and Ratification. All Loan Documents to which the Loan Parties are a party are amended as follows, to the extent necessary: (a) all

references to the Credit Agreement are amended to mean the Credit Agreement as amended by this Amendment, (b) all references to the “Obligations”

are amended to mean the “Obligations” as modified by this Amendment. Each Loan Party acknowledges and agrees that all Loan

Documents remain in full force and effect as amended by this Amendment.

7. Representation

and Warranties. Each Loan Party represents and warrants that as of the Effective Date:

(a) the

representations and warranties by such Loan Party in the Loan Documents to which it is a party are true and correct in all respects as

though made on the Effective Date, except to the extent that any of them speak to a different specific date, in which case they are true

and correct as of such date;

(b) no

Default or Event of Default exists;

(c) the

execution, delivery and performance by Loan Parties of this Amendment and all Loan Documents executed in connection with this Amendment

will not (i) contravene any applicable law, (ii) conflict or be inconsistent with or result in any breach of any term, covenant, condition

or provision of, or constitute a default under, or result in the creation or imposition of (or the obligation to create or impose) any

lien upon any Loan Party’s property or any Loan Party’s other assets pursuant to the terms of any indenture, mortgage, deed

of trust, agreement or other instrument to which the such Loan Party is a party or by which any Loan Party or any of the Collateral or

a Loan Party’s other assets is bound or may be subject, or (iii) violate any term of a Loan Party’s certificate of formation

or other documents and agreements governing the Loan Party’s existence, management or operation;

(d) Loan

Parties are not required to obtain the consent of any other party, including any Governmental Authority, in connection with the execution,

delivery, performance, validity or enforceability of this Amendment or any other Loan Documents executed in connection with this Amendment;

(e) Loan

Parties have the requisite power and authority to execute, deliver and carry out the terms and provisions of this Amendment and the other

Loan Documents executed in connection with this Amendment, and have taken all necessary actions to authorize their execution, delivery

and performance of this Amendment and such Loan Documents;

(f) Each

Loan Party has duly executed and delivered this Amendment and the other Loan Documents to which it is a party; and

(g) This

Amendment and any other Loan Documents executed by a Loan Party in connection with this Amendment constitute such Loan Party’s legal,

valid and binding obligations, enforceable in accordance with the terms of the Loan Documents, subject to (i) the effect of any applicable

bankruptcy law, or (ii) general principles of equity.

8. Defaults

Unaffected. Nothing in this Amendment will prejudice, act as, or be deemed to be a waiver of any Default or any right or remedy available

to the Agent or the Lenders by reason of any Default.

9. Fees

and Expenses. Borrower shall pay all reasonable and documented fees, expenses and disbursements incurred by the Agent in connection

with the preparation and documentation of this Amendment and the other documents and instruments to be executed in connection with this

Amendment, including the costs and expenses of the Agent’s legal counsel.

10. Releases.

(a) Each

Loan Party, for itself and on behalf of all its Affiliates, and its and their respective members, managers, officers, agents, attorneys,

employees, directors, partners, agents, representatives, administrator, and all of their successors and assigns (collectively the “Releasing

Parties” and each, a “Releasing Party”), releases and forever discharges the Agent, the L/C Issuer,

the Lenders, and each of the Agent’s, the L/C Issuer’s, and the Lenders’ Affiliates, and its and their respective members,

managers, officers, agents, attorneys, employees, directors, partners, agents, representatives, administrator, and all of their successors

and assigns (collectively, the “Released Parties” and each, a “Released Party”), from

any and all claims, demands, cross-actions, controversies, causes of action, damages, rights, liabilities and obligations, at law or in

equity whatsoever, known or unknown, whether past, present or future, now held, owned or possessed by any or all Releasing Parties, or

that any Releasing Party may, as a result of any actions or inactions occurring on or before the Effective Date, in the future hold or

claim to hold under common law or statutory right, arising, directly or indirectly, out of the Loans or any of the Loan Documents (collectively,

the “Released Claims”).

(b) Each

Loan Party acknowledges and agrees that (i) this Section 10 is a full, final and complete release, (ii) any of the Released Parties

may plead this Section 10 as an absolute and final bar to any or all suit or suits pending or that are filed or prosecuted in the

future by any Releasing Parties, or anyone claiming by, through or under any of the Releasing Parties, in respect of any of the Released

Claims, (iii) no Releasing Party is entitled to any recovery on account of the Released Claims, and (iv) the consideration provided for

this Section 10 is not an admission of liability by any of the Released Parties.

11. Governing

Law; Miscellaneous. This Amendment is a Loan Document. Article IX of the Credit Agreement, including those provisions relating

to governing law, jurisdiction, venue, acknowledgments, and waiver of jury trial are incorporated into and made a part of this Amendment,

mutatis mutandis, as if fully set forth herein. The rules of construction in Section 1.2 of the Credit Agreement are expressly

made applicable to this Amendment.

12. Counterparts;

Electronic Signatures. This Amendment may be executed in any number of counterparts with the same effect as if all signatories had

signed the same document, and all counterparts must be construed together to constitute the same document. This Amendment and the other

Loan Documents may be transmitted and/or signed by facsimile or digital signature and/or transmission. The effectiveness of any such signatures

will have the same force and effect as manually-signed originals and shall be binding on all parties to this Amendment and the other Loan

Documents.

[Signature

Page(s) Attached]

THIS FIRST AMENDMENT TO CREDIT

AGREEMENT is executed and delivered by the undersigned effective as of the Effective Date.

| |

BORROWER: |

| |

|

| |

MACH NATURAL RESOURCES LP, a Delaware limited partnership |

| |

|

| |

By: |

Mach Natural Resources GP, LLC, its general partner |

| |

|

|

| |

By: |

/s/ Kevin R. White |

| |

|

Kevin R. White |

| |

|

Chief Financial Officer |

| |

|

|

| |

OTHER LOAN PARTIES: |

| |

|

| |

MACH NATURAL RESOURCES GP LLC, a Delaware limited liability company |

| |

|

|

| |

By: |

/s/ Kevin R. White |

| |

|

Kevin R. White |

| |

|

Chief Financial Officer |

| |

|

|

| |

MACH NATURAL RESOURCES INTERMEDIATE LLC, a Delaware limited liability company |

| |

|

|

| |

By: |

/s/ Kevin R. White |

| |

|

Kevin R. White |

| |

|

Chief Financial Officer |

| |

|

|

| |

MACH NATURAL RESOURCES HOLDCO LLC, a Delaware limited liability company |

| |

|

|

| |

By: |

/s/ Kevin R. White |

| |

|

Kevin R. White |

| |

|

Chief Financial Officer |

Signature

Page

First

Amendment to Credit Agreement

| |

BCE-MACH LLC, a Delaware limited liability company |

| |

|

|

| |

By: |

/s/ Kevin R. White |

| |

|

Kevin R. White |

| |

|

Chief Financial Officer |

| |

|

|

| |

BCE-MACH II LLC, a Delaware limited liability company |

| |

|

|

| |

By: |

/s/ Kevin R. White |

| |

|

Kevin R. White |

| |

|

Chief Financial Officer |

| |

|

|

| |

BCE-MACH III LLC, a Delaware limited liability company |

| |

|

|

| |

By: |

/s/ Kevin R. White |

| |

|

Kevin R. White |

| |

|

Chief Financial Officer |

| |

|

|

| |

BCE-MACH III MIDSTREAM HOLDINGS LLC, a Delaware limited liability company |

| |

|

|

| |

By: |

/s/ Kevin R. White |

| |

|

Kevin R. White |

| |

|

Chief Financial Officer |

Signature

Page

First

Amendment to Credit Agreement

THIS FIRST AMENDMENT TO CREDIT

AGREEMENT is executed and delivered by the undersigned effective as of the Effective Date.

| |

ADMINISTRATIVE AGENT, L/C ISSUER, AND LENDER: |

| |

|

| |

MIDFIRST BANK, a federally chartered savings association |

| |

|

|

| |

By: |

/s/ Chad Dayton |

| |

|

Chad Dayton, Senior Vice President |

Signature

Page

First

Amendment to Credit Agreement

THIS FIRST AMENDMENT TO CREDIT

AGREEMENT is executed and delivered by the undersigned effective as of the Effective Date.

| |

LENDER: |

| |

|

| |

Morgan Stanley SENIOR FUNDING, INC. |

| |

|

|

| |

By: |

/s/ Aaron McLean |

| |

|

Aaron McLean, Vice President |

Signature

Page

First

Amendment to Credit Agreement

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

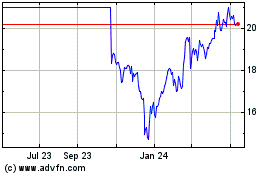

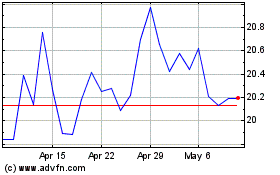

Mach Natural Resources (NYSE:MNR)

Historical Stock Chart

From Nov 2024 to Dec 2024

Mach Natural Resources (NYSE:MNR)

Historical Stock Chart

From Dec 2023 to Dec 2024