LiveWire Group, Inc. (“LiveWire” or the “Company”) (NYSE: LVWR)

today reported fourth quarter and full year 2023 results.

“LiveWire concluded 2023 with a strong Q4 performance,

delivering on units and operating loss guidance for the full year

with the successful delivery to market of S2 Del Mar®, the first

model built on our S2 platform that continues to generate a

positive response from the media, our retailers, and our riders. We

expect 2024 to be a year highlighted by product innovation, market

expansion, and continued cost improvements,” said Karim Donnez,

CEO, LiveWire.

2023 Highlights and Financial Results

- Launched Del Mar, the first model built with an all-new

in-house developed battery pack, power electronics, motor,

telematics, and associated software

- Unit sales of 660 electric motorcycles, up double digits versus

prior year

- Consolidated operating loss in line with our expectations

driven by product development costs relating to S2 platform,

delivery of Del Mar, a provision for an obligation for excess

inventory components, and additional costs to stand up the

organization as a stand-alone public company

- Ended the year with 126 retail partners globally

Fourth Quarter 2023 Summary of Results

- Unit sales of 514 electric motorcycles, with an increase in

consolidated revenue of 64% versus prior year

- Consolidated operating loss increase over prior year of $4.9

million resulting primarily from costs related to increased volume

and a provision for an obligation for excess inventory

components

- Continued investment in developing models on the S2

platform

LiveWire Group, Inc. – Consolidated

Results

$ in millions*

4th quarter

Full Year

2023

2022

Change

2023

2022

Change

Revenue

$15.1

$9.2

64

%

$38.0

$46.8

(19

%)

Operating (Loss)

($33.8

)

($28.9

)

17

%

($116.0

)

($85.0

)

36

%

Net Loss

($33.1

)

($22.4

)

48

%

($109.6

)

($78.9

)

39

%

LiveWire Group, Inc. – Segment

Results

$ in millions*, except units

4th quarter

Full Year

2023

2022

Change

2023

2022

Change

Electric Motorcycles

LiveWire (units)

514

69

645

%

660

547

21

%

Harley-Davidson LiveWire

(units)

—

—

0

%

—

50

(100

%)

Electric Motorcycle Shipments

(units)

514

69

645

%

660

597

11

%

Revenue

$8.0

$1.6

400

%

$11.5

$14.0

(18

%)

Operating (Loss)

($34.2

)

($29.7

)

15

%

($116.6

)

($89.1

)

31

%

$ in millions*

4th quarter

Full Year

2023

2022

Change

2023

2022

Change

STACYC Segment

Revenue

$7.1

$7.6

(7

%)

$26.5

$32.8

(19

%)

Operating Income

$0.4

$0.8

(50

%)

$0.6

$4.2

(86

%)

*Amounts may not add up due to

rounding

The Company’s consolidated net loss was $109.6 million for the

year ended 2023 compared to $78.9 million for the year ended 2022.

The increase of $30.7 million was in line with our expectations

driven by a provision for an obligation for excess inventory

components, increased selling, administrative and engineering

expense for product development costs relating to the S2 platform,

delivery of Del Mar and additional costs to stand up the

organization as a stand-alone public company. The Company also had

an increase of $9.1 million of non-operating mark-to-market expense

resulting from the increase in the fair value of warrant

liabilities year-over-year which was offset by an increase of $9.3

million in interest income.

The Company’s consolidated net loss was $33.1 million for the

fourth quarter 2023 as compared to $22.4 million in the same period

prior year driven by the segment results noted below, an increase

of $6.7 million of non-operating mark-to-market expense related to

the increase in fair value of the outstanding warrants as of

December 31, 2023 as compared to December 31, 2022, offset by an

increase of $1.2 million in interest income.

LiveWire Group, Inc. is comprised of two business segments:

- Electric Motorcycles – focused on the sale of electric

motorcycles and related products

- STACYC – focused on the sale of electric balance bikes for kids

and related products

Electric Motorcycles

Electric Motorcycle revenue increased in fourth quarter 2023

compared to the same quarter in the prior year due to sales of Del

Mar units. Increased operating losses compared to the fourth

quarter of 2022 were primarily related to increased costs as a

result of increased volumes and a provision for an obligation for

excess inventory components.

STACYC

STACYC volumes were up in the fourth quarter of 2023 compared to

2022, while revenue and operating income were down due to product

mix and pricing.

2024 Financial Outlook

For the full year 2024, the Company expects:

- Electric Motorcycle sales of 1,000 to 1,500 revenue units

- Operating Loss of $115 million to $125 million

Webcast

The public is invited to attend an audio webcast from 8-9 a.m.

CST. LiveWire leadership will be joining the Harley-Davidson, Inc.

audio webcast to discuss our results, developments in the business,

and updates to the Company’s outlook. The webcast login can be

accessed at

https://investor.livewire.com/news-events-1/events/default.aspx.

The audio replay will be available by approximately 10:00 a.m.

CST.

About LiveWire

LiveWire has a dedicated focus on the electric motorcycle

sector. LiveWire’s majority shareholder is Harley-Davidson, Inc.

LiveWire comes from the lineage of Harley-Davidson and is

capitalizing on a decade of its learnings in the EV sector. With a

dedicated focus on EV, LiveWire plans to develop the technology of

the future and to invest in the capabilities needed to lead the

transformation of motorcycling. www.livewire.com

Cautionary Note Regarding Forward-Looking Statements

The Company intends that certain matters discussed in this press

release are “forward-looking statements” intended to qualify for

the safe harbor from liability established by the Private

Securities Litigation Reform Act of 1995. All statements other than

statements of historical facts contained in this press release,

including statements concerning possible or assumed future actions,

business strategies, events or results of operations, and any

statements that refer to projections, forecasts or other

characterizations of future events or circumstances, including any

underlying assumptions, are forward-looking statements. These

statements involve known and unknown risks, uncertainties and other

important factors that may cause our actual results, performance or

achievements to be materially different from any future results,

performance or achievements expressed or implied by the

forward-looking statements. Words or phrases such as “anticipate,”

“believe,” “continue,” “could,” “estimate,” “expect,” “intend,”

“may,” “might,” “objective,” “ongoing,” “plan,” “potential,”

“predict,” “project,” “should,” “will” and “would,” or similar

words or phrases, or the negatives of those words or phrases, may

identify forward-looking statements, but the absence of these words

does not necessarily mean that a statement is not forward-looking.

The forward-looking statements in this press release are only

predictions. We have based these forward-looking statements largely

on our current expectations and projections about future events and

financial trends that we believe may affect our business, financial

condition and results of operations. These forward-looking

statements speak only as of the date of this press release and are

subject to a number of important factors that could cause actual

results to differ materially from those in the forward-looking

statements, including the risks, uncertainties and assumptions

described in prior public filings titled “Risk Factors.” These

forward-looking statements are subject to numerous risks,

including, without limitation, the following: our history of losses

and expectation to incur significant expenses and continuing losses

for the foreseeable future; our limited operating history, the

rollout of our business and the timing of expected business

milestones, including our ability to develop and manufacture

electric vehicles of sufficient quality and appeal to customers on

schedule and on a large scale; our financial and business

performance, including financial projections and business metrics

and any underlying assumptions thereunder; changes in our strategy,

future operations, financial position, estimated revenues and

losses, projected costs, prospects and plans; our ability to

attract and retain a large number of customers; our future capital

requirements and sources and uses of cash; our ability to obtain

funding for our operations and manage costs; challenges we face as

a pioneer into the highly-competitive and rapidly evolving electric

vehicle industry; our operational and financial risks if we fail to

effectively and appropriately separate the LiveWire business from

the H-D business; H-D making decisions for its overall benefit that

could negatively impact our overall business; our relationship with

H-D and its impact on our other business relationships; our ability

to leverage contract manufacturers, including H-D and Kwang Yang

Motor Co., Ltd., a Taiwanese company (“KYMCO”), to contract

manufacture our electric vehicles; retail partners being unwilling

to participate in our go-to-market business model or their

inability to establish or maintain relationships with customers for

our electric vehicles; potential delays in the design, manufacture,

financing, regulatory approval, launch and delivery of our electric

vehicles; building out our supply chain, including our dependency

on our existing suppliers and our ability to source suppliers, in

each case many of which are single-sourced or limited-source

suppliers, for our critical components such as batteries and

semiconductor chips; our ability to rely on third-party and public

charging networks; our ability to attract and retain key personnel;

our business, expansion plans and opportunities, including our

ability to scale our operations and manage our future growth

effectively; the effects on our future business of competition, the

pace and depth of electric vehicle adoption generally and our

ability to achieve planned competitive advantages with respect to

our electric vehicles and products, including with respect to

reliability, safety and efficiency; our business and H-D’s business

overlapping and being perceived as competitors; our inability to

maintain a strong relationship with H-D or to resolve favorably any

disputes that may arise between us and H-D; our dependency on H-D

for a number of services, including services relating to quality

and safety testing. If those service arrangements terminate, it may

require significant investment for us to build our own safety and

testing facilities, or we may be required to obtain such services

from another third-party at increased costs; any decision by us to

electrify H-D products, or the products of any other company; our

expectations regarding our ability to obtain and maintain

intellectual property protection and not infringe on the rights of

others; potential harm caused by misappropriation of our data and

compromises in cybersecurity; changes in laws, regulatory

requirements, governmental incentives and fuel and energy prices;

the impact of health epidemics, including the COVID-19 pandemic, on

our business, the other risks we face and the actions we may take

in response thereto; litigation, regulatory proceedings,

complaints, product liability claims and/or adverse publicity; and

the possibility that we may be adversely affected by other

economic, business and/or competitive factors. Because

forward-looking statements are inherently subject to risks and

uncertainties, some of which cannot be predicted or quantified and

some of which are beyond our control, you should not rely on these

forward-looking statements as predictions of future events. The

events and circumstances reflected in our forward-looking

statements may not be achieved or occur, and actual results could

differ materially from those projected in the forward-looking

statements. Moreover, we operate in an evolving environment. Some

of these risks and uncertainties may in the future be amplified by

new risk factors and uncertainties that may emerge from time to

time, and it is not possible for management to predict all risk

factors and uncertainties. As a result of these factors, we cannot

assure you that the forward-looking statements in this press

release will prove to be accurate. Except as required by applicable

law, we do not plan to publicly update or revise any

forward-looking statements contained herein, whether as a result of

any new information, future events, changed circumstances, or

otherwise. You should read this earnings release completely and

with the understanding that our actual future results may be

materially different from what we expect. We qualify all of our

forward-looking statements by these cautionary statements.

LiveWire Group, Inc.

Consolidated Statements of

Operations

(In thousands, except per

share amounts)

(Unaudited)

(Unaudited)

(Unaudited)

Three months ended

Twelve months ended

December 31,

2023

December 31,

2022

December 31,

2023

December 31,

2022

Revenue, net

$

15,091

$

9,218

$

38,023

$

46,833

Costs and expenses:

Cost of goods sold

20,279

6,942

43,795

43,929

Selling, administrative and engineering

expense

28,567

31,153

110,217

87,859

Total operating costs and expenses

48,846

38,095

154,012

131,788

Operating loss

(33,755

)

(28,877

)

(115,989

)

(84,955

)

Other income, net

—

—

—

235

Interest expense related party

—

—

—

(475

)

Interest income

2,365

1,214

10,537

1,191

Change in fair value of warrant

liabilities

(1,688

)

5,033

(4,020

)

5,033

Loss before income taxes

(33,078

)

(22,630

)

(109,472

)

(78,971

)

Income tax (benefit) provision

15

(192

)

78

(33

)

Net loss

$

(33,093

)

$

(22,438

)

$

(109,550

)

$

(78,938

)

Net loss per share, basic and diluted

$

(0.16

)

$

(0.11

)

$

(0.54

)

$

(0.46

)

Weighted-average shares, basic and

diluted

202,672

202,404

202,504

172,003

LiveWire Group, Inc.

Consolidated Balance

Sheets

(In thousands)

(Unaudited)

December 31,

2023

December 31,

2022

ASSETS

Current assets:

Cash and cash equivalents

$

167,904

$

265,240

Accounts receivable, net

4,295

2,325

Accounts receivable from related party

3,402

525

Inventories, net

32,122

29,215

Other current assets

3,004

4,625

Total current assets

210,727

301,930

Property, plant and equipment, net

38,483

31,567

Goodwill

8,327

8,327

Deferred tax assets

4

—

Lease assets

1,868

3,128

Intangible assets, net

1,347

1,809

Other long-term assets

6,192

5,044

Total assets

$

266,948

$

351,805

LIABILITIES AND

SHAREHOLDERS’ EQUITY

Current liabilities:

Accounts payable

$

3,554

$

7,055

Accounts payable to related party

20,371

5,733

Accrued liabilities

21,990

20,343

Current portion of lease liabilities

1,152

1,312

Total current liabilities

47,067

34,443

Long-term portion of lease liabilities

792

1,913

Deferred tax liabilities

93

15

Warrant liabilities

12,319

8,388

Other long-term liabilities

814

246

Total liabilities

61,085

45,005

Shareholders' equity:

Preferred Stock

—

—

Common Stock

20

20

Treasury Stock

(1,969

)

—

Additional paid-in-capital

339,783

329,218

Accumulated deficit

(131,988

)

(22,438

)

Accumulated other comprehensive income

17

—

Total shareholders' equity

205,863

306,800

Total liabilities and shareholders'

equity

$

266,948

$

351,805

LiveWire Group, Inc.

Consolidated Statements of

Cash Flows

(In thousands)

(Unaudited)

Twelve months ended

December 31,

2023

December 31,

2022

Cash flows from operating activities:

Net loss

$

(109,550

)

$

(78,938

)

Adjustments to reconcile net loss to net

cash used in operating activities

Depreciation and amortization

4,993

4,401

Payment of contingent consideration in

excess of acquisition date fair value

—

(413

)

Change in fair value of warrant

liabilities

4,020

(5,033

)

Stock compensation expense

8,926

394

Provision for doubtful accounts

53

145

Deferred income taxes

74

(125

)

Inventory write-down

2,719

1,074

Cloud computing arrangements development

costs

(473

)

(4,894

)

Other, net

(117

)

(144

)

Changes in current assets and

liabilities:

Accounts receivable, net

(2,023

)

4,156

Accounts receivable from related party

(2,877

)

(593

)

Inventories

(5,626

)

(21,068

)

Other current assets

1,621

(1,283

)

Accounts payable and accrued

liabilities

160

6,371

Accounts payable to related party

14,638

6,269

Net cash used by operating activities

(83,462

)

(89,681

)

Cash flows from investing activities:

Capital expenditures

(13,462

)

(14,081

)

Net cash used by investing activities

(13,462

)

(14,081

)

Cash flows from financing activities:

Repurchase of common stock

(1,969

)

—

Proceeds received from sale of

warrants

1,557

—

Borrowings on notes payable to related

party

—

15,333

Net proceeds from the Business

Combination

—

293,717

Payment of contingent consideration up to

acquisition date fair value

—

(1,767

)

Transfers from Parent

—

59,051

Net cash provided (used) by financing

activities

(412

)

366,334

Cash and cash equivalents:

Cash and cash equivalents—beginning of

period

$

265,240

$

2,668

Net increase (decrease) in cash and cash

equivalents

(97,336

)

262,572

Cash and cash equivalents—end of

period

$

167,904

$

265,240

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240208290699/en/

Media Contact: Jenni Coats (414) 343-7902 Financial

Contact: Shawn Collins (414) 343-8002

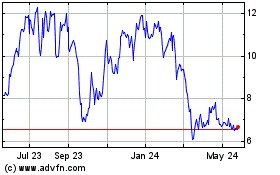

Livewire (NYSE:LVWR)

Historical Stock Chart

From Dec 2024 to Jan 2025

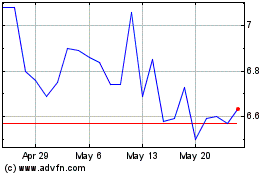

Livewire (NYSE:LVWR)

Historical Stock Chart

From Jan 2024 to Jan 2025