- Report of Foreign Issuer (6-K)

October 22 2010 - 8:57AM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE

COMMISSION

Washington, DC 20549

FORM 6-K

REPORT OF

FOREIGN PRIVATE ISSUER

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the Month of October, 2010

KOREA ELECTRIC

POWER CORPORATION

(Translation of registrant’s name into English)

411, Yeongdong-daero, Gangnam-gu, Seoul 135-791, Korea

(Address of principal executive offices)

Indicate by check mark whether

the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F

x

Form 40-F

¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is

submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Indicate by check mark whether the registrant by furnishing the information contained in this form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the

Securities Exchange Act of 1934.

Yes

¨

No

x

If “Yes” is marked, indicate below the file number assigned to the

registrant in connection with Rule 12g3-2(b): 82-

.

This Report of Foreign Private Issuer

on Form 6-K is deemed filed for all purposes under the Securities Act of 1933, as amended, and the Securities Exchange Act of 1934, as amended.

Korea Electric Power Corporation

(“KEPCO”) hereby announces its unaudited non-consolidated estimated earnings results for the first nine months ended September 30, 2009 and 2010 as attached hereto.

Disclaimer:

The financial information relating to the non-consolidated results of

operations of Korea Electric Power Corporation (“KEPCO”) for the first nine months ended September 30, 2009 and 2010 as presented below (the “Information”) has been prepared by KEPCO based on preliminary internal estimates.

The Information has been prepared on a non-consolidated basis based on Korean GAAP. The Information has neither been audited nor reviewed by KEPCO’s independent accountants, Deloitte Anjin LLC., or any other independent public accountants. The

Information may differ significantly from the actual non-consolidated financial results of operations of KEPCO for the first nine months ended September 30, 2010, and accordingly should not be relied upon for investment, including but not

limited to purchase of any securities, or for other purposes.

Korea Electric Power Corporation

PRELIMINARY NON-CONSOLIDATED STATEMENTS OF INCOME (Unaudited)

For the first nine months ended September 30, 2009 and 2010

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Unit : in billions of Korean Won)

|

|

3Q

2010

(Jan.~Sep.)

|

|

|

3Q

2009

(Jan.~Sep.)

|

|

|

Change

|

|

|

Operating revenues:

|

|

|

28,885

|

|

|

|

25,054

|

|

|

|

15.3

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sale of electric power

|

|

|

28,142

|

|

|

|

24,781

|

|

|

|

13.6

|

%

|

|

Other operating revenues

|

|

|

282

|

|

|

|

249

|

|

|

|

13.1

|

%

|

|

Revenues for other businesses

|

|

|

461

|

|

|

|

24

|

|

|

|

1834.0

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses:

|

|

|

30,761

|

|

|

|

24,974

|

|

|

|

23.2

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Purchased power

|

|

|

26,035

|

|

|

|

20,875

|

|

|

|

24.7

|

%

|

|

Maintenance

|

|

|

500

|

|

|

|

548

|

|

|

|

(8.7

|

)%

|

|

Depreciation

|

|

|

1,517

|

|

|

|

1,494

|

|

|

|

1.5

|

%

|

|

Other operating expenses

|

|

|

2,254

|

|

|

|

2,018

|

|

|

|

11.7

|

%

|

|

Expenses for other businesses

|

|

|

455

|

|

|

|

39

|

|

|

|

1055.1

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income

|

|

|

(1,876

|

)

|

|

|

80

|

|

|

|

(2448.4

|

)%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-operating income:

|

|

|

2,804

|

|

|

|

1,778

|

|

|

|

57.7

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gain on foreign currency transactions and translation

|

|

|

147

|

|

|

|

174

|

|

|

|

(15.8

|

)%

|

|

Investment income from affiliates

|

|

|

2,327

|

|

|

|

1,262

|

|

|

|

84.4

|

%

|

|

Other

|

|

|

330

|

|

|

|

342

|

|

|

|

(3.5

|

)%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-operating expenses:

|

|

|

1,098

|

|

|

|

1,425

|

|

|

|

(23.0

|

)%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expenses

|

|

|

858

|

|

|

|

761

|

|

|

|

12.8

|

%

|

|

Loss on foreign currency transactions and translation

|

|

|

43

|

|

|

|

529

|

|

|

|

(92.0

|

)%

|

|

Investment loss from affiliates

|

|

|

42

|

|

|

|

27

|

|

|

|

58.8

|

%

|

|

Other

|

|

|

155

|

|

|

|

108

|

|

|

|

43.5

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings before taxes

|

|

|

(170

|

)

|

|

|

433

|

|

|

|

(139.3

|

)%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Provision for income taxes

|

|

|

(119

|

)

|

|

|

144

|

|

|

|

(182.6

|

)%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income

|

|

|

(51

|

)

|

|

|

289

|

|

|

|

(117.7

|

)%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its

behalf by the undersigned, thereunto duly authorized.

|

|

|

|

|

By:

|

|

/s/ Shin, Chang-keun

|

|

Name:

|

|

Shin, Chang-keun

|

|

Title:

|

|

Vice President

|

Date:

October 22, 2010

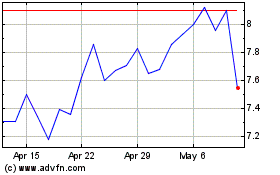

Korea Electric Power (NYSE:KEP)

Historical Stock Chart

From Oct 2024 to Nov 2024

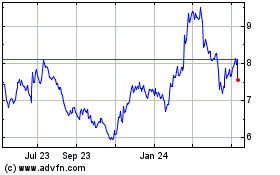

Korea Electric Power (NYSE:KEP)

Historical Stock Chart

From Nov 2023 to Nov 2024